Pensions

NEST is the U.K.'s experiment with a government-sponsored, portable defined contribution plan for low- and middle-income workers at small companies. Most NEST participants are still far from retirement, but...

British regulators scrutinize ‘FundedRe’ in pension deals

The Prudential Regulatory Authority, the Bank of England's financial regulatory arm, told UK life insurers in late July that it has concerns about the use of 'funded reinsurance' (FundedRe)...

Athene’s group annuities not the ‘safest available,’ lawsuit charges

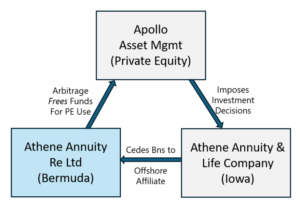

The suit against Athene may be a test case for the legitimacy of Bermuda Triangle strategy. In other news from the Bermuda Triangle: Annuity sales boom attracts private equity-backed...

Here Come the Suits

Close observers of the 'Bermuda Triangle' strategy weren't surprised when class action lawsuits were filed against AT&T, State Street Global Advisors and Lockheed Market for their choice of Athene...

Of Athene, Pension Risk Transfers, and Fiduciaries

The ERISA Advisory Council recently heard comments on changing the criteria that fiduciaries use when vetting annuity providers in pension risk transfer deals. Athene's vice chairman defended his company's...

A ‘Cashback’ Pension-Building Card, from Germany

'The Vantikcard uses the 1% cashback as a kickstart into retirement savings and for customers to then save on top of the cashback,' a Vantik veteran said. Right: Vantik...

Denmark’s ‘Arnes’ can apply for early pensions

A new program, which acknowledges the physical toll of blue collar work, allows people to claim their state pensions up to three years earlier than the standard national pension...

Athene Takes Another Bite at Pensions Apple

In a pension risk transfer deal, Athene Holding will acquire about $4.9 bn in pension assets and liabilities from Lockheed Martin. But when do these deals become too much...

A close look at ‘collective defined contribution’ plans

A timely new white paper from the Center for Retirement Initiatives at Georgetown University makes a case for these retirement plans, which try to blend elements of defined benefit...

Prudential closes $8.4 billion pension reinsurance deal

'We see the use of a third-party onshore UK-regulated insurer as limited recourse intermediary as the logical next step in de-risking solutions,' Prudential's Rohit Mathur said.

Falling discount rates hurt DB pensions at insurers: AM Best

Only 184 insurance companies rated by AM Best had defined benefit plans at year-end 2019, compared with 257 in 2016, according to a new report. Aggregated insurance company unfunded...

Big 4Q rally for US pension risk transfer deals: LIMRA SRI

'Fourth quarter 2020 buy-out sales continue this trend and represented the highest quarterly sales total recorded since fourth quarter 2012,' said Mark Paracer of SRI.

How to Solve the World’s Retirement Crisis

Retrofitting 401(k) plans with lifetime income options is one of the thorniest challenges of our time. We describe three possible solutions to that puzzle, from Nobelist Robert Merton and...

Honorable Mention

Sammons Financial buys $3 billion Ohio-based RIA/TAMP; MetLife unit completes pension risk transfer deal with Weyerhaeuser; Equitable publishes study on educators' retirement savings rates; National Guardian Life buys Everplans;...

The future of longevity risk transfer deals

A Senior Financial Sector Expert at the International Monetary Fund asks why longevity risk swaps aren't as popular as longevity risk buy-outs (or buy-ins) with institutional investors. This post...

Public pensions are not a drag: Study

Economic growth attributable to public pensions generated approximately $341.4 billion in state and local revenues. Adjusting this figure for taxpayer contribution $162 billion yields pensions’ net positive impact of...

House MEP bill could fuel pension risk transfer deals

According to a CBO estimate, HR397 calls for loans and grants to insolvent or troubled multiemployer pensions totaling almost $49 billion between 2019 and 2024 and almost $68 billion...

Shekel by Shekel: How Israelis Save

For the last decade, Israeli workers have contributed to mandatory defined contribution savings plans at work and must convert at least part of their savings to a lifetime income...

In Austria, earlier retirement was associated with earlier death

An additional year in early retirement increased a man’s probability of death before age 73 by 1.85 percentage points and reduced the age at death by an average of...

Britain’s DB plans roiled by gender equalization

The DB schemes of the UK’s 350 biggest listed companies showed a combined estimated deficit of £36bn (€41bn) on October 31, down from a £3bn aggregate surplus on September...