Bermuda Triangle Story

Nassau Financial gets $200 million from Golub Capital; AM Best affirms ratings of Aspida Group, backed by Ares Mgt; 3M swaps its $2.5bn DB pension for a MetLife group...

Athene’s group annuities not the ‘safest available,’ lawsuit charges

The suit against Athene may be a test case for the legitimacy of Bermuda Triangle strategy. In other news from the Bermuda Triangle: Annuity sales boom attracts private equity-backed...

For Ibexis Life, Cayman Outshines Bermuda

This Missouri-domiciled life insurer epitomizes the asset-manager-driven life/annuity companies that have been disrupting the U.S. life/annuity business since 2010 or so. In its first year selling fixed indexed annuities,...

Life Insurers as LEGO Monsters

Michael Gordon, CEO of Axonic Insurance, part of Axonic Capital, sees the future of the life/annuity/asset-management business as an increasingly a la carte affair, where the components of the...

MassMutual platform to distribute Aspida Life fixed-rate annuities

The platform, Flourish, is a wholly owned and independently operated subsidiary of MassMutual. It serves more than 750 wealth management firms managing some $1.5 trillion in financial assets.

Reinsurance on NAIC agenda this week

More news: Private ownership of life re/insurers may affect credit ratings, says Fitch; F&G issues its first RILA; American Equity Investment Life reports 2023 results; Global Atlantic closes $10bn...

This Year’s Legal Battles

The life/annuity industry faces three big legal issues this year. All stem from, or are complicated by, the patchwork regulation of financial products in the US, our out-of-date pension...

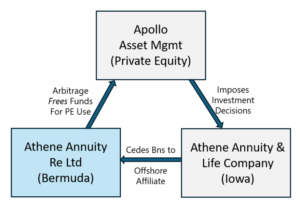

NAIC Urged to Limit ‘Bermuda Triangle’ Strategy

'The ability of insurers to significantly lower the total asset requirement for long-duration blocks of business that rely heavily on asset returns appears to be one of the drivers...

Of Athene, Pension Risk Transfers, and Fiduciaries

The ERISA Advisory Council recently heard comments on changing the criteria that fiduciaries use when vetting annuity providers in pension risk transfer deals. Athene's vice chairman defended his company's...

Why ‘Offshoring’ Annuity Risk Is Wrong

Many for-profit US life/annuity companies do not use independent reinsurers. They use an affiliated or captive reinsurer in a jurisdiction like Bermuda, the Cayman Islands, Vermont, or Arizona. This...

NAIC Reassures Congress on Private Equity-Led Insurers

Responding to Sen. Sherrod Brown's March inquiry, the association of state insurance commissioners gave high marks to their own oversight of PE-linked life/annuity companies. But the NAIC's 'nothing...

Fortitude Re’s expansion continues

Fortitude Re bought Rx Life Insurance Company from Heritage Life. Now named 'Fortitude US Reinsurance Company,' and domiciled in Arizona, it will enable Bermuda-based Fortitude Re to offer clients...

Why RIJ Obsesses over the ‘Bermuda Triangle’

Private equity is no longer a sideshow in the annuity industry. Its involvement is now the main event. But we know too little about private equity’s growing role in...

USAA inked a pair of reinsurance deals in 2021

USAA, a reciprocal insurer, completed reinsurance transactions with Commonwealth Annuity and Life and Fortitude Re, according to its 2021 annual statements.

Private Equity in the Life/Annuity Biz

Experts Tim Zawacki of S&P Global Market Intelligence, Rosemarie Mirabella of AM Best, and Jason Kehrberg of PolySystems presented data on “Private Equity and the Life Insurance Industry” at...

‘Bermuda Triangle’ news

FNF 'dividends' 15% of F&G Annuities & Life stock to shareholders; Ares Management announces $40 billion in lending commitments; Athene gets ‘Excellent’ strength rating from AM Best; KKR closes...

Prudential divests $31 billion block of in-force VAs

Prudential executive vice president and head of US Businesses Andy Sullivan said his company will focus on selling more of its “protected outcome solutions, like FlexGuard and FlexGuard Income.”

‘Private equity’s insurance innovation needs a risk check’: Risk. net

In this guest editorial, the editor-in-chief of Risk.net applauds the innovation that private equity firms bring to the annuity industry, but urges regulators to 'assess the private equity model,...

MassMutual flies into the ‘Bermuda Triangle’

MassMutual has all the pieces--a life insurer that issues fixed annuities, a stake in a Bermuda reinsurer, a big in-house asset manager, and various partnerships--that should enable it to...

Fortitude Re, Midwest Holdings pursue ‘triangle’ strategies

Fortitude Re, a reinsurer backed by The Carlyle Group, a $276 billion private equity firm, is completing its annuity-reinsurance-asset management strategy. Midwest Holdings' life insurer, American Life, has launched...