Retirement assets total $34.9 trillion in 4Q2020: ICI

Total US retirement assets were $34.9 trillion as of December 31, 2020, up 7.5 percent from September and up 9.3 percent for the year. Retirement assets accounted for 33 percent of all household financial assets in the United States at the end of December 2020, according to the Investment Company Institute’s latest quarterly report.

Assets in individual retirement accounts (IRAs) totaled $12.2 trillion at the end of the fourth quarter of 2020, an increase of 9.1 percent from the end of the third quarter of 2020. Defined contribution (DC) plan assets were $9.6 trillion at the end of the fourth quarter, up 6.8 percent from September 30, 2020. Government defined benefit (DB) plans— including federal, state, and local government plans—held $7.1 trillion in assets as of the end of December 2020, a 7.6 percent increase from the end of September 2020. Private-sector DB plans held $3.4 trillion in assets at the end of the fourth quarter of 2020, and annuity reserves outside of retirement accounts accounted for another $2.5 trillion.

Americans held $9.6 trillion in all employer-based DC retirement plans on December 31, 2020, of which $6.7 trillion was held in 401(k) plans. In addition to 401(k) plans, at the end of the fourth quarter, $600 billion was held in other private-sector DC plans, $1.2 trillion in 403(b) plans, $384 billion in 457 plans, and $739 billion in the Federal Employees Retirement System’s Thrift Savings Plan (TSP).

Mutual funds managed $4.4 trillion, or 66 percent, of assets held in 401(k) plans at the end of December 2020. With $2.6 trillion, equity funds were the most common type of funds held in 401(k) plans, followed by $1.2 trillion in hybrid funds, which include target date funds.

IRAs held $12.2 trillion in assets at the end of the fourth quarter of 2020. Forty-five percent of IRA assets, or $5.5 trillion, was invested in mutual funds. With $3.1 trillion, equity funds were the most common type of funds held in IRAs, followed by $1.1 trillion in hybrid funds.

Retirement entitlements include both retirement assets and the unfunded liabilities of DB plans. Under a DB plan, employees accrue benefits to which they are legally entitled and which represent assets to US households and liabilities to plans. To the extent that pension plan assets are insufficient to cover accrued benefit entitlements, a DB pension plan has a claim on the plan sponsor.

As of December 31, 2020, total US retirement entitlements were $40.6 trillion, including $34.9 trillion of retirement assets and another $5.8 trillion of unfunded liabilities. Including both retirement assets and unfunded liabilities, retirement entitlements accounted for 39 percent of the financial assets of all US households at the end of December.

Unfunded liabilities are a larger issue for government DB plans than for private-sector DB plans. As of the end of the fourth quarter of 2020, unfunded liabilities were 44 percent of benefit entitlements for both state and local government and federal government DB plans, compared with only 4 percent of benefit entitlements for private-sector DB plans.

Jasmine Jirele succeeds Walter White as CEO of Allianz Life

Jasmine Jirele has been named president and CEO of Allianz Life, effective September 1, 2021, subject to independent auditor and regulatory filings, the company announced this week. She will succeed Walter White, who will step down on that date and retire December 31, 2021.

Jirele has been Allianz Life’s chief growth officer since 2018, with responsibilities for expanding into new markets, where she has been responsible for product innovation, marketing, communications, and Allianz Ventures.

Prior to re-joining Allianz Life in 2018, Jirele was an executive vice president within Wells Fargo’s Consumer Bank division, and was previously a senior vice president in Wells Fargo’s Wealth and Investment Management division.

She also held various leadership roles in marketing, product innovation and operations at Allianz Life. Jirele holds a B.A. in business and journalism from the University of St. Thomas and an MBA from Hamline University.

White will be nominated to serve as an independent director on the Allianz Life Insurance Company of North America Board of Directors.

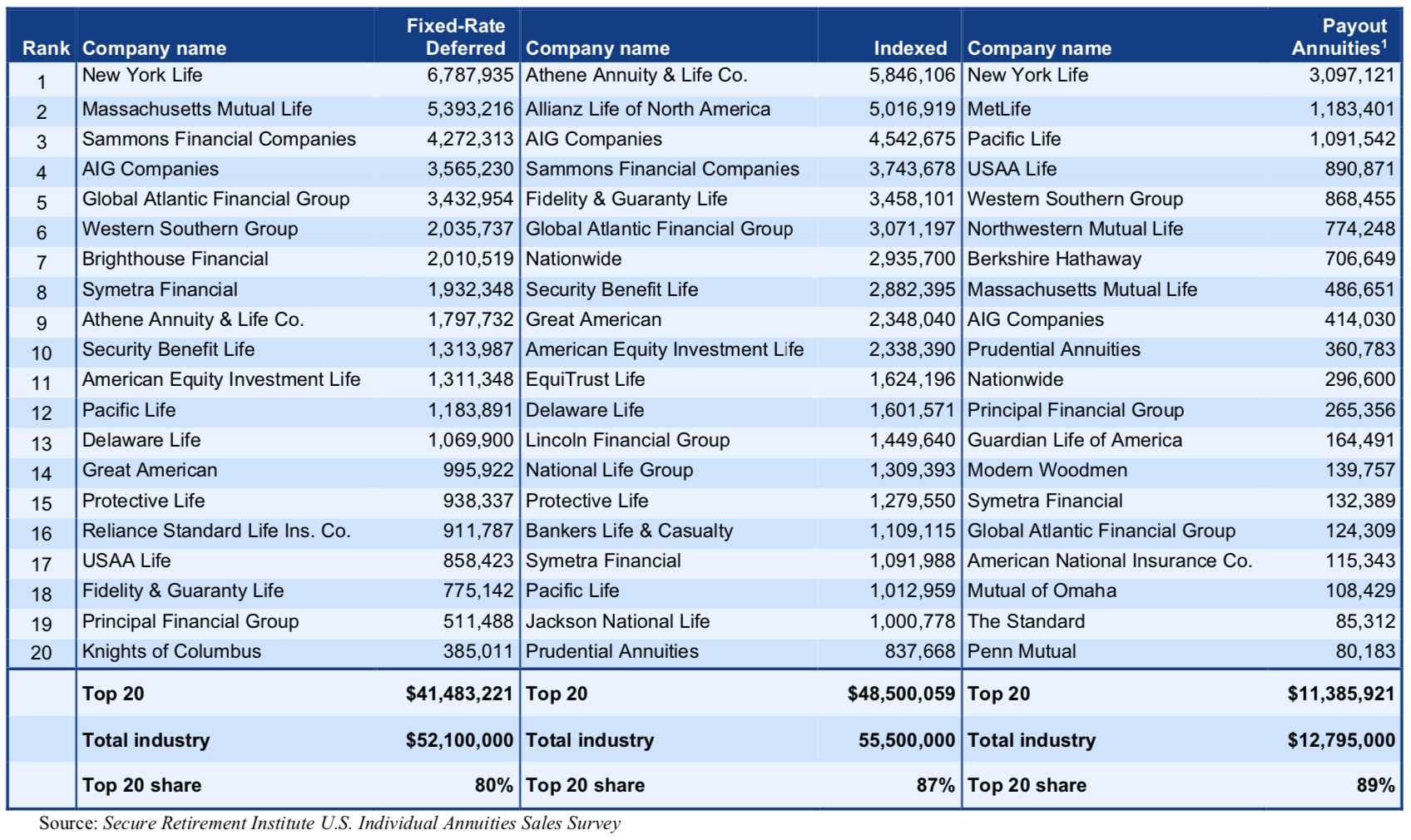

NY Life 2020 numbers include more than $13.7bn in annuity sales

New York Life, the largest US mutual life insurance company, released 2020 results this week, reporting a record $27 billion in surplus, $702 billion in assets under management, $1.1 trillion in individual life insurance in force in the US and $12.5 billion in total dividends and benefits paid to policy owners and their beneficiaries.

In 2020, New York Life declared $1.8 billion in dividends to eligible participating policy owners in 2021, its second largest payout in company history, according to a release. It also reported life insurance sales of $1.2 billion, annuity sales of over $13.7 billion, and $2.3 billion in operating earnings.

New York Life also completed its largest acquisition ever, acquiring Cigna’s group life and disability insurance business. It is now rebranded New York Life Group Benefit Solutions. The $6.3 billion acquisition added about 3,000 employees and over nine million customers to New York Life, placing it among the top five insurers in the group life and disability insurance businesses.

The four major financial rating agencies renewed New York Life financial strength ratings, giving it the highest ratings currently awarded to any US life insurer and making the company one of only two in the industry to achieve this standard out of the 800 life insurers operating in the US today, the release said.

C-level management changes at Voya

Voya Financial is updating its operating model, which focuses on retirement plans, employee benefits, and investment management, and its leadership team, according to an announcement this week by chairman and CEO Rodney O. Martin, Jr.

New vice chair roles

Michael Smith will serve as vice chairman in addition to his role as chief financial officer and leader of Voya’s Finance and Risk areas. Smith has expanded responsibilities for technology, data science, transformation, continuous improvement, procurement, sourcing and supplier management, and real estate.

Michael Katz, Voya’s chief strategy, planning and investor relations officer, and Santhosh Keshavan, Voya’s chief information officer, will join Voya’s executive committee.

Charles Nelson will serve as vice chairman and chief growth officer, with responsibility for growing Voya’s current base of more than 13 million individual and institutional customers and approximately 55,000 employers. He will oversee sales and distribution, relationship management, health and wealth marketing and customer solutions.

William Harmon will assume a new role as Voya’s chief client officer, leading the health and wealth sales, distribution and relationship management teams.

New CEOs of Health and Wealth Solutions

Heather Lavallee, currently president of Retirement Tax-Exempt Markets, will become CEO of Wealth Solutions.

Robert Grubka, who currently serves as president of Employee Benefits, will become CEO, Health Solutions.

Grubka and Lavallee will join Voya’s executive committee. They will collaborate with Christine Hurtsellers, CEO of Investment Management, on enterprise business growth.

Voya Financial, Inc. (NYSE: VOYA), a Fortune 500 company, serves about 14.8 million individual customers, workplace participants and institutions in the United States. In 2020, it had $7.6 billion in revenue. The company had $700 billion in total assets under management and administration as of Dec. 31, 2020.

© 2021 RIJ Publishing LLC. All rights reserved.