FlexChoice Access offers a 5% compounded annual deferral bonus for the first 10 contract years. Contract owners can choose whether to receive level payments for life or higher withdrawals...

Poland unveils retirement system overhaul

Poland is preparing to use auto-enrollment to move workers into a new kind of employer-based defined contribution plan, with mandatory employer and employee contributions. The 20-year-old system of diverting...

Principal’s Mexico retirement business acquires MetLife’s

After the purchase, Principal in Mexico will manage around 3.4 million individual accounts for retirement with the equivalent of US$12.3 billion of assets under management at the current exchange...

Western & Southern reports $337 million in PRT business

Western & Southern offers pension risk transfer (PRT) services through its institutional markets business unit, which it established in September 2017.

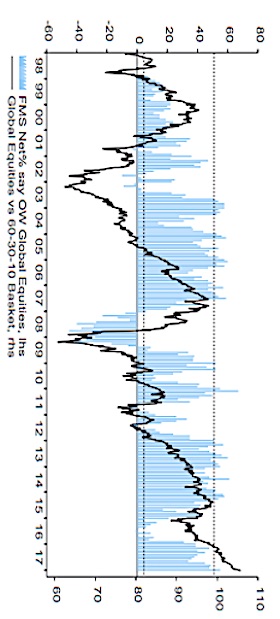

Net Percentage of Asset Allocators Reporting Overweight in Equities Surpasses Previous Spikes

High number of investors are overweight in equities, despite, also, stating that equities are overvalued.

A.M. Best gives life/annuity industry a “negative outlook”

The industry 'remains plagued by macroeconomic and regulatory factors' as well as 'lackluster sales, rapidly evolving technological requirements and changing consumer preferences and behavior,' the ratings agency said in...

Interest outpaces adoption of digital advice: Cerulli

Investors ages 30-39 and older investors with $2 to $5 million to invest showed the greatest enthusiasm for pure digital offerings, the research firm said.

ETF traders dumped U.S. equities but not global: TrimTabs

“Contrarians should consider favoring U.S. equities over non-U.S. equities now,' the alert from the Los Angeles-based investment research firm said.

Honorable Mention

Securities America adds two new advisor groups; Transamerica Center for Retirement Research promotes Saver's Credit; new book from Wolters Kluwer explains new tax law; Great Western fee-based FIA joins...

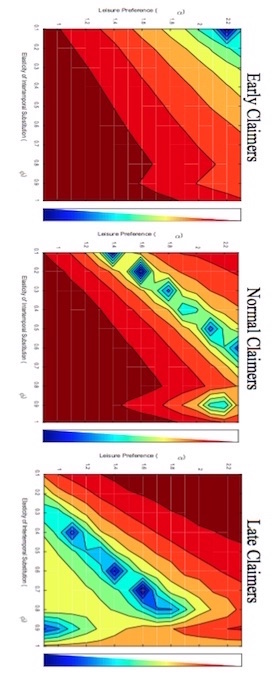

Incentivizing Delayed Social Security Claiming with Lump Sum Payments and Reduced Annuities (Effects for Early, Normal and Late Claimers

Source: “Optimal Social Security Claiming Behavior under Lump Sum Incentives: Theory and Evidence, “ Raimond Maurer, Olivia S. Mitchell, Ralph Rogalla, and Tatjana Schimetschek, 2017DC-02-08-2017

England’s first hybrid retirement plan gets a tentative start

Under a recent agreement, the Royal Mail will contribute 13.6% of members’ pensionable pay to a new type of DB/DC hybrid plan and union members will contribute 6%. Government...

Managed accounts are a proxy for income options in DC plans: Cerulli

'While the DC industry continues to wonder how best to structure in-plan retirement income solutions..., managed accounts are quietly making progress as a less controversial option for plan sponsors...

ADP and Financial Engines in financial advice deal

The Financial Engines advisory service offering, on the ADP platform, will launch in the summer of 2018. The deal expands FE's reach to thousands of small and mid-sized firms...

Honorable Mention

Lori Lucas is named CEO of Employee Benefit Research Institute, Prudential inks $1.8 billion pension risk transfer deal, DPL to bring no-load annuities to RIAs, Nuveen bolsters DCIO sales...

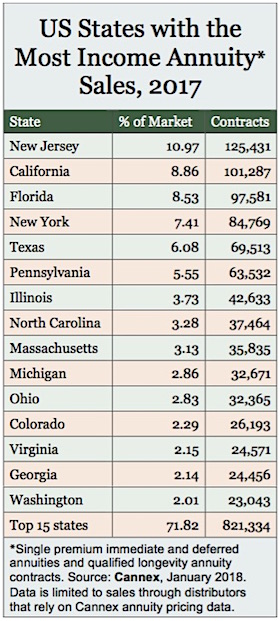

US States with the Most Income Annuity Sales, 2017

Source: Cannex, January 2018

‘Missing’ group annuitants give MetLife a share shock

“It's not just embarrassing, it could cost MetLife future business,” wrote Canadian pension blogger Leo Kolivakis, who follows global pension issues and insurance companies. A.M. Best affirmed MetLife's A+...

Prudential plays the ‘index card’

The PruSecure fixed indexed annuity offers one-, three-, and five-year index term options. Initial cap rates provide “up to a 32% return” based on the chosen index, credit term,...

High demand for bond mutual funds is ‘concerning’: TrimTabs

The inflow of $38.2 billion into bond mutual funds (MFs) and ETFs this month through Thursday, January 25 is on track to be the highest since October 2009, driven...

Outsourcing will persist in management of insurer general account assets: Cerulli

The 'pause that refreshes,' said the old Coca-Cola tagline. That's also how Cerulli characterizes the recent slowdown in the practice of assigning management of insurance carrier general account assets...