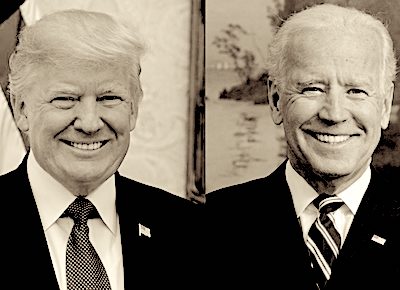

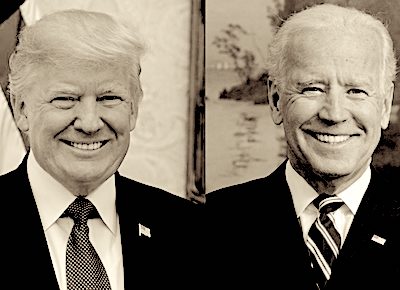

A Look at Biden’s Social Security Plan

There's more to Biden's proposal than raising payroll taxes on >$400k earners. The wealthy would see their benefits go up more in dollars, while the poor would see theirs rise more on a percentage basis. The Social Security 'funding gap' remains unresolved under the proposal, however.