In April of 2008, I started writing about the miserable stock markets we’ve experienced in this first decade of the 21st century, suggesting that things might even get worse. They did.

Then they got better in 2009, but not good enough to bring the decade into positive territory. We have just experienced the worst U.S stock market decade in the past eight decades, starting in the 1930s.

In this end-of-year commentary, I examine the past year and the past decade, placing them into perspective relative to the long run history of our stock markets. I discuss both domestic and foreign stock markets. Toward the end, I focus on my specialty, target date funds.

The worst calendar-decade ever

The worst calendar-decade ever

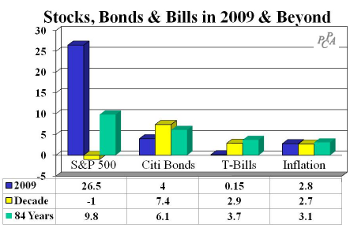

The U.S. stock market, as measured by the S&P 500, earned 26.5% in 2009, rebounding from a 37% loss in 2008. This recovery was not enough to restore previous losses, however, so we’ve ended the decade with an average annualized loss on the S&P of 1% per year, well below the 84-year long term average return of 9.8% per year.

By contrast, bond performance for the year (4%) and the decade (7.4%) was in line with historical averages (6.1%), as was inflation (2.8%). Completing the picture, we’re paying the government to use their mattress, with Treasury bills yielding 0.15% for 2009.

Of the eight calendar decades for which we have complete stock market data, the 2000s were the worst performing, although they were not the worst 10-year period ever. The following chart shows the returns of the past eight calendar decades, as well as the best and worst 10-year periods ever.

There have been worse times than the 2000s: the S&P lost 5% per year in the 10 years ending August 31, 1939, and we just experienced the worst real 10-year loss in the period ending February 28, 2009. That decade brought real cumulative losses of 49%, or 6.5% per year. Investors would have been better off in bonds or Treasury bills than in stocks.

In 2009, all boats were lifted

What sectors, styles, and countries have performed best and worst? The bottom line: everything worked in 2009, and only growth stocks failed for the decade. The real questions of course are all about the future; an understanding of the past should help.

As the exhibit on the right shows, every investment style had substantial gains in 2009. Smaller companies gained more than 40%, exceeding the 24% return to larger companies. Similarly, growth outperformed value, earning 37% versus 29%.

As the exhibit on the right shows, every investment style had substantial gains in 2009. Smaller companies gained more than 40%, exceeding the 24% return to larger companies. Similarly, growth outperformed value, earning 37% versus 29%.

The “stuff in the middle” that we call “Core” surprised by underperforming both value and growth, a somewhat unusual occurrence. Our style definitions are mutually exclusive and exhaustive, making them excellent for style analyses, both returns-based and holdings-based. Note that we use Surz Style Pure indexes throughout this commentary, as described at the end.

On the sector front, every sector had gains in aggregate, but it was certainly possible to lose money in several sectors. In the exhibit below, we show the range of portfolio opportunities available in each economic sector by using a simulation approach that creates portfolios at random, selecting from stocks in each sector. We call this approach “Portfolio Opportunity Distributions” (PODs).

As you can see in the next exhibit, Information Technology was the best performing sector for the year, earning 65.74% (middle of the “Info Tech” floating bar), while Finance was the worst sector with an 11.44% return. But note the ranges of the floating bars. Financials had a lot of opportunities, i.e. a large spread in portfolio returns, while consumer discretionary was quite narrow.

Note also how the S&P 500 performed in each sector (red dot), near median in most, but underperforming in energy, where smaller companies fared best. The S&P 500 underperformed the broad market of roughly 5500 stocks in 2009, earning 26.5% versus the total market’s 31% return. Note also the sector weighting differences in the bottom of the graph. You can use this exhibit to dissect your own performance.

Opportunities abroad

Moving outside the US, it was possible to double your money. Foreign markets fared much better than the US in 2009, earning 45% versus our 31%. Latin American stocks returned a sensational 108% in the year, and every country except Japan outperformed the US, so some will say that diversification “worked” in 2009, vindicating portfolio theory.

In the aftermath of the 2008 catastrophe many lamented that diversification didn’t work when you needed it most because everything tanked at the same time. Nothing works all the time, and diversification doesn’t promise better performance, just greater stability of returns. It is indeed a world market, and owning more than just U.S. companies was valuable in 2009.

The decade of the 2000s

Annual reporting season will start soon, and this is one of those unfortunate times when consultants and investment managers will try to console their clients by explaining how their pain is less, hopefully, than most others. Based on our analysis, the average US stock fund eked out a modest 0.1% per year gain during the past decade. It was a decrepit decade.

The good news, however, is that much of the pain was limited to just the growth sectors of the market. This will be particularly awkward and delicate for growth stock managers, and is likely to bring forth the difficult question about the superiority of value investing. As for value and blend (or core) managers, they should have delivered positive returns for the decade, with smaller value stocks delivering double-digit returns.

In other words, style effects are extremely pronounced and important for evaluating long-term performance. The old saw that value and growth perform about the same over the long run does not apply to the past decade. Similarly, there was a wide spread of country results during the decade, with Japan losing 2.8% per year while Australia & New Zealand delivered 20% returns.

So here’s my prediction of what evaluators like Morningstar will proclaim: Growth stock managers were more skillful than value managers during the decade because the majority of growth stock managers outperformed their benchmarks, while the majority of value managers lagged their benchmarks.

This is poppycock caused by a peer group flaw known as classification bias. Peer groups are terrible backdrops for evaluating performance. That’s why we provide you a better way in the next two exhibits, which are being published here weeks before the “real” results are available.

The universes in these exhibits are created using PODs. They represent all of the possible portfolios that managers could have held when selecting stocks from the indicated markets.

Traditional peer groups are very poor barometers of success or failure because of their myriad biases. Everyone knows that it’s easy to find a peer group provider that makes you look good, but for some reason the industry tolerates, even condones, this deceptive practice.

Now is the time to stop the subterfuge, because we can. PODs are bias free and are therefore a much more reliable performance evaluation backdrop, plus they’re available now, many weeks before the “real” biased peer groups. You can use the chart below to get an early and accurate ranking of your own portfolio. Just plot your dot.

TDFs: A good idea gone awry?

Many retirees, as well as those who are saving for retirement, have invested in target date funds. Target date funds start out aggressively when the target date is distant and then become more conservative as the target date draws near.

The target date fund (TDF) industry is growing rapidly. Currently encompassing $310 Billion, this industry is forecast to grow above $2.5 Trillion in the next 10 years [see Casey, Quirk 2009], primarily because it has become the preferred qualified default investment alternative (QDIA) under the Pension Protection Act of 2006.

TDFs are a reasonably good idea, but suffer from pathetic execution, at least so far. This is due in large part to the fact that most TDFs are currently designed to serve beneficiaries beyond the target date, to death, instead of to their presumed target-the retirement date.

Such funds have come to be known as “THROUGH” funds (as opposed to “TO” funds which are designed to end at the target date). A secondary issue with TO funds is the amount of equities that should be held at the target date; we believe zero is the correct answer because savings are most dear as retirement draws near.

2008 was disastrous for TDFs, with the typical 2010 fund losing 25%, because it held 45% in equities. 2010 funds are intended for those retiring between 2005 and 2015. We should have learned a lesson from 2008, but little has changed other than it is likely that the Securities and Exchange Commission and Department of Labor will require fuller disclosure, especially about the meaning of the date in target date fund names. Perhaps THROUGH funds will have to be called target death funds.

An important question for fiduciaries is what are the risk and reward trade-offs of THROUGH versus TO TDF paths. To answer this, we have measured ending wealth and risk for all 40-year glide paths going back to 1926. Importantly, the risk measure is dollar-weighted downside deviation, which we call “risk of ruin.” The rationale for this measure of risk is provided in my 2009 Advisor Perspectives article. The graph below summarizes the results.

As you can see, the reward-to-risk is about the same for the complete 40-year glide path, but TO funds dominate over the critical last 10 years of the path. So now you know the risk and reward considerations in your choice between TO and THROUGH – although both provide roughly the same reward-to-risk profiles over the full 40 years, “TO” funds are much safer over the final 10-year period as the target date approaches.

Defined contribution plan fiduciaries have come to believe that any target date fund will suffice because all target date funds are qualified default investment alternatives (QDIAs). But there are huge differences among target date funds, especially near the target date, so this generic belief is false. Fiduciaries have the responsibility to select and monitor good target date funds. In particular, convenience and familiarity are foolish reasons for entrusting employee savings to the plan’s recordkeeper.

Ron Surz is president of PPCA, Inc. and its subsidiary, Target Date Solutions.

This commentary incorporates Surz Style Pure® Indexes, StokTrib holdings-based style analysis and attribution, and Portfolio Opportunity Distributions. Surz Style Pure indexes are available for free on Evestment Alliance, MPI, Zephyr, Factset, Informa, SunGard, Pertrac, Morningstar, and other platforms. Designed especially for returns-based style analysis, they meet William F. Sharpe’s recommendation to use a style palette that is mutually exclusive (no stock is in more than one style) and exhaustive (the collection of indexes comprise the entire market).

REFERENCES

Basu, Anup and Michael Drew, “Portfolio Size Effects in Retirement Accounts: What Does it Imply for Lifecycle Asset Allocation.” Journal of Portfolio Management, April 2009

Casey, Quirk & Associates, “Target Date Retirement Funds: The New Defined-Contribution Battleground”. November 2009 Research Paper.

Siegel, Laurence B. 2003. Benchmarks and Investment Management. Research Foundation of CFA Institute, Charlottesville, Va.

Statman, Meir. “What Do Investors Want?” Journal of Portfolio Management, 30th Anniversary Edition 2004, pp. 153-161

Surz, Ronald J., “Should Investors Hold More Equities Near Retirement, or Less?” Advisor Perspectives, August 2009.

————–,“The New Trust but Verify.” PPCA White Paper, November 2009.

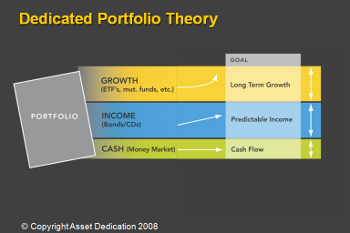

“It’s liability-driven investing for individuals,” said Huxley and Burns in a recent interview with RIJ. “We call it Dedicated Portfolio Theory. It relies on the same institutional concepts that foundations and endowments have used for years.”

“It’s liability-driven investing for individuals,” said Huxley and Burns in a recent interview with RIJ. “We call it Dedicated Portfolio Theory. It relies on the same institutional concepts that foundations and endowments have used for years.”  On the other hand, there’s nothing magical about this methodology. While aimed at creating a rolling buffer zone between a retiree’s market-sensitive assets and his or her monthly cash flow, it doesn’t necessarily exempt advisors or clients from potentially difficult timing decisions during retirement, Huxley and Burns conceded.

On the other hand, there’s nothing magical about this methodology. While aimed at creating a rolling buffer zone between a retiree’s market-sensitive assets and his or her monthly cash flow, it doesn’t necessarily exempt advisors or clients from potentially difficult timing decisions during retirement, Huxley and Burns conceded.