The Biden administration has a plan to replace the tax deduction for IRA and 401(k) plan contributions with a tax credit, according to former Commodity Futures Trading Commission (CFTC) chief market intelligence officer Andrew Busch. His comments were made at the Financial Services Institute’s annual conference and reported by Financial Advisor magazine this week.

During the 2020 election campaign, the Biden/Harris website recommended “equalizing the tax benefits of retirement plans,” which the Obama administration believed accrued disproportionality to high-income retirement plan participants; they save the most money and, because they are in higher tax brackets, defer more taxes.

“Current tax benefits for retirement savings provide upper-income families with a significant tax break, while providing a limited benefit for low- and middle-income workers,” Busch was reported to say. “Biden will equalize benefits across the income scale, so working families also receive substantial tax benefits when they put money away for retirement.” A federal “Saver’s Credit” is already available; it is currently worth up to $1,000 a year as a tax credit.

Opponents of changing the current tax incentives have said in the past that curtailing or changing the benefit will only reduce the incentive to save, noting that high-income retirees eventually pay at least some of the taxes back, depending on their tax brackets in retirement.

In 2017, Busch, a self-described economist and futurist, became the nation’s first Chief Market Intelligence Officer at the CFTC. He advised the SEC, the US Treasury, the Federal Reserve Board, the Federal Reserve of New York and the White House.

Busch said one of income Treasury Secretary Janet Yellen’s first priorities will be to reverse much of Donald Trump’s Tax Cuts and Jobs Act. “They’ll really attack that. Yellen has been very clear: They’re going to raise the corporate tax rate from 21% to 28%,” Busch remarked. In addition, he said, President Biden is considering a “corporate alternative minimum tax and wants to do away with tax cuts for anyone making more than $400,000 while attempting to make permanent those cuts under $400,000.”

Biden’s Social Security reform plan includes applying the 6.2% payroll tax to earned income over $400,000. Fewer than one percent, or 3.3 million Americans, are reported to earn that much in a year. The wealthy get most of their income from investment assets such as dividends and capital gains.

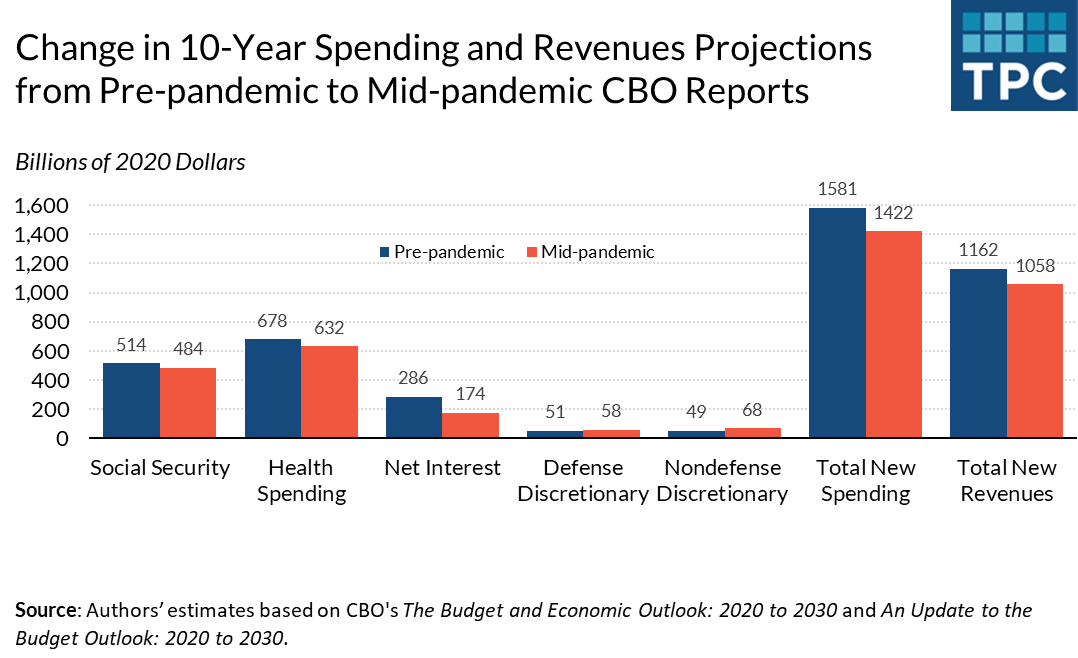

The President’s COVID-19 stimulus proposal of $1.9 billion breaks down into these categories:

- $750 billion for COVID-19 containment and vaccination, aid to state and local governments, and increased federal spending. That includes $350 billion in state and local aid, as well as money for vaccination, testing and tracing, and reopening schools

- $600 billion in direct aid to families: including $1,400 per-person rebate checks and the child tax credit expansion

- $400 billion to financially vulnerable households, including an additional $400 per week in unemployment benefits and the extension of the pandemic unemployment programs

- $150 billion to businesses: this category includes loans and grants to small businesses and paid sick leave.

Republicans favor a “skinny stimulus” plan that would reduce the overall price tag to about $618 billion. The “skinny stimulus” proposal was laid out in a one-page broadside from Sen. Susan Collins (R-ME) and nine other GOP senators to Biden. It recommended reducing individual stimulus checks to $1,000 from Biden’s proposed $1,400 and lowering the income ceiling of those receiving another round of individual checks.

A copy of the Republican proposal can be found here. About half of its outlays ($290 billion) would go to vaccination efforts ($160 billion) and to supplements of $300 per week unemployment benefit supplements ($130 billion). Another $220 billion would fund direct payments to Americans, with up to $1,000 going to singles earning less than $50,000 per year and couples earning less than $100,000. Dependents would receive $500 each.

Like the Biden plan, the GOP alternative would include money for vaccines and other public-health priorities; provide new money for the small-business loan programs created last year; and extend the current level of federal supplemental unemployment insurance. But it would not include funds sought by state and local governments, or rental assistance and progressive priorities such as a higher minimum wage and paid family leave, which Biden favors.

Last spring, the CARES relief act received unanimous approval by the Senate and passed the House with a bipartisan vote of 419 to 6. During the Great Recession of 2008-2009, no Republicans in the House and only three in the Senate supported President Barack Obama’s $800 billion stimulus, known as the American Recovery and Reinvestment Act of 2009 (ARRA), often citing the deficit and national debt as a reason for relative austerity.

Busch predicted GDP growth “north of 4% and rapid job growth,” in the coming year, adding that both could rise significantly if Congress passes a large stimulus package. “Keep in mind how much stimulus has already been released. Some $10.4 trillion has been allocated to the economy. If you are wondering why companies and stocks have recovered, this is why. And there is still $4 trillion that hasn’t made its way into the economy yet,” Busch told the FSI.

According to economists at the Brookings Institute, “Cumulative GDP through 2023 without additional fiscal support is about 3% below its pre-pandemic projected path. But with the $1.9 trillion package, real GDP reaches its pre-pandemic level by the fourth quarter of 2021, and then exceeds it over the next two years as households and businesses make up some of the economic activity foregone during the pandemic. Still, cumulative GDP through 2023 remains about 1% below its pre-pandemic projected path.”

(c) 2021 RIJ Publishing LLC. All rights reserved.