Symetra Life has become the latest US annuity issuer to bring to market a registered index-linked annuity (RILA), also known as a “buffered” annuity. The product offers five distinct index options, one-year performance caps as high as 15.0%, and protection against either up to or beyond a 10% annual loss.

The product is called “Symetra Trek.” According to the issuer, it offers significant free withdrawals during the six-year surrender charge period, and a one-year point-to-point interest crediting method with either a “buffer” (where the issuer absorbs an annual index drop of up to 10%, but no more) or a “floor” (where the contract owner absorbs an annual index drop of up to 10%, but no more).

Or, as the Symetra Trek product rate sheet explains, “The Buffer provides protection against the first 10% of index losses for each interest term. Losses beyond 10% will reduce the indexed account value. The Floor limits index losses to a maximum of 10% for each interest term. Losses of less than or equal to 10% will reduce the indexed account value.” A product prospectus is available.

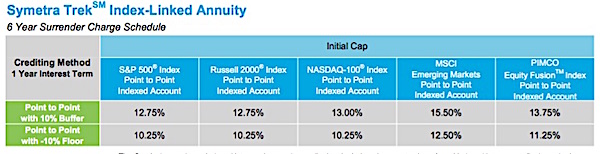

The five indices are: S&P500, Russell 2000, NASDAQ-100, MSCI Emerging Markets, and PIMCO Equity Fusion Index. The current one-year cap rates for the performance of those indices are higher for the buffer option, at 12.75%, 12.75%, 13.0%, 15.0% and 13.75%, respectively. The index caps on the floor option are 10.25%, 10.25%, 10.25%, 12.50% and 11.25%, respectively. The guaranteed fixed account rate is 1.60%.

Symetra is touting the availability PIMCO Equity Fusion Index as one of the special features of this contract. As of the end of February, this index was composed of technology-focused equities (30%), US large cap equities (25%), US small cap equities (25%) and emerging market equities (20%).

Since 2011, several life insurers have issued RILAs, including AXA, the product pioneer and category sales leader; Brighthouse (formerly part of MetLife), issuer of the top-selling RILA contract (advertised on TV during this month’s NCAA basketball tournament); Allianz Life, CUNA Mutual, Lincoln Financial, and Great American.

Some RILAs are available with three-year, five-year or six-year terms, in addition to the one-year term, but Symetra, a subsidiary of Sumitomo Life based in Bellevue, Washington, offers only a one-year term on the Trek contract.

“We always measure performance one year at a time,” said Kevin Rabin, vice president of Retirement Products, in an interview. “Certain of our bank and broker-dealer partners require that products have no more than a one-year term. The client gets 10% buffer or floor protection each year. He or she can rebalance every year.

“There are no fees embedded in the product, which capitalizes on our commitment to transparency. There’s an attractive liquidity feature. It gives the contract owner the ability to take out up to 15% of the contract value each year [during the six-year surrender charge period] or all the interest earned in the previous year, penalty-free. That’s a first in this category.

“There’s a clear need in the marketplace for both the buffer and floor strategies. In the beginning [2011], the product category was focused on the buffer. But we heard loud and clear that it was important to offer both floor and buffer protection options,” Rabin told RIJ. While the buffer option exposes the client to severe equity market drops, those drops are relatively rare, and the buffer’s performance caps are about 2.5 percentage points higher than the floor option’s.

“The demand for [Symetra Trek] isn’t coming from the ‘safe money’ people,” he said. “It’s coming from people who have a higher risk tolerance profile. This product is primarily for equity investors who want to manage their downside risk, not people who want a safe investment that has more return potential than bonds.

“Those folks can live with downside risk,” Rabin added. “They can even live with the ‘tail risk.’ They understand that the market has rarely been down more than 10% in a 365-day period. They know that the 10% buffer has covered many downside situations. This product offers a natural transition for someone who wants to dial down his or her equity risk rather than dial it up. It doesn’t replace a diversified portfolio. It’s one more sleeve, with a different risk profile, within a diversified portfolio.”

© 2019 RIJ Publishing LLC. All rights reserved.