Income Strategies

Low interest rates send players in different niches of the retirement business in different directions toward different solutions for different types of customers. Here's how the leading FIA issuer...

Project LIMA Aims to Solve the Annuity Puzzle

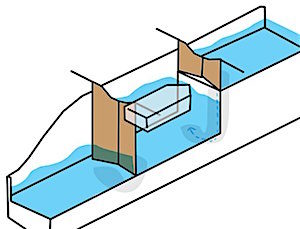

Milliman, the actuarial consulting firm, envisions putting a multi-premium deferred income annuity inside a 401(k) managed account as a way to turn tax-deferred savings into lifetime income. It seeks...

Applying Actuarial Science to Income Planning

Adviser Mark Shemtob uses actuarial science to analyze and compare retirement income strategies that employ both annuities and investments.

A Look Back at (and Beyond) the ‘Stretch’ IRA

Under the new SECURE Act, most non-spouses must withdraw and pay taxes on inherited IRA assets within ten years instead of "stretching" the process over (possibly) decades. What will...

Schwab adds hybrid robo income distribution service

Schwab Intelligent Portfolios has a $5,000 minimum and charges no advisory fee. Schwab Intelligent Portfolios Premium has a $25,000 minimum and charges an initial one-time $300 fee for planning and...

What rollover IRA owners are thinking

59% of US households with traditional IRAs in mid-2019, or 21 million US households, had accounts that included rollover assets from employer-sponsored retirement plans, according to a recent survey by...

A Few of Our Best Income Strategies

For today’s issue of RIJ, we’ve retrieved several of our best income-planning articles from our archives. In each case, the adviser goes beyond the “safe withdrawal” method to design...

‘Safety First’ Income Plans, Per Wade Pfau

Pfau's new book shows the benefits of replacing bonds with annuities for less risk and more income in retirement.

Making Income Rise as Health Declines

A fee-only adviser in Philadelphia used 'medically underwritten' or impaired annuities from Mutual of Omaha to increase the retirement incomes of older, single men in declining health.

Life Insurance in a Bucketed Income Plan

This case study from Securities America uses life insurance to help a 'constrained' mass-affluent retired couple protect the surviving spouse from a partial loss of pension and Social Security...

At the RIA Dance, Annuities Look for Partners

Nationwide Advisory Services and Great American announced moves this week aimed at making their fee-based annuities attractive and accessible to Registered Investment Advisors.

Taxes in Retirement: Front-Load or Back-Load?

Here are two ways a retired couple with a $1 million IRA might manage taxes: By either minimizing or maximizing them in the first 10 years of retirement. Zach...

Of ‘Thrillers, Spillers, and Fillers,’ Plus the Mueller Hearings

Like every decorative pot of plants, every retirement income plan needs a 'thriller, a spiller and a filler.' We also deconstruct this week's Mueller hearings.

Blueprint Income, a fintech firm, will sell Pacific Life deferred income annuity online

The deferred income annuity is called 'Next.' The two companies envision Generation X-ers using the Blueprint Income platform to buy a personal retirement pension, one installment payment at a...

A Chronicle of ‘NARIA,’ Nationwide’s Income-Generating VA for RIAs

The 'Nationwide Advisory Retirement Income Annuity' has no commission or surrender schedule and offers RIA clients a choice of 130 investment options. The income rider costs 80 basis points...

Risks That Can Ruin a Retirement

In the first of a two-article series, the retirement expert, author and editor enumerates and describes the many risks that retirees face. (Spoiler alert: Mortality is not one of...

Jackson and RetireUp partner on annuity illustration tool for advisors

RetireUp’s algorithms were chosen to power Jackson National’s wizard after RetireUp participated in a Jackson “Hothouse competition,” a “creative problem-solving methodology” that encourages teamwork, innovation and agility.

Two Client-Centric Income Strategies

We compare two easy-as-pie annuity strategies: Income starting at age 80 versus guaranteed income for the first 10 years of retirement. One hedges longevity risk, the other hedges sequence...

Survey shows how advisors generate income for clients

A survey by bond dealer Incapital LLC showed that 51% of financial advisors generate income for clients from dividend-paying stocks, 43% from equity income mutual funds, and 43% from...

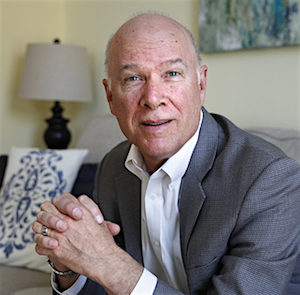

Steve Vernon’s Guide to Retirement Success

Steve Vernon's latest book on retirement, "Retirement Game-Changers," teaches anyone how to win not just the game of retirement income, but the game of life-after-55. Vernon (pictured) is...