Let’s assume that most American retirees would be better off with pensions. And let’s assume that most people who want a pension would have to buy it with part of their 401(k) savings. How then would you retrofit the 401(k) system to make that possible?

One new proposal is Project LIMA, or Lifetime Income Managed Accounts. This specific idea comes from the math laboratories of Milliman, the actuarial consulting firm whose risk-management algorithms are embedded in a wide range of mutual funds and annuities.

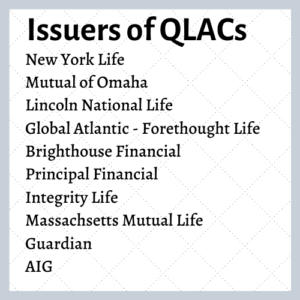

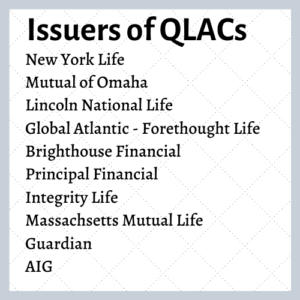

If a 401(k) plan sponsor adopted LIMA, a participant who has elected to use a managed account (as opposed to a target date fund) could apply a percentage of each payday contribution to the gradual purchase of a qualified lifetime annuity contract, or QLAC. In retirement, the QLAC would deliver inflation-adjusted monthly income for life.

We’re hearing about LIMA now because the SECURE Act finally passed. The Act makes it less likely that a participant might sue an employer over any adverse consequences of buying an in-plan annuity. That includes QLACs inside managed accounts as well as target date funds with “guaranteed income riders.”

But legal liability hasn’t been the only reason that illiquid, life-contingent deferred income annuities haven’t taken up residence in 401(k)s (though they’ve long existed in 403b plans). The fund firms who provide investment options for 401(k) earn a percentage of assets under management, or AUM.

Until now, any money diverted into multi-premium annuities would disappear from AUM and from recordkeeping statements. One of the proposals within Project LIMA is that the annuity value stays in the managed account, shows up in recordkeeping statements, and is in turn part of AUM. Richter is hopeful that providing this substantiated valuation process for the annuity income stream will provide a basis for billing.

Michelle Richter

“Milliman’s contribution to the recipe, and it’s essential to the design, is the valuation and dynamic re-valuation of the annuity within the managed account,” said Michelle Richter, the Milliman consultant who is leading the Project LIMA effort.

“Providing this substantiation valuation process for the annuity income stream will provide a basis for billing,” she added. “We are starting from a ‘safety first’ perspective [i.e., aiming to generate enough guaranteed income through the annuity to cover basic retirement expenses] and ladder into guaranteed income across the rate environment. But there are a lot of ways that this could be implemented.”

Growing income gradually

In a hypothetical example offered by Milliman, a 40-year-old participant, Jane Doe, has a $50,000 DC plan balance. She plans to retire at age 67. She’s a conservative investor who has chosen a managed account over a target date fund, and an asset allocation of 50% stocks and 50% bonds.

Jane is offered the option of enrolling in a managed account with a QLAC. She fills out a questionnaire that will reveal her estimated basic expenses in retirement and how much more guaranteed income, above Social Security and pension, if any, she will require to cover those expenses. She then chooses either to start a) buying a QLAC that will meet her essential monthly retirement expenses, b) buying a QLAC with her employer’s matching contribution, or c) not buy a QLAC.

The LIMA algorithm determines that approximately 3% of her savings should be contributed to a QLAC each year. At the end of the first year, she’ll have $25,000 in stocks, $23,519 in bonds, and a QLAC with a book value of $1,481. Fast-forward 13 years: At age 53, Jane now has $123,632 in stocks, $69,894 in bonds, and a QLAC with a book value of $44,293.

During those 13 years, the adviser handling her managed account would have rebalanced her portfolio allocations back to her conservative risk level. The LIMA algorithms would also determine the amount of annuities Jane Doe needs to acquire over time to achieve her ‘Safety First’ income targets. As Richter envisions the process, Jane will have purchased pieces of QLAC from several different life insurance companies by then.

If Jane decides to leave her employer, she can roll over to a managed IRA provided, perhaps, by the same fund company that provided her 401(k) managed account. Somehow—and this part isn’t complete—her slivers of QLAC from different insurers would be resolved into a single payment. She would begin receiving income from the QLAC sometime between age 72 and age 85.

“Several insurers tell us they have capacity for and interest in QLACs, assuming that the distribution likes it. A lot of new recordkeeping work would have to be done to handle QLACs in-plan, as opposed to selling them as standalone products,” Richter said.

“To the extent that the QLACs are embedded in a managed account structure, it’s easier for the recordkeeper and the asset manager to handle, as opposed to managing separate assets,” she added. “Since SECURE passing, there has been more discussion about how annuities as retirement income solutions are expected to make their way into 401(k) plans, and we are excited about the potential of designs like Project LIMA.”

What’s old is new again

The efficiency (or “utility” in economics) of this concept was recognized long ago. Many have seen the wisdom of buying annuities incrementally instead of with lump sums and delaying payouts to age 80 or later, when each premium dollar buys the most income.

In 2004, Moshe Milevsky of York University proposed the Advanced Life Deferred Annuity, or ALDA. It was contingent on both life and exhaustion of a deductible. “A consumer can invest or allocate $1 per month… and receive between $20 and $40 per month in benefits, assuming the deductible in this insurance policy is set high enough,” he wrote.

Jason S. Scott, Ph.D., the current director of the Retiree Research Center at Financial Engines, wrote in 2007, “A new type of annuity, a longevity annuity, is optimal for retirees unwilling to fully annuitize. For a typical retiree, allocating 10%-15% of wealth to a longevity annuity creates spending benefits comparable to an immediate annuity allocation of 60% or more.” But in 2011, when Financial Engines launched its managed account income-generation tool, Income+, automatic annuitization of assets was not in the design.

In 2008, six months before the financial crisis, MetLife and Barclays Global Investors collaborated on an ambitious but never-launched 401(k) program called SponsorMatch. Participants would apply their employers’ matching contributions to purchases of future income. That same year, MassMutual and entrepreneur Jerry Golden experimented with a rollover IRA product, the Retirement Management Account, which turned qualified retirement savings into income.

CANNEX, the provider of annuity data and comparative analysis tools, has been working for years on the problem of valuing income annuities so that they fit better into advisers’ AUM business models. Some of its technology might find its way into LIMA.

“We’ve been waiting for something to change in the industry to facilitate quotes in this area. The SECURE Act helps considerably,” Tamiko Toland, head of Annuity Research at CANNEX USA, told RIJ.

Several big retirement plan providers, such as Prudential and Empower, have already approached the in-plan annuity challenge, but from a different angle. They’ve offered target date funds with lifetime income riders as a 401(k) investment option. Their products are called IncomeFlex and SecureFoundation, respectively.

Unlike QLACs, these riders offer participants liquidity and a guarantee that, if their own account hits zero before they die (and they have obeyed the contractual limits on annual withdrawals), the insurer will continue making their monthly annuity payments as long as they live. Such contracts offer life insurers an attractive combination of high fee income with low risk exposure.

But sales of that TDF-based product have been low, in part because most plan sponsors hesitate to put their participants’ nest eggs in one life insurer’s basket. (Connecticut-based United Technologies Corp. solved that problem by using three living benefit providers that compete through a bidding process.) Richter is hopeful that multiple insurers will want to participate in Project LIMA.

“We started to quietly investigate the premise of the LIMA project back in the fall, with some reasonable industry interest,” Richter told RIJ. “We’re talking with a number of organizations spanning the asset management, recordkeeping and insurance industries. More than one version of what we’re imagining would require all of those three communities’ joint collaboration.”

© 2020 RIJ Publishing LLC. All rights reserved.