Connecticut Senator Chris Murphy took a bold first step to protect retirees impacted by pension risk transfer deals by introducing the Pension Risk Transfer Accountability Act of 2021 this week.

The Act directs the Secretary of Labor to review its guidance on fiduciary standards under the Employee Retirement Income Security Act of 1974 (ERISA) when selecting an annuity provider and to report to Congress on the findings of such review, including an assessment of risk to participants.

Since 2012, more than $200 billion in retiree liabilities have been transferred to insurance companies in pension de-risking transactions, also referred to as a pension risk transfer (PRT). Once a PRT is complete, retirees lose all of the uniform protections intended by Congress under ERISA and become subject to non-uniform state laws.

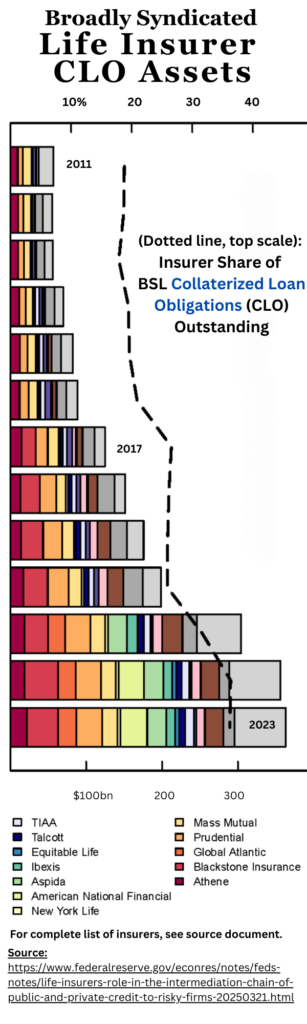

Meanwhile, insurance companies are selling off blocks of business to private equity firms at an unprecedented pace. Apollo owns 100% of Athene. Prudential Financial recently sold off $31 billion in variable annuity contracts to Fortitude Re. Blackstone Group recently acquired most of Allstate’s life insurance business. History suggests that private equity firms are more concerned about generating a return for their investors than policyholder security.

Given the fact that retirees lose so much in terms of ERISA protections post-PRT, it is critically important that pension plan sponsors undertake rigorous and thorough evaluations of both the claims paying ability and financial security of any insurer being considered for a PRT in a manner that is consistent with ERISA’s fiduciary requirements.

Defined Benefit Plan Sponsors should consider the following:

- Is the selected insurer is properly reserved under Statutory Accounting Principles (SAP) in all States where the insurer does business, taking into consideration the extent to which the selected insurer has taken credit for reinsurance with wholly owned captive reinsurers or affiliates that do not file annual statements in accordance with SAP?

- Does the selected insurer have significant exposure to affiliated reinsurers located outside of the United States?

- Has the selected insurer segregated assets into a separate account that is managed solely for the benefit of the retirees?

- Does the selected insurer maintain an appropriate level of capital and surplus that is not dependent in any way upon conditional letters of credit, surplus notes or circular parental guarantees?

- Is the selected insurer is rated A or better by two or more nationally recognized rating agencies?

Retiree earned benefits are not handouts. Many of today’s retirees worked for decades based upon promises made by their employers about their benefits packages, often trading higher salaries for pensions, life insurance and health care for life. These benefits need to be protected consistent with ERISA’s original protective purpose. With literally hundreds of billions in pension liabilities at stake, retirees and their families who did not choose a pension risk transfer need to know that the chosen insurer was fully and completely vetted by a defined benefit plan sponsor that is held to ERISA’s highest fiduciary standards. Thank you, Senator Murphy, for introducing this important legislation.

Edward Stone is the Executive Director of Retirees for Justice, Inc., a 501(c)(4) dedicated to protecting and preserving the earned benefits of America’s retirees.