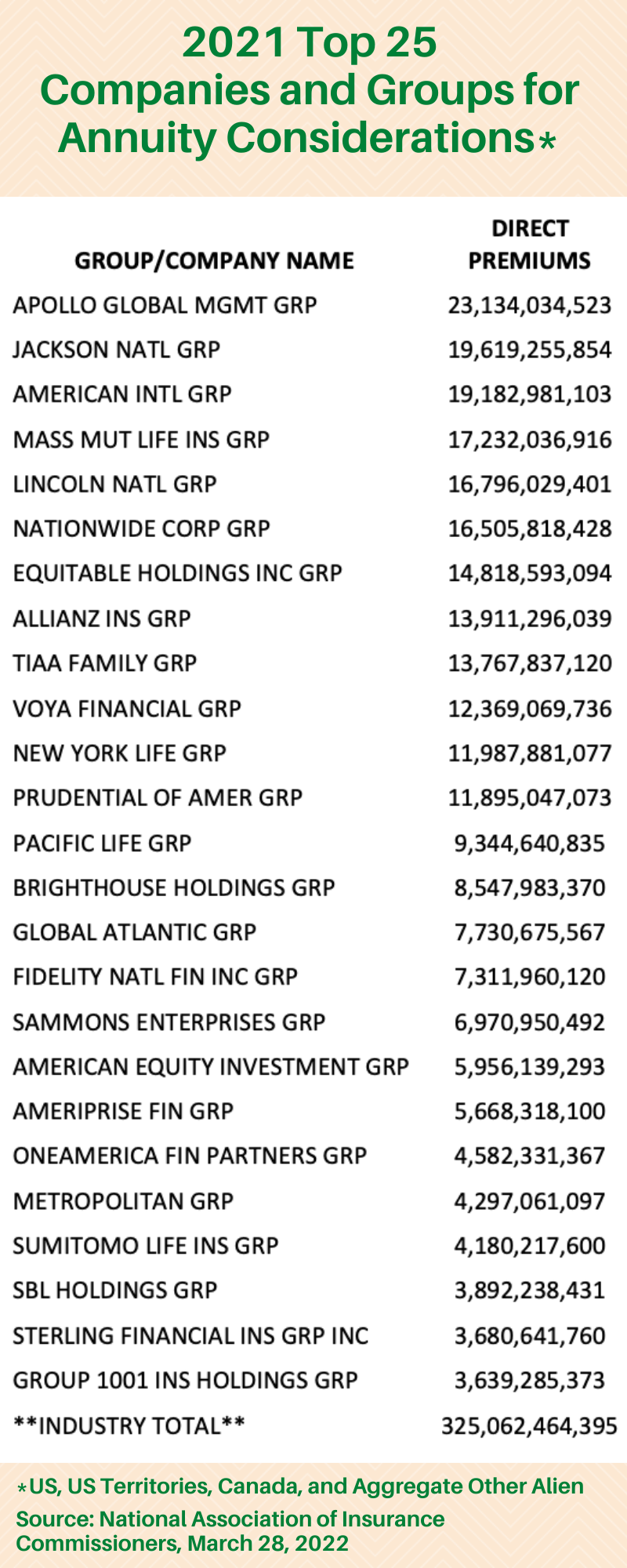

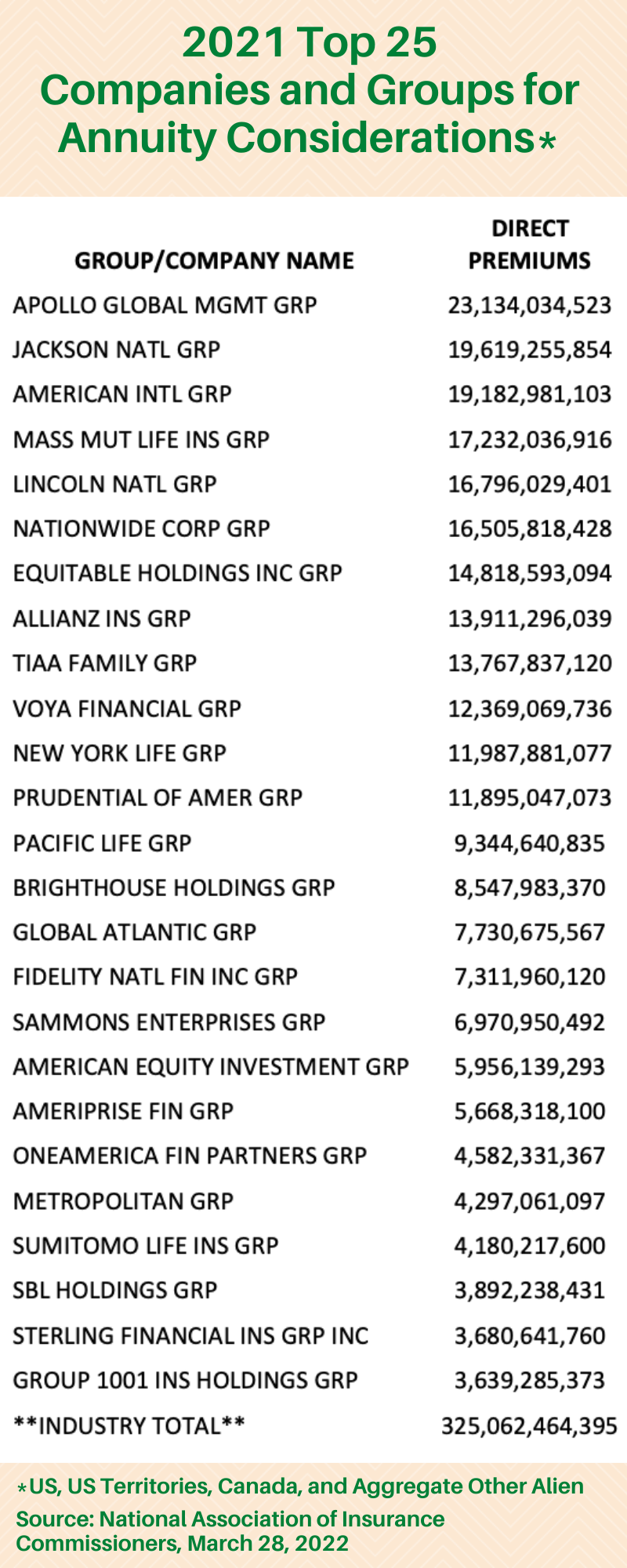

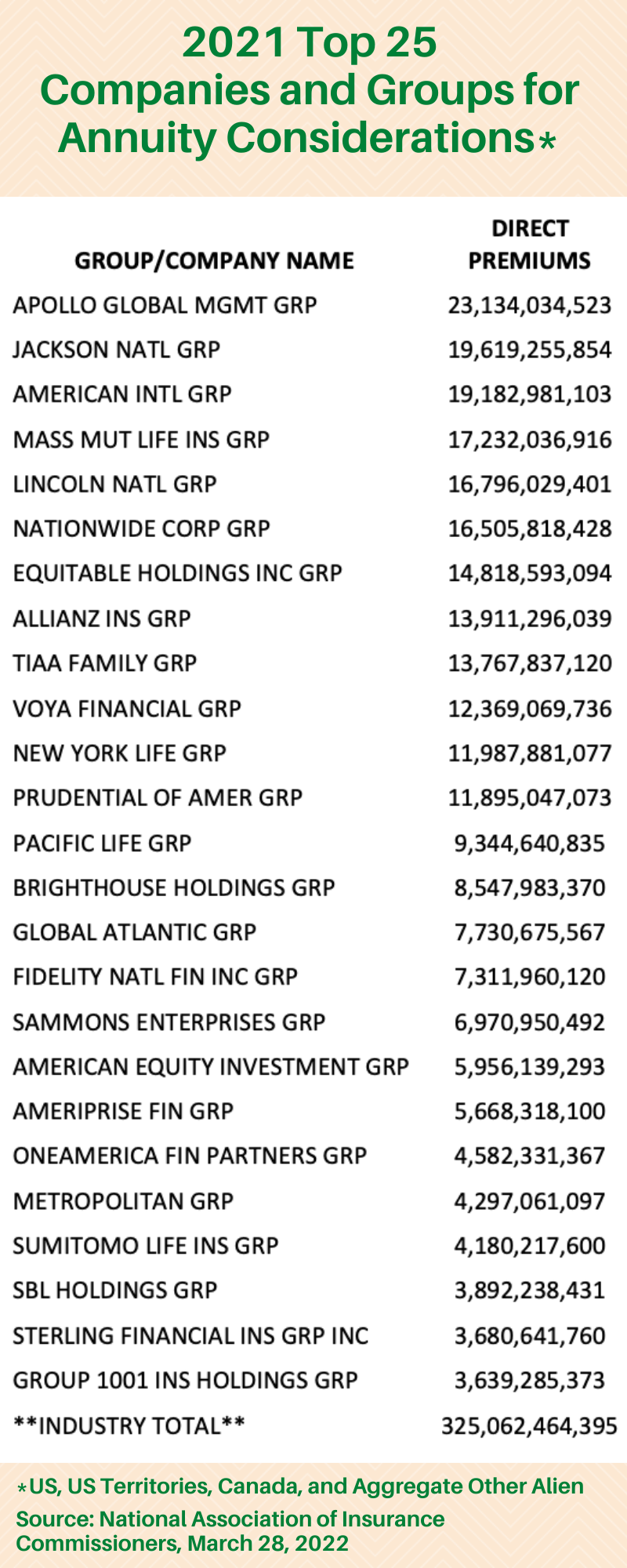

Top 25 Companies and Groups for Annuity Considerations, 2021

IssueM Articles

Cherry blossoms decorated the nation’s capital this week—pink flowers on a white birthday cake. Suppose, while admiring the florescent trees, I ran into a guy who never votes. The major political parties are like the Tweedle brothers, he says. It doesn’t matter who wakes up in the West Wing.

That’s not necessarily so, I’d say. I would suggest that we walk over to the Francis Perkins Building at 200 Connecticut Avenue NW, where the Department of Labor (DOL) lives.

A model of mid-1960s modernism, the steel-and-limestone Perkins Building has the charm of an IBM punch-card. It is named for the first woman cabinet member—appointed by Franklin Delano Roosevelt as Secretary of Labor in 1933. Perkins helped craft the New Deal.

The building also houses the Employee Benefit Security Administration, or EBSA. EBSA’s career attorneys write regulations that follow the laws that Congress passes. But EBSA’s chief is a political appointee, so his or her initiatives and rules tend to reflect the political predilections of the incumbent president and Labor Secretary.

That’s why any adviser who recommends rollovers to plan participants, or any asset manager that wants its unconventional funds placed as options in 401(k) plans, or any life insurer that favors annuities in defined contribution plans, should care who runs EBSA at any given time.

In the Trump administration, for instance, Labor Secretary Eugene Scalia and EBSA chief Preston Rutledge shelved the Obama Administration’s strict “fiduciary rule” and discouraged the use of ESG (Environmental, Social and Governance) funds in 401(k) plans. But they are gone, replaced by Biden’s team.

Ali Khawar

What policies is Biden’s EBSA likely to favor? It’s probably going to resemble Obama’s. We don’t know for sure, because EBSA is currently led by an acting Assistant Labor Secretary, Ali Khawar. (The Senate has not yet confirmed President Biden’s EBSA nominee, labor lawyer Lisa M. Gomez.)

Last week, Khawar, a veteran DOL attorney, was the featured speaker in a webinar hosted by the American Academy of Actuaries. To learn about EBSA’s current initiatives, we tuned in. Here are some of the themes Khawar touched on, followed by his comments:

Conflicts of interest

EBSA has a “Conflict of Interest” project. As we move from the defined benefit plan universe to a defined contribution and also an IRA universe, it’s important that people can trust and rely on the advice they receive. That’s even more important in a universe where they are responsible for making their own financial decisions.

Most Americans are not actuaries. They need advice on how much to save, how to invest, and how to take Social Security. We don’t have a system that equips individuals well enough to make these decisions on their own.

In spite of a lot of changes and efforts made over the years by DOL and others, it’s still the case that you may not be getting advice you can rely on. It depends largely on the product or the firm you’re dealing with. It’s important that there’s a level set of parameters across the board.

As a consumer, you shouldn’t have to figure out, ‘Which exemption [from a prohibited transaction] is the adviser I’m talking to using. Are they regulated by the NAIC? FINRA? Am I in a state that has adopted the fiduciary corollary rule?’ So we are focused on leveling the regulatory playing-field for the nation. We’re trying to bring more trust to the system, and we’re trying to address equity issues and get more people to participate. Some communities have lack of trust in financial services industry. That’s the Conflict of Interest project.

ESG investing

The issue of “Environmental, Social and Governance” or ESG investments is a long-running DOL focus. On President Biden’s first day in office, he asked the DOL to review the Trump administration’s actions on ESG. We had heard feedback on ESG from ERISA stakeholders. Their message was that the previous administration’s policy statements had a chilling effect, to the point where sponsors felt there was reason to exclude ESG investments.

We proposed an ESG rule last year. The comment period is closed and now we’re working on the final rule. We don’t think the DOL should say whether defined contribution plan sponsors should or shouldn’t take ESG into account when choosing investments. ESG is going to be financially material in some situations but not in others. We think the prior administration’s rules, which are still in effect, put a ‘thumb on the scale’ and took that decision-making power away from the plan sponsors. [That power] is critical to their analysis of risk and return; we expect them to take all of that into account. Our proposed rule is meant to straddle those concepts and to allow ESG investments but not to force them on anyone. That rule is a priority for us. We are currently digesting comments on that and hope to issue a final rule as soon as possible.

Prohibited Transaction Exemptions (PTEs) and Cryptocurrencies

We’re also accepting comments on prohibited transaction exemptions. We have proposed a way to look at processing applications for PTEs. We’re hoping to introduce some efficiency into the process, and hoping that people can give us more complete PTE applications.

As of March 10, we published Compliance Assistance Release 2022-01 on cryptocurrencies. We’ve been thinking about cryptocurrencies for months. We had received reports that certain retirement plan service providers were encouraging plan sponsors to make cryptocurrency investments directly available to their participants, so that they could buy Bitcoin or other cryptocurrencies through their plans. We found that concerning.

There are custodial, valuation, and financial literacy issues around offering cryptocurrencies to participants. What exactly are the messages that participants are getting? Do they see cryptocurrencies with their eyes fully open? Fiduciaries aren’t necessarily following these issues. On March 9, the president put out an executive order on cryptocurrencies. It asks a number of federal agencies, including DOL, to think about what a regulator framework for cryptocurrencies might look like. We think that the US must play a leadership role in establishing that framework and setting up a regulatory structure. We need to get the consumer protections right. As we’ve seen with other asset classes and innovations, they have been harmful for consumers and especially for diverse communities. The Biden administration is concerned about consumer protections in crypto. We believe 401k fiduciaries should be quite skeptical before they allow investments in cryptocurrencies and that they should exercise caution especially regarding direct investments in crypto.

Retirement income

We think it’s important to talk about lifetime income as lifetime income. Annuity is just one form of lifetime income. We don’t favor securities over insurance. We’re focused on making sure that plan participants have the income they need so that they don’t rely on public programs. There are a lot of different paths to achieve that goal.

Can we establish a national retirement policy for the whole country? I’m an optimist so I want to say yes. There have been conversations ever since ERISA was passed [in 1974] on how to ensure broader coverage. That conversation thread has never gone away. Today we’re having a conversation about Pooled Employer Plans.

In the past we had a similar conversation about SIMPLE IRAs. The question is the same: How do you get more employers into the system and how do you make it easy for them to set up a retirement plan? Everyone is coalescing around these important questions. To make that a reality, we’re having meetings like our meeting here today. That’s happening across the board. We especially want to pay attention to people who’ve been left out of the discussion in the past. The situation we’re in creates important conditions for needed improvements.

Investor education

Individuals need to make decisions about how much to save and whether they’re on track for secure retirement, and they have to know how to make their money last a lifetime. Most people don’t have those skills. So the question is, how to educate them about what it means to maximize the employer’s matching contribution, or what will be the impact of increasing contributions? How do we convey to young people the importance of saving early, and how to help the near-retiree think about retirement income. Disclosure is helpful to a point.

Then comes decumulation. At retirement, an element of choice paralysis can set in. Many people don’t know what to do with the money that they’ve accumulated. Taking a lump sum or a phased distribution from a defined contribution plan are common solutions. But we need to make other options more broadly available. Take-up of lifetime income solutions is low. The ‘fear element’ is a problem. Health also plays into it. In talking about retirement security, we tend to think in purely financial terms. But the amount of money that you will need in retirement depends in part on your personal health and on your level of health care spending. That makes the lifetime income issue especially interesting and challenging.

© 2022 RIJ Publishing LLC. All rights reserved.

Citizens of any of the 30 countries in the European Economic Area can work at jobs in any of the other member countries. As of last Tuesday, March 22, they can participate in equally border-agnostic retirement savings plans, called Pan European Personal Pensions, or PEPPs.

Not to be confused with the “Pooled Employer Plans” in the US, Europe’s PEPPs don’t require sponsorship or supervision by an employer, and don’t use an employer’s payroll system. Instead, each participant chooses a PEPP provider and contributes to their account on their own.

Banks, insurance companies, and asset managers can offer PEPPs. They must register their offerings with a central registry at the European Insurance and Occupational Pension Association (EIOPA), and agree to maximum 1% annual investment fees. Annuities may entail additional fees. Participants can switch providers, but only once every five years.

Europe’s retirement regulations are just now catching up with European labor trends. “In 2015, 11.3 million Union citizens of working age (20 to 64 years old) were residing in a Member State other than the Member State of their citizenship and 1.3 million Union citizens were working in a Member State other than their Member State of residence,” according to a July 2019 article in the Official Journal of the European Union. About 447 million people live in the EU.

“[EU] households are amongst the highest savers in the world, but the bulk of those savings are held in bank accounts with short maturities,” the Journal added. “More investment into capital markets can help meet the challenges posed by population aging and low interest rates.”

PEPPs can be offered by credit institutions, direct life insurance companies, institutions for occupational retirement provision (IORPs, which are authorized and supervised to provide also personal pension products), investment firms, asset managers, and EU alternative investment fund managers.

But there was a sign this week that insurance companies, for one industry category, may choose not to implement PEPPs. Hugh Prenn of the Capital Markets division of UNIQA Group, a major insurer in central and eastern Europe, who appeared in a webinar introducing PEPP this week, told RIJ that “There will be no PEPP from our side.”

He added, “I guess my opinion is representative for many if not all insurance companies.” Asked why he was on the webinar, he said, “Because I have been a member of the expert panel at EIOPA.” On EIOPA’s registry, no PEPP offerings are listed. Prenn noted an industry study showing that the consumer protections required on PEPPs will make it difficult to offer a product. [Note: We will update this story as more information becomes available.]

“Certainly higher interest rates could help us to become more interested,” Prenn said in the webinar. “That would make complying with these rules much easier. We would need benchmark rates of about 2%, and we are halfway there.” Without more yield, he noted, it would be impossible for an insurance company to meet the PEPP’s specific requirements for minimum returns and maximum losses.

He also expressed concern about potential legal liabilities. “How will a civil court see this regulation? In a negative market scenario, we will have unhappy customers pursuing us with skillful lawyers. This creates legal risks that will have to be covered by the 1% return on this product.”

European investors are famously averse to market risk. So a capital preservation feature was added to the default version of PEPP (Basic PEPP). “For the Basic PEPP with a guarantee, PEPP savers will have a legal obligation to ensure that PEPP savers recoup at least the capital invested. The guarantee on the capital shall be due only at the start of the decumulation phase and during the decumulation phase,” according to a PEPP fact sheet. Such guarantees will be difficult for providers to offer when yields are low.

In an aging, low birth-rate Europe, where a declining worker-to-beneficiary ratio is putting pressure on social insurance programs with tax-based, pay-as-you-go funding mechanisms, governments want to encourage individuals to save more on their own. European workers face many of the same retirement challenges that Americans do—insufficient savings, incomplete access to savings plans, and unconventional careers.

Contributions to PEPP funds could also help the investment industry in Europe. Europeans traditionally save at banks, and PEPPs could draw savings toward capital markets investments in exchange-listed companies. A larger market could also give PEPP providers greater efficiencies and economies of scale.

The idea for Europe’s PEPPs was hatched in July 2012 when the European Commission, eager for individual savers to shoulder more of their own pension burden, asked EIOPA to gather information on a personal, private pension option for EU workers. The project advanced slowly through the European bureaucracy until, in 2020, a package of new regulations and services was submitted for the European Commission’s approval.

RIJ submitted the following questions to the EIOPA this week and received the following answers:

Q. How do PEPP participants make contributions, especially if contributions aren’t facilitated by employer payroll mechanisms?

A. The PEPP is a pillar three product. It is separate from the state pensions and the occupational pensions. Savers make contributions on their own without facilitation by payrolls.

Q. Is there any limit to the number of companies that can offer plans?

A. No. Eligible providers are credit institutions, insurers, institutions for occupational retirement provisions as well as investment or management companies. Each provider can offer as many PEPPs as they want. There is a limit on the number of investment options. Providers can offer basic PEPP and six other investment options.

Q. How are plans distributed and payments made? Purely online? Is there an emphasis on smartphones?

A. It is not prescribed to use online distribution only. However, the PEPP Regulation aims to put ‘digital first’ and allows a fully digital disclosure and distribution. Digital disclosure may include more engaging forms of media (such as video) or interactive elements which makes it more appealing and easier to understand for consumers.

PEPP providers and distributors are obliged to give advice. The PEPP Regulation, in addition to traditional advice, allows either fully automated or semi-automated advice. Content of the pre(contractual) information to consumers has to be presented in a way that is adapted to the PEPP saver’s device used for accessing the document. Font size, size of the different elements should be adjusted depending on the device being used for accessing the information.

Q. Is there any limit to the kinds of savings vehicles—such as annuities, mutual funds, collective investment trusts—that PEPPs can offer?

A. Providers can offer different forms of out-payments, which can be modified by savers free of charge one year before the start of the decumulation phase, at the start of the decumulation phase and at the moment of switching providers. The forms of retirement income can be an annuity and life-long pay-out, a lump sum payment, drawn down payments or a combination of the aforementioned.

Q. How is the conversion to decumulation handled?

A. PEPP providers should inform PEPP savers two months before the dates on which PEPP savers have the possibility to modify their pay-out options about the upcoming start of the decumulation phase, the possible forms of out-payments and the possibility to modify the form of out-payments. Where more than one sub-account has been opened, PEPP savers should be informed about the possible start of the decumulation phase of each sub-account.

National competent authorities are required to publish national laws, regulations and administrative provisions governing the conditions related to the decumulation phase. These also are published on our website.

Tuesday’s webinar panelists included Til Klein, founder of Vantik, which puts credit card rewards into a personal pension, Christian Lemaire of the Occupational Pensions Stakeholder Group, Hugo Prenn of Uniqa Insurance, Tim Shakesby of EIOPA, and Peter Ohrlander, Directorate General for Financial Stability, Financial Services and Capital Markets Union at the European Commission.

© 2022 RIJ Publishing LLC. All rights reserved.

Equitable Holdings, Inc., (NYSE: EQH) announced that its AllianceBernstein (NYSE: AB) subsidiary has agreed to acquire CarVal Investors L.P., an established global private alternatives investment manager with $14.3 billion in assets under management (AUM).

The transaction is expected to close in the second quarter of 2022. It will make CarVal a wholly owned subsidiary of AllianceBernstein L.P. It will be rebranded as AB CarVal Investors. The transaction is subject to customary regulatory and closing conditions. CarVal and its employees will continue to operate from its Minneapolis, Minnesota headquarters and offices around the world.

Equitable Holdings has ~12,200 employees and financial professionals, ~$908 billion in AUM (as of 12/31/2021) and more than five million client relationships globally, offering retirement, asset management and affiliated advice services. As of February 28, 2022, AllianceBernstein had ~$739 billion in AUM.

CarVal Investors focuses on “opportunistic and distressed credit, renewable energy infrastructure, specialty finance and transportation investments,” an Equitable release said.

The transaction is expected to expand AB’s “higher-multiple private markets platform to nearly $50bn in AUM and elevate AB into a leading private credit provider with direct origination capabilities,” the release said.

AB will pay an upfront purchase price of $750 million and a multi-year earnout if certain targets are reached. The deal will be funded primarily through the issuance of AB Holding L.P. units, which are traded on the New York Stock Exchange. Equitable will allocate $750 million of general account assets into CarVal strategies to improve risk adjusted returns to policyholders; CarVal will have access to AB’s global distribution platform.

The acquisition is part of Equitable’s previously announced strategy to drive increased returns while growing AB’s private markets business through a $10 billion capital commitment, by allocating $750 million of General Account assets to CarVal strategies.

Equitable cited its strong capital position, year-end cash of $1.6 billion at Equitable Holdings, and the design of the acquisition, which includes a significant portion to be paid through an earnout structure, as supportive of the transaction.

The US life/annuity (L/A) industry saw a 61% increase in net income to $36.2 billion in 2021 despite higher expenses and benefit payouts, according to a new Best’s Special Report, titled, “First Look: 2021 Life/Annuity Financial Results.”

The data is derived from companies’ annual statutory statements received as of March 14, 2022, representing an estimated 93% of the total L/A industry’s net premiums written.

According to the report, total expenses for the industry grew 7.6%, as an additional $10.6 billion transferred to separate accounts minimized the increases in death, annuity and surrender benefits. Pretax net operating gain for the industry was $51.8 billion, up 38.2% over the prior year. A $3.3 billion increase in tax obligations and $2.7 billion reduction of net realized capital losses contributed to the higher net income result.

Capital and surplus rose 9.0% from the end of 2020 to $444.5 billion, as the net income result plus contributed capital, changes in unrealized gains and other changes in surplus were reduced by a $15.1 billion change in asset valuation reserve and $33.3 billion of stockholder dividends.

Driven by the coronavirus pandemic and rising inflation rates, medical expenses are likely to consume larger amounts of retirees’ incomes, according to HealthView Services’ annual Retirement Healthcare Costs Data Report.

The report is based on data from 530 million healthcare cases, inflation rates of individual healthcare-cost variables, government data, and Medicare projections.

“Current data reveals that even if consumer prices were rising at historical average inflation (of around 3%), a significant portion of retirees’ Social Security benefits would be needed to cover healthcare costs,” according to HealthView Services.

“With inflation rising to a 40-year high of 7.9% in 2022, the impact on future expenses will be significant. The 2022 Medicare Part B premium increase of nearly 15% (a record-high $518 annually for a married couple) may be a harbinger for future healthcare cost increases.”

Assuming healthcare costs grow at 1.5 to 2 times Consumer Price Index for the next two years, a healthy 55-year-old couple may be subject to anywhere from $160,000 to $267,000 in additional retirement healthcare costs, according to HealthView.

This will pose challenges for current and pre-retirees, and investment strategies and savings targets may need to be adjusted to reflect this new normal. Ultimately, a long-term strategic approach that focuses on in-retirement distributions to cover healthcare costs offers a path to ensure these expenses can be addressed.

Assumptions in the report are based on the expectation that the current period of high inflation is temporary and will revert to projections more consistent with historical averages. HealthView’s primarily focuses on the long-term impact of high healthcare inflation for a one-to-two-year period, and highlights the link between rising consumer prices and higher healthcare costs. The paper also reviews how increased use of medical services and other critical factors will drive healthcare inflation.

The Pension Benefit Guaranty Corporation (PBGC) has agreed to license annuity buyout pricing data from BCG Pension Risk Consultants I BCG Penbridge, as of January 1, 2022, according to a BCG release.

The data will be used to support PBGC liability measurements that are intended to replicate pricing in the US group annuity market. The PBGC oversees US defined benefit pension plans.

The BCG annuity buyout pricing data includes summary statistics (mean and standard deviation) of annuity pricing rates that are collected via a monthly BCG survey of participating insurance providers.

The data is provided for predetermined case sizes and durations of defined benefit pension plan annuity buyouts. The data is used to estimate the premium that an insurance company would charge for a buyout of a defined benefit plan.

In addition to licensing the annuity buyout pricing data to third parties, BCG uses the data that it collects from participating insurers to maintain The BCG PRT Index, which was established in 2011 and is the longest standing pension buyout index in the United States.

The Index provides easy comparisons of annuity buyout pricing to various pension liability measures and can also be customized to a specific defined benefit plan for ongoing buyout price monitoring.

“The group annuity pension risk transfer market [saw] record sales volume of $38.1 billion in 2021, and key market indicators are pointing to continued growth in the years to come,” said Steve Keating, managing director of BCG.

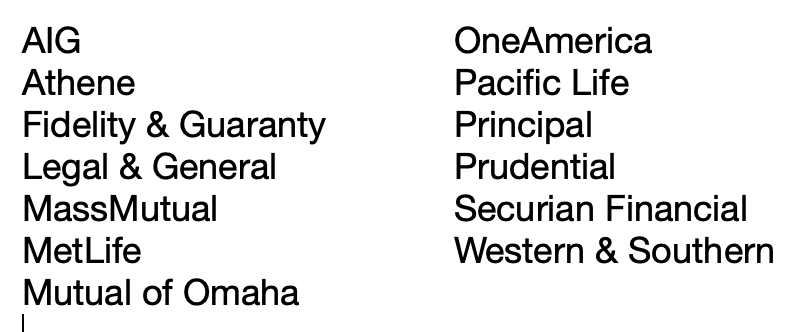

There are currently 18 insurers active in the US pension risk transfer annuity buyout market, with 10 new entrants since 2014 that remain in the market. Of the 18 currently active insurers, 13 currently participate in BCG’s monthly survey as follows:

PBGC insures single-employer and multiemployer private sector pension plans with over 33 million American workers, retirees, and beneficiaries. The agency’s two insurance programs are legally separate and operationally and financially independent. PBGC is directly responsible for the benefits of more than 1.5 million participants and beneficiaries in failed pension plans. BCG, based in Braintree, MA, specializes in assisting defined benefit plan sponsors with managing the costs and risks associated with their pension plans.

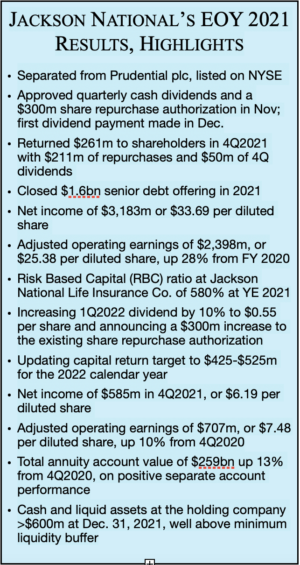

Jackson National Life Insurance Company and Producers Choice Network (PCN) are partnering to offer Jackson National’s fee-based advisory annuity products to the more than 6,500 investment advisor representatives (IARs) at Registered Investment Advisors (RIAs) served through PCN’s outsourced insurance desk, according to a release this week.

Bill Burrow, senior vice president, Private Wealth & Insurance Professionals, Jackson National Life Distributors LLC, and Jamie Kosharek, president, Producers Choice Network, are key executives in the initiative.

PCN is a subsidiary of Raymond James. It distributes annuities to fee-based advisers through its One Insurance Solution for RIAs program. www.1insurancesolution.com.

Jackson Financial Inc. is a US holding company and the direct parent of Jackson Holdings LLC (JHLLC). Wholly owned subsidiaries of JHLLC include Jackson National Life Insurance Company, Brooke Life Insurance Company, PPM America, Inc. and Jackson National Asset Management, LLC.

The law firm of KlaymanToskes reports that it continues to investigate potential FINRA arbitration claims on behalf of investors who sustained losses exceeding $100,000 in Northstar Financial Services (Bermuda) purchased through full-service brokerage firms, including Truist Investment Services (NYSE: TFC).

Northstar was a Segregated Accounts Company regulated by the Bermuda Monetary Authority, and marketed its fixed and variable annuity products as offering segregated account protection, allowances for liquidity and a variety of commitment periods, as well as the benefits of a Bermuda trust structure.

Northstar Financial Services (Bermuda) is currently in bankruptcy proceedings in both the Supreme Court of Bermuda and the United States while investors are claiming that their financial advisors misrepresented the investment as a safe, low risk product like a CD that had guaranteed monthly income with principal protection. Full-service brokerage firms besides Truist Investment Services that sold Northstar Financial Services (Bermuda) products include:

KlaymanToskes is investigating potential FINRA arbitration claims relating to Truist Investment Services’ sales practices concerning Northstar Financial Services (Bermuda) products.

The firm wishes to contact former and current customers of Truist Investment Services who suffered losses exceeding $100,000 from Northstar investments, and who have information related to the handling of their investments.

Lincoln Financial Group (NYSE: LNC) has named Darrel Tedrow as Senior Vice President, Mergers and Acquisitions and Jim Tierney as Senior Vice President, Strategy, both reporting to Chris Neczypor, who leads the Chief Strategy Office.

The Chief Strategy Office focuses on enterprise-wide long-term strategic planning, potential mergers and acquisitions and competitive intelligence.

Tedrow returns to the Chief Strategy Office after two years as the Director of Advancement at Worldlink International Ministries. He has spent more than 15 years at Lincoln Financial in the life insurance business and corporate finance organization.

Tierney will work across the organization to develop broad-based, innovative strategies to further enhance Lincoln’s value for shareholders and complement the company’s organic growth. He joins from Lincoln Financial’s Information Technology organization. Tierney has more than 20 years of industry experience – 11 of them at Lincoln Financial. Tedrow and Tierney have both been named members of Lincoln Financial’s Corporate Leadership Group.

© 2022 RIJ Publishing LLC. All rights reserved.

Morningstar, Inc., published its annual Target-Date Strategy Landscape Report this week. It shows that total assets in target-date strategies grew to a record $3.27 trillion at the end of 2021, nearly a 20% increase over the previous year.

“Assets in target-date strategies reached a record high in 2021 as investors poured net contributions of $170 billion into the space,” said Megan Pacholok, manager research analyst at Morningstar (NASDAQ; MORN).

“We are also seeing the remarkable advance of collective investment trusts, which made up roughly 86% of 2021’s net inflows. Plan sponsors are attracted to the lower costs of these vehicles, and we expect their growing popularity to persist.”

The largest five providers control roughly 79% of the target-date market. They are: Vanguard, Fidelity, American Funds, BlackRock, and State Street.

The 2022 report examines the growing trend of collective investment trusts (CITs) as plan sponsors’ preferred target-date vehicle, how fees continue to be a key driver in target-date selection, and primary differences between “to” versus “through” glide paths.

The Target-Date Strategy Landscape Report is available here. Key findings from the report include:

CITs are on pace to overtake mutual funds as the most popular target-date vehicle in the coming years. In 2021, net contribution to CITs far outpaced mutual funds ($146 billion to $24 billion) and accounted for 86% of target-date strategy net inflows. These vehicles now make up 45% of total target-date strategy assets, up from 32% five years ago.

Fees continue to influence target-date fund flows. The cheapest quintile of target-date share classes amassed $59 billion in 2021, up from $41 billion in 2020. Collectively, the three more-expensive quintiles had outflows of more than $38 billion.

Vanguard Target Retirement collected the most net new money after slipping from the top spot last year for the first time since 2008. It accumulated more than $55 billion of net inflows in 2021, with Fidelity Freedom Index collecting the second most with approximately $45 billion.

Target-date managers have become more comfortable with higher equity stakes over the last decade. In 2021, portfolios 20 years to retirement had a median equity weighting of 82%, roughly one-fifth larger than ten years ago.

Firms’ preference for “through” retirement glide paths over “to” retirement is one reason for the shift toward higher equity weightings, as “through” retirement glide paths’ gradual de-risking after the target-retirement date allows for more equity risk during savers’ working years.

Morningstar today published a Fund Spy article on Morningstar.com that reviews the latest ratings for target-date fund series that Morningstar covers, available here.

Morningstar Target-Date Fund Series Reports

Morningstar Target-Date Fund Series Reports (the Reports) are designed to help individual investors, financial advisors, consultants, plan sponsors, and other interested fiduciaries make informed decisions when selecting a series of target-date funds. The methodology for the Reports is available here.

Morningstar Target-Date Fund Series Reports and Morningstar’s Analyst Ratings for target-date series are available in Morningstar Direct, the company’s global investment analysis and reporting platform for financial professionals, and in Morningstar Office, Morningstar Advisor Workstation, and Morningstar Analyst Research Center, the company’s investment planning and research platforms for financial advisors.

© 2022 Morningstar, Inc.

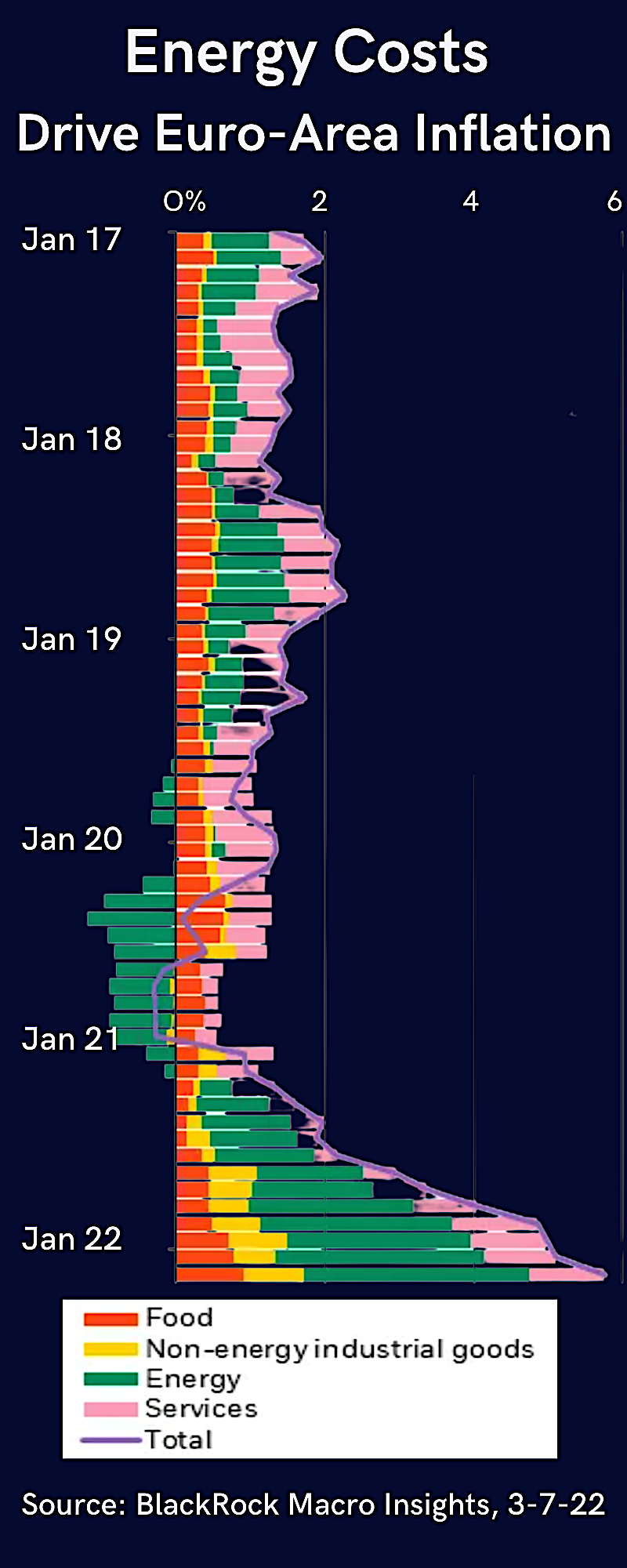

The Fed last week signaled a large and rapid increase in its policy rate over the next two years and struck a surprisingly hawkish tone, indicating it’s ready to go beyond normalizing to try to tame inflation.

It’s easy to talk tough, and we believe the Fed is unlikely to fully deliver on its projected rate path. The reason? It would come at too high a cost to growth and employment. We do now see a higher risk of the Fed slamming the brakes on the economy as it may have talked itself into a corner.

The Federal Reserve has kicked off its hiking cycle with a quarter-point increase—the first since 2018. The decision was expected. What surprised was the Fed’s stated goal to get the fed funds rate to 2.8% by the end of 2023 (see the pink dots on the chart).

This level is in the territory of destroying growth and employment, in our view. [Click here for the extended version of this commentary, with charts.]

At the same time, the Fed’s latest economic projections pencil in persistently high inflation but low unemployment – even as it has called current labor conditions tight. We believe this means the Fed either doesn’t realize its rate path’s cost to employment or—more likely—that it shows its true intention: to live with inflation.

We think this is necessary to keep unemployment low because inflation is primarily driven by supply constraints and high commodities prices.

The Bank of England (BoE), the first major developed market (DM) bank to kick off the current hiking cycle, increased its policy rate for the third time to 0.75%. Like the Fed, the BoE recognized additional inflation pressures from high energy and commodity prices. It also signaled that it may pause further rate increases, with rates back at pre-pandemic levels. We believe this means the BoE is willing to live with energy-driven inflation, recognizing that it’s very costly to bring it down.

The BoE provides a glimpse of what other DM central banks may do once they get back to pre-pandemic rate levels and the effect of rate rises on growth become apparent. The Fed’s tone may change as the consequences for growth become more apparent after aggressively hiking this year.

The Fed last week perhaps wanted to appear tough by implying even more rate increases in future years to keep inflation expectations anchored, in our view, without expecting to deliver those hikes. To be sure: The Fed will normalize policy because the economy no longer needs pandemic-induced stimulus.

It has also signaled it will start reducing its balance sheet, marking the start of quantitative tightening. Finally, we expect the Fed to raise the fed funds rate to around 2% this year—close to pre-pandemic neutral levels—and then pause to evaluate the effects.

What are the risks? Central banks are in a tough spot. First, they may start to believe some of their own rhetoric—and think they can raise rates well above neutral levels without damaging growth. They could hike too much, too fast as a result—and plunge economies into recession. We think this risk has risen since last week’s Fed meeting.

Second, inflation expectations could de-anchor and spiral upward as markets and consumers lose faith that central banks can keep a lid on prices. This could force them to act aggressively amid persistently high inflation.

Last week’s central bank actions reinforce our views. We see more pain ahead for long-term government bonds even with the yield jump since the start of the year. We expect investors will demand more compensation for the risk of holding government bonds amid higher inflation. We stick with our underweight to nominal government bonds on both tactical and strategic horizons.

We think the hawkish repricing in short-term rates is overdone and prefer short-maturity bonds over long-term ones. We prefer to take risk in equities over credit in the inflationary backdrop because we expect real—or inflation-adjusted—yields to stay historically low. We added to the DM equity overweight two weeks ago. We still like the overweight in this environment but see a differentiated regional impact from higher energy prices.

Stocks rallied and government bond yields climbed last week after the Fed raised rates and Chinese policymakers soothed beaten-down Chinese markets. Chinese equities rebounded after officials suggested an end to the crackdown on tech companies and announced a relaxation of Covid restrictions to hit growth targets. We believe China’s ties to Russia have created a risk of geopolitical stigma, including potential sanctions.

© 2022 BlackRock, Inc.

The most provocative of the five research papers in this March edition of RIJ’s Research Roundup has to be Michael Doran’s “The Great American Retirement Fraud.” A professor at the University of Virginia School of Law, Doran faults US tax policy for subsidizing what, in his opinion, is a deceptively regressive defined contribution system of thrift.

We also feature recent research by the Urban Institute, whose economists show that millions of Americans won’t have adequate income in retirement if the Social Security system doesn’t avoid its anticipated insolvency in 2034. Another paper, co-authored by the principal economist at the Federal Reserve, measures how the cost of managing interest rate risk and offsetting “adverse selection” affects the prices of income annuities.

Two Harvard economists, David M. Cutler and Noémie Sportiche, show that the mental and emotional stresses of the Great Financial Crisis in the US were not evenly distributed across demographic groups. Finally, Danish economists, collaborating with an American, try to solve a mystery: Why do so many people gain wealth during their “decumulation” years?

Preparing for Retirement Reforms, by Karen E. Smith, C. Eugene Steuerle, and Damir Cosic of the Urban Institute, October 2021.

Unlike the helmsmen of the ill-fated HMS Titanic, who didn’t foresee any icebergs ahead, economists watching over Social Security know that the program approaches a political-regulatory-financing iceberg of its own, circa 2034.

That’s the year that actuaries predict the Social Security program will have enough payroll tax revenue to pay only about 75% of its promised benefits. If Congress doesn’t change the rules of the program before then, every beneficiary of the Old Age and Survivors Insurance program would take a 25% benefits haircut.

In this study, economists at the Urban Institute in Washington, DC, use their Dynamic Simulation of Income (DYNASIM) microsimulation model to forecast the impact of such a reduction on the America’s overall financial readiness for retirement. The authors defined readiness as the ability to replace 75% of pre-retirement income in retirement.

The share of Social Security beneficiaries with inadequate income will increase from 26% in 2020 to 45% by 2090 without any reforms to the program, they found, and to 39% if Congress enacted reforms proposed by the Bipartisan Policy Center. The BPC proposes a roughly equal blend of benefit cuts and tax increases to restore Social Security to solvency.

Americans can prepare for the worst by working longer or saving more. “Working longer by one year, by two years, or in line with increases in life expectancy, would reduce the share of Social Security beneficiaries unable to replace 75% of their preretirement earnings by two to five percentage points. A person with a 50% replacement rate, for example, might increase that number to 54% with an extra year of work,” the economists wrote.

Among top-quintile lifetime earners, one more year of work could close 25% of the savings gap, while saving 10% more of earnings could close 60% of the savings gap. For bottom-quintile lifetime earners, one more year of work could close 9% of the savings gap, while saving 10% of earnings more could close 19% of the gap.

Alternately, a person could save more over the course of their working lives. But they would have to save substantially more. “The average projected income gap among those Social Security beneficiaries with income below our adequacy standard in 2065 is $13,330 in 2018 price-adjusted dollars. To fill this gap, vulnerable workers would need to save about $272,700 more on average to close their income gap for 20 to 25 years of expected retirement,” the study said.

For those, such as women who raised children at home, who had too few years of earned income to qualify for benefits, the authors noted the possibility of a minimum Social Security benefit equal to the 2025 single-person poverty income level. If enacted, it would close 41% of the savings gap among bottom-quintile lifetime earners and 25% of the gap for second-quintile lifetime earners in 2065, the report suggested.

Does Social Security face an existential financial crisis? Not necessarily. Unless offset by higher immigration or changes in the way the program is financed, a falling worker-to-retiree ratio in the years ahead will require higher taxes per worker or lower payments per beneficiary. But defenders of the program say that simple remedies, such as raising the amount of earned income subject to the payroll tax, would solve the problem. That might raise costs for highest earners, but they benefit disproportionately from tax expenditures [a tax expenditure is a tax the government doesn’t collect or defers collection of] on defined contribution plans.

The Great American Retirement Fraud, by Michael Doran, University of Virginia School of Law.

Most Americans save for retirement by buying mutual fund shares with tax-deferred contributions to accounts in employer-sponsored, defined contribution plans. But the program has a weakness. Millions of workers whose employers don’t choose to sponsor plans are left out.

In a recent paper, a University of Virginia law professor calls the defined contribution system a “fraud.” He argues that its benefits accrue mainly to the wealthy: Because they save the most and pay the highest marginal tax rates, they benefit the most from tax incentives for saving.

“Over the past twenty-five years, the retirement savings of middle-income earners have remained flat or increased only modestly, and the retirement savings of lower-income earners have actually decreased,” writes Michael Doran. “But the increases in retirement savings among higher-income earners have been so large that average retirement savings as a whole have increased, making it appear that retirement security has improved across the board.”

“The supposed interest in helping lower-income and middle-income earners has been a stalking horse for the real objective of expanding the tax subsidies available to higher-income earners. The legislation has repeatedly raised the statutory limits on contributions and benefits for retirement plans and IRAs, delayed the start of required distributions, and weakened statutory non-discrimination rules—all to the benefit of affluent workers and the financial services companies that collect asset-based fees from retirement savings.

“The result has been spectacular growth in the retirement accounts of higher-income earners but modest or even negative growth in the accounts of middle-income and lower-income earners. Despite the benign but misleading rhetoric about enhancing retirement security for everyone, the real beneficiaries of the retirement-reform legislation have been higher-income earners, who would save for retirement even without tax subsidies, and the financial-services industry, whose lobbyists have driven the retirement-reform legislative agenda.”

Doran argues that the system isn’t making America more retirement-ready. “The most recent update of the National Retirement Risk Index, published in January of 2021, indicates that approximately 49% of all households are at risk of being unable to maintain pre-retirement living standards during retirement,” he writes. “And the distribution of at-risk status is not even across different levels of household wealth: among low-wealth households, 73% are at risk; among middle-wealth households, 45% are at risk; and among high-wealth households, 29% are at risk… The number of at-risk households has increased since 2004, the first year for which the National Retirement Risk Index was calculated.”

What’s Wrong with Annuity Markets?, by Stephane Verani, the Federal Reserve Board, and Pei Cheng Yu, University of New South Wales, Australia.

It’s a truism in the annuity industry that when prevailing interest rates go down and stay down for long periods, that life/annuity companies earn less on their bonds and must raise the prices (i.e., lower the payout rates) of single premium immediate annuities (SPIAs). (Variable annuities and index-linked annuities are not as rate-sensitive.)

It’s also known that healthier people buy life annuities. Known as “adverse selection” (AS), this phenomenon compels annuity issuers to charge more for SPIAs than they would if more people with average longevity expectations purchased life annuities.

The principal economist at the Federal Reserve in Washington, DC, Stephane Verani, and an Australian business school professor, Pei-Cheng Yu, assert that the frictions from managing these two risks—interest rate risk and AS—raises the cost and lowers the supply of lifetime income annuities. Indeed, the two risks interact; rising annuity prices discourage all but the healthiest customers.

“A large share of the notoriously high life annuity price markups can be explained by the cost of managing interest rate risk. We propose a novel theory of insurance pricing that reflects both informational frictions and interest rate risk.

“We develop an algorithm for annuity valuation to decompose the contribution of demand- and supply-side frictions in annuity markups using over 30 years of annuity price data and a novel identification strategy that exploits bond market shocks and the US insurance regulatory framework.

“Our main result is that interest rate risk significantly constrains the supply of life annuities. A corollary is that the best time to sign up for a life annuity is during a time of overall financial market stress, as annuity prices are lower when investment grade bond spreads are higher!,” the authors write.

“The average AS-adjusted markup is substantial and around 16%. We show that the cost of managing the interest rate risk associated with selling life annuities accounts for at least half of the AS-adjusted markup or eight percentage points,” they add. “That is, in addition to the well-known cost of adverse selection, the supply of private longevity insurance is constrained by life insurers’ own vulnerability to uninsurable aggregate shocks.

“A substantial fraction of annuity markups reflects insurers’ cost of managing interest rate risk. The effect of interest rate risk, a supply-side friction, is likely to add to the adverse effects of other noted demand-side frictions on annuity demand including, for example, bequest motives, behavioral biases, and pre-existing annuitization, such as Social Security.”

Economic Crises and Mental Health: The Effects of the Great Recession on Older Americans, by David M. Cutler Noémie Sportiche.

Can you remember your mental state during the Great Recession of 2008? Was your home foreclosed on? Did you lose your job? Were you distressed by the drop in the financial markets? Two Harvard economists searched the data to see if older people suffered more emotional pain or mental anguish that others during that difficult period.

David M. Cutler and Noemie Sportiche searched through house price data in the Health and Retirement Study and studied rates of depression, chronic pain severity and functional limitations, and the use of medications to treat sleep, depression, and anxiety. They found no sign that the elderly suffered. They found ample evidence that homeowners of color did.

“The mental health impacts of the Great Recession were heterogeneous and unequally distributed,” Cutler and Sportiche wrote. “We find that mental health was not impacted on average, either for older adults aged 51 to 61 or for seniors aged 65 to 74.

“Instead, we find that falling house prices worsened only the mental health of those in economically vulnerable households… Black and other non-white homeowners show signs of worsened mental health across most measures. White homeowners did not exhibit worsened mental health but became more likely to take medication.”

The authors were “not able to clearly identify the pathway through which house prices affected the mental health of populations.” They concluded, “The mechanisms underlying mental health effects extend beyond housing wealth or foreclosures.”

“As the mental health of seniors aged 65 to 74 was not affected, it is possible that mental health effects are mediated through features of the labor market or have smaller impacts among seniors because of reasonably generous social insurance programs available to this age group.”

Consumption and Saving After Retirement, by Bent Jesper Christensen and Malene Kallestrup-Lamb of Aarhus University, Denmark, John Kennan, University of Wisconsin-Madison.

The wealth of retirees tends to go up rather than down, on average. That’s contrary to the life-cycle hypothesis, which holds that retirees will spend down their savings to maintain their pre-retirement consumption level. An American economist and two Danish economists decided to explore the inconsistency.

“One would expect that wealth accumulated before retirement would be used to augment consumption in later life, with the implication that wealth should decline over time,” wrote researchers Bent Jesper Christensen and Malene Kallestrup-Lam of Denmark’s Aarhus University, and University of Wisconsin’s John Kennan.

So why, they ask, do “many people choose to work full-time for about 40 years, and not work at all for the remaining 15 years or so, rather than taking more time off when they are younger, and working more when they are older”

They had more than an idle interest in this topic. Social security systems around the world might cost trillions of dollars less to finance (in the long run) if more people worked longer, paid taxes longer, and received their pension payments for fewer years. That is: if it were known why so many people retire early, perhaps incentives for working longer could be developed.

The trio analyzed data for Denmark’s 1927 birth cohort, for which the old-age pension (OAP) claiming age was 67. To simplify the research, they focused on single people neither married nor cohabiting. They followed at group from 1995, at which point almost all of them had retired, to 2016.

Their conclusion: Some individuals are saving because they are currently in a low marginal utility state, but expect to move to a “high marginal utility state” in the future. In other words, they believed that they’d get more enjoyment out of their money by spending it later rather than sooner.

Note: The life-cycle hypothesis (LCH) is an economic theory that describes the spending and saving habits of people over the course of a lifetime, according to Investopedia. The theory states that individuals seek to smooth consumption throughout their lifetime by borrowing when their income is low and saving when their income is high. The concept was developed by economists Franco Modigliani and his student Richard Brumberg in the early 1950s. Its applicability for over-leveraged Americans in the 21st century is open to debate.

Marginal utility is the enjoyment a consumer gets from each additional unit of consumption. It calculates the utility beyond the first product consumed. If you are hungry and eat three Big Macs in a row, you are likely to enjoy the first more than the second and the second more than the third. And so on until you regret it. It’s akin to the principle of diminishing returns.

© 2022 RIJ Publishing LLC. All rights reserved.

Total fourth quarter sales for all deferred annuities were $60.9 billion, up 1.7% from the previous quarter and an increase of 8.1% when compared to the same period last year, according to Wink’s Sales & Market Report for 4th Quarter 2021.

Total 2021 sales all deferred annuity sales were $243.6 billion, up from $209.1 billion in 2020. All deferred annuities include the variable annuity, structured annuity, indexed annuity, traditional fixed annuity, and MYGA product lines.

Total sales for fixed or variable index-linked annuities in 2021 was $103.6 billion, or about 40% of all deferred annuity sales. Fixed indexed annuity (FIA) sales accounted for $65.5 billion. Sales of structured annuity (aka RILAs, or registered index-linked annuities) accounted for $38.1 billion. Traditional variable annuity (VA) sales were $87.7 billion.

[Note: Structured annuities can be thought of as variable annuities or as indexed annuities. They are registered and SEC-regulated, like variable annuities. But, like FIAs, they are general account products, not separate account products.]

Sixty-three indexed annuity providers, 46 fixed annuity providers, 69 multi-year guaranteed annuity (MYGA) providers, 15 structured annuity providers, and 45 variable annuity providers participated in the 98th quarterly edition of the report.

Jackson National Life was the leading seller of deferred annuities with a market share of 8.1%. Equitable Financial moved into second place, followed by Massachusetts Mutual Life Companies, Allianz Life, and AIG. Jackson National’s Perspective II Flexible Premium Variable and Fixed Deferred Annuity, a variable annuity, was the top selling contract for the twelfth consecutive quarter.

Total fourth quarter non-variable deferred annuity sales were $28.6 billion; down more than 1.9% from the previous quarter and down more than 0.4% from the same period last year.

Total 2021 non-variable deferred annuity sales were $117.7 billion. Non-variable deferred annuities include the indexed annuity, traditional fixed annuity, and MYGA product lines.

Massachusetts Mutual Life Companies ranked as the top seller of non-variable deferred annuity sales, with a market share of 12.3%, followed by Athene USA, AIG, Allianz Life, and Global Atlantic Financial Group. MassMutual’s Stable Voyage 3-Year, a MYGA, was the top-selling non-variable deferred annuity, for all channels combined.

Total fourth quarter variable deferred annuity sales were $32.2 billion, up 5.2% from the previous quarter and up 17.2% from the same period last year. Total 2021 variable deferred annuity sales were $125.9 billion. Variable deferred annuities include the structured annuity and variable annuity product lines.

Jackson National Life ranked as the top seller of variable deferred annuity sales, with a market share of 15.2%, followed by Equitable Financial, Lincoln National Life, Allianz Life, and Brighthouse Financial. Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity, a variable annuity, was the top selling contract.

Indexed annuity sales for the fourth quarter were $16.9 billion; down 2.3% from the previous quarter, and up 12.3% from the same period last year. Total 2021 indexed annuity sales were $65.5 billion. Indexed annuities have a floor of no less than zero percent and limited excess interest that is determined by the performance of an external index, such as Standard and Poor’s 500.

Athene USA ranked as the top seller of indexed annuities, with a market share of 14.1%, followed by Allianz Life, AIG, Sammons Financial Companies, and Fidelity & Guaranty Life. The Allianz Benefit Control Annuity was the top-selling indexed annuity, for all channels combined for the fifth consecutive quarter.

“Indexed annuity sales are down, but don’t count them out. With the markets steadily rising and fixed interest rates so depressed, I anticipate that sales of this line will bounce back by the second quarter of the new year,” said Sheryl Moore, CEO of Wink, Inc., and Moore Market Intelligence.

Traditional fixed annuity sales in the fourth quarter were $486.9 million. Sales were up 34.9% from the previous quarter, and up about 2.6 % from the same period last year. Total 2021 traditional fixed annuity sales were $1.7 billion. Traditional fixed annuities have a fixed rate that is guaranteed for one year only.

Global Atlantic Financial Group ranked as the top seller of fixed annuities, with a market share of 20.6%, followed by Modern Woodmen of America, American National, EquiTrust, and Brighthouse Financial. Forethought Life’s ForeCare Fixed Annuity was the top-selling fixed annuity, for all channels combined, for the sixth consecutive quarter.

Multi-year guaranteed annuity (MYGA) sales in the fourth quarter were $11.2 billion; down 2.5% from the previous quarter, and down 15.1% from the same period last year. Total 2021 MYGA sales were $50.4 billion. MYGAs have a fixed rate that is guaranteed for more than one year.

MassMutual ranked as the top carrier, with a market share of 23.3%, followed by New York Life, AIG, Pacific Life Companies, and Western-Southern Life Assurance Company. MassMutual’s Stable Voyage 3-Year was the top-selling multi-year guaranteed annuity for all channels combined for the third consecutive quarter.

Structured annuity sales in the fourth quarter were $10.1 billion; up more than 10.9% from the previous quarter, and up 20.2% from the previous year. Total 2021 structured annuity sales were $38.1 billion. Structured annuities have a limited negative floor and limited excess interest that is determined by the performance of an external index or subaccounts.

Allianz Life ranked as the top seller of structured annuity sales, with a market share of 20.7%, followed by Equitable Financial, Brighthouse Financial, Prudential, and Lincoln National Life. Pruco Life’s Prudential FlexGuard Indexed VA was the top-selling structured annuity for all channels combined, for the second consecutive quarter.

“This was both a record-setting quarter and a record-setting year for structured annuity sales,” said Moore. “The 2021 sales topped the prior year’s record by nearly 59%! And soon, more companies will enter this growing market.”

Variable annuity sales in the fourth quarter were $22.1 billion, up 2.8% from the previous quarter and up 15.9% from the same period last year. Total 2021 variable annuity sales were $87.7 billion. Variable annuities have no floor, and potential for gains/losses that are determined by the performance of the subaccounts that may be invested in an external index, stocks, bonds, commodities, or other investments.

Jackson National Life was the top seller of variable annuities, with a market share of 21.7%, followed by Equitable Financial, Nationwide, Lincoln National Life, and Pacific Life Companies. Jackson National’s Perspective II was the top-selling variable annuity for the twelfth consecutive quarter, for all channels combined.

© 2022 RIJ Publishing LLC.

All innovations have their downsides. From the bicycle to social media, inventions that provide great benefits to their users can leave others behind. Private equity’s new brainwave for the insurance industry – reinsure everything in Bermuda, boost allocations to structured credit and discount liabilities – is no different. [This article appeared today at Risk.net.]

Private equity money is flowing into insurance, bringing with it new ideas and new risks. Last year saw a slew of deals, including the purchase of Global Atlantic by KKR, and the acquisition of Allstate’s life unit by Blackstone, which also took a 9.9% stake in AIG’s life and retirement business. A subsidiary of Ares Management acquired F&G Reinsurance at the end of 2020, renaming it Aspida Re.

These firms are following a path blazed by Apollo, which has turned Athene, the insurance platform it established in 2009, into a profit engine for its credit business. Apollo’s big idea was to allocate a larger share of fixed income investments to higher-yielding asset-backed securities (ABS), and away from corporate bonds, which account for the bulk of traditional insurers’ assets. Athene had 20% of its portfolio in ABS as of June 2021, with more than half of this in collateralised loan obligations (CLOs). The average insurer allocates 7% to ABS, with 2.6% in CLOs.

Athene’s assets are reinsured in Bermuda, where corporate bonds and CLOs with the same credit rating receive similar capital treatment. In the US, they receive the same capital treatment. But Bermuda also allows excess spread to be booked as up-front profit. This reduces an insurer’s liabilities and required reserves and boosts available capital.

The capital benefits can be substantial. In recent years, CLOs have generated 175 basis points of additional spread compared with similarly rated corporate bonds. Athene holds $17 billion of CLOs, which could translate to nearly $1.5 billion of excess yield over five years. One veteran insurance risk manager describes this as “manufacturing capital.”

That’s not all. Athene sources a large share of its private credit investments from Apollo and its affiliates, generating additional fees for its owner. CLOs are stuffed with levered loans originated by private equity sponsors, such as Apollo. Apollo’s strategy is, in many ways, brilliant. Rock-bottom rates hurt insurers and made them vulnerable to takeovers. Apollo gave the sector new life. But its emphasis on alternative assets and offshoring risk has also split the industry.

There are two ways of viewing the new entrants, according to the chief risk officer at a large US insurer: the private equity firms are doing something that is in some way unsustainable, or they are providing a useful jolt of competition into a sector that had run out of new ideas. “We should get on with it,” he says.

Others are more wary of piling into CLOs. Regulators have been sounding the alarm about leveraged loans for years. The National Association of Insurance Commissioners, which sets capital standards for US insurers, is now taking a closer look. Last month, it released a list of 13 “regulatory considerations” related to private equity-owned insurers.

These include “material increases in privately structured securities” and “potential conflicts of interest and excessive and/or hidden fees” in investment products – “for example, a CLO which is managed or structured by a related party.” The regulator is also reviewing “insurers’ use of offshore reinsurers (including captives) and complex affiliated sidecar vehicles to maximize capital efficiency, reduce reserves, increase investment risk, and introduce complexities into the group structure.”

Private equity-owned insurers now manage more than $500 billion of US life and retirement assets. There is little doubt they have brought innovation to a sector that was struggling to meet return goals in an era of low interest rates. But not every innovation is appropriate for financial institutions with long-term liabilities. Insurance regulators need to properly assess the private equity model, preferably before the next credit crisis hits.

Copyright Infopro Digital Limited. Used by permission.

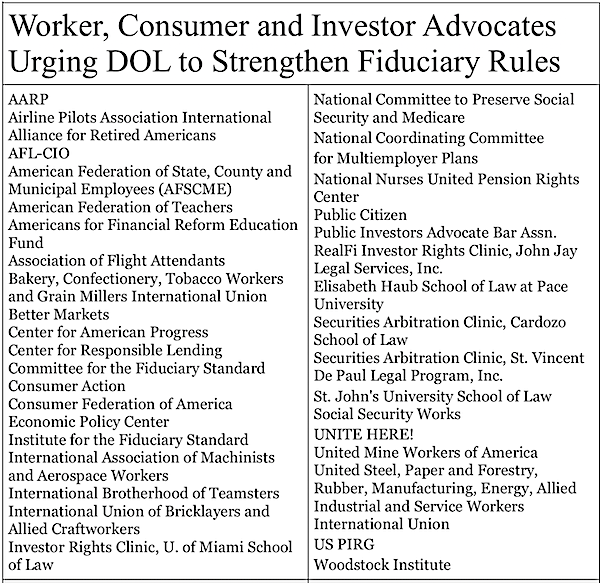

A coalition of three dozen consumer advocacy groups is urging the Department of Labor to “update and eliminate loopholes in the current definition of ‘fiduciary investment advice’ …and protect retirement savers who are predominantly covered by individual account plans.”

In a press release and letter, the groups asked Acting Assistant Secretary of Labor Ali Khawar—a place holder for Lisa M. Gomez, whose nomination to lead the DOL’s Employee Benefit Security Administration has met opposition in the Senate—to, in effect, reject the more investment industry-friendly “Reg BI” that was developed by the Securities and Exchange Commission during the Trump Administration for use by both insurance and investment product distributors.

The rule has special implications for insurance agents. It will determine whether they are eligible for a “prohibited transaction exemption” (PTE) from a law that would otherwise prevent them from advising prospective clients to “roll over” savings from a 401(k) account to an IRA—to an annuity in an IRA, for instance—when getting paid a commission by a life insurer to sell the annuity. It also involves the life/annuity companies that issue the annuities, and their potential responsibility for representations made by those who sell their products.

Does that commission payment represent a fatal conflict of interest for the agent—a conflict between the client’s welfare and the agent’s financial welfare? Reasonable people have been disagreeing for years.

The advocacy groups’ letter comes as the Biden DOL is still working on a proposal to change the rule back to the Obama administration’s version (PTE 84-24)—more consumer-protective—or leave it in the Trump administration’s version (PTE 2020-02), which was open to interpretation.

Like most pension-related regulations, the regulations under debate here are complex, opaque to outsiders, but fraught with commercial implications for the sale of financial products that involve the exchange of tax-deferred, DOL-regulated savings accounts, like 401(k)s and IRAs.

The following description of the current state of affairs, written by the ERISA law firm of Faegre Drinker for a recent webinar, is plainer than most:

The Department of Labor’s (DOL) expanded interpretation of fiduciary status for recommending Plan-to-IRA rollovers and IRA-to-IRA transfers means that many more insurance agents will be fiduciaries for making those recommendations — and, as such, will need the protections of a prohibited transaction exemption (PTE) due to their compensation, both cash and non-cash. PTE 2020-02 provides the most flexibility, but requires that insurance companies be “co-fiduciaries.” PTE 84-24 is more limited, but imposes less of a burden on insurance companies.

Countless billions of dollars are at stake, because 401(k) participants collectively hold trillions of dollars of assets in their accounts. The rules under question here have been in play—in the DOL bureaucracy and in the federal courts—for at least six years. Issuers of fixed indexed annuities (FIAs) and variable annuities (VAs) are among the most interested parties. Insurance agents compete with financial advisers for rollovers, and don’t want to face special restrictions merely because they take commissions from annuity issuers. In the race for rollover dollars, the advisers and their brokerages have been winning. (Organizations signing the letter are listed below.)

A long and winding paper trail

In 2016, the Obama DOL, after years of study, passed a “best interest” rule that narrowed the ability of insurance agents to recommend rollover annuities to participants and get paid commissions by annuity companies for doing so.

In the competition for rollover dollars, this would have put agents at a disadvantage relative to financial advisers, such as Registered Investment Advisors, who do not take commissions from product manufacturers.

The debate over this hung on a long-standing “five-part test” that determines whether a financial intermediary can conduct him- or herself like a mere broker toward the client (and clearly a sales representative with only a passing relationship to the client) or must meet the high ethical standards of trusted “fiduciaries” who must acts “solely” in the “best interest” of their clients.

After the Trump administration froze the Obama rule, a bevy of financial services industry lobbying groups filed a lawsuit to have the rule vacated and a Texas federal appeals court judge ruled in their favor. (The lead plaintiffs’ attorney, Eugene Scalia, was appointed Secretary of Labor in 2019.) Subsequently, the Securities and Exchange Commission, established a vague compromise rule, called “Reg BI.” It established that advisers or agents are equally free to pitch rollovers to participants as long as they don’t put their own pocket-book interests ahead of the participant’s financial well-being.

Investment and insurance companies can live with this compromise; it gives them flexibility in marketing rollovers to participants. Consumer advocates believe that it allows agents to make sales recommendations in the guise of unbiased investment advice.

As their new letter to Acting Assistant DOL Secretary Khawar noted, the current rule:

frames the retirement advice provider’s basic obligation in comparatively weak terms. It provides that advice is in the retirement investor’s “best interest” as long as it does not place the retirement advice provider’s financial or other interests “ahead” of the retirement investor’s interests, or “subordinate” the retirement investor’s interests to those of the advice provider.

This formulation of ‘best interest,’ which establishes a kind of parity between the interests of the two parties, because neither interest is placed ahead of the other, is contrary to the statutory mandate that fiduciaries must discharge their duties “solely in the interest of the participants and beneficiaries and for the exclusive purpose of providing benefits to participants and their beneficiaries.”

There are lots of side issues that add nuance to this controversy. The Obama-era Employee Benefit Security Administration, led by Phyllis Borzi, preferred, all things being equal, that more retirees would leave their money in 401(k)s, where they enjoy the low fees and consumer protections encoded in the federal Employee Retirement Income Security Act of 1974 (ERISA), which governs retirement plans and pensions.

But they were fighting the tide of history. Defined contribution 401(k) plans were never designed to hold employee savings after the employees retire; they were created as profit-sharing plans, not as pensions. So participants often have no incentive to keep their money there—especially if their particular plan offers few investment options and/or has high costs. Only recently have employers expressed a desire to keep retiree money in their plans, mainly to preserve the economies of scale that keep costs down.

In addition, consumer groups have an abiding suspicion of deferred annuities and the commissioned agents who sell them. Twice in the past 20 years, they’ve urged the federal government to regulate annuities more closely. Both times, they failed. In 2007, the SEC tried to reclassify FIAs as securities, and therefore subject to federal regulation (instead of as state-regulated insurance products).

In 2016, the Obama DOL’s rule which would have required agents selling FIAs and VAs to pledge that they were acting solely in their prospective clients’ best interests when recommending those products to retired plan participants. It made agents subject to class-action federal lawsuits if they violated the pledge.

As noted above, the annuity industry sued to overturn this rule, and a Fifth District Circuit Court of Appeals judge vacated it, ruling against the DOL. The Trump DOL—then led by Secretary Scalia—chose not to contest the ruling.

© 2022 RIJ Publishing LLC. All rights reserved.

MassMutual has launched a new variable annuity (VA) contract with an optional guaranteed lifetime withdrawal benefit. The contract is called Envision. The income benefit, exclusive to the Envision contract, is called RetirePay.

“RetirePay offers guaranteed income in the form of the Annual Lifetime Benefit Amount that will never lose value due to negative market performance and that offers opportunities for higher income through step-ups and higher withdrawal rates by age and years of deferral, according to a MassMutual release.

MassMutual had $11.7 billion in variable annuity assets under management as of September 30, 2021, according to Morningstar. It was ranked 20th in VA AUM, with a market share of less than six-tenths of one percent. By comparison, TIAA had group VA assets of $547 billion and Jackson National had individual VA assets of about $246.9 billion at the end of the third quarter of 2021. Industry-wide, the market value of VA assets under management exceeds $2 trillion.

Envision is aimed at individuals “nearing or in retirement including when they are approaching key retirement and milestone ages of 62, 67 and 72,” the release said. Under the RetirePay option, 62-year-olds who bought this product and delayed income until age 72 would be able to withdraw 7.35% (6.45% for married couples) of their benefit base (premium plus growth) per year. There are two versions of the option.

The premium version, for an annual fee of 1.60% of the benefit base, would step up the benefit base every quarter to capture new high-water marks (if any) in the values of the separate accounts that the client has invested in. For 1.45% of the benefit base per year, there’s a step-up on each account anniversary. The insurer can adjust the rider fee up to 2.50% per year. The cost of the step-up benefit is the same for one or two persons.

There are investment restrictions for the RetirePay GLWB. The contract’s mortality and expense risk charge (typically used to cover distribution costs) is 1.15%. There’s an administration charge of 0.15%. The surrender fee is 7% for the first three years, gradually dropping to zero in the eighth year. Fund expenses range from 52 basis points to 165 basis points per year. If the account value ever drops to zero while the annuitant(s) are living, the issuer may adjust the withdrawal rates. According to the current rate sheet, withdrawal rates do not change when the account value drops to zero.

© 2022 RIJ Publishing LLC. All rights reserved.

US life insurance and annuity writers achieved record levels of capitalization, maintained strong liquidity and posted improved earnings in 2021 despite historically low interest rates, inflationary headwinds and continued pandemic uncertainty, according to a new AM Best report.

The annual Review & Preview Best’s Market Segment Report, “U.S. Life/Annuity: Record Capitalization, Strong Liquidity, and Improved Earnings in 2021,” notes that although initial fears about the effects of the pandemic on the life/annuity industry have subsided, COVID-19 cases and death claims continued in 2021, further impacting the mortality book of business that is core to life insurers. At the same time, according to the report, many companies benefited from their prior investments in enterprise risk management, took advantage of the opportunity to shed legacy businesses and saw realized and unrealized gains from strong financial markets.

The industry’s capital and surplus showed solid growth through third-quarter 2021, up $26.2 billion to $480.9 billion, and is likely to continue to grow for full-year 2021. The life/annuity segment recorded net income of $27.0 billion in the nine-month period, up 105% from the same prior-year period, with overall sales of life insurance and annuities seeing strong growth.

“The pandemic drove home the importance of life insurance and consumers adjusted to life during a pandemic,” said Michael Porcelli, senior director, AM Best. “Companies also became acclimated to the remote work and sales environment, which was needed to compete during COVID-19.”

Other highlights in the report include:

Schedule BA assets continued to grow, to 8.4% of total invested assets at third-quarter 2021, compared with 6.2% in 2016, although some insurers have securitized Schedule BA assets and sold them to institutional investors as a way to diminish exposure and capital risk charges.

Although the commercial mortgage loan market has seen increases in delinquencies, exacerbated by the pandemic, life/annuity insurers’ allocations still grew, albeit with a modest shift to industrial properties and multifamily housing from office and retail.

Overall headwinds from the low interest rate environment, as evidenced by an investment yield that has declined each year of the past decade and was 4.1% in 2020, are likely to continue to create drag on margins until longer-term interest rates and credit spreads return to more-historical levels.

New capital continues to enter the life/annuity market, driven by private equity firms with an ability to source and manage fixed-income assets and greater interest in the pension risk transfer market. Additionally, with insurers willing to shed certain blocks of business, merger and acquisition activity ramped up in 2021.

AM Best expects the life/annuity industry to reach an equilibrium between companies seeking opportunities to build a less capital-intensive business, minimize the pressure of persistent low interest rates on profitability and diversify earnings; and companies with fixed-income asset management sourcing, evaluation capabilities and a capital-intensive business appetite.

“As 2021 has shown, life/annuity insurers will seek to unload interest-sensitive lines of business, including variable and fixed annuities, as well as capital-intensive lines of business, such as long-term care and universal life with secondary guarantees,” said Porcelli. “Also, given consumers’ growing awareness of the need for financial security, companies looking for scale and efficiency may make investments in and partnerships with insurtechs a higher priority.”

© 2022 AM Best.

AIG Life & Retirement and Annexus, a designer and marketer of indexed annuities, have partnered to issue and distribute a new fixed indexed annuity (FIA), the “X5 Accelerator Annuity.” The contracts will be issued by American General Life Insurance Company and marketed through the Annexus network of independent distributors.

The product features a bonus that immediately increases the benefit base (the notional amount on which retirement income payments would be based) to 135% of the initial premium. There’s also a “multiplier” that can “increase lifetime income by 250% of net interest earned every year during the accumulation phase,” an AIG release said.