We compare two easy-as-pie annuity strategies: Income starting at age 80 versus guaranteed income for the first 10 years of retirement. One hedges longevity risk, the other hedges sequence...

Money Myths, Legal Realities

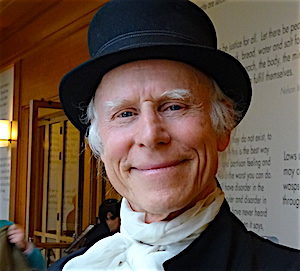

At a conference at Harvard Law School called "Money as a Democratic Medium," law professors debated the origins, purposes, and rightful ownership of money in the modern era. (Photo:...

BlackRock, Microsoft & Retirement: What’s Up?

BlackRock and Microsoft's cryptic announcement of a new partnership on a platform for plan participants has puzzled industry executives, who shared their views 'on background' with RIJ. (Pictured: A...

The Newest Retirement Income Fintech

Kindur, which debuts in January, is a low-cost, digital advice-and-investment-management engine that will help Boomers turn income from annuities and investments into a retirement paycheck. Its founder is Rhian...

Honorable Mention

A.M. Best affirms Ohio National’s A+ rating, despite lawsuits; $24 million settlement in BB&T Bank excessive fee case; AIG names new chief financial officer; E*Trade offers online investing tool;...

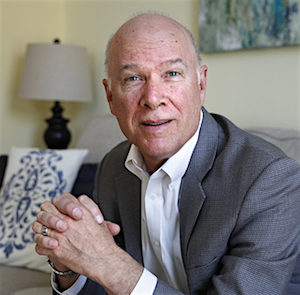

Steve Vernon’s Guide to Retirement Success

Steve Vernon's latest book on retirement, "Retirement Game-Changers," teaches anyone how to win not just the game of retirement income, but the game of life-after-55. Vernon (pictured) is...

The Links between Golf and RMDs

RMDs produce zero change in a client’s wealth. They just create a 'balance sheet' adjustment, where money moves from a pre-tax to an after-tax account, current taxes get paid,...

Greetings from the First ‘Retirement Management Forum’

Some 200 members of the Investments & Wealth Institute (IWI) came to Amelia Island, Florida, this week to learn about the principles underlying the Retirement Management Advisor designation, which...

Annuities ‘Compensate’ Even Short-Lived People

'Nature wants us to pool longevity risk,' writes annuity expert Moshe Milevsky. He explains why in a new paper, 'Swimming with Sharks: Longevity, Volatility and the Value of Risk...

Where the Income Puck is Going

Producers selling indexed annuities with living benefits in the context of the semi-robo retirement income plans: This is emerging model for selling income products to Boomers. It’s not ideal....

2018: A come-back year for indexed annuities

Indexed annuities were once the problem child of the annuity world. Now, having survived the Obama Department of Labor's attempt to corral them, they're more like the darling of...

Employer Match vs. Auto-Enrollment; The Winner Is…

'Most of the estimates from the literature substantially understate the effect of matching,' write analysts Nadia Karamcheva and Justin Falk of the Congressional Budget Office's Microeconomic Studies Division. (Image...

‘Auto-Portability’ Gets Closer to Reality

After five years of pitching their idea for automatically moving assets from one 401(k) plan to the next when a worker changes jobs, Retirement Clearinghouse this week received the...

Ohio National Sued for Compensation Breach

So far in November, three variable annuity sellers, including Commonwealth Financial, have filed federal class action lawsuits against Ohio National Life, which this fall left the annuity business and...

A Retirement Income Plan from United Income

One of the smallest of the robo-advisors (United Income) has some of the biggest backers (Morningstar's chairman and eBay's founder) and a veteran (HelloWallet) CEO. RIJ asked United Income...

‘I’m Not Retired. I’m Independent.’

Unlike, retirement, “independence” has no demeaning or dismissive connotations. Every American yearns for independence. It’s the ideal on which our country was built. When’s your Independence Day?

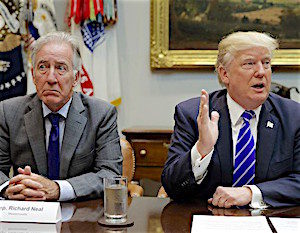

New Bedfellows: Richard Neal and the 401(k) Industry

As the next Ways & Means chairman, the liberal Massachusetts congressman won't just be the gatekeeper of retirement legislation. He’s also the only legislator who can ask for President...

What’s Up, Doc Huffman?

Ohio National Life's withdrawal from the annuity business continues to rile advisors and broker-dealers who carry a lot of the insurer's rich old living benefit products on their books--and...

An Industry Haunted by Its Own History

The ghost of demutualization haunts much of the annuity industry today. But that topic was not on the agenda of the annual LIMRA conference in New York earlier this week...

Honorable Mention

Arthur Laffer, the supply-sider, dabbles in financial wellness; BBVA launches robo-advice tool on BNY Mellon Pershing platform; Migration to bonds finally reverses: TrimTabs.