What do Social Security benefits and marshmallows have in common? When placed squarely in front of most people, both are hard to resist.

Almost everyone knows about the famous “marshmallow test.” In the late 1960s, Dr. Walter Mischel of Stanford put marshmallows under the noses of preschoolers and asked them to wait 15 minutes before popping them in their mouths. Some were promised a reward if they “delayed gratification.” Most kids couldn’t go the distance.

Similarly, Social Security benefits become available to most Americans at age 62, and people who retire in their early- to mid-60s tend to file for Social Security right away. Few retirees delay claiming until age 70, when the monthly benefit is as much as 76% higher than at 62.

Experts at the Center for Retirement Research (CRR) at Boston College would like to help people stop treating Social Security like a marshmallow. In a new paper, they recommend adding a default option to 401(k) plans that would make it easy for retirees who retire before age 70 to use their tax-deferred savings for living expenses so they don’t have to claim Social Security until then.

This “bridge” strategy isn’t new. But the authors of the new paper, led by CRR director and retirement thought-leader Alicia H. Munnell, offer calculations proving that, over the long run and for many mass-affluent Americans, this approach beats other common strategies, such as buying an immediate or deferred income annuity with part of one’s savings.

“[We] would introduce a default into 401(k) plans that would use 401(k) assets to pay retiring individuals ages 60-69 an amount equal to their Social Security Primary Insurance Amount (PIA) – the monthly amount at an individual’s full retirement age,” write Munnell, Gal Wettstein, and Wenliang Hou in “How Best to Annuitize Defined Contribution Assets?”

Alicia Munnell

Defaulting participants receive “their PIA (the benefit at full retirement age) for as many years as their balances will permit and are assumed to claim once their balances are exhausted or at age 70, whichever is later.” In a footnote, the authors concede that underfunded retirees should ideally work longer, save more and claim later. The bridge strategy, they say, would be their best alternative to that.

Bridge to somewhere

The “bridge” concept has enjoyed episodes of popularity in academic and public policy circles over the past 15 years. It partly reflects the low interest-rate environment. Better to decumulate fixed income investments that are earning under 4%, the logic goes, than to forego an annual 8% rollup in Social Security benefits.

That strategy faces a couple of potential headwinds in the financial services world, however. In a kind of corollary to Gresham’s Law (which dictates that “bad money drives out good”), most new retirees are inclined to spend the “government’s money” first and conserve their own liquid savings for later. Fee-based planners aren’t likely to recommend that strategy; the spend-down from a retirement account would lower the advisers’ own asset-based income.

The CRR’s bridge policy doesn’t harmonize with the bottom-line interests of annuity issuers and distributors either. The strategy relies on using savings to maximize Social Security benefits, not to buy commercially available income annuities. There’s a reason for that: buying “extra” Social Security benefits is much cheaper.

The bridge concept, in essence, would prevent early retirees from unwisely locking in a lifetime of minimal Social Security benefits. “Providing a temporary stream of income to replace an individual’s Social Security benefit would break the link between retiring and claiming,” the paper said. “As a result, retirees could delay claiming Social Security in order to maximize this valuable source of annuity income.”

“As with any default,” the paper said, “the worker would retain the ability to opt out in favor of a lump-sum or other withdrawal, including leaving the funds in the plan. Even if the payments had started, workers would still be entitled to change their mind and change the size of the distribution, or switch to a lump sum for their remaining 401(k) balances, rolling the lump sum to an IRA as a tax-free transaction.”

The CRR team ran an analysis comparing the bridge strategy with other strategies, which are listed below.

- Applying 20% or 40% of tax-deferred savings to the purchase of an immediate income annuity beginning at age 65.

- Applying 20% or 40% of tax-deferred savings to an income bridge between age 65 and 70.

- Applying 20% of tax-deferred savings to the purchase of a deferred income annuity with income starting at age 85, and either spending down the remaining 80% between ages 65 and 85, or spending only required minimum distributions from age 70½ to age 85.

For single men, single women, and couples with tax-deferred wealth at the 75th percentile level ($106,000, $110,000 and $275,000, respectively) and assumed Social Security benefits of $15,348, $14,514, and $28,569 (respectively), the income bridge was the least expensive way to finance retirement over the long-term.

The optimum strategy for a specific man or woman would of course vary, depending on factors such as total household wealth, expenses, and “shocks” (financial or health-related) during retirement. The authors didn’t even try to calculate the optimal strategy for couples because too many variables were involved.

United Technologies’ experiment

There’s a lot besides the “bridge” proposal in this comprehensive 40-page paper. The authors venture an explanation for the long-standing “annuity puzzle” (i.e., low immediate income annuity sales). They also offer useful updates on existing private sector solutions to the challenge of turning 401(k) savings into lifetime income.

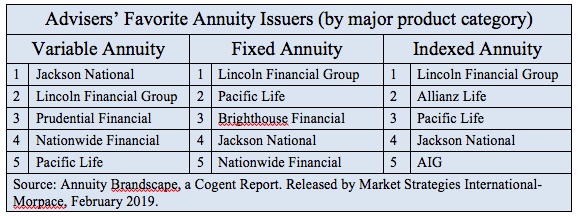

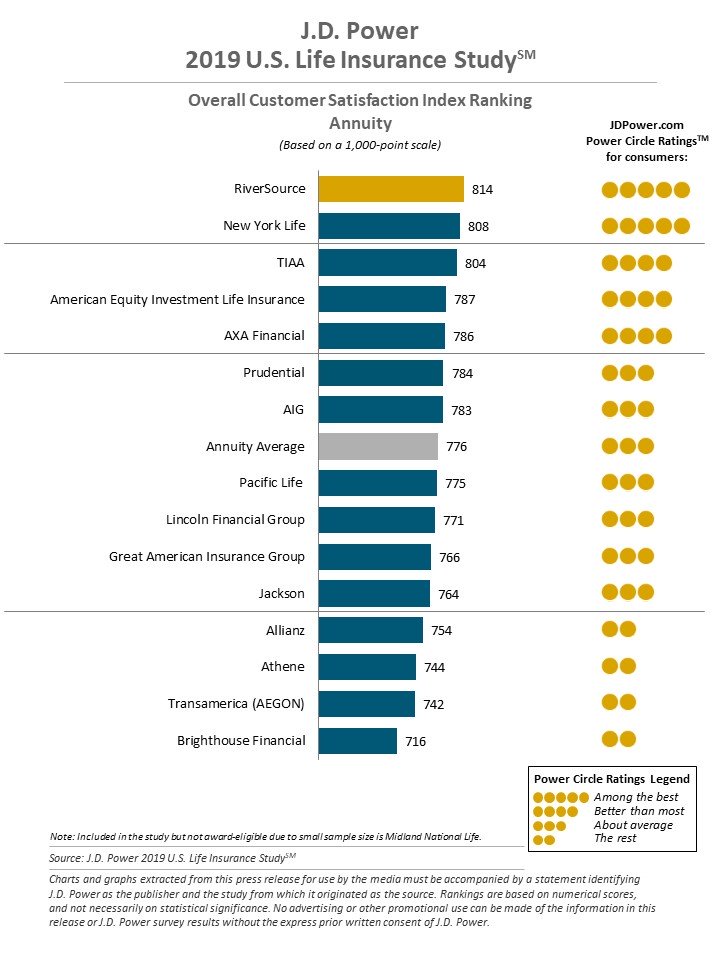

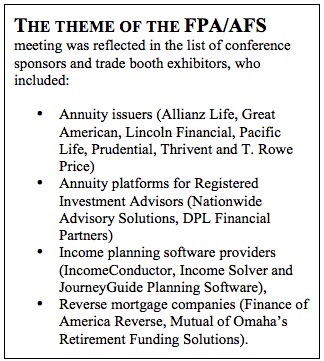

For instance, the paper describes United Technologies Corp.’s (UTC) novel solution, TIAA’s 403(b) group annuity approach, and the solution marketed by Prudential, Great-West and Transamerica to 401(k) plans, which involves attaching an optional guaranteed lifetime withdrawal rider (GLWB) to a plan participant’s target date fund.

The UTC defined contribution plan design, which replaced a defined benefit pension plan, resembles a GLWB rider but with three life insurance companies offering the option instead of one. The three companies bid against each other once a year to offer the highest annual lifetime floor income to each participant in the program, based on the participant’s contributions in the prior year.

About third of UTC’s participants have opted for what is called the Lifetime Income Strategy (LIS), but they’ve transferred less than 10% of their assets into the program. “At the end of July 2019, the company’s defined contribution plan had over 140,000 participants and $28.5 billion in assets. The LIS, which was introduced as the default for new hires in 2012, had about 45,000 participants and $1.9 billion in assets,” the paper said.

Factoids mentioned in passing

The paper includes a number of interesting factoids, such as:

- During retirement, support from spouses and other relatives has significant financial value. “Marriage provides 46% of the protection offered by a fair annuity for a 55-year-old individual,” the paper said. “Adding risk sharing between parents and children, the risk-sharing potential within families is substantial.”

- People with annuities live, on average, about 3.5 years longer than the rest of the population.

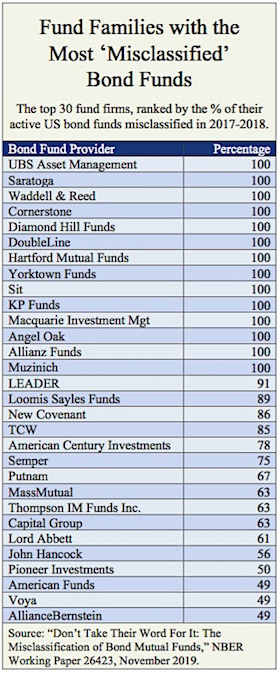

- Commercial annuities cost about 15% to 20% more than they would if the issuers added no administration or marketing costs, and calculated the benefits solely on the bases of life expectancy tables, premium size and discount rates.

© 2019 RIJ Publishing LLC. All rights reserved.