Seeking scale, Nationwide adopts two BNY Mellon funds

Nationwide’s Investment Management Group business has adopted two mutual funds from the BNY Mellon Family of Funds: BNY Mellon Disciplined Stock

Fund (reorganized as Nationwide Mellon Disciplined Value Fund) and BNY Mellon Growth and Income Fund (reorganized into the existing Nationwide Dynamic U.S. Growth Fund), effective December 16, 2019.

“The fund adoptions expand Nationwide’s lineup of investment offerings and could provide potential asset growth opportunities that, if realized, may result in more efficient portfolio management and economies of scale,” Nationwide said in a release.

The Nationwide Mellon Disciplined Value Fund seeks total return by investing primarily in common stocks. John Bailer, Brian Ferguson and David Intoppa of Mellon will manage the Fund.

The Nationwide Dynamic U.S. Growth Fund seeks long-term capital growth. Mellon Portfolio Managers Vassilis Dagioglu, James H. Stavena and Joseph Miletich, began managing the fund in July of 2018 and will continue to do so.

Symetra’s new asset management unit helps parent invest in U.S.

The first task of Symetra Financial Corporation’s new standalone investment subsidiary, Symetra Investment Management Company (SIM), will be to help Sumitomo Life Insurance Company, Symetra’s parent, invest in U.S.-based assets, Symetra announced recently.

The initiative allows Symetra to expand its investment capabilities and assets under management, the company said in a release from Margaret Meister, president and chief executive officer, Symetra Financial. Sumitomo completed its first investment of $500 million through a corporate bond fund in December 2019.

Mark E. Hunt, president of SIM, which manages almost $40 billion in assets, will remain executive vice president and chief investment officer for Symetra Financial. SIM’s operations include a fixed income team in Farmington, Connecticut, and a commercial mortgage loans team in Bellevue, Washington.

The SIM team also includes Colin Elder, senior managing director and head of commercial mortgage loans; Nicholas Mocciolo, senior managing director and head of structured bonds and derivatives; and Evan Moskovit, senior managing director and head of corporate fixed income.

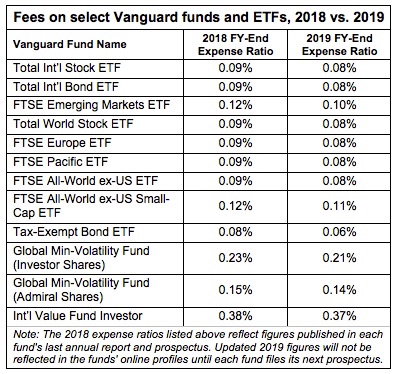

Small and smaller: Vanguard ETF and fund fees dip slightly

Nine Vanguard stock and bond ETFs reported lower expense ratios in annual reports published December 24, 2019, including the $24.3 billion Vanguard Total International Bond ETF, the $17.3 billion Vanguard Total International Stock ETF, and the $63.2 billion Vanguard Emerging Markets Stock ETF, the largest in its category.

Vanguard also reported lower expenses on two actively managed mutual funds, Vanguard Global Minimum Volatility Fund and Vanguard International Value Fund.

In aggregate, these changes represent $27.7 million in savings returned to investors, bringing the total 2019 client savings to $69 million. A hypothetical $50 billion fund with a 10 basis point annual expense ratio would generate $50 million in gross management fee revenue.

The table below shows a list of expense ratio changes by fund. Last week, Vanguard announced expense ratio reductions on three international income-oriented funds and four externally managed active equity funds.

Index industry veteran joins Morningstar

Morningstar, Inc. has appointed Ron Bundy to lead its global Morningstar Indexes business. Bundy joined the firm in December as managing director, Morningstar Indexes.

The move “reflects Morningstar’s continued investment in a fast-growing indexes business that continues to elicit global demand amid the trend toward low-cost investing,” Morningstar said in a release. Morningstar’s Open Indexes Project supports the trend.

Bundy was most recently CEO of North America benchmarks and head of strategic accounts for global index provider FTSE Russell. Prior to Russell’s 2014 acquisition, Bundy served as CEO of the Russell Index Group, where he grew a U.S.-centric business 20-fold into a global operation.

Also joining Morningstar is Pat Fay, managing director of Morningstar Indexes. Fay was formerly head of research and consulting for EQDerivatives and, before that, global head of derivatives for FTSE Russell. During his eight years with CBOE, Fay led the launch of VIX derivatives.

Since its inception in 2002, Morningstar Indexes has grown asset value linked to Morningstar Indexes to $64 billion (as of Sept. 30, 2019), launched hundreds of beta and strategic beta indexes, embedded Morningstar’s independent research into differentiated offerings—such as the Morningstar Wide-Moat Focus Index Family and Morningstar Women’s Empowerment Index—that have underpinned a number of prominent ETF launches.

For pensions, falling yields undercut rising asset prices

In 2019, U.S. corporate pension funding ended down $30 billion for the year, with the funding ratio dropping from 89.4% at the end of 2018 to 89.0% as of December 31, 2019, according to the year-end results of Milliman Inc.’s latest Pension Funding Index, which analyzes the 100 largest U.S. corporate pensions.

Plan assets outperformed expectations, posting an annual return of 15.66% and a gain of $174 billion, Milliman said in a release. But record-low discount rates resulted in plan liabilities increasing as well, by $204 billion during 2019.

As of December 31, the Milliman 100 discount rate had fallen 99 basis points, from 4.19% at the end of 2018 to 3.20% a year later. This marks the lowest year-end discount rate that has been recorded in the 19-year history of the Milliman 100 Pension Funding Index (PFI).

“For corporate pensions during 2019, the funded status environment was like trying to fill a bucket full of holes with water,” said Zorast Wadia, author of the Milliman 100 PFI. “Funding levels would rise given superb asset gains but then quickly recede given offsetting liability movements attributable to ever-falling discount rates. Many plan sponsors can expect to have a rise in pension expense in 2020 given the funded status losses suffered by plans during 2019.”

Under an optimistic forecast (with rising interest rates of 3.80% by the end of 2020 and 4.40% by the end of 2021) and asset gains (10.6% annual returns), the funded ratio would climb to 104% by the end of 2020 and 121% by the end of 2021.

Under a pessimistic forecast (a 2.60% discount rate at the end of 2020 and 2.00% by the end of 2021 and 2.6% annual returns), the funded ratio would decline to 82% by the end of 2020 and 76% by the end of 2021.

Public pensions

Milliman’s 2019 Public Pension Funding Study (PPFS), which analyzes funding levels of the nation’s 100 largest public pension plans, included an independent assessment on the expected real return of each plan’s investments.

For Milliman’s 2019 PPFS, the estimated aggregate funded ratio of the nation’s largest public pension plans is 73.4% as of June 30, 2019, with the estimated combined investment return at 7.34% in Q1 2019 and 2.66% in Q2, and aggregate plan assets reaching $3.84 trillion as of June 30. Total Pension Liabilities (TPL) for these plans crossed the $5 trillion mark for the first time, and as of June 30, 2019 Milliman estimates the PPFS aggregate TPL to be $5.23 trillion.

“Plan assets continue to keep pace with liability growth, buoying public pension funding,” said Becky Sielman, author of Milliman’s Public Pension Funding Study. But plan sponsors are making low interest rate assumptions. “While interest rate assumptions of 8.00% were once the norm, 85 of the public pensions in our study now have assumptions of 7.50% or below,” she said.

See the full Milliman 100 Public Pension Funding Study at http://www.milliman.com/ppfs/. The complete Pension Funding Index can be found at https://us.milliman.com/en/periodicals/corporate-pension-funding-index. To see the 2019 Milliman Pension Funding Study, go to https://us.milliman.com/en/Insight/2019-Corporate-Pension-Funding-Study.

© 2020 RIJ Publishing LLC. All rights reserved.