Select Alternative Asset Manager-Linked Life/Annuity Reinsurers

IssueM Articles

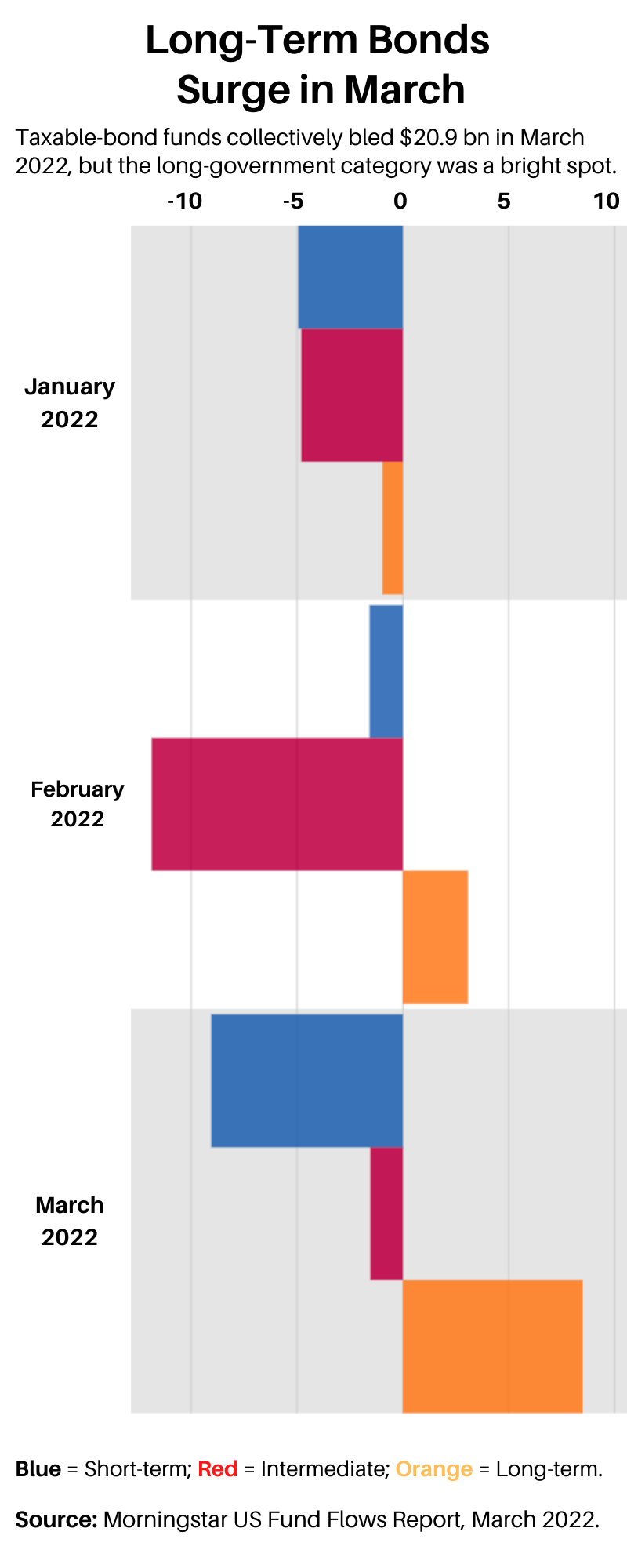

Investors appear cautious, according to Morningstar’s Flow of Funds Report for March 2022. They added only $30 billion to long-term mutual funds and exchange-traded funds during the month—completing the weakest quarter since 1Q2020, when COVID was raging.

Most equity and fixed-income markets are in negative territory so far in 2022, the report said. Four fund families saw impressive flows into their passive funds: iShares, Vanguard, SPDR State Street Global Advisors, and Invesco (in that order).

In March, US equity funds collected an industry-leading $41 billion, down from $50 billion in February. International-equity funds collected just $7.2 billion, their weakest inflow since December 2020. S&P 500 Index funds and other large-blend funds took in $26.5 billion to lead all Morningstar Categories.

Large-growth funds, rebounding, gathered $9.3 billion in March, their fourth-highest monthly organic growth rate in 10 years. Passive funds gained $15.3 billion and while active funds shed $6.0 billion.

Although investors took a net $20.9 billion out of taxable-bond funds in March, the long-government category enjoyed a 9.8% one-month organic growth rate—its best since February 2016—and gained $8.7 billion. In government-only and diversified funds, investors preferred longer-term bond offerings in the first quarter.

High-yield bond funds saw a $27.8 billion exodus in March. The category suffered a worst-ever organic growth rate (or decline, in this case) of negative 7% in the first quarter. The bank-loan category, a source of inflation protection, pulled in $19.2 billion in the first quarter.

In other highlights of the Morningstar report:

© 2022 RIJ Publishing LLC.

AM Best will participate in a panel discussion focused on the increasing role of private equity in the insurance industry during the upcoming 2022 Life Insurance Conference hosted in part by LIMRA, which will take place April 25-27, in Tampa, FL.

Rosemarie Mirabella, director, will participate in the discussion titled, “Private Equity and the Life Insurance Industry,” which is scheduled from 1-2 p.m. EDT on Tuesday, April 26, at the JW Marriott, 510 Water St., Tampa, FL. Recent years have seen a growing increase in the prominence of private equity firms involved in insurance merger and acquisition activity and reinsurance transactions.

Mirabella oversees a team of AM Best analysts who are responsible for monitoring and evaluating a myriad of insurance companies that operate in the personal lines, commercial lines and life/annuity segments in the United States and Canada.

In addition to LIMRA, the event is also being hosted by the Life Office Management Association (LOMA), the Society of Actuaries (SOA) and the American Council of Life Insurers (ACLI). For more information on the 2022 Life Insurance Conference, please visit the event page and agenda.

AIG Life & Retirement, which AIG intends to spin off this year as an independent public company, has extended its Power Series of Index Annuities with a new five-year index annuity for New York only.

The Power Index 5 NY is issued by The United States Life Insurance Company in the City of New York (US Life), a member company of American International Group, Inc (NYSE: AIG).

With inflation rising at its fastest pace in 40 years, consumers may be looking for a retirement product that guarantees growth to help offset increasing costs. Power Index 5 NY combines tax-deferred growth potential and protection guarantees backed by the claims-paying ability of US Life.

The new index annuity is guaranteed to increase in value—either by capturing the upside potential of three leading equity market indices or by locking in a fixed growth rate even when the market is flat or down. At the end of five years, investors get access to their money without withdrawal fees.

The new 5-year index annuity gives consumers the opportunity to grow their assets with interest earned based on the performance of the S&P 500, Russell 2000 and MSCI EAFE. Like all fixed indexed annuities, Power Index 5 NY does not directly invest in these indices. There is no market risk to principal, and the account balance will never decline due to market fluctuations.

“The product includes a Minimum Accumulation Value (MAV) that is separate from the account balance and increases by 1% per year, regardless of index performance,” an AIG release said. “Should index returns remain flat or down, Power Index 5 NY locks in the guaranteed growth from the MAV after 5 years and then every year thereafter. If interest earned through the performance of the equity market indices is greater than the MAV, consumers will benefit from this upside potential.”

“Index annuities like Power Index 5 NY can protect assets from interest rate risk and market fluctuations, while providing the opportunity to generate more income,” said Pinsky. “We are working with many financial professionals who are using index annuities to look beyond traditional fixed income assets to help generate growth and income for their clients.”

Effective May 2, 2022, Pacific Life’s Pacific PremierCare suite of life insurance products will no longer be available for new sales, the mutual insurer announced this week.

The discontinued products include Pacific PremierCare Choice one-year, five-year, 10-year, and lifetime premium whole life insurance products with long-term care (LTC) benefits and Pacific PremierCare Advantage Universal Life Insurance with Long-Term Care Benefits in California.

“Pacific Life remains committed to the long-term care market as we continue to recognize US consumers’ large, unmet need in this area,” said Greg Reber, Pacific Life senior vice president and chief distribution officer, life insurance business, in a release.

“We conducted a thorough strategic review of the LTC marketplace and see great potential in the market for chronic health (CHR) and LTC riders on cash value life insurance policies.”

Pacific Life said it has seen sales of hybrid LTC products decline as the current environment has made it difficult to be both competitive and profitable. “By focusing solely on riders for our cash value products to meet the LTC need, the company can prioritize and utilize resources more effectively,” the release said.

Pacific Life will continue to service all in-force Pacific PremierCare policies. For existing policyowners, there will be no change.

Craig DeSanto has assumed New York Life’s chief executive officer (CEO) position, the large mutual company announced. DeSanto was named CEO-elect in November 2021 after serving as a member of New York Life’s Board of Directors since February 2021 and as New York Life’s president since July 2020. As CEO, he will remain president.

DeSanto succeeds Ted Mathas, who served as CEO for nearly fourteen years. Mathas will remain chairman of the board in a non-executive capacity. New York Life has $760 billion in assets under management and a workforce of more than 23,000 agents and employees.

DeSanto joined New York Life in 1997 as an actuarial summer intern and was promoted into roles of increasing responsibility across the company’s finance and business operations, which included leading the institutional and individual life insurance businesses. In 2015, he diversified a portfolio of businesses that generate roughly half of New York Life’s earnings and contribute significantly to dividends paid.

In 2018, DeSanto assumed oversight for New York Life’s retail annuity business line. In 2019, he took charge of New York Life Investment Management (NYLIM), New York Life’s multi-boutique third-party asset management business serving institutions and individuals around the world with more than $432 billion in assets under management. In 2020, he led the effort to close the acquisition of Cigna’s Group Life and Disability business, now New York Life Group Benefit Solutions.

Three out of five retirement-age investors (61%) believe that low interest rates, combined with rising inflation, will make it harder to create a retirement income stream that will last their lifetimes, a study by Global Financial Atlantic Group found.

A quarter of participants in the survey (24%) said they are extremely or very concerned about the impact of inflation on their ability to live comfortably in retirement.

The survey of retirement-age investors (ages 55 to 70) with between $250,000 and $2 million in assets and no pension, reached conclusions that were similar to conclusions reached by many annuity issuer-sponsored surveys of the past 15 to 20 years.

Nearly all (96%) believe protected, guaranteed monthly income in retirement is important (35% said it was extremely important). But less than a quarter currently use annuities (24%) or bonds (23%) to protect their assets.

Most cited a mixed portfolio of stocks and mutual funds (73%). Two-thirds (67%) cited cash equivalents as their ways to protect assets, in contradiction to fears of a stock market correction (66%) and continued inflation (57%) this year.

Among those surveyed, about two-thirds (68%) work with financial professionals. Nearly nine in ten (88%) of those advised by financial professionals have discussed ways to minimize the risk in their investment portfolio, just 28% say annuities were part of the conversation.

The study also revealed that annuity owners are more confident about retirement security than non-owners. Three in five of those with an annuity (62%) say the amount of money they have saved for retirement will last the rest of their life, versus less than half (48%) of those without an annuity.

A full 40% of those without an annuity say they “don’t know” if the money they have saved will last the rest of their lives. Half (48%) of annuity owners are extremely or very comfortable with their investment asset and retirement protection strategy, compared to only one-third (33%) of those without an annuity.

© 2022 RIJ Publishing LLC. All rights reserved.

Buy-and-hold investors in equity index funds, equity value funds and real estate sector funds earned the highest average returns in 2021. Investors in bond funds fared poorly, according to Dalbar’s Quantitative Analysis of Investor Behavior (QAIB) for the period ending December 31, 2021.

The average investor has maintained an approximate 70% equity to 30% fixed income allocation since 2017, Dalbar said. Inflation for calendar 2021 was 7.04%. The highlights of the latest QAIB survey are below.

The average equity fund investor:

The average fixed income fund investor:

The average real estate fund investor was the top performing sector fund investor, earning 38.89% in 2021.

Retention rates increased for the average fixed income fund investor and average asset allocation fund investor in 2021. For bond investors, retention rates jumped to 3.44 years from 3.12 years. For asset allocation investors, retention rates increased from to 5.45 years from 4.38 years.

The aggregate outflow of equity assets and inflow of fixed income assets over the past several years suggest a rebalancing on the part of investors after significant appreciation of the equities within the portfolio.

The equity markets have shown an ability to recover from major declines within five years. Since 1940, the S&P experienced a drop of 10% or more in eight years. In those eight years, the S&P recovered within a year, and it recovered from every decline of greater than 10% within the subsequent five years.

Prudent Assett Allocation is an investment strategy, created by Dalbar, that sets aside the cash needs for five years into preservation investments. The remainder of the portfolio is invested in growth assets that maximize return.

QAIB uses data from the Investment Company Institute (ICI), Standard & Poor’s, Bloomberg Barclays Indices and proprietary sources to compare mutual fund investor returns to an appropriate set of benchmarks. Covering the period from January 1, 1985 to December 31, 2021, the study utilizes mutual fund sales, redemptions and exchanges each month as the measure of investor behavior.

These behaviors reflect the “Average Investor.” Based on this behavior, the analysis calculates the “average investor return” for various periods. These results are then compared to the returns of respective indices.

DALBAR, Inc., based in Marlborough, MA, is a leading independent expert for evaluating, auditing and rating business practices, customer performance, product quality and service. Launched in 1976, DALBAR evaluates investment companies, registered investment advisers, insurance companies, broker/dealers, retirement plan providers and financial professionals. Its awards are recognized as marks of excellence in the financial community.

© 2022 RIJ Publishing LLC.

Larry Summers, former US Treasury secretary, former chief economist of the World Bank, president emeritus of Harvard, and predictor of a looming era of “secular stagnation,” is playing the role of Cassandra again.

The US won’t be able to chill inflationary trends in 2023 without a recession, say Summers and colleague Alex Domash of the Harvard Kennedy School of Government in a recent paper, “A labor market view on the risks of a US hard landing.” (NBER Working Paper No. 29910.) And the Federal Reserve, they say, shouldn’t soft-pedal the situation by predicting a “soft” economic “landing” after a few brake-tapping rate hikes.

Larry Summers

The authors cite economic precedent as their guide. “The empirical evidence supports the view that taming accelerating inflation requires a substantial increase in economic slack. Since 1955, there has never been a quarter with price inflation above 4% and unemployment below 5% that was not followed by a recession within the next two years,” the authors write.

The root of the problem, in their view, is that too many Americans have jobs and are earning more. Where more sanguine economists have pointed to supply-chain bottlenecks and high petroleum prices as the drivers of the current inflation, Summers and Domash see high wages.

Today’s labor market “is significantly tighter than implied by the unemployment rate,” they write. “The vacancy and quit rates currently experienced in the United States correspond to a degree of labor market tightness previously associated with sub-2% unemployment rates.”

They link the tight labor market to wage inflation of 6.5% in the past year—the highest level experienced in the past 40 years—and point to data showing that high levels of wage inflation have historically been associated with a substantial risk of a recession over the next one to two years.

“There have also only been two periods where wage inflation fell by more than one percentage point in a year—in 1973 and 1982—and both times coincided with a recession. We show that periods that historically have been hailed as successful soft landings—including 1965, 1984, and 1994—all had labor markets that were substantially less tight than the present moment,” the paper says.

Summers and Domash take the sobering position that workers only benefit from rising wages to a limited degree, and then begin to lose their subsequent wage gains to inflation.

“Historically, when wage growth reaches such high levels, inflation tends to accelerate and erodes workers’ real wages. Labor costs represent more than two-thirds of all business costs across the economy, which means that wage inflation contributes significantly to underlying inflation and drastically increases the risk of a wage-price spiral. Using quarterly data going back to 1965, we document how real [inflation-adjusted] wages increase with nominal wages up until nominal wage growth reaches about 4.3%, and fall thereafter,” the authors write.

“While some have argued that the Fed has successfully engineered soft landings in the past, we note that these periods had significantly lower inflation and higher levels of labor market slack than the current moment. Our results suggest that it is unlikely that we are going to have wage inflation come down with a level consistent with low product price inflation without a significant increase in economic slack.”

In other recent research:

“Trends in Retirement and Retirement Income Choices by TIAA Participants: 2000–2018,” by Jeffrey R. Brown, Gies College of Business, University of Illinois at Urbana- Champaign; James M. Poterba, MIT, and David P. Richardson, TIAA-CREF Institute. NBER Working Paper No. 29946, April 2022.

This paper reveals how thousands of retirees from TIAA 403(b) plans withdrew their savings after entering retirement over the past 20 years. The authors found that a rising percentage of TIAA retirees don’t withdraw from their accounts until the IRS forces them to take required minimum distributions, or RMDs. (Until 2019, the RMD age was 70½; it is now 72.) A falling percentage of retirees take income as a life-contingent annuity.

“The fraction of retirees taking no income until the RMD age of 70.5 rose from 10% in 2000 to 52% in 2018,” write authors Brown, Poterba and Richardson. Over the same time period, shrinking numbers of TIAA retirees took income in the form of life-contingent annuities. “The percentage of all TIAA beneficiaries with life annuities… declined from 52% to 31% between 2008 and 2018,” the paper said.

Distribution choices depended on the retirement age of the participant and the size of the account balance, the authors found. As might be expected, those who postponed retirement until after age 70 were more inclined, relative to those who retired before age 70, not to take any distributions of their TIAA savings until the RMD age. Participants in the middle 60% of the account balance spectrum were more likely to choose a life annuity than were those with the highest or lowest balances.

“The Savings Glut of the Old: Population Aging, the Risk Premium, and the Murder-Suicide of the Rentier,” by Joseph Kopecky, Trinity College, Dublin, and Alan M. Taylor, University of California at Davis. NBER Working Paper No. 29944, April 2022.

The authors of this paper tie the demographic changes that followed World War II—the 1946-1964 “baby boom” and the subsequent aging of the boomer generation—to the bull markets in stocks and the decline in safe interest rates over that time.

“A large mass of aging households—the boomers—drive a savings glut which, as they near retirement, especially depresses real interest rates on safe assets,” Kopecky and Taylor write. “As they age, they reduce portfolio allocations to equity, so they do not have the same effect on risky equity returns, widening the equity risk premium.”

Aging households “accumulate more wealth, but then they also tend to shift its composition towards safe and away from risky assets (i.e., into bonds and out of equities). Household assets by age peak in the 70s in the 2016 Survey of Consumer Finance, but the equity share peaks at a much younger age, in the 50s.”

The authors predict that there won’t be a sequel to the boomer-driven shock wave of the past and present. “The current weight of demographic forces on asset returns appear to be much closer to a return to an old normal rather than a new normal that some have described… the boomer-driven demographic forces from the 1960s to the 2010s were a truly abnormal feature by historical standards,” they write.

“A Sustainable, Variable Lifetime Retirement Income Solution for the Chilean Pension System,” by Olga M. Fuentes, Pension Regulator Chile, Richard K. Fullmer, Nuova Longevita Research, and Manuel García-Huitrón, Nuovalo Ltd. March, 2022.

Chile is one of the few countries in the world, along with Canada and the US, to have a “deep and efficiently functioning annuity market,” according to this paper. But because the country’s existing retirement system faces the same stresses as elsewhere—a rising elderly population and low interest rates—the government is looking at new ways to finance Chileans’ retirement.

The number of old age dependents per 100 working-age Chileans is expected to rise from 27 in 2020 to 59 by 2050 and to 86 by 2100. The proportion of the population aged 60+ is on track to more than double, to 40% in 2100 from 17% in 2020. In 2050, the ratio of individuals aged 80 and over to the working-age population is expected to be three times larger than it is today.

Fullmer, a tontine entrepreneur, actuary and former senior executive at Russell Investments and T. Rowe Price, and his co-authors suggest that Chile adopt tontines. Their paper includes descriptions of the Chilean retirement system (the typical three-legged stool: a modest basic pension, a mandatory defined contribution plan with optional annuitization, and private savings). It follows with a description of tontines and their potential role in the future of retirement financing—in Chile and elsewhere, including the US.

Tontines, for the uninitiated, are a type of life annuity; participants make an irrevocable investment and later receive an income from a chosen inception date until they die. But they are cheaper than annuities because they eliminate the middleman: No life insurance company guarantees the income stream or adds its overhead to the cost. Instead, participants bear the investment risk (i.e., income can fluctuate) and longevity risk (the risk that their investment pool might be exhausted before all of them have died).

One of the main benefits of this paper is its detailed description of tontines and its demonstration that tontines can be adapted to almost any situation that might call for an annuity. Tontines, in short, have come a long way since they were invented in the mid-17th century.

“A Comparative Perspective on Long-Term Care Systems,” by Rainer Kotschy and David E. Bloom. NBER Working Paper No. 29951, April 2022

Even if demand for long-term care insurance (LTCI) rises, there may not be an adequate supply of caregivers for the rising numbers of elderly men and women—insured or not—who can’t feed, bathe, or dress themselves, according to new research.

The authors look at the trends in rates of partial disability among the elderly—as reflected in data on deficits in activities of daily living (ADL)—in European Union countries, Switzerland, Israel, the UK, and the US.

“Our results predict an average increase in care demand of 47%, with the largest increases in Southern and Eastern Europe,” they write. But many countries will lack a sufficient number of well-trained caregivers. To relieve that anticipated shortage, wages for caregivers may need to rise, or immigration rates increase, or licenses be required of caregivers.

Unlike the US, Germany, the Netherlands, Israel, Japan and South Korea have compulsory public long-term care insurance. The coverage is financed variously through payroll taxes, copayments, and subsidies from taxing authorities.

The authors suggest that old-fashioned preventive health maintenance through a healthy diet and regular exercise may be the best way for individuals and societies to reduce their needs for long-term care services.

“Good population health—in terms of a low disability share among the elderly—can moderate growth in care demand,” they conclude. But “only a few countries explicitly target disability prevention in their long-term care strategy.”

Bloomberg, the respected online business news source, has been publishing a series of editorials on America’s “retirement crisis.” They’re arriving late to the discussion, which started in the 1980s.

But no one has solved the crisis—generally measured by the percentage of Americans on track for downward mobility in retirement—so Bloomberg is still early.

In the most recent installment, the Bloomberg editors call the existing 401(k) program “dysfunctional” and a “morass.” The program, they say:

“The US can do much better, at no extra cost,” the Bloomberg editors say.

Their solution, put simply, would give all US workers access to the kind of low-cost, high-match defined contribution plan (e.g., 401(k), 403(b)) that workers at many large corporations enjoy today, but government-sponsored. It would be:

Universal. Everyone with a Social Security number would be auto-enrolled, with an opt-out opportunity.

Simple. Participants would automatically start contributing 3% of pay per year to “lifecycle” (target-date funds) unless they prefer to pick from a curated list of actively managed funds.

Portable. Participants would own their accounts, which would follow them automatically from job to job.

Progressive. Contributions by the lowest earners would receive an annual government match of $1,000 or more.

Flexible. Participants could dip into their accounts for emergencies.

Income-oriented. At retirement age, “account holders are offered a small selection of simple annuities, which provide regular payments for as long as they live — a conversion that could be made automatic, with payments adjusted for inflation.”

According to Bloomberg, such plans already exist, in the form of the federal Thrift Savings Plan and the UK’s National Employment Savings Trust (NEST). They might also have included TIAA and perhaps Australia’s Superannuation Fund.

The tax expenditure

Some of the issues Bloomberg raises have already been addressed, if not necessarily resolved, by policymakers. Many large employer-sponsored plans already have auto-enrollment, auto-investment in target date funds, and some have adopted auto-escalation of contribution rates. Congress has approved Pooled Employer Plans, which could expand coverage and take pressure off employers, and lower barriers to annuities in DC plans. State-sponsored auto-IRAs in California and Illinois are also helping expand coverage to workers at small firms.

The tax expenditure seems to be Bloomberg’s prime target. The US Treasury forgoes more than $200 billion a year in income taxes. Bloomberg is not the first to ask:

Bloomberg seems to underestimate the resistance to tinkering with this tax expenditure. A multi-trillion dollar retirement industry has grown up around the tax expenditure. The Obama Administration tried to cap the subsidy on savings and redistribute the tax expenditure more equitably, but industry lobbyists turned it back. If Social Security is the third-rail of American politics, the existing IRA/401(k) subsidy is the third-rail of retirement policy.

Speaking of Social Security, Bloomberg didn’t explain how its DC vision would be integrated with the popular Old Age and Survivors Insurance program. Social Security is nearly universal, simple, portable, progressive, flexible (in its start date) and income-oriented. Employers provide a 6.2% match. All but the top earners rely on it for a big chunk of their retirement income.

The Bloomberg plan reminds me of plans in countries where the governments have replaced pay-as-you-go public pensions with a two part system consisting of a means-tested minimal pension (paid for by general tax revenue) and a workplace defined contribution plan to which employers must contribute but do not control.

Bloomberg appears to overlook the problems that these plans often encounter as they try to manage the transition from accumulation to decumulation; they typically need “smoothing” mechanisms to reduce disparities in individual outcomes.

If Bloomberg would like to such a system replace Social Security, I’m against their idea. Social Security works. It needs tinkering, to be sure. There should probably be a minimum basic pension, and an increase in the level of income subject to payroll taxes might offset the tax-break imbalance. But it’s not yet time to retire the Old Age and Survivors Insurance program and replace it with a shiny new object.

Social Security should remain popular, even after a modest tax hike, because it does so many things that investments can’t do. As I’ve written before: You may be able to invest your money better than the government can. But you can’t insure yourself retirement against market risk, interest rate risk, sequence risk and longevity risk as efficiently as the government does via Social Security.

Each of Social Security’s protections has under-appreciated financial value. DC accounts offer only risk exposure, to varying degrees; they can’t provide protection from risk. And life insurance company balance sheets can’t support an entire nation’s longevity risk indefinitely. Uncle Sam can; that’s why we have Social Security. Demographic change may make the program more or less expensive, but it’s worth the price.

Though not fresh, Bloomberg’s views are reasonable. Tax loopholes tend to widen with time, and the subsidy for retirement savings has grown from the size of a needle’s eye to a freeway as wide as Southern California’s I-5. A case can be made that tax deferral has become a bloated and unbalanced subsidy. And the complexities of tax deferral only add to the DC system’s cost.

But Bloomberg’s editors don’t acknowledge the time (and frustration) that others have spent on these same issues, and they ignore the remaining obstacles to change. In the end, your position on DC policy will probably depend on whether you’ve benefited from the 401(k)/403(b) system. My household had the good fortune to participate in low-cost plans with generous matching contributions. Everyone should be so lucky.

© 2022 RIJ Publishing LLC. All rights reserved.

E

MetLife Investment Management (MIM), the institutional asset management business of MetLife, Inc. (NYSE: MET), announced the launch of a private equity fund investment platform for institutional clients in concert with the closing of approximately $1.6 billion in commitments to a new MIM-managed fund-of-funds.

The new fund purchased a portfolio of approximately $1.2 billion of private equity and venture capital assets with funded and unfunded commitments totaling $1.2 billion from MetLife affiliates as part of a managed secondary sale transaction anchored by funds managed by HarbourVest Partners L.P., which served as lead investor.

MIM syndicated a portion of the transaction to other unaffiliated institutional clients. Following the closing, MIM intends to deploy approximately $400 million on behalf of the fund on new private equity opportunities.

“This new platform and secondary transaction speak to MetLife’s 30-year track record as a leading private markets investor and MIM’s ability to generate strong results in alternative asset classes,” said Steven Goulart, president of MIM and executive vice president and chief investment officer for MetLife. “This initial transaction provides us the opportunity to demonstrate the strength of our investment capabilities in private equity and venture capital and provide this offering to unaffiliated institutional investors, while also adjusting MetLife’s alternatives exposure.”

The portfolio of assets acquired by the fund consists of nearly 80 high quality private equity and venture capital fund investments diversified globally and across a range of sectors. The sale follows strong returns for the MetLife general account’s private equity portfolio, which held $14.0 billion in private equity assets at the end of 2021.

MIM’s private equity team consists of 12 professionals and has deployed nearly $18.0 billion of alternative investments on behalf of MetLife between 2007 and 2021. MIM had $669.0 billion in total assets under management as of December 31, 2021. Campbell Lutyens & Co. served as advisor to MetLife for this transaction.

S investors nationwide ages 45–75 from February 17 – February 28. 2022. The survey included 317 respondents with employer-provided defined contribution retirement plans.

Some 84% of respondents at 162 pension funds are at least moderately concerned inflation will erode their ability to reach their investment objectives, and 48% plan to increase the inflation sensitivity of their portfolio in 2022, according to an IPE.com report on a poll by investment consultancy bfinance.

Pension funds plan to hedge inflation by increasing exposure to infrastructure, private debt and real estate, the research found. Private debt (39%) and real estate (36%) were highly popular. Alternatives were a more popular inflation hedge than equities (18%) or inflation-linked bonds (12%).

“These asset allocation changes represent a continuation of longer-term shifts in favor of illiquid strategies and real assets,” said a bfinance spokesperson. “Investors’ concerns about inflation and rising rates are giving greater impetus to these trends.”

Only 8% of respondents plan to increase exposure to commodities as an inflation hedge. Only 9% of pension funds indicated they had increased exposure to commodities over the past 12 months. Half of the pension funds surveyed were from Europe, with the rest from North America, Asia Pacific and the Middle East & Africa.

Four in 10 pension funds said that Russia’s invasion of Ukraine and other recent geopolitical developments will or already have changed their ESG approach, either in-house or via changes made by their external asset manager partners.

Others said the conflict had not itself affected what they are doing, but it reinforced the need for a sophisticated ESG approach. “Emerging market country exposures, controversial weapons and fossil fuel firms are coming under particular scrutiny,” bfinance’s Kathryn Saklatvala said.

A Dutch pension fund told bfinance that the war in Ukraine caused it to rethink its weapons exclusion list, saying: “We will also place more scrutiny on role of state-owned companies and companies that otherwise act as extensions of the state, where the state was blacklisted under our ESG policy, even though Russia wasn’t blacklisted under our criteria prior to the invasion.”

Eagle Life Insurance Co., a subsidiary of American Equity Investment Life, has announced enhancements to Select Focus Series and Eagle Select Income Focus fixed index annuities.

Those products will gain two new index options and a Performance Rate Rider, adding to existing index options: the S&P 500 Index and the S&P 500 Dividend Aristocrats Daily Risk Control 5% Excess Return Index. The new options are:

Franklin Global Trends Index. This multi-asset index adds a global option to the Eagle Life portfolio. Comprised of both national and global asset classes, it “dynamically allocates across 10 global asset classes,” including equities, fixed income and alternatives.

Invesco Dynamic Growth Index. This index combines US equities and bonds, matching allocation strategies to one of four economic cycles — recovery, expansion, slowdown or contraction. It addresses risk by monitoring market performance and making intra-day allocation adjustments as needed.

Performance Rate Rider. This optional rider allows contract owners to increase participation rates on the annuity’s crediting strategy, which could potentially boost the amount of interest credited to it. The cost for applying the PRR to selected crediting strategies will not change for the length of the annuity’s surrender charge period.

Micruity Inc., has appointed Elizabeth Heffernan as Head of Partnerships and Consulting Strategy. A long-time Fidelity executive, she will “work closely with Micruity platform partners to optimize their product design for the data-connectivity of the Micruity annuity ecosystem,” according to a release this week.

Heffernan spent 24 years at Fidelity Investments in a variety of roles including marketing, sales and product, most recently working Investment Strategies. She also spent two years as the Managing Director of Business Development with Hueler Companies.

Elizabeth has spent the last 14 years working closely with asset managers and insurers on the design and connectivity of income products to the record keeping system, including significant work with Plan Sponsors and Participants to understand their goals and objectives in the Retirement Income space.

Elizabeth Heffernan is an active member of the Defined Contribution Institutional Investment Association (DCIIA) and is currently serving as Chair of the Retirement Income committee.

The Micruity Advanced Routing System (MARS) facilitates frictionless data sharing between insurers, asset managers, and record keepers through a single point of service that lowers the administrative burden for plan sponsors and enables them to turn retirement savings plans into retirement income plans at scale.

© 2022 RIJ Publishing LLC.

Publicly traded US life/annuity insurance companies saw a strong recovery in 2021, with net income more than tripling to $32.5 billion in 2021 from the previous year, driven largely by a 13% boost in revenue, according to a new AM Best report.

The industry saw a $35 billion increase in revenue to $297.5 billion in 2021, coming on the back of a modest increase in premiums, as well as increases in net investment income and realized gains, according to the report.

Companies continue to perform relatively well despite volatility in mortality from COVID-19 and still consider COVID-19 mortality as having an earnings impact rather than a balance sheet impact, suggesting no significant changes to reserves. Most carriers continue to experience higher mortality rates than usual; in 2021, mortality was higher for working-age populations, which affected individual and group life claims.

Other report highlights include:

Net investment income rose by roughly $11.9 billion to $85.7 billion. The persistent drag from the low interest rate environment continues to impact margins, but ongoing growth in general account invested assets, aided by premium growth and assets under management, has pushed investment income higher.

Of the 17 publicly traded companies in the analysis, 13 experienced a decline in capital, amounting to an overall 5% decrease. Share buybacks, which were halted during the pandemic, resumed in 2021; the return of share repurchases, as well as a modest increase in dividends paid, contributed to the decline in capital.

Total debt among publicly traded life/annuity insurers remained essentially flat in 2021 at $85.7 billion. Most of the companies that have been able to take advantage of the low interest rate environment and issue long-term debt have already done so, either to fund business growth or for upcoming maturities.

Investors continue to shift to indexed products from fixed-rate ones to seek protection from rising inflation. Traditional variable annuities experienced very strong growth, bolstered by favorable equity markets—while registered indexed-linked annuities continued the rapid growth of prior years.

© 2022 RIJ Publishing LLC.

The SECURE Act (the “Act”) made two major changes to the required minimum distribution rules under Internal Revenue Code (“Code”) Section 401(a)(9):

1. It extended the required beginning date for distributions from age 70-1/2 to age 72, other than distributions from tax-qualified plans which can be deferred until retirement except in the case of 5% owners, and

2. Except for a limited category of beneficiaries, it substantially reduced the period over which post-death distributions can be made, the latter element of which is sometimes referred to as eliminating the stretch IRA.

The IRS recently issued proposed regulations implementing these statutory changes, which apply to tax-qualified retirement plans, 403(b) plans, IRAs, and eligible deferred compensation plans under Code Section 457.

Compliance with the proposed regulations constitutes a reasonable, good faith interpretation of the amendments made by the SECURE Act. The proposed regulations would apply for purposes of determining required minimum distributions for calendar years beginning on or after January 1, 2022. For a 2021 calendar year distribution paid in 2022, taxpayers must apply the existing Code Section 401(a)(9) regulations.

The proposed regulations address the effective date for both of the SECURE Act statutory modifications. With respect to the new required beginning date of age 72, the SECURE Act provided that this change applied to individuals who attain age 72 on or after January 1, 2020. The statutory language could have been read as providing that if the individual died prior to January 1, 2020 and before attaining age 70-1/2, then the existing rule would apply. However, IRS took the position that the new rule should apply to any individual who would have attained age 72 on or after January 1, 2022 had he or she survived, which includes those born on or after July 1, 1949.

With respect to the new distribution rules, the relevant date for determining which set of regulations should apply to a trust providing for multiple beneficiaries depends upon the date of death of the oldest beneficiary.

As amended, Code Section 401(a)(9) retains the existing distribution periods for five (5) categories of beneficiaries, referred to as “eligible designated beneficiaries” or “EDBs”—surviving spouses, minor children of the individual, disabled persons, chronically ill persons, and beneficiaries who are not more than 10 years younger than the individual. With respect to this latter requirement, the proposed regulations take the position that there must actually be a 10-year age difference between the participant and the beneficiary. These EDBs can continue to receive payments based on life expectancy payments and are not required to receive the balance after 10 years.

For designated beneficiaries who are not eligible designated beneficiaries, all distributions must be completed by the end of the tenth year following the date of the death of the plan participant or the owner of an IRA. If the individual had already begun receiving payments, payments must continue to the designated beneficiary based on the designated beneficiary’s life expectancy, but if the individual had not already begun receiving payments, i.e., the individual died before his required beginning date, the designated beneficiary can defer all distributions until the end of the tenth year following the date of death of the plan participant or the owner of an IRA.

From the perspective of a defined contribution plan sponsor, the proposed regulations provide that, if the employee has an eligible designated beneficiary, the plan may provide either that the life expectancy rule applies or the 10-year rule applies. Alternatively, the plan may provide the employee or EDB with an election between the 10-year rule and the life expectancy rule. However, if the defined contribution plan does not include either of these options, the default option is the life expectancy rule. As a result, it is first necessary to determine which individuals qualify as eligible designated beneficiaries, and the proposed regulations provided this additional guidance:

1. Children. For defined contribution plans, the age of majority for a child is age 21, the age of majority in most jurisdictions (a few jurisdictions have younger ages, but none have older ages). However, defined benefit plans that were applying the definition of age of majority in the existing regulations may continue to do so. The proposed regulations do not define “child,” but as the SECURE Act commentary indicates that the intention was to limit it and certainly to exclude grandchildren, it appears that “child” means biological or adopted children of the participant.

2. Disability. With respect to disability, if the beneficiary is under the age of 18, the definition of disability is modified to be a “medically determinable physical or mental impairment that results in marked and severe functional limits, and can be expected to result in death or be of long-continued and indefinite duration.” A determination of Social Security disability is a safe harbor.

a. Date of Determination. The date of disability is determined as of the employee’s death. As a result, if the beneficiary is a minor child and the child becomes disabled after the date of the employee’s death, the child will cease to be an eligible designated beneficiary when the child attains age 21.

b. Documentation. The documentation requirements for disabled and chronically ill individuals, including the required certifications by licensed health care practitioners, must be provided by October 31 of the calendar year following the calendar year of the employee’s death.

3. Multiple Beneficiaries. Naming more than one designated beneficiary can be especially problematic. If just one of the group is not an eligible designated beneficiary, that preferred status is lost for the entire group. All must be eligible designated beneficiaries, or all must be treated as designated beneficiaries. There are two exceptions to this general rule. An eligible designed beneficiary who is appointed with one or more others who are simply designated beneficiaries may extend distributions over his or her life expectancy if:

a. The eligible designated beneficiary is a child. If the beneficiary is the child of the employee and had not reached the age of majority (age 21) at the time of the employee’s death, then that child will be treated as an eligible designated beneficiary.

b. The eligible designated beneficiary is such because he or she is disabled or chronically ill and is entitled to lifetime benefits in a multi-beneficiary trust which will not pay benefits to others prior to that individual’s death.

Separate accounting rules are applied to the individual interests of the beneficiaries in trusts with multiple beneficiaries.

A variety of issues arise in determining whether an individual is an eligible designated beneficiary, particularly where the nominal beneficiary is a trust. Without special “see-through” trust provisions, a retirement asset with a trust as beneficiary may need to be distributed by the end of the 5th year following the year the participant dies. The proposed regulations provide numerous examples, and the preamble to the proposed regulations discusses this issue in detail. We encourage all individuals to seek competent tax counsel for their unique situations.

As with most IRS regulations, the regulation package is lengthy – 275 pages. A great deal of guidance is presented in the preamble and the proposed regulations, which is relevant from both an employee benefit perspective and an estate planning perspective. This client alert is the first in a series of client alerts that will discuss different aspects of the proposed regulations.

© 2022 Wagner Law Group.

Inflation is the obsession du jour, so on Tuesday I spent my lunch hour listening to economists discuss the “I” word in a live panel discussion broadcast on Twitter. Their main concern: That the Fed’s response to inflation might cause a recession.

The Bipartisan Policy Center (BPC) in Washington sponsored the one-hour colloquy. Its expert guests included Justin Wolfers, an economist at the University of Michigan, Diane Swonk, chief economist at Grant Thornton, and Xan Fishman, director of Energy Policy and Carbon Management at the BPC. Shai Akabas, the BPC’s Director of Economic Policy, moderated.

The broadcast coincided with this week’s release of the March 2022 Consumer Price Index (CPI) report. As you’ve probably read, the annualized “headline” inflation rate, which includes groceries and gasoline, was a fairly shocking 8.5%, with a 1.2% rise in March alone.

The “core” inflation rate, which excludes the cost of food and energy prices, was 6.5% year over year. It rose a mere 30 basis points in March. The near 50% increase in gasoline prices over the past year, and its effect on the cost of transporting food, presumably accounted for at least part the 2% gap between the headline and core inflation rates. But let’s not presume.

Irony is the currency of journalism, and the BPC’s Akabas initiated the conversation by invoking one. The general public appears to have interpreted the steady tattoo of news about inflation as an indicator that the US economy is sick, he has noticed. “Inflation is on everyone’s mind. People think the economy must be losing jobs, and that things must be bad overall,” he said.

But they’re getting it backwards, he added. Higher inflation is symptomatic of a strong economy—as measured by today’s low unemployment rates. People are working and spending. Job openings are going unfilled because so many people have jobs. The economy, therefore, is so good that it’s bad. To make it better, we must make it worse.

The experts discussed possible causes of the high inflation rate, and tried to weight them. Among the culprits:

Neither economist suggested any danger of “runaway” inflation. Neither invoked high government spending, high budget deficits or high long-term federal debt as possible sources of inflation. All of those factors were true during the Great Moderation, when headline inflation was regarded as sublimely low.

So what should the Fed do? No one seems to recommend Milton Friedman’s advice anymore, which was to reduce the money supply; it’s almost impossible to measure the “money supply.”

“The right answer is for the Fed to move closer to a ‘neutral’ interest rate, but that’s still some distance from where we are,” said Wolfers. [The neutral rate is the mythical Goldilocks rate at which the economy is neither shrinking or growing.] “Right now, the Fed is raising the nominal rate just to keep up with inflation. It’s not tightening, it’s just becoming less expansionary.”

As for the likelihood of a recession, Wolfers was less pessimistic than Swonk. “I’ve been surprised by the frequency of the use of the word ‘recession’ lately,” he said. “It puzzles the heck out of me. We’re creating 400,000 jobs a month. The economy is going gangbusters. So I don’t know where the recession talk is coming from.”

But Swonk worries that aggressive anti-inflation tactics by the Fed could tip the US economy from too hot to too cold by early 2023—especially if the Fed simultaneously raises the Fed Funds Rate and sells a bunch of the mortgage back securities (MBS) that it bought during past crises as a way to put a floor under falling bond prices. That purchasing process was known as quantitative easing; its reverse is called quantitative tightening. (Selling the MBS will increase their supply, putting downward pressure on their prices and, ipso facto, upward pressure on their yields.)

“The Fed would like to get the Fed funds rate to 2%,” said Swonk. (The Fed funds rate is the rate that banks pay to borrow reserves from each other. It was 2.43% in April 2019, after having been close to zero from December 2008 to December 2015.)

“But then there’s the economic quagmire of the Fed’s balance sheet.” She noted that quantitative tightening—a term-of-art for the sale of financial assets that are on the Fed’s balance sheet—“can amplify the effects of rate hikes in ways not necessarily well known. I’m afraid that the monetary policy could cause a recession or even a contraction in growth by the end of this year.”

No one mentioned the potential impact of rising interest rates on the stock market. Rising rates trigger instant mark-downs in the market prices of bonds. But the effect on stocks isn’t as direct. The stock market seems more like a JENGA tower: after an indeterminable series of quarter-point rate hikes, it will collapse. Nor did they mention that higher rates could make investments in new bonds more attractive for savers (and insurance companies).

During the past 20 years, neither Fed chairs Alan Greenspan, Ben Bernanke, Janet Yellen or Jay Powell figured out a way to raise interests rates from zero back to neutral without triggering some kind of economic calamity. Some fresh thinking may be required. Raising interest rates, driving down asset prices, and sparking layoffs can’t be the best way to neutralize a petroleum-driven inflation.

Note: My understanding is that the Fed doesn’t exactly “raise” rates. Instead, the Federal Open Market Committee, through its purchases and sales of bonds, reduces its “accommodation” of the banks’ demand for reserves–which banks need in order to cover the checks written by their customers. Banks then have to compete a little harder for Fed Funds, which they accomplish by bidding up the Fed Funds Rate.

Accommodation can become too much of a good thing. “Current US monetary policy is set at peak accommodation, which is putting upward pressure on inflation,” said St. Louis Fed President Jim Bullard in a recent statement. In his opinion, “This situation calls for rapid withdrawal of policy accommodation in order to preserve the best chance for a long and durable expansion.”

© 2022 RIJ Publishing LLC. All rights reserved.

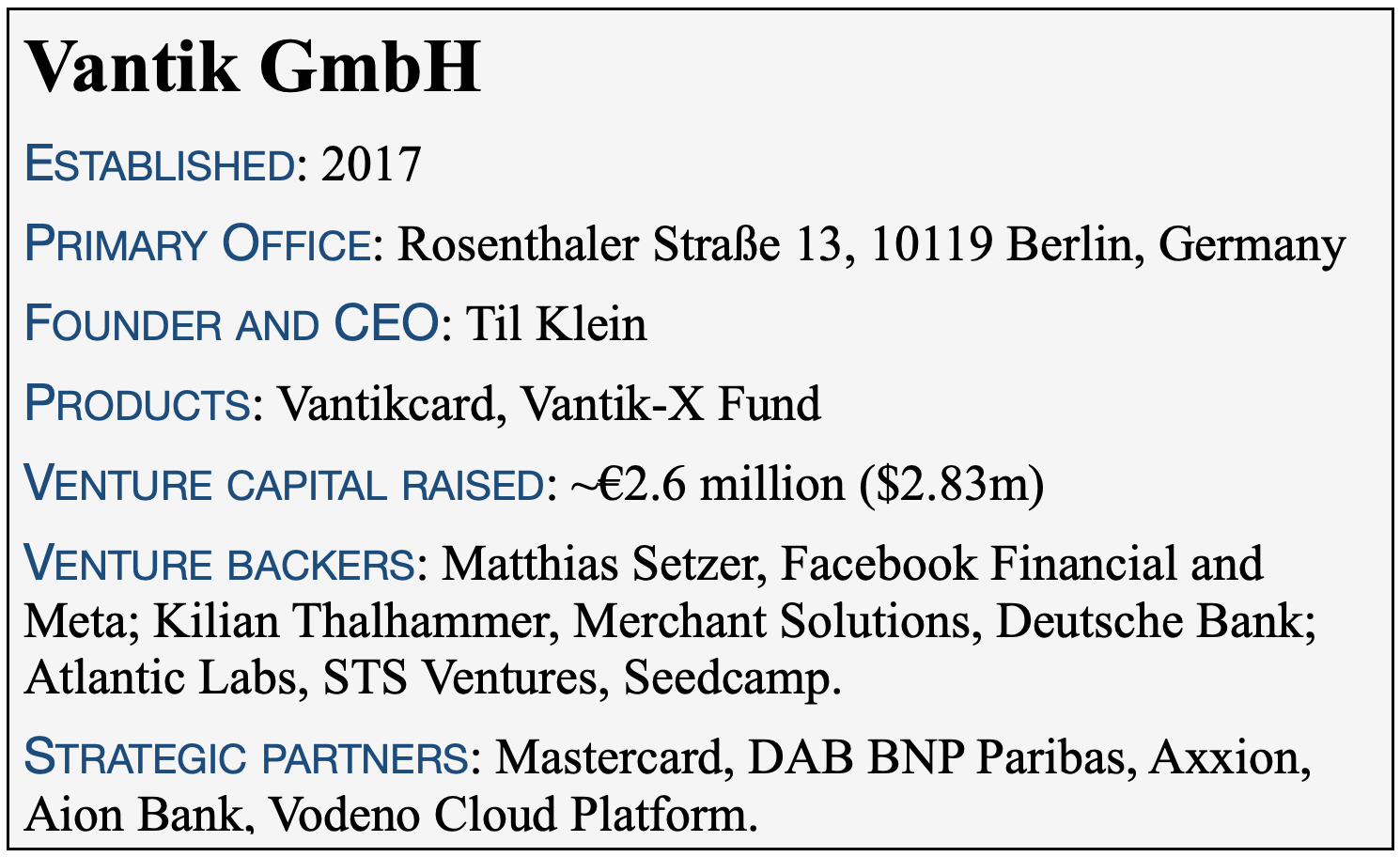

A Berlin-based “pensiontech” firm and its venture-cap backers are betting that European Millennials will like the idea of saving sustainably for retirement whenever they use their Mastercard debit cards to buy lattes, burgers, or sneakers.

The company, Vantik, issues the Vantikcard (a white-label Mastercard debit card). It promises to invest 1% of the value of all Vantikcard purchases into the Vantik X fund—a fund of ESG (environmental, social, and governance) exchange-traded funds (ETFs).

The fund-of-funds was launched in December 2018, by Til Klein, a 30-something German with a resume that includes Boston Consulting Group and UBS wealth management. Vantik issued its first private-label Mastercard debit card in April 2021. (Before launching the card, Vantik pursued retail ETF investors in other ways.) As of last Friday, the Vantik-X fund had about €5.4 million ($5.88m) under management and an NAV of €6.29 ($6.85)—up 26% from its €5 ($5.45) opening price.

“Our goal is to radically simplify old-age provision,” says the Vantik literature. “Nowadays nobody needs long contract terms for complicated old-age provision products that are not worth it in the end anyway. With the Vantikcard we enable you to start your retirement provision. So that you can easily save a small part for your pension while paying.”

Vantik integrates several au courant technologies—smartphones, ESG investing, Application Programming Interfaces between banks and phones, Apple Pay and Google Pay, cash-back rewards—to capture the hearts and wallets of young Europeans at a time when EU regulators and corporations dither over defined contribution pension reform.

Not coincidentally, Klein is a member of the expert council on European pensions at EIOPA, the European insurance supervisory authority. He was one of the panelists in a recent webinar kicking off the Pan European Pension Product, or PEPP. According to Klein, Vantik has begun the process of obtaining a permit to offer a PEPP. For a recent RIJ article on PEPPs, click here.

Kickstarter

Before you click to your calculator to prove that people can’t spend their way to adequate savings at a rate of 100:1, give Klein credit for finding a way to tease European Millennials into linking their bank accounts to his Vantik X fund—and by making the relationship sticky.

Vantikcard users can’t liquidate the Vantik X fund shares that they buy with their cash back rewards until age 55 or later, when they retire. If they cancel the card, they forfeit the shares that the company bought for them with their rewards.

But the rewards are just a “kickstarter.” Once Vantikcard holders have begun buying Vantik-X shares with their cash back rewards, they will be encouraged to supplement their rewards-based shares with regular transfers from checking accounts at any German bank to the Vantik fund. Their own investments are fully liquid.

It’s all about behavioral finance. “The idea with Vantikcard is to use the 1% cashback as a kickstart into retirement savings and for customers to then save on top of the cashback. The biggest problem for many people is to get started. The Vantikcard helps with that,” a person with knowledge of the company told RIJ.

Klein told GQ magazine last December, “It’s not about supplementing your pension with the cash-back alone. The aim is to create a low-threshold entry opportunity. We want to take the fear out of old-age provision and finally break the vicious circle of constant procrastination.”

Somewhere down the road, annuities could enter the picture. At age 55, Vantik X shareholders can sell their shares and take a lump sum or buy an annuity that pays out a regular lifetime income, according to press reports. In the meantime, they pay an all-in annual expense ratio of 0.95%. That covers fund management, transfers, trading, etc. (The card itself is free and has no annual fee.)

Somewhere down the road, annuities could enter the picture. At age 55, Vantik X shareholders can sell their shares and take a lump sum or buy an annuity that pays out a regular lifetime income, according to press reports. In the meantime, they pay an all-in annual expense ratio of 0.95%. That covers fund management, transfers, trading, etc. (The card itself is free and has no annual fee.)

There’s a “safety buffer”—though not a guarantee— designed to prevent loss of principal over the long run. According to one press report, “one percent of the funds collected from investors flows into a Vantik security buffer. The aim of the buffer is that at the beginning of retirement the investor has at least the amount that he has paid in… the safety buffer is managed by an independent foundation and compensates for a possible loss of capital at the beginning of retirement.”

Roundup time

Klein isn’t the first fintech entrepreneur to build a smartphone app that aims to make automated micro-investing easy for debit card-using young adults. In the US, the Acorns app gets people started investing by “rounding up” their purchases and buying ETFs with the difference. Betterment Visa debt card holders get various cashback rewards on purchases from select retailers. In Germany, there’s the Vivid Prime. It costs €9.9 per month and offers 1% cashback (up to €150) on all purchases, plus access to exclusive retailer discounts.

Vantik recently announced its own round-up feature. “So if you buy a coffee for 2.60 euros, you can automatically round up 0.40 euros and save for retirement. You’ll also be able to set your own savings rules so you can save at your own pace. One such rule could be that you pay five euros into the pension plan every time you’ve eaten burgers again,” Klein said in the GQ interview. The daily spending limit, assigned to each cardholder by Aion, Vantik’s bank, is between €400 ($435) and €1,250 ($1,358). Cardholders can earn cashback up to €100 ($109) each month.

Vantik’s approach may sound gimmicky—and far from proven—to someone at a hundred-year-old brick-and-mortar life insurance company. As a perk, for instance, Vantik invites members to personalize their plastic cards with special “artist, social media names and gamer tags.” But it’s a gimmick that seems to resonate with those who’ve grown up with iPhones in their hip pockets and buds in their ears. Two-thirds of his cardholders personalize their plastic cards, Klein said.

“This is exactly what we need for old-age provision: an easy-to-understand, low-threshold and motivating introduction,” he told GQ. “My tip: Don’t ask an expert, don’t read any books, don’t research on the internet, don’t try to calculate a pension gap. Just start first. The most important thing is to take the first step.”

© 2022 RIJ Publishing LLC. All rights reserved.

Due to an arcane mismatch in rules, you might inadvertently pay too much tax on distributions from your retirement accounts. Most states follow the federal rules so this may be a problem in only a few states. In those few, however, the mismatch could inadvertently result in you erroneously paying significant additional state income taxes. Massachusetts is an outlier, along with Pennsylvania and New Jersey.

Your state might not permit a 401k/IRA deduction

Withdrawals from retirement accounts are taxable for both federal and state purposes to the extent they are determined to consist of contributions that were not previously subject to tax. This makes sense. If you received a deduction for a contribution, such as to an IRA, or were not taxed on a contribution, such as to a 401(k) plan, the contribution, along with tax-deferred earnings on that contribution, become taxable when they are distributed. On the other hand, if you make a non-deductible contribution to an IRA you have a “basis” in that contribution and need not be taxed when that basis is returned to you.

Most states follow the federal income tax rules so the return of basis is the same for purposes of determining your federal income tax and state income tax. Massachusetts, Pennsylvania and New Jersey are the contrarians. In those states, any contribution that was not tax deductible when it was made should be withdrawn as a “return of basis” and not taxed. If you are not aware of this, you might report a distribution in the same amount on both your federal and state income tax returns. This would result in your paying tax twice: once when you made the contribution, and again when you withdraw it.

The Massachusetts mismatch

Since Massachusetts does not allow a deduction for amounts originally contributed to an IRA, the distributions are not taxable until the full amount of your contributions which were previously subject to Massachusetts taxes are recovered.

As an example, assume that in 2010 you made a $5,000 contribution to your IRA. If you met the income limitations for a deductible IRA for that year, you could have deducted the contribution on your federal income tax return. If you lived in Massachusetts, however, you could not have deducted the contribution on your state income tax return.

Assume that in 2021, the account has grown to $8,000 and you withdraw the entire account value. For federal tax purposes, you have no basis in the account because none of it has been previously taxed. You should add the entire $8,000 as ordinary income to your federal income tax return ($8,000 gross ordinary income equals $5,000 contribution that was previously deducted plus $3,000 gain that was tax deferred while accumulating in the IRA). For your Massachusetts return, you have already been taxed on the $5,000 contribution but the $3,000 gain has not yet been included in income. You therefore should add only $3,000 as ordinary income to your Massachusetts return ($8,000 less $5,000 return of basis equals $3,000 gross ordinary income).

Avoid overpaying state income tax

Taxpayers who are unaware of this disparate treatment may pay too much state income tax. It is critical, therefore, to know your state’s rules, or work with a competent tax adviser who does. It is also important to keep clear records of your non-deductible contributions throughout the years.

Nondeductible IRA contributions are recorded each year via IRS Form 8606. That form is also used to report distributions from traditional, SEP or SIMPLE IRAs (if you have a basis in them), as well as conversions to or distributions from Roth IRAs. These forms are important to have on hand as you prepare your returns for years in which you receive distributions. But Form 8606 does not report amounts that are not deductible in your state.

For added protection, we suggest that you also maintain a spreadsheet that records all of your IRA contributions, deductions claimed for contributions (state and federal), all distributions from those accounts, and related dates.

State rules vary significantly

Currently, eight states—Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming—have no state income tax at all. If you are lucky enough to live in one of those states, mismatched basis is not an issue for you. Some states have income taxes but exclude distributions from employer-based plans and IRAs. Others exempt distributions but impose age or other limitations. Still others may pro-rate distributions so that each payment is partially taxable and partially a return of basis. As the example above illustrates, Massachusetts is among those that permit previously taxed contributions to be returned tax-free first.

Further complications arise when you move. If you lived in a state that follows the federal rules when you made a distribution but lived in a state where you could not deduct your contribution when it was made, the second state may or may not have a mechanism by which your basis can be recognized and be reduced from taxable income. Massachusetts considers the contribution to be a return of basis only if it was previously taxed by Massachusetts.

Vigilant taxpayers must become well-informed to navigate these complex rules. Once again, adequate records and professional advice are key to your success.

© 2022 Wagner Law Group.

In a deal announced last September 15, Prudential Financial, Inc., has completed the sale of $31 billion of in-force variable annuity account values to Fortitude Re, a subsidiary of Bermuda-based Fortitude Group Holdings LLC.

The block of assets and liabilities consisted mainly of non-New York traditional variable annuities (VA) with guaranteed living benefits that were issued by Prudential Annuities Life Assurance Corporation prior to 2011, according to a Prudential release.

For several years before and after the 2008 financial crisis, Prudential was a leading seller of variable annuities that carried several types of guarantee that contract owners would receive an income for life, without ever giving up access to their money, even if their own principal was depleted by withdrawals, market volatility, or fees, as long as they agreed to keep their annual withdrawals within certain limits.

As a result of regulation and low interest rates, as well as uncertainty over when or how contract owners might use the benefit—or not use it all—the guarantee became expensive for Prudential to maintain. Other life/annuity companies have been in the same predicament; one solution has been to cut losses and sell the in-force blocks of VA contracts to reinsurers.

Reinsurers based in Bermuda and owned or affiliated with “private equity” or “alternative asset” managers are perhaps the most avid buyers of such blocks. AIG sold its reinsurance division to The Carlyle Group and other investors, who renamed it Fortitude Re, which is based in Bermuda.

RIJ has published a series of articles about this phenomenon, describing it as the “Bermuda Triangle strategy.”

Prudential will continue to service and administer all contracts in the block following the transaction. Prudential also will continue to sell protected outcome annuity solutions through other existing subsidiaries.

“This transaction is another key step in our journey to become a higher growth, less market sensitive and more nimble company,” said Prudential executive vice president and head of US Businesses Andy Sullivan. He said Prudential will focus on selling more of its “protected outcome solutions, like FlexGuard and FlexGuard Income.” Those products are less risky and therefore less capital-intensive for Prudential than VAs with guaranteed lifetime withdrawal benefits (GLWBs).

Debevoise & Plimpton LLP served as legal counsel to Fortitude Re. Sidley Austin LLP served as legal counsel to Prudential, and Goldman Sachs & Co. LLC served as exclusive financial advisor.

Prudential Financial, Inc., is a financial services company and global investment manager with more than $1.5 trillion in assets under management as of Dec. 31, 2021. It has operations in the United States, Asia, Europe, and Latin America.

The Fortitude Re Group includes Bermuda’s largest multi-line composite reinsurer, with unique competitive advantages and expertise to design bespoke transactional solutions for legacy Life & Annuity and P&C lines.

Fortitude Re is backed by a consortium of investor groups led by The Carlyle Group and T&D Insurance Group of Japan. Fortitude Re holds approximately $48 billion in invested assets as of Dec. 31, 2021.

© 2022 RIJ Publishing LLC. All rights reserve.

Dieting to lose weight can be a hassle, especially late in life, when, as Fats Waller sang, we don’t get around much anymore.

Spending at a “safe” annual rate in retirement is a type of dieting. But instead of kale salads, you consume dividends, interest, capital gains, Social Security benefits, pensions, annuity income or principal.

We tend to avoid income planning and dieting. Nonetheless, choosing a prudent withdrawal rate—not just in Year One of retirement but in every year thereafter—is important, especially for those who hope to tease a stable income from a vacillating portfolio.

Four percent used to be the default withdrawal rate from a 60:40 portfolio. But after a 40-year bull market in stocks and bonds, gurus like Wade Pfau warn that fallow seasons lie ahead. They advise retirees to trim that 4% rate by 10% (to 3.6%) or even 20% (to 3.2%) if they want their money to last 30 years.

In the latest edition of Morningstar’s quarterly magazine, investing experts Christine Benz, Jeffrey Plak and John Rekenthaler compare the hypothetical outcomes of different “safe withdrawal” methods, assuming a $1 million 50/50 portfolio, a start age of 65, and a 90% chance of not zeroing out before age 95.

The four methods are:

Withdrawing four percent the first year and then adding annual upward inflation adjustments when necessary, except in years when your investments are down.

Using the Required Minimum Distribution (RMD) method, which gradually raises the annual withdrawal rate as life expectancy shrinks.

The “guardrails” strategy that smoothes income by spending only moderately more in good years only moderately less in down years.

A 10% spending reduction after a losing year.

For additional perspective, they compared these methods with a “control” method of 4% plus inflation adjustments every year.

Each method revealed certain strengths and weaknesses in the face of identical hypothetical market conditions. The more annual income they permitted, the lower the portfolio’s value at the end of 30 years. Predictably, their specific rules resulted in smoother or choppier spending patterns over the years.

For Method One, where the retiree skipped inflation adjustments to a 4% withdrawal during down performance years, the average lifetime portfolio withdrawal rate was 3.45%, the standard deviation of cash flow was a mere 5%, and the retirees ended up with more money ($1.33 million) than they had at retirement.

Method Two, the RMD method, is designed to exhaust tax-deferred portfolios before death, produced a high average annual income (4.6%) but with a whopping cash-flow standard deviation of 49% and an ending balance of just $130,000.

Method Three, the “guardrails” method championed by Jonathan Guyton and William Klinger, offered a compromise between the two previous methods. It delivered a 4.07% average annual income, a standard deviation of 30% and an average ending value after 30 years of $740,000.

Method Four, which involved a 10% austerity haircut in losing years, resembled method one in its results. It produced an average annual income of 3.42%, a standard deviation of cash flow of only 8%, and a legacy value of $1.4 million.

In the real world, of course, there are a lot more variables than in a hypothetical world. Retirement security depends a lot on luck. You don’t know whether you’re retiring with the wind at your back or in your face. That’s especially true if you’re relying on risky investments to yield bread-on-the-table every night instead of covering all your basic expenses with a pension, Social Security, or an income annuity.

There are certain factors you can control. Retiring later means fewer years to finance. Claiming Social Security later allows you to qualify for higher monthly benefits for life, especially if you work and contribute to the program until age 70. Paying off your mortgage and other debts before retirement eases the pressure on your investments.

Safe withdrawal rates are hard to determine in part because no one knows how long he or she will live and need an income to live on. Annual adjustments to spending rates can also be labor-intensive. The uncertainty of such a plan can also create a lot of anxiety.

One alternative for someone with $1 million and a need for $40,000 a year in excess of Social Security would be to put $500,000 in a fixed-rate, 10-year annuity and the other half in a risky portfolio, and lean on withdrawals from the annuity when stocks don’t do well. That cushions you from market risk.

Or you could hedge your risk another way: Use $300,000 to buy a life annuity paying $18,000 a year for life (with 10 years certain) and draw another $22,000 (3.3%) from your remaining $700,000 investment portfolio. That cushions you from market risk and from longevity risk. Guaranteed annuities, appropriately customized and combined with invested assets, can buffer financial risks and let clients sleep more easily in retirement. Unless they are multi-millionaires, why should retirees expose all of their money to the mercy of the markets?

© 2022 RIJ Publishing LLC. All rights reserved.

Morningstar has published the first chapter of its biannual Global Investor Experience (GIE) report, which assesses the experiences of mutual fund investors in 26 markets across North America, Europe, Asia, and Africa. The report is now in its seventh edition.

The first chapter, “Fees and Expenses,” evaluates an investor’s ongoing cost to own mutual funds compared to investors across the globe. Morningstar assigns a grade of Top, Above Average, Average, Below Average, and Bottom to each market.

For the fourth study in a row, Australia, the Netherlands, and the United States earned Top grades as the most investor-friendly markets in terms of fees and expenses. They earned top grades due to their typically unbundled fund fees. Bottom grades went to Italy and Taiwan as markets with the highest fund fees and expenses.

“In many markets, fees are falling, driven by a combination of asset flows to cheaper funds and the repricing of existing investments,” said Grant Kennaway, head of manager selection at Morningstar and a co-author of the study.

“The increased prevalence of unbundled fund fees enables transparency and empowers investor success. However, the global fund industry structure perpetuates the use of upfront fees and the high prevalence of embedded ongoing commissions across 18 European and Asian markets can lead to a lack of clarity for investors. We believe this can create misaligned incentives that benefit distributors, notably banks, more than investors,” he said in a release.

More than six in 10 non-retirees (63%) said they fear running out of money more than death, but fewer than half (46%) of retired respondents feel that way, according to the new 2022 Retirement Risk Readiness Study from Allianz Life.

Americans who are still balancing careers, family and saving worry more about their financial future today than they did a year ago. This is most true for those 10 or more years from retiring.

About two-thirds (68%) of pre-retirees believe they can afford to finance their future goals, down from 75% a year ago. Nine-tenths (89%) of retired respondents are confident about funding their future financial goals.

Key findings of the survey:

· 63% of non-retirees fear running out of money more than death, versus 46% of retired respondents

· 68% of pre-retirees feel confident about being able to financially support their future goals, down from 75% in 2021

· 42% of retirees said they retired earlier than expected, down from 68% in 2021; fewer did so due to healthcare issues (26% down from 33% in 2021) or unexpected job loss (15% down from 22% in 2021)

· 54% of non-retirees admitted to spending too much money on non-necessities during the pandemic

Allianz Life conducted an online survey, the 2022 Retirement Risk Readiness Study, in February 2022 with a nationally representative sample of 1,000 individuals age 25+ in the contiguous US with an annual household income of $50k+ (single) / $75k+ (married/partnered) OR investable assets of $150k.

Capital Group, provider of the American Funds, and the Workplace Solutions group within Morningstar Investment Management LLC, a subsidiary of Morningstar, Inc., have announced a new target date service, Target Date Plus, with personalized allocation advice tailored to a retirement saver’s specific needs and objectives.

Employers can use the service as a qualified default investment alternative (QDIA). It blends the American Funds Target Date Retirement Series with Morningstar Investment Management’s experience delivering online investment advice through its user interfaces and network of integrated recordkeepers. Morningstar Investment Management serves 1.7 million managed accounts users.

“Target Date Plus underscores Capital Group’s efforts to provide more flexibility in how it distributes its investment services and is a natural evolution of the firm’s target date series. The service offers additional personalization by incorporating an individual’s age, salary, assets, savings rate, and company match rate,” according to a release this week.

“Morningstar Investment Management analyzes this information and provides the investor with a customized asset allocation and investment portfolio. Morningstar Investment Management can also inform the individual if and when they may benefit from allocating part of their savings to a guaranteed income annuity.”

Through its data network and integrations, Morningstar Investment Management obtains the necessary data points from recordkeepers to furnish and build out a personalized asset allocation and fund-level portfolio for each investor. That network also enables the service to return the investment recommendation to the recordkeeper to process and implement.

AM Best has removed from under review with positive implications and upgraded the Long-Term Issuer Credit Rating (Long-Term ICR) to “aa” (Superior) from “aa-” (Superior) and affirmed the Financial Strength Rating of A+ (Superior) of Prudential Retirement Insurance and Annuity Company (PRIAC), headquartered in Newark, NJ. The outlook assigned to the Credit Ratings (ratings) is stable.

The ratings reflect PRIAC’s balance sheet strength, which AM Best assesses as strongest, as well as its strong operating performance, very favorable business profile and appropriate enterprise risk management.