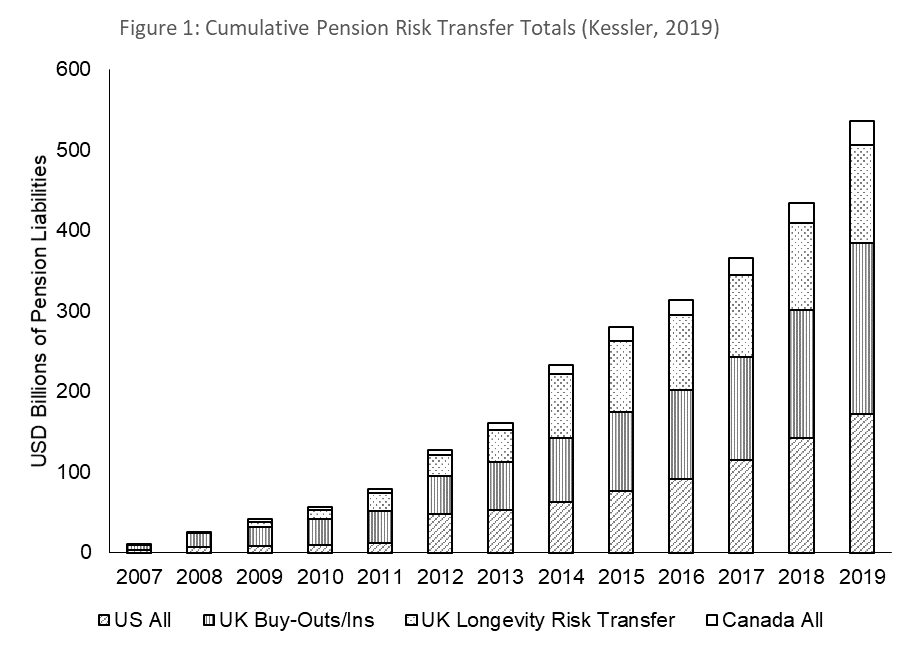

Reduced returns and longevity risk are making it challenging for employers to offer defined benefit pensions. Nevertheless, in some countries with large defined benefit pension plan sectors, sponsors are transferring these obligations and their associated investment and longevity risks, to life (re)insurers via buy-outs, buy-ins, and longevity swaps (Figure 1).

Little Institutional Investor Interest in Longevity Risk Transfer Markets

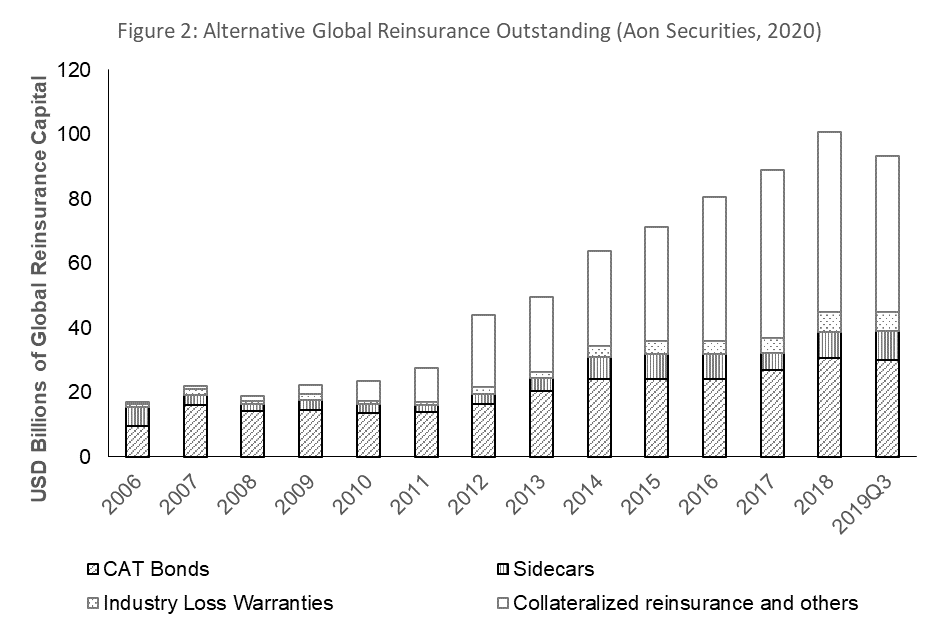

Thus far, (re)insurers have been hanging on to most of these risks themselves. This is in sharp contrast to catastrophe (CAT) risks, which (re)insurers are increasingly transferring to capital markets (Figure 2). Such transfers have taken the form of CAT bonds and collateralized reinsurance products. Meanwhile, there has been no longevity bond issuance, and there have been only a few, albeit large, longevity swap transactions.

The largest longevity risk transfer markets in operation today are in the United Kingdom and the United States (Figure 1). In both cases, growth has been driven by the introduction of stricter pension disclosure standards, along with stricter regulations mandating risk-based guarantee schemes (2004 U.K. Pensions Act and 2006 U.S. Pension Protection Act).

Most pension longevity risk transfer today is achieved with buy-outs and buy-ins. Buy-outs transfer all the pension fund’s liabilities in return for an up-front premium, which in some cases is paid from an “in-kind” transfer of the pension fund’s assets (Daniel, 2016). In a buy-in, the sponsor retains the pension assets and liabilities, but it then receives periodic payments from an insurer in return for an up-front premium, to cover promises made to pension participants.

Longevity swaps transfer only longevity risk, and the premiums are spread over the life of the contract based on the difference between actual and expected benefit payments. This vehicle is typically combined with a liability-driven investing asset allocation approach, one which matches the expected cash flow profile to that of the pension benefit payments (plus an inflation swap if the plan offers indexed benefits; Citi, 2016).

Longevity risk might seem to be an attractive asset class for institutional investors, as it is likely to be largely uncorrelated with other risk factors in their portfolios. In 2012 and 2013, Dutch insurer Aegon successfully executed two such swaps totaling €13.4 billion targeted at institutional investors (Whittaker 2012; Osborn 2013). Nevertheless, there have apparently been no similar transactions since then.

What Can Longevity Risk Transfer Markets Learn from Catastrophe Risk Transfer Markets?

(Re)insurers are using CAT risk transfer markets to finance and diversify their coverage of low-probability high-severity event risk. They are attractive to (re)insurers because most market-based CAT risk transactions are fully collateralized against peak exposures, so if there is such an event, they pay out more quickly than reinsurance. They are attractive to institutional investors, most of whom invest via specialist funds because of the attractive yields.

Collateralized reinsurance, CAT bonds, and sidecars comprise over 90% of alternative CAT risk transfers (Aon, 2020). Here investors make an up-front investment which collateralizes the peak risk coverage. In exchange for assuming the risk of principal loss, they pay interest/premia until redeemed at maturity, unless a loss event occurs, in which case some or all of the collateral is released to the (re)insurer. The differences between the types of transactions are mainly legal and structural.

If one looks to CAT risk transfer markets for how to ignite capital markets interest in longevity risk, the keys would seem to be short maturities and full collateralization to minimize credit risk. Yet there remains a tension between investor preferences for short-term instruments and the long-term nature of longevity risk exposures.

Academic Studies Suggest Ways of Broadening Longevity RIsk Transfer Market

MacMinn and Zhu (2018) suggest that value-based products with shorter terms could be more attractive to cedents than cash-flow based risk transfer. These could be facilitated by agreements between market participants regarding which mortality models to use for the design, and how to price each longevity-linked deal. More publicly-available granular data (e.g., disaggregated by geographic area, gender, socio-economic status, cause of death, and occupation) would also help.

There may also be tensions between (re)insurers’ preferences for indemnity transactions to minimize basis risk, versus investors’ preferences for standardized index-based transactions. (Re)insurers favor risk transfer products where indemnity triggers base event-contingent payments on actual losses, making them close substitutes for reinsurance contracts.

Still other investors prefer index-based, modeled, and parametric indices which mitigate moral hazard risks but expose reinsured parties to the basis risk that the coverage may not exactly match actual losses. Nevertheless, Michaelson and Mulholland (2014) and Cairns and El Boukfaoui (2019) provide some promising ways to bridge this gap. Biffis and Blake (2014) have proposed that an optimal format would entail a CAT bond-like tranched principal-at-risk instrument.

Will Longevity Risk Transfer Products Remain Niche Players?

It should be noted, however, that some analysts suggest that activating investor interest in longevity risk transfer markets is an intractable problem, because by hedging the risk, (re)insurers lose a valuable balance sheet put option (MacMinn and Brockett, 2017). Moreover, Zelenko (2014) suggests that markets may be held back by the moral hazard problem related to the perceived likelihood that the government would bail out (re)insurers and/or annuitants hit by systematic longevity risk events. The next decade will help resolve the differing perspectives.

Reprinted with permission of the author and the Pension Research Council, on whose website this blogpost appeared.