Letterman, look out. Retirement Income Journal offers its own list of the year's highlights in the retirement income industry (or in one person's small corner of it).

Rep. Ryan’s Express Could Save—or Derail—Public Pensions

Perhaps the most pointed aspect of the bill, H.R. 6484, is its requirement that states use Treasury rates, which are historically low, to discount pension obligations and calculate funding...

Why Prudential Sells the Most VAs

Constant proportion portfolio insurance, or CPPI, has helped Prudential attract crowds to its Highest Daily VA. Now other insurers are wondering if they should employ CPPI.

AllianceBernstein’s Multi-Insurer In-Plan Annuity

To make sure that the glide paths of plan participants' TDFs lead to a 'safe landing,' asset manager AllianceBernstein has enlisted three insurers--AXA Equitable, Lincoln and Nationwide--to equip them...

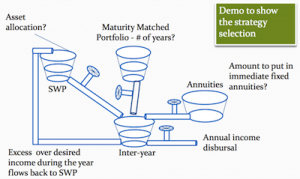

An Entrepreneur Tackles Decumulation, with TIPS

Manish Malhotra’s FIAP platform, set to launch next year, will enable advisors to build retirement income streams out of laddered TIPS, immediate annuities, and withdrawals from balanced portfolios.

The $1.1 Trillion Tax Hike

The "Zero Plan" proposed by the co-chairs of the National Commission on Fiscal Responsibility and Reform last week calls for the end of $1.1 trillion in tax breaks. The...

Singing from the Fee-Only Song Book

Given their focus on planning rather than sales, fee-only advisors seem well-suited to the labor-intensive process of creating customized retirement income solutions for their clients.

Good Day at BlackRock

BlackRock will use the SPARK Institute's new IT standards to deliver the LifePath in-plan income solution--a deferred income annuity in a target-date fund of funds. “That’s a very important...

A New Brand of VA Conference

Under Cathy Weatherford’s command, the IRI annual conference has become smaller, more strategic, less tactical, and more Washington-oriented.

Plan Experts Like Annuities

In a workshop at this week's ASPPA annual meeting in Washington, D.C., few third-party administrators believed that the average couple will be able to afford the retirement they dream...

Retirement Income ‘Smackdown’

In a three-way competition at the CFDD conference, the winning income plan was one that maximized Social Security, converted a 401(k) to a Roth IRA, and rebalanced the remaining...

A Fortune in Reversals

New federal reverse mortgage rules make it cheaper for seniors to tap their home equity for a line of credit.

Making a Case for the 401(k) Annuity

Executives from major plan providers, including Christine Marcks, president of Prudential Retirement, along with trade group officials and ERISA experts, pitched ideas about in-plan income options at DoL/Treasury Department...

“What Investors Really Want”

That’s the name of behavioral economist Meir Statman’s new book. We all yearn for upside potential and downside protection—and maybe a weekly Lotto ticket, he says.

Imperfect Harmony

Hundreds of riled-up advisors and brokers, including Harold Evensky, have responded to the SEC's RFI on "harmonizing" their standards of conduct. Here's some of what they wrote.

Financial Engines’ Secret Income Plan

Financial Engines CEO Jeff Maggioncalda expects his firm to roll out an in-plan income option to DC participants in late 2010 or early 2011. He won't reveal details, but...

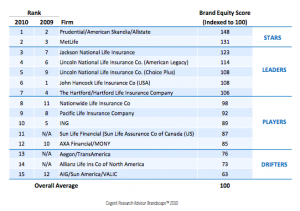

Which Are the Hottest VA Brands?

Who do advisors think of first when asked to name a variable annuity provider? The just-published 2010 Advisor Brandscape from Cogent Research reveals that and much more.

The Downside of Upping the Retirement Age

Social Security turns 75 on Saturday, and pressure to raise the claiming age for full benefits is rising. But that would hurt the least well-off most, said experts at...

The Gospel of Matthew Hutcheson

The 40-year-old leader of the “independent fiduciary movement” is passionate about making retirement plans more responsive to the needs of participants.

They’re Relatively Well-Off

The median annual income for people over age 65 in the United States is only $18,000, including public assistance and financial help from friends and family. The average—skewed upward...