'There are three factors that we think are converging and are likely to help move the needle” in terms of expanding plan adoption by small employers, said Ben Norquist,...

Sneak Preview of New Book on Behavioral Finance

In a chapter of a forthcoming book, four Ivy League academics discuss the possible reasons why so few people buy life annuities. I add a few theories of my...

Mind the Coverage Gap

'I am not aware of any predictions that a significant percentage of small employers who do not currently offer a plan will now adopt a PEP,' said Jack Towarnicky,...

The ‘Institutionalization’ of the 401(k)

The defined contribution retirement system may be about to become less employer-driven and more industry-driven. RIJ talks about it with DCIIA president and CEO Lew Minsky.

Turning the 401(k) on Its Head

Executives at State Street Global Advisors, Transamerica, Securian, and Prudential discuss their strategies for developing multiple employer 401(k) plans for small companies and helping to close the 401(k) ‘coverage...

Border Turmoil and Social Security Solvency

'The inflows of migrant workers compensate the falling birth rate in our country, which is the gravest threat to the sustainability of our pension system,” an Italian official said...

Provider-Sponsored 401(k): Part III

This is the third installment of our series on the push for shifting plan sponsorship from employers to service providers and the "institutionalization" of retirement in the US. This...

My Encounter with CFPs Who Like Annuities

It seems self-evident that advisors who have insurance somewhere in their DNA—who sold insurance early in their careers—will be much more receptive to selling annuities later in life.

Fuzzy Words in a Retirement Bill

The Retirement Enhancement and Savings Act of 2018 has bipartisan support and a greater-than-average chance of passing. Many believe that it could lead to provider-sponsored 401(k) plans. But bill...

Everybody into the Pool?

If pending legislation passes, retirement service providers could begin to sponsor 401(k) plans. Asset managers are especially keen on these ‘pooled employer plans’ or ‘open MEPS.’

JENGA as a Financial Metaphor

Playing JENGA and watching the interest rate yield curve flatten involve similar degrees of suspense.

Adding a ‘Retirement Tier’ to 401(k)s

Drew Carrington, who markets Franklin Templeton funds through jumbo 401(k) plans, believes that plans should include a “retirement tier” reserved for participants who are nearing retirement. His payout funds...

How Much Retooling Does the 401(k) Need?

At the ERISA Advisory Council's meeting this week and at an EBRI webinar, proposals to inject lifetime income elements into 401(k) plans were debated and evaluated.

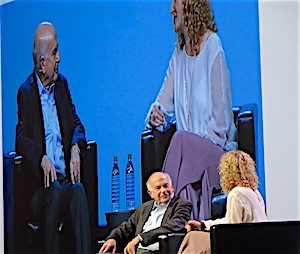

Introducing the ‘Alliance for Lifetime Income’

Two dozen major life insurers and asset managers have formed a non-profit to educate the public about the benefits of lifetime income products. That's never been done before, they...

‘Show Me the Income’

The focus was on mutual funds and ETFs at Morningstar's 30th Investor Conference this week in Chicago, but retirement financing and the 'best interest' proposal were also discussed. (Photo:...

SEC Had to Fudge the Definition of ‘Best Interest’

Unlike the DOL, the SEC doesn't need to score to win this game. It can afford to punt.

An Income Strategy for ‘M.T. Knestors’

We gave WealthConductor LLC a real retirement income case to solve. Here's the 'bucketing' plan their IncomeConductor software created for a couple with $663,000.

The Complex Truth about Retiree Medical Costs

The cost of medical care in retirement doesn't look as scary when you break it down into annual expenses and remember that insurance covers most of the big-ticket items.

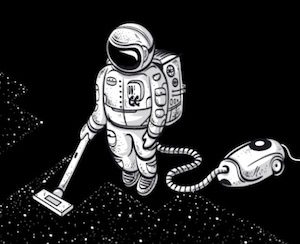

This Is Worse than the Fiduciary Rule

Nature abhors a vacuum, and so does the retirement industry. Now that the Obama fiduciary rule is gone, some people are realizing that it actually served a purpose. The...