A new report from Diversified Services Group, Inc. and Greenwald & Associates offers predictions from 24 industry experts about the shape of the retirement industry ten years from now....

Ten Images that Explain Retirement

No, this image isn't one of them! A while ago, we asked retirement advisers what images they use to illustrate complex financial principles. The frequent response: “When you find...

The Retirement Industry Conference

Want lots of 2013 data on annuity sales and VA rider use? You’ll find it—plus Richard Thaler’s crowd-stumping riddle—in this roundup of news from the recent LIMRA/LOMA/SoA conference in...

Waiting for the Fiduciary Train

Don't hold your breath waiting for the second draft of the Department of Labor's fiduciary proposal. That's one takeaway from a four-hour meeting at the Practicing Law Institute in...

With New Indexed Annuity, Nationwide Takes a Walk on the Wild Side

In February, Nationwide introduced New Heights, a fixed indexed annuity with an enticing "uncapped" crediting strategy and a novel living benefit rider for the b/d and independent agent channels....

SEI Ups its TDF Game

Six months ago, SEI, which specializes in multi-manager TDF funds, recruited veteran defined contribution specialist Scott Brooks (left) away from Deutsche Asset & Wealth Management to start making presentations...

Happy Fifth Anniversary, RIJ

Today’s issue of RIJ, which represents our 250th issue and marks our five-year anniversary as a publication, seems like an appropriate vehicle for a brief message about how we’re...

Where Young Advisors Can Give and Get Advice

“Think of the robo-advisors as high-tech, low-touch, and the high-minimum fee-only planners as low-tech, high-touch. We’re high-tech, high-touch," said Alan Moore, a young planner who, with Michael Kitces, has...

Whose Retirement Crisis Is It, Anyway?

The thrust of last week’s ICI Retirement Summit was that there’s no broad retirement savings crisis needing government action. But that doesn’t mean Boomers won’t need help with decumulation....

Orange You Glad the Re-branding Campaign is Almost Over?

“Orange signals our optimism,” Ann Glover, the CMO of Voya Financial, told RIJ in talking about the importance of Voya's keeping the ING color as it separates from ING...

Bill Sharpe’s New Retirement Blog

On the verge of his 80th birthday, Sharpe, who won the 1990 Nobel Prize for his Capital Asset Pricing Model, has been writing a blog that documents his work...

Managed-Vol: Bromide for Queasy Retirees

Managed-volatility funds can adequately address the income volatility worries of many high net worth retirees, say Milliman and Jefferson National, both of whom are pitching such funds. ...

The Bucket

Brief or late-breaking items from Great-West Lifeco, fi360, SunGard and Cerulli.

In Radical Move, Britain Deregulates Retirement

“Pensioners will have complete freedom to draw down as much or as little of their pension pot as they want, any time they want,” said the UK Chancellor of...

Top 20 annuity sellers in 2013

In 2013, Jackson National Life sold $20.9 billion worth of variable annuities and New York Life sold $6.5 billion worth of fixed annuities, to lead those categories. Jackson had...

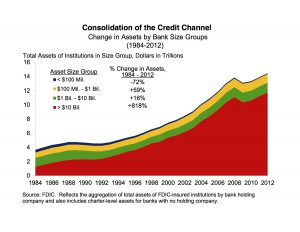

Beware of Oligopolies in Banking

"I suspect that 2014 will prove to be a critical juncture for determining the future of the banking industry and the role of regulators within that industry," said the...

‘I’ll never retire’ vow weakens with age, survey shows

As people pass age 35 and near retirement, they grow less willing to retire later and more willing to downsize their expenses and lifestyle, according to a new survey...

Poland’s clawback of privately-managed DC funds criticized

In a new report, the OECD (Organization for Economic Co-operation and Development) said the forced transfer—tantamount to state confiscation of private money—of OFE funds to the ZUS has damaged...

AIG’s Bermuda-based unit to offer captive insurance out-sourcing

AIG Captive Management Services in Bermuda will manage the regulatory requirements, financial reporting, and administrative functions for all customers participating in Grand Isle SAC Ltd.

Schlichter sues a hospital chain for “excessive” plan fees

The latest ERISA suit from St. Louis plaintiffs attorney Jerry Schlichter (pictured) claims that Novant Health Inc. violated its fiduciary duty by paying excessive fees to Great-West Life &...