Featured

As was the case during the global financial crisis, investors today seem to be having difficulty in estimating, pricing, and hedging a variety of tail risks properly, writes NYU...

Orange You Glad the Re-branding Campaign is Almost Over?

“Orange signals our optimism,” Ann Glover, the CMO of Voya Financial, told RIJ in talking about the importance of Voya's keeping the ING color as it separates from ING...

RetirePreneur: Fred Barstein

The founder of The Retirement Advisor University and author of the NAPA Net newsletter has just finished hosting the NAPA (National Association of Plan Advisors) annual conference in New...

Video: A Chat with Morningstar’s Retirement Solutions Group

In this seven-minute video, RIJ editor Kerry Pechter interviews Nathan Voris, the large market practice leader, and Jeremy Stempion, the director of investments, of the Retirement Solutions Group of...

Eyewitness to History in the UK

Our guest columnist, who spends part of each year in Britain, offers this exclusive analysis of the implications of the announcements about retirement regulation and annuities by Britain's top...

Net annuity cash flow at b/ds fell 19% in 2013: DTCC

December 2013 was the first month of negative net flow into annuities since Analytic Reporting of Annuities, an online service of DTCC’s National Securities Clearing Corporation (NSCC), began collecting...

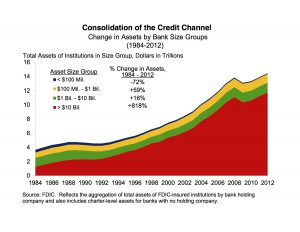

Beware of Oligopolies in Banking

"I suspect that 2014 will prove to be a critical juncture for determining the future of the banking industry and the role of regulators within that industry," said the...

In Hartford, a Public IRA Proposal

RIJ traveled to Hartford on Tuesday for a hearing on a bill that would require most Connecticut employers to offer a retirement plan and would create a default public...

RetirePreneur: Laura Varas

'To me, retirement is the most interesting area of finance because it’s about how we live our lives,' says Hearts & Wallets consultant Laura Varas. 'We should give people...

Our 401(k) System, in Black and White

Bloomberg and Strategic Insights gave two opposing views of defined contribution plans in separate reports in recent weeks. Bloomberg reporters called DC plan sponsors stingy. Strategic Insights, in a...

Journal of Retirement Publishes Winter 2014 Issue

An article by Steve Vernon of the Stanford Center on Longevity lists seven objections to annuities and offers counter-arguments to each. The issue also includes articles on tontines, on...

Prudential’s New Edge: Dynamic Rate-Setting

To reduce interest rate risk exposure, Prudential has adopted a protocol that allows it to change roll-up rates and payout rates on its living benefit riders within a month,...

Prudential’s New Edge: Dynamic Rate-Setting

"If manufacturers can be more dynamic in reacting to changing conditions they don't have to set prices as conservatively. That should benefit investors," said a competitor about Prudential's ability...

The Dollar and the Damage Done

The Fed should adjust its rhetoric and, if necessary, its policies to reflect the fact that its actions disproportionately affect other countries, with repercussions on the US economy, writes...

BlackRock’s Non-Insured Path to Predictable Income

The five new CoRI Funds may appeal to near-retirees who currently have a lot of money in bond funds and are afraid that those funds will lose value as...

Prudential launches new version of Highest Daily GLWB

In the latest iteration of Prudential's Highest Daily guaranteed lifetime withdrawal rider, contract owners must put 10% of premium into a fixed-rate fund. Like its predecessors, this version of...

RetiremEntrepreneur: Andrew Rudd

Andrew Rudd, the co-founder of Barra, Inc. (now the MSCI Barra suite of portfolio analysis tools) started Advisor Software Inc. in 1995 to adapt Barra technology for adviser use....

The Active Ingredient

"In the past year or two, we’ve seen the introduction of 80 actively managed ETFs," writes Russell Wild, the author of ETFs for Dummies. "But they have not exactly...

MyRA Defies the Equities-First Rule

Contributions by young workers to President Obama's proposed MyRA accounts go into a government bond fund. Does that policy contradict the conventional wisdom that young people should invest mainly...

Pondering the End of QE

"After more than five years, QE has arguably entrenched expectations for continued low or even negative real interest rates – acting more like addictive painkillers than powerful antibiotics," writes...