Meet the newest high-roller in the “Bermuda Triangle” world.

Since last July, Sixth Street, a fast-growing asset manager, acquired The Hartford’s old life/annuity business, established reinsurers in Bermuda and the Cayman Islands, and executed big capital relief deals with three large life/annuity companies.

In September, Lincoln Financial Group closed an ongoing “flow reinsurance” deal with Sixth Street’s insurers. On December 30, 2021, Allianz Life reinsured $20 billion worth of fixed indexed annuity contracts with the firm. This week, Principal Financial Group closed a $25 billion reinsurance deal with Sixth Street entities.

AM Best reported this week that Sixth Street and its insurance affiliates now manage $111 billion in insurance liabilities and surplus.

The flurry of 10- and 11-digit deals vaults Sixth Street, founded in 2009 and led by Michael Muscolino and Alan Waxman, two former Goldman Sachs executives, into the elite group of large asset managers, including Apollo/Athene, Ares, Blackstone, Brookfield, Carlyle, Eldridge, and KKR who now play an unprecedented role in supplying life insurers with capital and wringing higher returns out of their assets.

Michael Muscolino

These firms have mastered what RIJ calls the “Bermuda Triangle” strategy. The strategy generally involves three financial entities: a US life insurer that holds or manufactures annuity contracts, a Bermuda or Cayman firm that reinsures the annuity liabilities, and an alternative-asset manager.

In contrast to other Bermuda Triangle firms, Sixth Street is known as an “aggregator” of annuity contracts that life insurers would like to divest or reinsure. It differs from Athene and KKR, which have purchased life insurers and issue and reinsure their own annuities. It also differs from Blackstone, which manages money for insurers as a strategic partner. These businesses often position themselves as “Insurance Solutions” providers.

The three-way strategy

And the annuity industry certainly needs solutions.

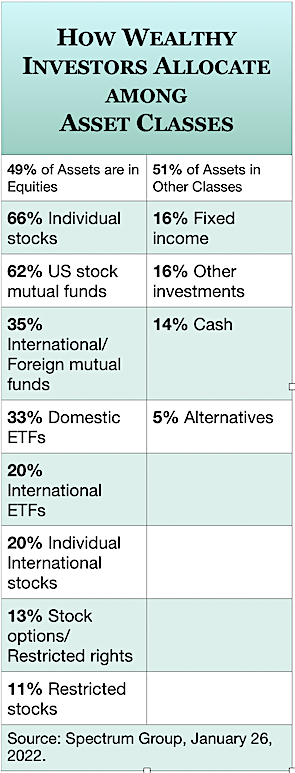

As a whole, the life/annuity industry holds hundreds of billions of dollars worth of annuity and life insurance contracts, funded by policyholder savings and locked into various financial guarantees to those policyholders. Those contracts are high maintenance for the insurers; regulations require them to hold large amounts of semi-idle surplus capital against potential losses. Surplus capital requirements tend to rise when insurers earn less on the investments that finance their guarantees.

The life/annuity companies have turned to the Insurance Solutions teams at Bermuda Triangle practitioners for help. The firm’s Bermuda or Cayman reinsurer can use favorable local accounting rules to shrink the estimated cost of the annuity liabilities. This lowers the insurer’s surplus capital requirement—instantly “unlocking,” in some cases, tens or hundreds of millions of dollars for the insurer to use in new ways. Many publicly traded insurers use these windfalls to buy back shares of their stock. Others use it to invest in new lines of business.

RIJ asked one life/annuity executive, whose company has been through a Bermuda Triangle deal, to rate, on a scale of one to 10, the importance of the reinsurance/capital-relief component as a driver of these deals for life/annuity companies. “10,” he wrote back from his iPhone.

That insight applies to the recent Sixth Street deals. “For Allianz, Principal, and Lincoln, the capital release from the reinsurance is a key aspect. However, equally important is the impact on reserves by shifting the investment risk to reinsurer. For annuity insurers, reserve swings have significantly affected operating results,” said Scott Hawkins, an analyst at Conning.

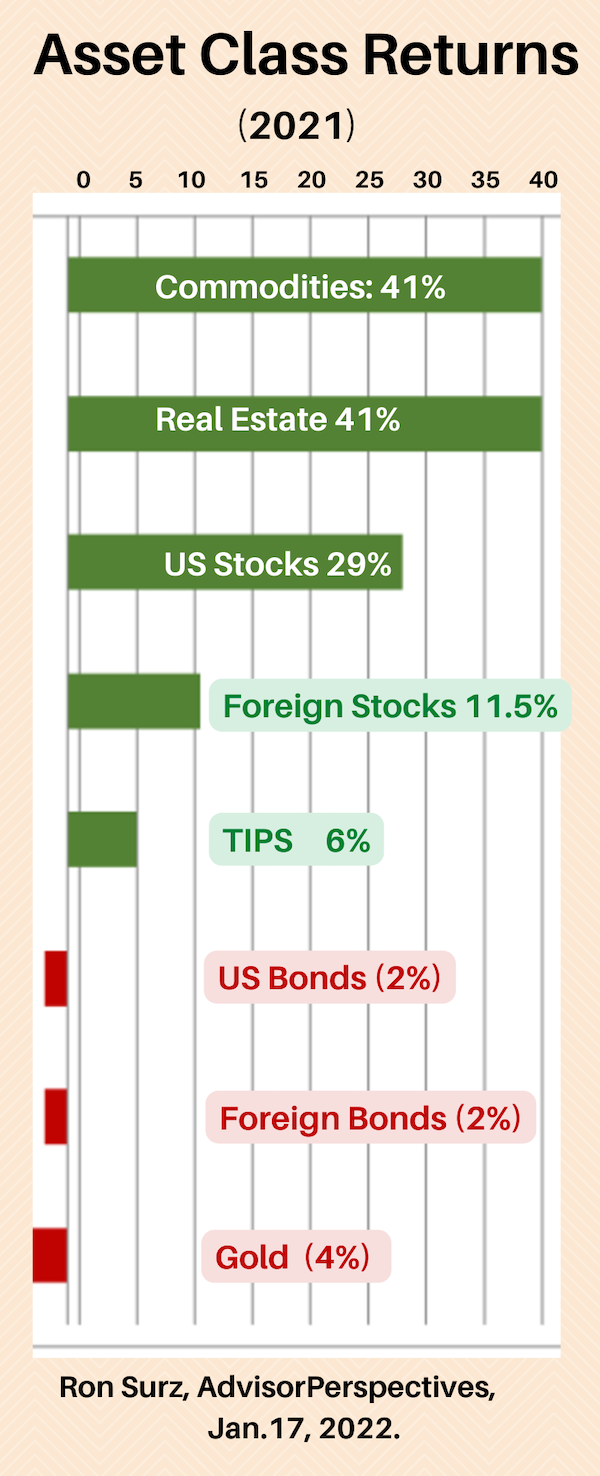

Meanwhile, the life insurer hires the asset management or insurance-linked securities teams of the Bermuda Triangle companies to find higher-yielding investments. These asset managers–at Sixth Street or Blackstone or KKR–tout their ability to raise the investment returns of life insurers by selling them tranches of collateralized loan obligations or real estate-backed securities. These securities are often tailored to meet the life insurer’s risk/return requirements.

There are many variations to the Bermuda Triangle strategy. Sometimes a single holding company owns the life insurer, reinsurer, and the asset manager, as Athene does. As a source of incoming cash, the asset managers prefer fixed indexed annuity (FIA) assets. The lengthy terms of FIA contracts—up to 10 years—allow the asset managers to invest money in higher-yielding, longer-term investments.

Besides being “sticky” and predictable, existing FIAs are also relatively resistant to a rising interest rate environment; they rely on the appreciation of equity options for yield. That’s one reason why they began to replace fixed-rate annuity contracts two decades ago; Investors tended to break their existing fixed-rate annuity contracts when new annuities offered higher rates.

The Bermuda Triangle strategy has put hundreds of billions of dollars in motion. Principal said this week that its reinsurance deal with Sixth Street, which covers $16 billion worth of fixed annuity assets and $9 billion worth of ULSG ( universal life secondary guarantee) contracts, will release about $800 million in capital. “The company plans to return the proceeds to shareholders through share repurchases,” a Principal release said.

Sixth Street’s genealogy

Sixth Street jumped into the Bermuda Triangle strategy in 2021 by buying Talcott Reinsurance Life (the former Hartford Life Insurance Company) from Hopmeadow Holdings for $2.25 billion. It also set up the reinsurer Sutton Life Re in Hamilton, Bermuda (rated A- or Excellent by AM Best) and a similar reinsurer in Georgetown, Cayman Islands. It then executed the Lincoln, Allianz Life and Principal deals in quick succession.

After being acquired by Sixth Street, Talcott’s first reinsurance deal was with Lincoln National, last September. It was the “first flow variable annuity reinsurance transaction in recent years for a product actively sold in the market,” a Talcott release said. In flow reinsurance, annuity contracts are reinsured directly after they are written.

Talcott agreed to co-insure business written on Lincoln’s flagship variable annuity (VA) living benefit rider, which can give policyholders income for life. Exercising those riders may be optional for the policyholder, which means that the issuers have difficulty predicting how they will be used. The nagging presence of that risk drives up capital requirements.

The Lincoln-Talcott reinsurance treaty covers business written from April 1, 2021, through June 30, 2022, to a maximum of $1.5 billion. Lincoln will continue to service and administer the policies it reinsured.

Alan Waxman

On Dec. 3, 2021, according to a news report, Allianz Life Insurance Company of North America announced reinsurance agreements with Sixth Street’s Talcott unit and with a separate firm, Resolution Re, part of Resolution Life Group Holdings LP.

Under the transaction, Resolution Re agreed to reinsure $26 billion of Allianz Life’s FIA liabilities; it then “retroceded” $12 billion of the liabilities to Talcott’s Sutton Life Re affiliate in Bermuda. Separately, Sutton agreed to reinsure $8 billion of Allianz Life FIA liabilities. Like Lincoln, Allianz Life said it will continue to service the contracts it reinsured.

The dealmakers

Before going independent in 2009, Sixth Street was the former credit arm of TPG, a $109 billion private equity firm, according to the Wall Street Journal. The TPG Sixth Street Partners (TSSP) Adjacent Opportunities funds became Sixth Street’s “TAO” Investment funds. In 2020, Sixth Street caught the attention of Wall Street when it raised $24.7 billion through the TAO funds—an impressive sum, even by buyout-firm standards. In 2021, Sixth Street bought 20% of the San Antonio Spurs basketball team and a controlling interest in Legends Hospitality, a sports and live entertainment company co-founded by affiliates of the New York Yankees and Dallas Cowboys.

Muscolino told Institutional Investor magazine last December that Sixth Street began to explore the insurance business about five years ago. “We got to know the business, working within the regulatory framework, and understanding how to look out for policyholders,” he told the reporter.

In regulatory filings, Muscolino estimated his own net worth at $60 million and Waxman’s at $20 million. With a 1999 MBA from the University of Chicago Booth School, he spent time at Accenture, Goldman Sachs, and FG Companies. Waxman, a Penn graduate, was a group chief executive at Goldman Sachs and a vice-president at TPG before cofounding Sixth Street.

In one of its regulatory filings, Sixth Street indicated that it has the luxury of being able to invest in long-term deals without fear that its investors will panic and run. Annuity contract owners, for instance, can’t pull their money out of their contracts before the end of their terms without facing surrender charges.

As for its other stakeholders, Sixth Street told Connecticut insurance regulators last year, “The evergreen structure of the TAO Funds means they have no fixed term, and no liquidity requirement for individual investors or investments—investors cannot redeem their investments in the TAO Funds or otherwise cause the sale of underlying investments of the TAO Funds to generate liquidity.”

© 2022 RIJ Publishing LLC. All rights reserved.