Offshore Regulatory Arbitrage by US Insurers Explained

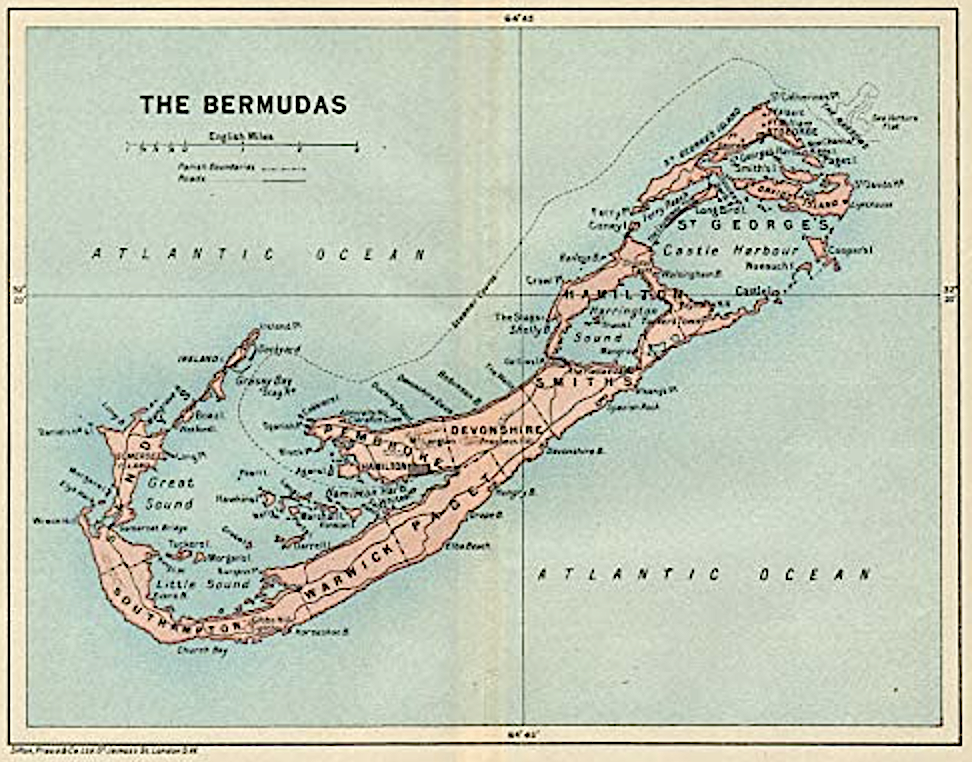

In a recent report, Moody's analysts showed that the accounting 'regime in Bermuda tends to allow for a higher discount rate than other jurisdictions' and this 'directly impacts the level of liabilities and therefore an insurer's level of available capital.'