Retirement giants will partner on forthcoming ‘PEP’

Mercer, the global benefits consulting firm with $300 billion in global OCIO, has selected Empower Retirement as the recordkeeper for Mercer Wise 401(k), the firm’s outsourced 401(k) solution, and to use Empower as its record keeper when it launches a Pooled Employer Plan (PEP) in early 2021, according to a Mercer release.

Launched in 2017, Mercer Wise 401(k) now has over $1 billion in participant assets under management. Mercer, which ranked as the largest Outsourced Chief Investment Officer (OCIO) according to Pensions & Investments magazine, with some $300 billion in global OCIO assets under management.

“Besides our growth in OCIO AUM, we’ve also experienced strong growth in interest for our manager research through MercerInsight, our digital delivery platform, and in our traditional investment consulting client base. As of June 2019, over half of Mercer’s $15 trillion in assets under advisement were from MercerInsight clients that have access to the firm’s manager research5,” said Deb Clarke, Mercer’s Global Director of Research.

PEPs were made legally possible by a provision in the 2019 SECURE Act. That provision allows many unrelated employers to join a single large multiple employer plan offered by a Pooled Plan Provider. In the past, only companies with some natural affiliation—geographical, professional, union-related—could belong to a single plan. For employers who want to offer a plan but not start one, joining a PEP allows one-stop shopping.

“Given recent market volatility, the complexity of retirement plan and investment issues, and many competing demands for employers’ time, the idea of outsourcing to a high-quality pooled plan can be a compelling one,” said a Mercer executive in the release.

Mercer’s clients include many types of institutional investors, such as defined benefit and defined contribution plans, insurance assets, financial intermediaries, not-for-profit foundations, endowments and healthcare systems, family offices and sovereign wealth funds. Mercer clients will now also have the benefit of access to Empower, the second largest retirement services provider in the US, after Fidelity Investments. Robert Reynolds, chair of Great-West Lifeco US, and Edward F. Murphy III, president and CEO of Empower Retirement, and Robert Reynolds, chair of Empower’s parent, Great-West Lifeco US, are former senior executives at Fidelity.

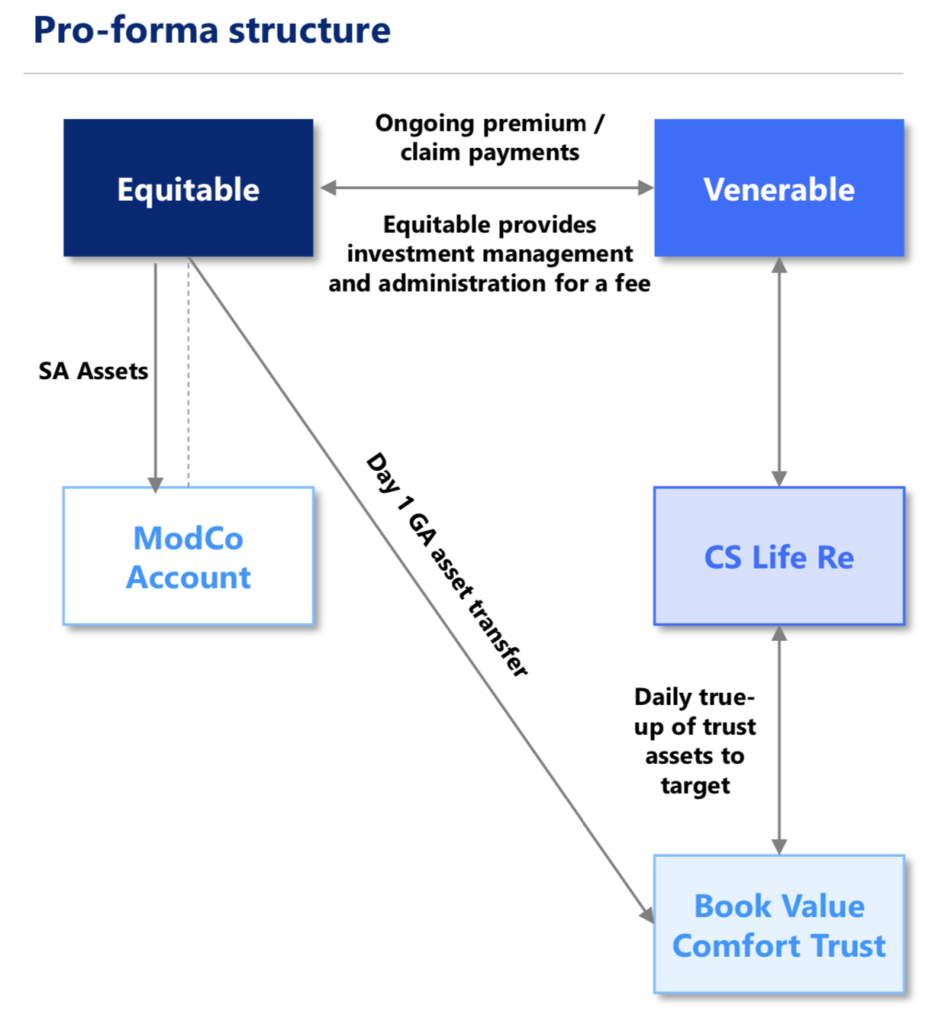

In 2019, Great-West Lifeco sold almost all of its individual life and annuity business to Protective Life, a subsidiary of Tokyo-based Dai-ichi Life Holdings, in a reinsurance deal valued at about $1.2 billion. The value included a positive ceding commission to Great-West Lifeco’s U.S entities and a capital release of approximately US$400 million.

The business transferred included bank-owned and corporate-owned life insurance, single premium life insurance, individual annuities, and closed block life insurance and annuities. This business contributed approximately US$95 million, to Great-West Lifeco net earnings for the first three quarters of 2018.

GWL&A will retain a small block of participating life insurance policies which will be administered by Protective following the close of the transaction. GWL&A’s retirement and investment management divisions, Empower Retirement and Great-West Investments, are not affected by this transaction.

New ‘structured outcome’ ETF from TrueMark

Rosemont, IL-based asset manager TrueMark Investments has launched NVMZ, the fifth ETF in the True-Shares structured outcome product suite. The TrueShares Structured Outcome (November) ETF is sub-advised by SpiderRock Advisors, a Chicago-based asset management firm specializing in option overlay strategies.

The fund seeks to provide investors with structured outcome exposure to the S&P 500 Price Index. The structured outcome ETF suite combines downside buffers with uncapped upside participation.

“NVMZ’s structure allows for the potential of an asymmetric return profile,” according to a TrueMark release. The fund seeks to provide investors with returns (before fees and expenses) that track the S&P 500 Price Index, while seeking to provide a buffer of 8-12% on that index’s losses over the fund’s one-year investment period.

In practice, the fund adviser will target the buffer at 10% of index declines over the investment period following the first day of trading while also allowing for uncapped upside participation. NVMZ’s expense ratio is 0.79%.

NVMZ is the fifth of twelve monthly series ETFs in the True-Shares Structured Outcome ETF suite. Each fund will roll over at the end of a year-long term, at which point the downside buffer and upside participation will reset based on current pricing for the options used by the strategy for each respective ETF.

Due to the cost of the options used by the Fund, the correlation of the Fund’s performance to that of the S&P 500 Price Index will be less than if the Fund invested directly in the S&P 500 Price Index without using options, and could be substantially less, the release noted.

‘Annuity Switchboard’ now available for annuity distributors

Beacon Annuity Solutions, a provider of cloud-based software, has introduced Annuity Switchboard, a source of “pre-sale and compliance-driven solutions” for annuity manufacturers and distributors, according to a news release.

Annuity Switchboard “enables insurers to communicate their most current annuity rates and product information at key point throughout the annuity purchase cycle,” the release said. The information will be directed to broker/dealers, banks, brokerage general agencies and other distribution partners.

“Switchboard provides secure real time access to carrier information on thousands of fixed, fixed index, indexed variable and variable annuity products along with more than 10,000 rates. Custom APIs deliver a seamless integration into bank and broker dealer compliance systems as well as carrier back offices,” the release said.

Beacon also has an archive of closed annuity products with versioning going back to 1997. The archive enables brokers to make detailed comparisons of the exact version of an exchanged product verses a recommended one for any type of annuity.

In addition to supporting annuity sales and distribution, the Annuity Switchboard interface “allows annuity providers to control and understand how their products are being used across their own distribution ecosystem.

“Carriers effectively manage each distributor’s access to its products and approve all its annuity offerings for each distributor down to the state level planned product roll outs and integration with straight through processing. Over time, carriers experience less NIGOs (applications deemed Not In Good Order) and breakage, resulting in reduced acquisition costs.”

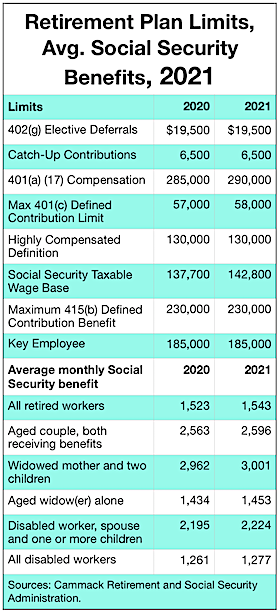

IRS publishes inflation adjusted limits for employers

The IRS has released Revenue Procedures 2020-45 and 2020-32, which set forth the 2021 inflation-adjusted limits for certain employee welfare benefit plans and the dollar amounts used for certain discrimination testing, according to a bulletin published by the Wagner Law Group.

Health FSAs. The 2021 limit for employee salary reduction contributions to health flexible spending accounts will remain at $2,750. If the cafeteria plan permits the carryover of unused amounts, the maximum carryover amount is $550.

Health Savings Accounts. The 2021 limit on contributions to health savings accounts (“HSA”s) increases to $3,600 (up from $3,550) for a self-only HSA, and $7,200 (up from $7,100) for a family HSA. For 2021, the minimum deductible required for a high deductible health plan (“HDHP”) remains (unchanged from 2020) at $1,400 for employee-only coverage, and $2,800 for family coverage. The maximum out-of-pocket amount for an HDHP (including deductibles, co-payments and other amounts, but not including premiums) cannot exceed $7,000 (up from $6,900) for self-only coverage and $14,000 (up from $13,800) for a family.

Dependent Care. There were no changes to the limits for dependent care flexible spending account contributions, and the maximum tax-exempt benefit from a dependent care assistance plan remains at $5,000 ($2,500 if married and filing separately), as this amount is not indexed to inflation.

Transportation and Parking. For 2021 the qualified transportation benefit limit for transit passes and for qualified parking remains at $270 per month.

Highly Compensated Employee. “Highly compensated employees” (or “HCE”s) must be determined for several welfare plan nondiscrimination tests. For the 2021 plan year, the IRS announced in Notice 2020-79, that an employee who earns more than $130,000 in 2020 is an HCE.

Patient-Centered Outcomes Research Institute (“PCORI”) Fee. As a reminder, the Further Consolidated Appropriations Act, 2020 (enacted last December) extends the PCORI fee obligations for ten years. While it was set to expire for policy/plan years ending on or after October 1, 2019, the fee will continue to be assessed through 2029. To date, the IRS has not yet released the PCORI fee amount for the 2021 plan year.

Revenue Procedure 2020-45 is available at: https://www.irs.gov/pub/irs-drop/rp-20-45.pdf, and Revenue Procedure 2020-32 is available at: https://www.irs.gov/pub/irs-drop/rp-20-32.pdf.

US financial assets surpass $50 trillion: Cerulli

The 2019 total US professionally managed market at $51.5 trillion, according to Cerulli Associates.

The split of US professionally managed assets continues to favor institutional client channels (53.8%) over retail client channels (46.2%), although retail client channel marketshare has increased by 5.2 percentage points since 2009, according to Cerulli’s latest report, “The State of US Retail and Institutional Asset Management 2020.”

Retail and institutional distribution is increasingly intermediated by third parties. In retail client channels, the share of assets that move through the third-party distribution channel has increased from 72.8% in 2014 to 74.3% in 2019. Similarly, the share of institutional client assets moving through third-party distribution has climbed from 45.6% to 53.6%.

“Centralized influence points, such as investment consultants and broker/dealer (B/D) home offices, can help amplify distribution efforts as they provide a single point of contact for what is the potential of multiple client relationships,” said Brendan Powers, associate director, in a press release.

B/D-affiliated financial advisors are shifting to fee-based business models and increasingly adopting asset allocation model portfolios, emphasizing a focus on financial planning and delivering holistic advice.

“In this case, platform shelf space and model inclusion will be gate-kept by the home office,” adds Powers. The collective bargaining power and negotiating skills of investment consultants on the institutional side means that the fee negotiation process will be a challenging part of winning new business.

Investors and their intermediaries have access to a greater variety of vehicles. The report cites that open-end mutual funds (31.7%) and institutional separate accounts (22.4%) hold 54.2% of US professionally managed assets. However, both vehicles’ five-year compound annual growth rates lag those of model-delivered and manager-traded dual-contract separate accounts, exchange-traded funds (ETFs), and collective investment trusts (CITs).

“Investors are increasingly open to vehicles beyond traditional open-end mutual funds and institutional separate accounts. Cost, transparency, and customization are becoming increasingly important attributes,” Powers said. “Looking forward, asset managers should be focused on building out new investment vehicle capabilities to the extent that they can provide more flexibility to clients in selecting how they want to consume the strategies their firm offers.”

Questions and answers

Questions and answers

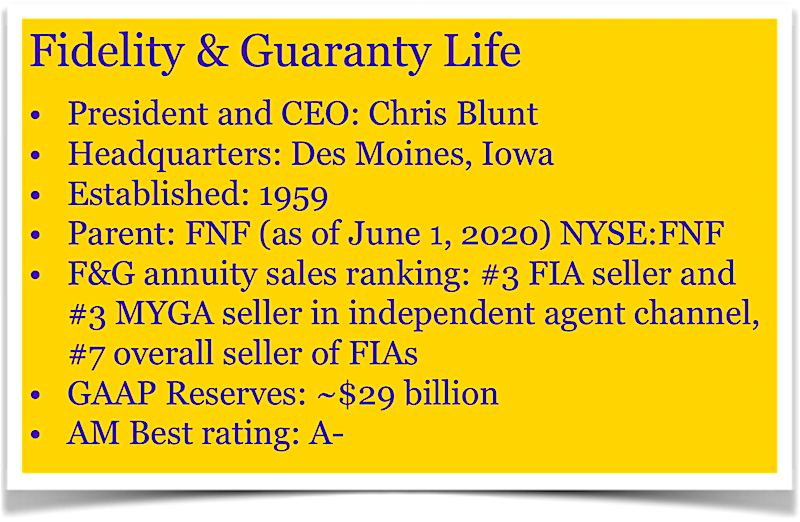

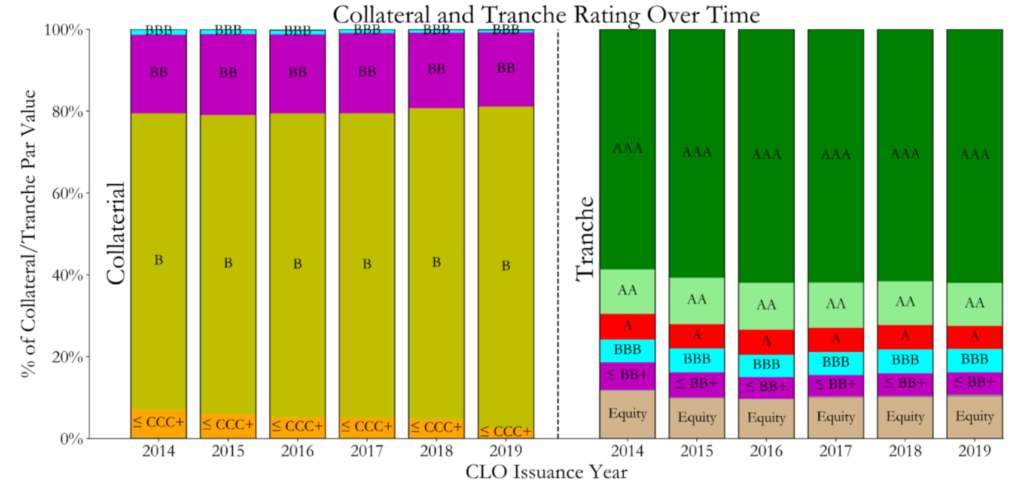

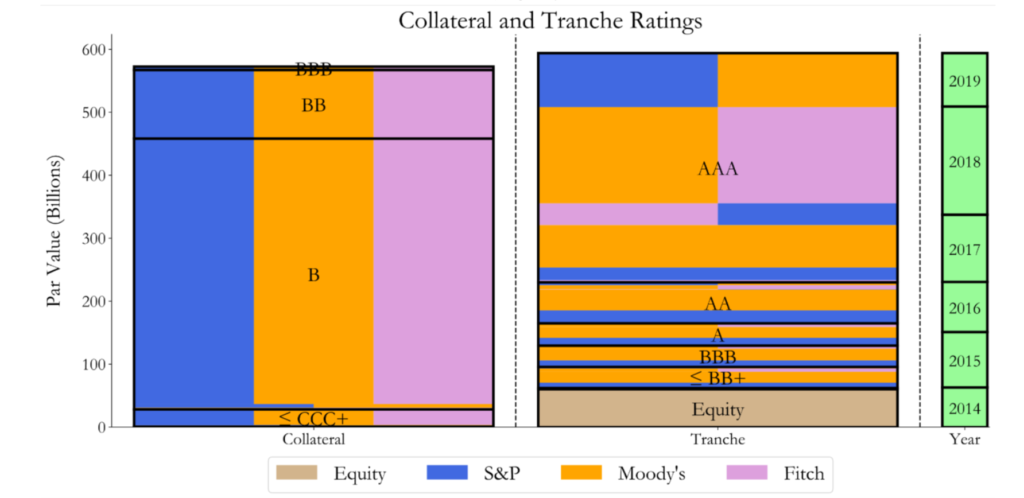

RIJ: Which tranches of asset-backed securities does F&G buy?

RIJ: Which tranches of asset-backed securities does F&G buy?

assets transferred under the agreement have a lower average yield than AFG’s overall annuity portfolio yield, and the policies ceded have an overall cost of funds that is higher than that of AFG’s retained business,” a press release said. “AFG expects to earn an increase in the net interest spread on its retained $34 billion of annuity reserves.”

assets transferred under the agreement have a lower average yield than AFG’s overall annuity portfolio yield, and the policies ceded have an overall cost of funds that is higher than that of AFG’s retained business,” a press release said. “AFG expects to earn an increase in the net interest spread on its retained $34 billion of annuity reserves.”