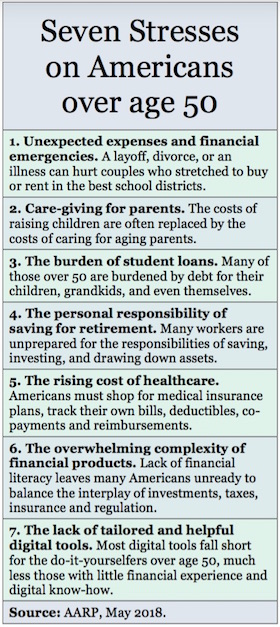

Estimates of the amount of money that Americans will spend on health care during retirement range from the scary to the staggering. The numbers tend to obscure the fact that Medicare, Medicare supplements and Medicaid prevent most medical catastrophes from becoming financial catastrophes for US retirees.

Some of the projections of lifetime costs are nonetheless shocking. “The average couple [at age 65] will need $280,000 in today’s dollars for medical expenses in retirement, excluding long-term care,” says Fidelity’s website. Syndicated columnist Gail MarksJarvis has written, “The average 65-year-old couple retiring in a year can expect to spend $404,253 in today’s dollars on health insurance and other health care costs.”

Broken down into annual expenses, medical care looks much more affordable. The averages translate into $5,000 to $10,000 per year per retiree, not counting inflation. If you exclude the cost of long-term care (as most estimates do), medical costs in retirement consist largely of the insurance premiums, deductibles, co-pays and other out-of-pocket costs that come out of income rather than savings.

Any individual’s actual costs will likely be higher or lower than the average, of course. It depends on genes, luck, health status at retirement, eating and exercise habits, longevity, wealth level, gender, marital status, where you live, how much you can afford to spend, whether you come to rely on Medicaid or charity, how much insurance coverage you buy and whether, if you end up in a nursing home, you choose single or double occupancy.

Horror stories are common enough. Medical costs can easily bankrupt someone with catastrophic health issues who has chosen not to buy “gap” insurance to supplement Medicare. That person could either expect to suffer the indignities and deprivations common before the federal government started subsidizing health insurance for the elderly in the mid-1960s, or try to qualify for Medicaid and other forms of public assistance or charity.

“The Lifetime Medical Spending of Retirees,” a new article from the National Bureau of Economic Research, brings academic discipline to bear on this question. It finds that, from age 70 onward, households will on average face about $122,000 in medical spending in 2014 dollars, including what is received from Medicaid, over their remaining lifetimes.

The range is wide, however. Costs will surpass $330,000 (in 2014 dollars) for five percent of retirees. An unlucky one percent of retired households will face costs of more than $640,000 during retirement. (This article focuses on non-working retired households, either single or married. Single households will have lower costs than couples.)

“For a couple initially in good health and at the median of the income distribution, we find that mean lifetime out-of-pocket (OOP) + Medicaid spending at age 70 is $154K, while mean lifetime OOP age 70 is $127K,” one of the authors, John B. Jones of the Richmond branch of the Federal Research, told RIJ in an email.

“Of the measure of average total annual medical expenses we use in the paper, 14% represent insurance premia (including part Medicare Part B), 21% represents payments by Medicaid, 16% represent out of pocket death (e.g., funeral) expenses, 49% includes other payments for copays/deductibles for doctor visits/nursing home care/drug expenses/hospital visits/dental visits,” Eric French, of the University College London and another co-author of the paper, told RIJ in an email.

In the study, average medical spending (in 2014 dollars) rises from $5,100 per year on average at age 70 to $29,700 at age 100. At the 95th percentile in costs (one in 20 households), the range is $13,400 at age 70 to $111,200 at 100. Average funeral and burial expenses range from $11,000 at age 72 to $34,000 at age 100. In any given year, one in 1,000 households will suffer a health shock that costs more than $125,000 (in 1998 dollars), the NBER economists wrote.

Jones pointed out that his team’s paper involves spending by people who turned 70 about 25 years ago, while recent estimates such as Fidelity’s are based on people who turned 65 recently and will incur rising costs in the future.

“Health spending at all ages rises over time, so today’s 70-year would expect to spend more than 1992’s 70-year old,” he wrote. Adjusting for inflation, he calculated that households turning 70 today would face an estimated $235,000 for lifetime out-of-pocket costs and receive an additional $46,000 from Medicaid, on average.

For comparison, HealthView, a provider of health care cost-projection software, currently estimates that a 70-year-old couple today (assuming that the wife lives two years longer than her husband) can expect future lifetime health care expenses ranging from about $148,000 (if the husband lives to age 78 and the wife to age 80) to almost $399,000 (if the husband live to age 90 and the wife to age 92).

“Our data consists of forward projections based on 70 million pieces of claims data from range of health insurers, broken down by state,” said Ron Mastrogiovanni Sr., who founded HealthView in 2008. His numbers do not include the value of Medicaid coverage. Expenses are concentrated in the final years of life, he added; living an extra two years could mean $70,000 in addition outlays per person.

Although averages have little predictive value for any single individual, they give advisors a place to start when estimating clients’ future outlays for health insurance and out-of-pocket medical expenses.

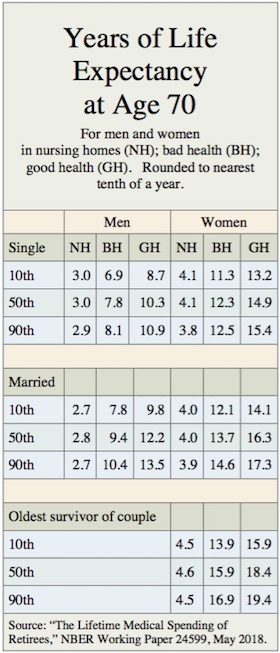

Risks of needing nursing home care also vary. “Although high-income people are less likely to be in a nursing home at any given age, they live longer, and older individuals are much more likely to be in a nursing home,” the paper said.

Nursing home risks are different for men than women. “While 37% of single women and 36% of married women alive at age 70 will enter a nursing home [for more than 120 days] before they die, the corresponding quantities for single and married men are 26% and 19%, respectively,” the researchers added.

Gender, wealth level, and health status help determine life expectancy, which affects costs. To take the worst-case scenario, a 70-year-old poor man (bottom 10% of income scale) in a nursing home is likely to live only about three years on average. To take the best-case scenario, a 70-year-old woman in the 90th percentile of wealth, in good health, could expect to live more than 15 years.

Marriage improves life expectancy: The average life expectancy of a surviving spouse in good health at age 70 ranges from 16 years (for poor couples) to 19.4 years (for the most affluent couples), the study showed.

According to the Centers for Medicare and Medicaid Services website, per person health care spending for those 65 and older was $18,988 in 2012. Medicare spending grew 3.6% to $672.1 billion in 2016, or 20% of total national health expenditures (NHE). Medicaid spending grew 3.9% to $565.5 billion in 2016, or 17% of total NHE.

According to the Henry J. Kaiser Family Foundation, Medicare spending in 2013 ($575.8 billion) was financed by these sources: 41% general tax revenue, 38% payroll taxes, and 13% beneficiary premiums. The remaining eight percent came from taxes on Social Security benefits, state sources and interest.

Taxes on US retirees for health care will be going up, especially for those with higher incomes. “The floors for the Net Investment Income Tax and the Medicare surtax passed under the Obama administration aren’t indexed for inflation. Thus more taxpayers will owe both taxes over time,” Howard Gleckman, a senior fellow at the Urban Institute, told RIJ in an email.

“The Medicare story is much more complicated,” he added. “For about 70% of Medicare beneficiaries, a hold-harmless provision in the law means their Part B premiums cannot increase faster than their Social Security benefits. But for those with incomes above about $85,000, premiums will rise faster than Social Security benefits. The increases are tied to income, so the more you make the bigger your premium increase.”

The NBER article cited above was co-authored by John Bailey Jones and Justin Kirchner of the Federal Reserve Bank of Richmond, Mariacristina De Nardi of the Federal Reserve Bank of Chicago, and Rory McGee and Eric French of University College London. The research was based on data from the Health and Retirement Survey (HRS) collected from retired Americans between 1995 and 2014.

© 2018 RIJ Publishing LLC. All rights reserved.