FINRA's recent report on conflicts of interest at brokerages laid bare some dingy practices. Some say it's a move to burnish FINRA's credentials as a candidate for regulator of...

Driven by VA de-risking, managed-vol funds grow

Assets in funds in this category reached $200.1 billion by mid-2013 after rising to $153.9 billion at year-end 2012 from $30.9 billion at year-end 2006, an annualized growth rate...

Cincinnati voters opt to reform, not replace, an underfunded public pension

Voters apparently reacted negatively to a requirement in the proposal that would have required the city on the Ohio River to pay off the pension’s $862 million liability in...

MetLife and ING benefit from Romanian pension growth

Dutch insurance giant ING, with the biggest Romanian DC fund by assets and membership, recorded the highest profit so far this year, of RON146.7m (€33.1m). As of the end...

Vanguard consolidates three managed payout funds into one

“The funds have faced challenges in meeting their objectives, given a financial market environment marked by a prolonged period of historically low bond yields,” said a Vanguard release.

The Bucket

Brief or late-breaking items from Bankers Life and Casualty Company, New York Life, The American College, Vanguard, Mass Mutual, Jackson National Life, Jefferson National and Cerulli Associates.

Quote of the Week

"In an economic system in which a sovereign government operates through its own monetary system, spending (or lending) must occur before taxing. In addition, taxes are not a funding...

A Second Look at the ‘Floor-Leverage Model’

Two weeks ago we reported on new research by Jason Scott and John Watson of Financial Engines about a retirement income strategy that combines 85% safe assets with a...

Send MetLife’s ‘regards to Broadway, remember it to Herald Square’

MetLife announced that it will open a global technology hub in Cary, N.C., and create thousands of jobs there to complement its retail headquarters in Charlotte.

American General launches ‘Power Index Plus’ FIA

The new fixed indexed annuity offers three interest-crediting strategies, a one-year fixed interest account and two that are pegged to the S&P500 (excluding dividends): an annual point-to-point index interest...

Low COLA: The pause that doesn’t refresh

Since 2000, Social Security benefits have lost 31% of their buying power, according to The Senior Citizen League's 2013 Survey of Senior Costs. During that period, benefits rose 38%...

Second issue of new scholarly journal on retirement published

There are nine new articles in the fall edition of The Journal of Retirement, edited by George A. (Sandy) Mackenzie.

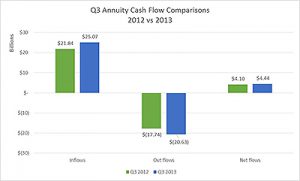

Annuity cash flows perk up in 3Q 2013: DTCC

Net flows into annuity products nearly doubled in the third quarter, to $4.4 billion from $2.3 billion in the second quarter. Outflows fell to 20.6 billion from $21.1 billion,...

Quote of the Week

“Never let the perfume of the premium distract you from the stench of the risk”—a maxim expressed by a reinsurance company executive at the American Council of Life Insurers’...

How the Economic Machine Works

In this informative and entertaining video, hedge fund billionaire Ray Dalio explains the U.S. economy as he sees it, in terms that anyone can understand, if not agree with....

Retirement Savings in a Co-Ed Dorm?

The investment industry wants to benefit from the tax-deferral subsidy and charge whatever it likes on the subsidized money in rollover IRAs. That’s asking for a lot. More important,...

A Case of Low Book Yields

“Even if rates were to slowly rise, they would still be historically low. There would be less pressure on companies, but the overall portfolio rate of return could continue...

Quote of the Week

“The story of book yields on investable assets, as with invested assets, has been one of decline. Gross book yields for the life insurance industry decreased 18 bps in...

The Bucket

Brief or late-breaking items from Financial Engines, Prudential, Guardian Insurance and BNY Mellon.

As DB wanes in the UK, Brits continue to mull retirement reform

“We do not want to set down a law that says ‘there are three ways you can do pension, and here’s what they are,’” said Steve Webb, Britain's pensions...