Featured

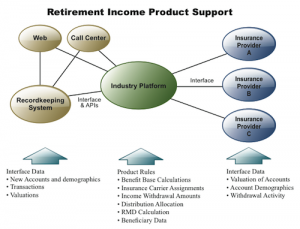

DST Systems’ Larry Kiefer says his firm’s new “middleware” simplifies the distribution of lifetime income products to plan participants, IRA owners and others.

Heritage Foundation Suggests Means-Testing for Social Security, Medicare

Under the conservative think-tank's proposal, a new optional, auto-enrolled savings plan would start in 2014. Under this plan, 6% of each worker’s income would go in a retirement savings...

Reading the Minds of the Affluent

Cogent Research has tapped into the attitudes of wealthy retirees and pre-retirees toward retirement income products.

VA Update from Ernst & Young

Leading up to the May 1 deadline for contract changes, issuers continued to tinker with every aspect of their contracts--to reduce overall risk and to align their compensation formulas...

What’s Up Down Under? SPIA Sales.

An ad campaign featuring the 1967 Buffalo Springfield classic, "For What It's Worth," and other factors are helping drive higher income annuity sales in Australia for Challenger Ltd. Their...

Most tax benefits of private pensions go to high earners: GAO

The largest share of 401(k) assets is clustered in big accounts, and the highest-earning participants reap the most tax benefits, says a GAO study. The CEO of ASPPA, a...

A Month of SPIAs

Starting with today’s issue, we’ll devote four weeks of cover stories and features to single premium immediate annuities. Millions of mass=affluent Americans will need them.

Solving the SPIA compensation puzzle

By re-valuing each client's annuity contract each day, New York Life enables advisors to charge a fee based on the (shrinking) cost of replacing the income stream.

An Advisor’s Perspective

Antoine Orr, president of Plancorr Wealth Management LLC in Greenbelt, Maryland, tells his clients to pay down debt and invest only what they can afford to lose. "African American...

A Scholar’s Perspective

"It’s not as if African Americans were a different species. They are over-represented among lower income populations, but that’s where their distinctiveness stops,” said Wilhelmina A. Leigh, Ph.D., of...

More info on New York Life’s DIA Emerges

The deferred income annuity will allow pre-retirees to build up retirement income over time, it was revealed at the LIMRA Retirement Industry conference in Las Vegas last week.

An Industry Awaits Fee Transparency Rule with Trepidation

“This new ERISA 408(b)(2) disclosure has a bite to it," writes Louis Harvey of Dalbar in DSG Dimensions. ERISA attorney Fred Reish (left) estimates that 401(k) fee transparency rule...

America Isn’t a Corporation

Congressman Paul Ryan's approach to the budget makes sense only if you think America should function like a corporation and that Medicare payments are income for beneficiaries. Nix to...

What Advisors Say About Wholesalers, Etc.

"Keep the golf balls, umbrellas, coffee mugs, etc., and provide as much info, training and current ideas as possible." That's one advisor's anonymous comment about annuity wholesalers in the...

“The Ultimate Ponzi Scheme”

In the third of three excerpts from "Guaranteed to Fail," the authors explain how off-budget housing guarantees through Fannie Mae and Freddie Mac have enabled a succession of presidents...

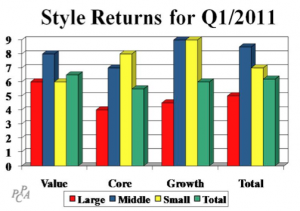

Have Investment Managers Earned Their Fees?

To help readers evaluate their own investment managers, our guest columnist offers a summary of the first quarter's equity returns by style, sector, and country.

One Reason the Crisis Got So Bad

Banks needed to reserve 4% for mortgage loans, but only 1.60% for mortgage-backed securities issued by Fannie Mae or Freddie Mac. So banks loaded up on MBSs. A second...

When Herds Get Overconfident, Run for Cover

Steve Utkus of the Vanguard Retirement Research Center proposes a four-part model to explain the psychological dynamics behind the most recent financial bubble, and similar bubbles.

RIIA Marks a Few Milestones

The Retirement Income Industry Association, led by Francois Gadenne, has published the third edition of the text for its RMA certification program, and the first issue of The Retirement...

Putnam’s Man with a Plan

Putnam Investments CEO Robert Reynolds called for a new lifetime income regulatory body and announced a decumulation tool for Putnam funds in a speech at the RIIA meeting this...