Indexed annuity sales were $14.5 billion in the first quarter of 2018, up 11% from the first quarter 2017 and up 4% since last quarter, according to LIMRA Secure Retirement Institute’s (LIMRA SRI) First Quarter 2018 U.S. Retail Annuity Sales Survey.

This was the second strongest start for indexed annuity sales since LIMRA SRI starting tracking annuity sales. LIMRA SRI expects indexed annuity sales to increase 5-10% in 2018.

“For the first time in eight years, we saw [first quarter] growth in the indexed annuity market when compared to fourth quarter,” said Todd Giesing, annuity research director, LIMRA Secure Retirement Institute. “This uptick in sales is a combination of an improved outlook on a regulatory front, as well as rising interest rates creating the opportunity for more attractive rates.”

Overall, U.S. annuity sales were $51.8 billion in the first quarter of 2018, which was level with first quarter 2017 results.

“Due to the DOL fiduciary rule being vacated in April 2018 and the expectation for positive economic factors, we have revised our 2018 annuity forecast and now expect a 5-10% increase in annuity sales growth,” Giesing said.

In the first quarter, variable annuity (VA) sales totaled $24.6 billion, down 1% from the prior year. VA sales declined for the 17th consecutive quarter.

“While this quarter wasn’t strong for VAs, we are seeing some companies introduce new products, raise crediting rates for guaranteed living benefit products and loosen restrictions on investments, said Giesing. “Combined with the vacated Department of Labor fiduciary rule, we expect VA sales will improve throughout the year. As a result, LIMRA SRI is forecasting VA sales to be 0-5% higher in 2018, compared with 2017 results.”

Fee-based VA sales increased 70% to $780 million in the first quarter, but still represent just three percent of the total VA market.

As for structured annuities, LIMRA has chosen the term “registered indexed-linked annuities” to describe them and will include them in the overall VA sales figures. Registered index-linked annuity sales were $2.2 billion, an increase of 4% in the first quarter, compared with the first quarter of 2017. But sales declined 6% when compared with the prior quarter. These products represent about 9% of the retail VA market.

Total sales of fixed annuities remained flat in the first quarter at $27.2 billion. Fixed annuities have outperformed VA sales seven out of the last eight quarters. LIMRA SRI expects overall fixed annuity sales to increase 10-15% in 2018.

Sales of fixed-rate deferred annuities, (book value and market-value-adjusted) fell 14% in the first quarter, to $8.7 billion. After multiple quarters deviating from the 10-year treasury rate, this quarter the sales aligned with the treasury rate growth. LIMRA SRI expects fixed-rate deferred sales to increase 15-20% in 2018.

First quarter single premium immediate annuity (SPIA) sales rose to $2.1 billion in the first quarter, up 5% over the same quarter last year. SPIA sales have remained in the $2 billion to $2.2 billion range for the past two years.

Deferred income annuity (DIA) sales fell 6% in the first quarter 2018 to a five-year low of $515 million. Overall, LIMRA SRI believes that increasing interest rates and other economic factors will cause combined SPIA and DIA sales to grow 5-10% in 2018.

The first quarter 2018 Annuities Industry Estimates can be found in the LIMRA SRI’s updated Data Bank. To view variable, fixed and total annuity sales over the past 10 years, visit Annuity Sales 2008-2017.

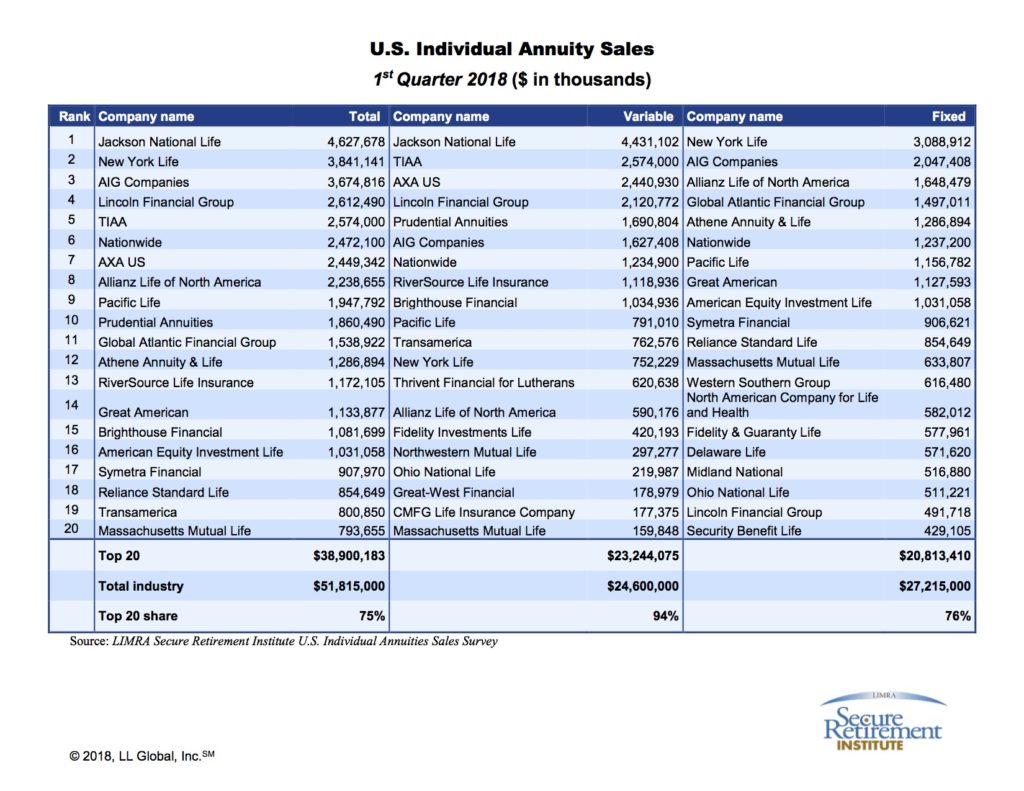

To view the top twenty rankings of total, variable and fixed annuity writers for first quarter 2018, please visit First Quarter 2018 Annuity Rankings. To view the top twenty rankings of only fixed annuity writers for first quarter 2018, please visit First Quarter 2018 Fixed Annuity Rankings.

LIMRA Secure Retirement Institute’s First Quarter U.S. Individual Annuities Sales Survey represents data from 96% of the market.

© 2018 LIMRA.