Data Connection

IssueM Articles

I was just finishing an article on the economic uncertainties facing life/annuity companies in 2026 when I read that U.S. commandos had captured Venezuela’s dictator Saturday and brought him to the U.S. for prosecution.

The U.S. government and large oil companies will “run” Venezuela for the foreseeable future.

For a micro-second, I discounted the abduction as another presidential stunt—a photo-op, a red carpet roll-out, and a victory-lap on social media. Then I remembered Iraq and Afghanistan, and lessons unlearned.

But let’s stay on-task. Here’s what I wanted to say about interest rates and deregulation:

* * *

Donald Trump did and said a lot in 2025 that could affect the insurance industry in 2026. It’s hard to know where to begin.

Health insurers face the potential side-effects of lower Affordable Care Act subsidies. Property/casualty insurers face the growing risks of climate-related catastrophes (with less weather data from the U.S. government).

As for life/annuity companies, the president’s call for lower interest rates, his invitation to alternative investments and longevity solutions in 401(k) plans, and his deregulatory fervor have, to use an off-season metaphor, loaded the bases this year.

Why the rush to lower interest rates? Targeted at 3.5%-3.75%, the current fed funds rate looks close to a goldilocks level. But the president wants lower rates and Kevin Hassert, the heir-apparent to Jerome Powell as Fed chair, is expected to comply.

Lower benchmark rates could juice the economy. They reduce borrowing costs, stimulate the carry trade, lower the hurdle rate for financing new ventures, raise the prices of existing bonds and, of course, reduce unemployment and make it cheaper to finance a home or car.

But they’re not a free lunch. In 2025, falling rates reduced the value of the dollar against the euro by about 15%, to €0.85 from €0.97. A German car that cost $60k a year ago might cost more than $70k today, ceteris paribus. Low rates can also stimulate inflation.

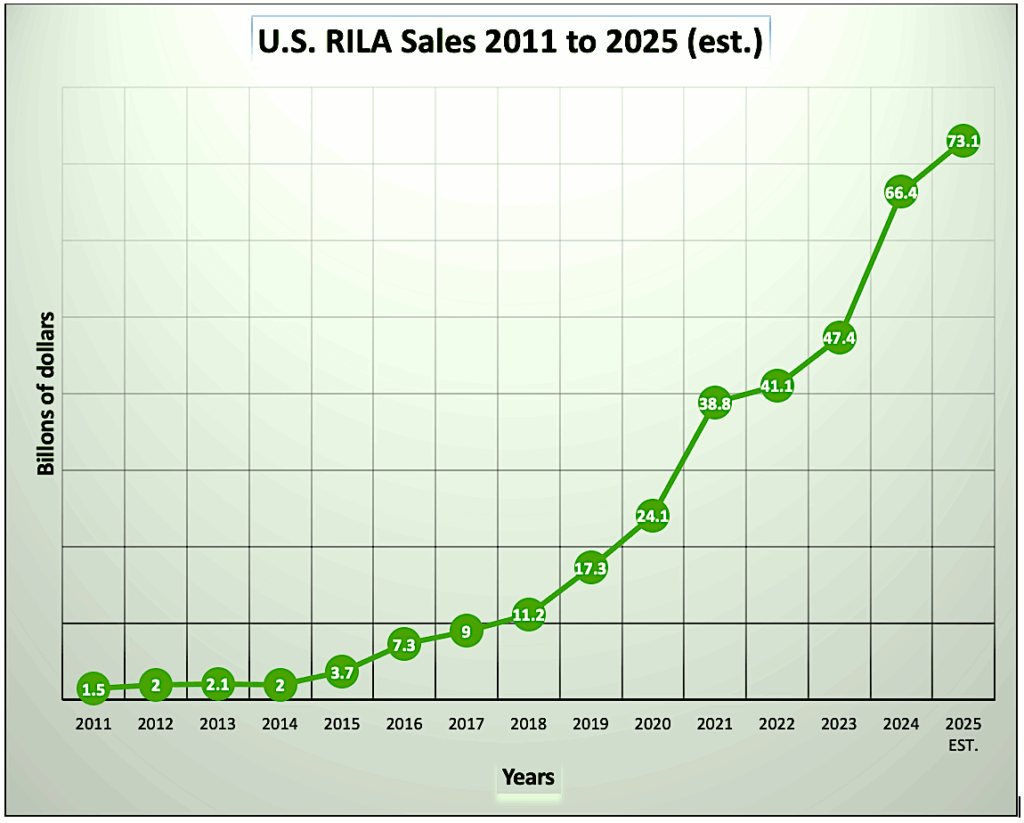

The stock markets love low rates. Looser monetary policy is usually a green light for buying equities. Market history shows a fairly consistent reverse-correlation between equity prices and interest rates. (See chart below.) Rising stock prices can help sales of annuities whose returns follow equities, such as all variable or index-linked annuities. Lower interest rates tend to hurt sales of fixed-rate deferred and fixed immediate annuities.

Source: ChatGPT, from U.S. government sources.

Soon-to-be former Fed chair Jerome Powell deserves more credit for his seven years of service than he gets from President Trump or the public. Powell lifted the fed funds rate (to 5.33% in mid-2024 from 0.09% in January 2021) without triggering an equities avalanche. That was huge.

Powell’s higher rates, besides blunting inflation, generated record sales of fixed deferred annuities. Gross MYGA and FIA sales were $127.8B and $93.8B in the first three-quarters of 2025. (Net annuity sales tend to be closer to zero, given the high rate of surrenders and exchanges.)

Instead of praise for all that, Powell and the Biden administration were blamed for the Covid-era inflation. But that inflation spike, while squeezing many U.S. consumers in 2022, turned out to be temporary and may have prevented a much more painful and longer-lasting asset deflation.

Regarding regulation:

The president, a convicted felon and lifelong scofflaw, opposes regulation. Last January, he mandated the withdrawal of 10 existing regulations for every new one. The deputy Labor secretary for the Employee Benefit Security Administration, Daniel Aronowitz, is an avowed enemy of the regulations on whose basis the plaintiffs’ bar brings class-action suits against retirement plan sponsors.

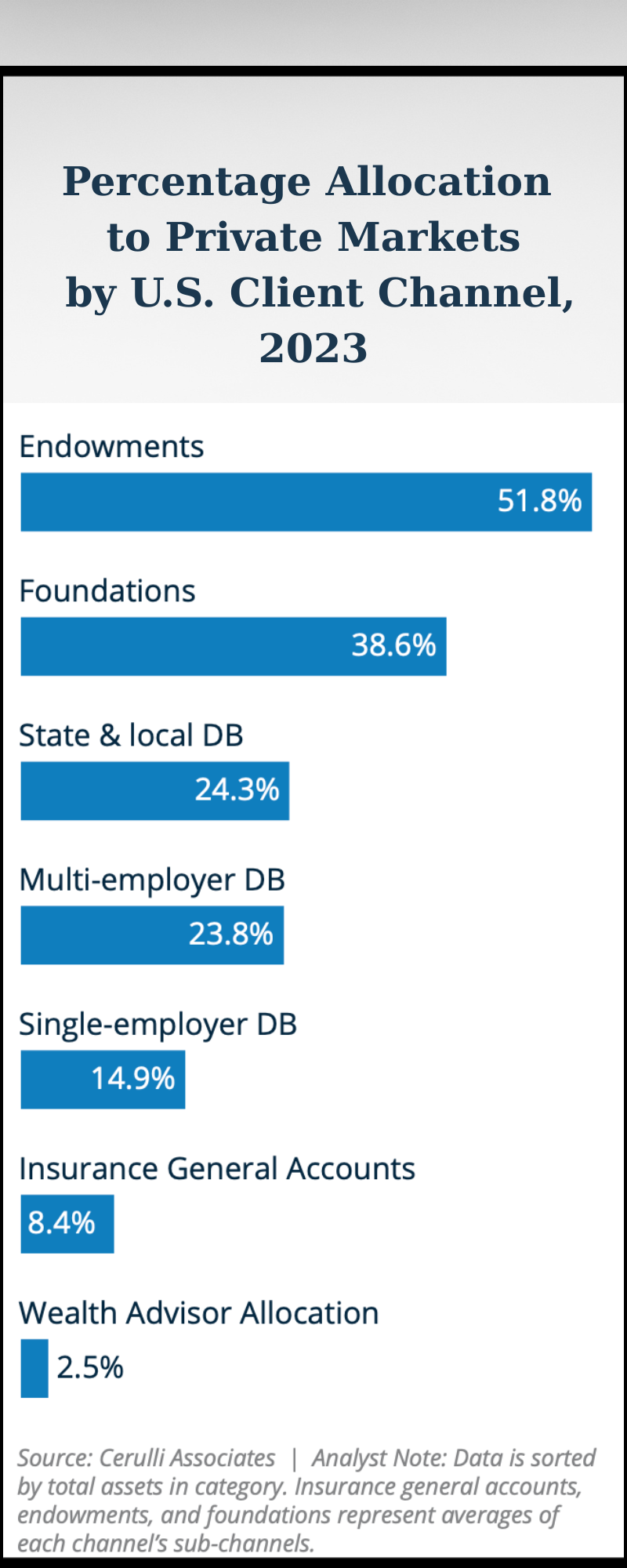

Deregulation in the qualified plan world would remove legal barriers to distributing private market assets, crypto-currencies and deferred annuities through the QDIAs (qualified default investment alternatives) in 401(k) plans, which represent a $10 trillion market.

Alternative assets and collective investment trusts (CITs) instruments are more lightly regulated than the so-called 40-Act mutual funds in 401(k) investment lineups. Like low interest rates, however, deregulation isn’t a free lunch. It can bring higher risk-taking, leading to crashes and litigation.

The point of regulations is often missed. They’re often demonized as distortions of Congressional intent by executive-branch bureaucrats. But laws and regulations are the trunk and branches of the same legal trees. Without regulations, regulators can’t apply or enforce Congress’ laws.

Then there’s political risk in Washington:

It’s never a good idea to put “all your eggs in one basket.” That’s Lesson One for new investors. Diversification makes for a smoother, if less exciting, ride. This principle also applies to politics. But, at least until next January, all our political eggs are in the Trump basket.

* * *

Political power in the U.S. today is concentrated in the Oval Office. Instead of seeking consensus, the chief executive appears to make national policy unilaterally—or float trial balloons for new policies—with social media posts and executive orders. The tariffs mess illustrated the president’s hubris. The Venezuelan adventure even more so.

With the crises in Ukraine and Gaza still far from resolved, we woke on January 3 to learn that the U.S. had, in effect, taken charge of a country of 30 million people and some of the world’s largest untapped oil reserves. The stated goals of arresting and deposing Nicholas Maduro are to stanch the flow of drugs into the U.S. from Latin America and to recover oil rights stolen from U.S. companies decades ago.

An uncertain year just got much less certain.

© 2026 RIJ Publishing LLC. All rights reserved.

As of January 1, 2026, private defined benefit (DB) pensions in the Netherlands have begun converting to collective defined contribution (CDC) plans, as mandated by the Future of Pensions Act, enacted by the Dutch parliament in mid-2023.

An estimated 9.5 million individual pensioners with savings of €1.8 trillion are on the move. By January 1, 2028, all of the Netherlands’ employers, unions, insurers, and premium pension institutions must comply with the new rules.

CDC is a hybrid of 401(k) and DB. In the Dutch version of CDC, workers and employers make mandatory tax-deferred contributions (27% of pay; 18% from employers and 9% from employees) to collectively-managed funds.

Relative to DB fund managers, CDC managers have more latitude to invest in high-yield alternatives, like private credit. Some observers predict that CDC could deliver a 7% increase in retirement income payments. The manager of the largest pension fund estimates the transition could boost investment in private equity and credit investments by about five percentage points—or €90bn—over the next five years.

While participants have “personal accounts,” and accumulations at retirement depend largely on contributions and performance of the collective fund over their lifetimes, the accumulations are not liquid and are paid out only as annuities starting at age 67. A rule that might allow 10% lump-sum distributions at retirement is still in limbo.

“Participants can see their returns and their costs online, but with the collective mandate they don’t control their own pots,” Annette Mosman, CEO of APG, manager of the civil service pension plan ABP, the largest Dutch pension fund.

“There are 20 life-cycle groups [with age-appropriate asset allocations, target-date funds]. The normal retirement age is 67. When you reach age 55, most schemes will let you see what your benefit will be at 67, based on your current salary and assumed returns of 4% to 5%. Our target replacement rate is 70% of the average salary,” she said.

“You could almost call it a tontine,” Jorik van Zanden, a pension consultant at AF Advisors in Rotterdam, told RIJ. No government, corporation or insurer provides guarantees that participants will receive a fixed or rising income for as long as they live. Instead, the fund is managed for long-term sustainability. When participants change jobs, their savings follows them.

Dutch unions, employers and government started talking about DB pension reform some 15 years ago, when low interest rates were crippling plans’ ability to pay inflation-adjusted benefits. Today’s financial Goldilocks moment—with strong equity returns and robust fixed income yields—creates favorable conditions for the change. Workers’ accrued benefits in their old plans are credited to their new plans.

Each industry sector in the Netherlands designs its own pension plan and chooses among more than 100 fund managers. Participants in each plan pool their longevity risk; when participants die before retirement, their notional share of the assets remains in the plans.

Participants also share investment risk. Ten percent of contributions go into a “solidarity reserve.” With market appreciation, the reserve can grow to as much as 30% of the value of the fund. If losses at the fund level threaten to reduce the fund’s ability to meet targeted payout levels (70% of the average wage), the reserve makes up the difference.

“So, if I retire a day before a crash, there’s a possibility that the buffer will dampen the impact,” van Zanden said. It’s called a solidarity reserve, because, by funding a buffer fund, the young to some extent might be paying for the old. In the Netherlands, we prefer certainty to the possibility of higher income.”

“The reserve or buffer will be use when markets work against us, and makes sure that no groups see their benefits shortened,” Mosman told RIJ. It’s worth noting that Dutch CDC entails a single fund into which money is contributed and invested and from which benefits are paid, rather than having two: a risky accumulation fund and a safe distribution fund.

The single-fund approach makes the “smoothing” mechanism possible, keeps all the money invested for potential “raises” in payout rates, but eliminates any chance of guaranteed lifetime income.

There are more than 100 pension funds in the Netherlands, with some €2 trillion under management. The three largest are ABP (for civil servants), PFZW (for the health and welfare sector), and PMT (for engineers and metal workers). They account for about two-thirds of total private pension savings. Dutch plans invest globally and have no obligation to buy Dutch government bonds or to support any particular Dutch industry sector, Mosman said.

Like many countries, the Netherlands has adopted a “three-legged” retirement security model. There’s a basic “first-pillar” pension (the “AOW”) that accrues at the rate of 2% a year for everyone who lives or works in the Netherlands. It is pegged to half the minimum wage. In 2025, the gross monthly payment was €1,580.92 for a retired single person and €1,081.50 for each member of a retired couple, excluding an 8.00% holiday allowance paid annually in May. For those with excess savings, there’s also a “third-pillar,” which resembles U.S.-style 401(k) plans.

For the Dutch, the British and American practice of swapping out a DB plan with a group annuity issued by an insurance company (via a pension risk transfer, or PRT) wasn’t an option, because retirement plans are designed at the industry-sector level, by management and labor, and not sponsored by single employers.

The American practice of closing a DB plan and offering a simple 401(k) wealth-accumulation plan to new employees wasn’t possible in the Netherlands either, where workers had grown accustomed to pensions.

“Each industry sector had a choice between a ‘flexible’ CDC variant and ‘collective/solidarity’ variant. The flexible variant is more like U.S. defined contribution. Most sectors chose solidarity, which surprised many of us. This variant is a good midway point between DC and DB,” Mosman told RIJ.

“It allows the social partners in each plan—the unions, employers and the government—to choose the size of their solidarity reserve. Their actuaries have to demonstrate that the size of the buffer works for all of the age-cohorts in the plan. The reserve or buffer will be use when markets work against us, and makes sure that no groups see their benefits shortened.”

It’s hard to imagine American workers giving up the liquidity and self-directed investing aspects of 401(k) plans, and equally hard to imagine U.S. employers accepting mandatory contributions (on top of payroll taxes). Some U.S. 401(k) plan sponsors are embedding optional deferred annuities in their plans.

But most Americans, unaccustomed to thinking about their 401(k)s as retirement income vehicles, have yet to embrace such options. History suggests that it’s easier for workers to convert to a CDC plan if they’re coming from DB plans—where there was no liquidity—than if they’re coming from DC plans—where there was.

“Life-contingent savings and payments only work when they’re compulsory,” Per Linnemann, a former chief actuary of Denmark, told RIJ. “It would not be attractive in the Anglo-Saxon countries and in Denmark, where you have a choice.

“It may be more appealing to combine income-drawdown with longevity-sharing and survivor benefits at a very old age, when they have the biggest impact,” he said. “By that time, the bulk of the savings will have been paid out as retirement income. This may mitigate participants’ loss aversion when facing the risk of losing a large proportion of their savings if they pass away early in retirement.”

Linnemann is describing, in effect, a program of systematic withdrawals from investments starting at retirement, coupled with a deferred income annuity starting at age 80 or later. Retiree with adequate savings can create such plans themselves, but they’d pay retail for the annuity.

Companies in the Netherlands that don’t belong to any existing sector can choose the flexible variant of the new system, which is like a 401(k), and doesn’t require mandatory contributions to a CDC pension—if they don’t belong to any sector that has a pension.

Booking.com, for instance, claimed that it was a tech company, not part of the Dutch travel sector. “The new corporate models don’t want mandatory contributions. But that’s the strength of the system,” Mosman told RIJ.

Last March, the Dutch Supreme Court rejected Booking’s claim and must participate in the travel sector CDC. The ruling forced the Amsterdam-based company to sign up for the scheme and make back payments dating from 1999, at an estimated cost of more than €400 million.

© 2026 RIJ Publishing LLC. All rights reserved.

The fall 2025 edition of the Journal of Retirement (Vol. 13, Issue 2) is now available. Readers of Retirement Income Journal—no relation—should find something useful here. See brief abstracts of the articles below. Full access to the J of R requires a subscription.

“A Simple Plan to Address Social Security Insolvency,” by Andrew G. Biggs and Kristin A. Shapiro. To close the Social Security funding gap without raising taxes, Biggs and Shapiro present a new framework, starting in 2033, in which monthly benefits would be capped at $2,050 (in 2024 dollars). That amount “would provide full scheduled benefits for roughly half of retirees,” the authors calculate. “Benefit reductions for the remaining, higher-income, half of retirees would be progressive.”

“Evaluating the Role of Life Annuities in Retirement Income Strategies,” by Gaobo Pang and Mark Warshawsky. “Using life annuities maximizes a steady flow of income, can reduce the strain on the remaining un‑annuitized savings, and accommodates growth,” write the authors. “Partial annuitization in combination with withdrawals is generally the best strategy for raising the welfare of retirees.”

“Stochastic Optimal Retirement Planning with Renewable Energy Investments,” by Samuel Essamuah Assabil and Ali Abubakar. Perhaps those with “snow on the roof” (i.e., white hair on the head) should put solar panels up there too. “Solar power and compare outcomes of investing solely in annuities with those from a hybrid strategy combining annuities and solar energy. Despite uncertainty in solar returns, findings show that retirees who diversify enjoy greater financial security,” the authors write.

“A Tax-Efficient Model Predictive Control Policy for Retirement Funding,” by Kasper Johansson and Stephen Boyd. As a way to improve on the classic 4% withdrawal rule for retirement income, these authors recommend “Model Predictive Control.” MPC involves annual tweaks in personal retirement plans. “Each year the retiree forms a new plan for the future years, using the current account values and life expectancy, and optionally, updated information such as changes in tax rates or rules,” they write, asserting that these annual course-corrections can deliver both constant, inflation-adjusted consumption and maximize bequests.

“Generational Differences in Retirement Planning Perspectives,” Hyungkee Baek, David D. Cho, and Doseong Kim. “Millennials [those born 1981 to 1996] exhibit less motivation for retirement saving and a lower preference for long-term planning” but, ironically, are “confident in retirement adequacy, without strong motivation for retirement saving or future time preference,” these researchers conclude after reviewing publicly-available financial surveys.

The Fall issue also includes two commentaries about emergency savings programs: “Workplace Emergency Savings: Key Findings from AARP’s National Survey,” by Warren Cormier and Karen Witham, and “Do Emergency Savings Programs Work and What Is in It for the Employer?” by Brett Hammond and Anthony Webb.

© 2025 RIJ Publishing LLC.

Sales for all types of annuities reached $117.0bn in the third quarter of 2025, up 1.8% from the previous quarter and up 1.5% year-over-year, according to the 113th edition of Wink’s Sales & Market Report.

Athene USA ranked first in overall annuity sales, with a 9.1% market share, followed by Jackson National Life, Corebridge Financial, and New York Life. The report includes sales data from 139 life insurers.

In a second consecutive record-setting period, third quarter sales for all deferred annuities were $113.2bn, up 1.4% from the previous quarter and up 2.0% year-over-year. “Deferred annuities” include all but income annuities.

Athene USA ranked first in deferred annuity sales, with a 9.4% market share, followed by Nationwide, Jackson National Life, Corebridge Financial, and Allianz Life. Nationwide’s Secure Growth 5-Year, a multi-year guaranteed rate annuity (MYGA) annuity, was the top-selling deferred annuity in the third quarter, for all channels combined.

Total third quarter sales for non-variable deferred annuities (MYGAs, traditional fixed-rate annuities, and fixed indexed annuities, or FIAs) were $75.6 billion. Sales were down 2.9% from the previous quarter and down 5.1% year-over-year.

Athene USA ranked first in sales of non-variable deferred annuities, with a 13.5% market share, followed by Corebridge Financial, Nationwide, Massachusetts Mutual Life Companies, and Allianz Life. Nationwide’s Secure Growth 5-Year MYGA, was the quarter’s top-selling non-variable deferred annuity, for all channels combined.

Total third quarter variable deferred annuity sales were $37.5 billion, up 11.7% from the previous quarter and up 20.3% year-over year. Variable deferred annuities include structured annuity (RILAs) and traditional variable annuities.

Jackson National Life was first in variable deferred annuity sales, with a market share of 16.1%, followed by Equitable Financial, Lincoln National Life, Allianz Life, and Brighthouse Financial. Jackson’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity was the top-selling variable deferred annuity in the quarter, for all channels combined.

Total income annuity sales in 3Q2025 were $3.8 billion, up 15.3% from the previous quarter and down 10.7% year-over-year. Income annuities include single-premium immediate annuities (SPIAs) and deferred income annuities (DIAs).

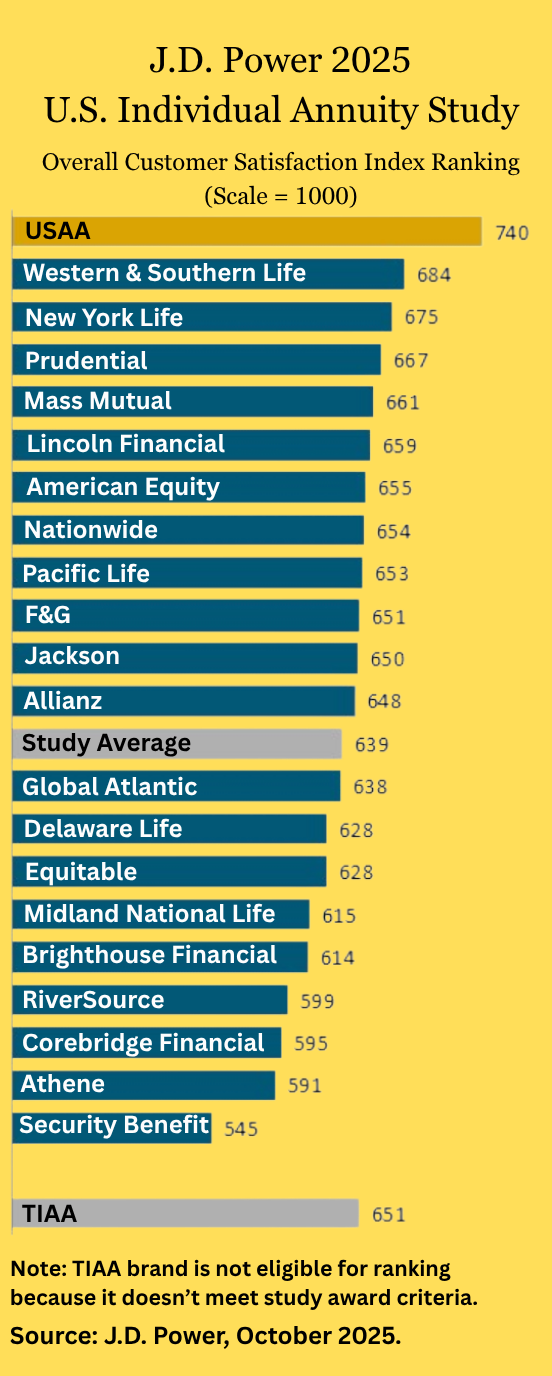

New York Life was the top-seller of income annuities with a 41% market share, followed by Massachusetts Mutual Life Companies, USAA, Nationwide, and Western-Southern Life Assurance Company.

© 2025 RIJ Publishing LLC.

When people speculate about what could “go wrong” with the surge of private credit assets onto life insurance company balance sheets (and potentially into thousands of defined contribution plans), they usually imagine “black swans” that, like the Category 5 hurricane that leveled Jamaica, seem to come out of nowhere. Economists call those “exogenous shocks.”

Or people imagine the periodic blind sell-offs that follow the failures of major financial institutions, when, to paraphrase Warren Buffett, even those who are “wearing bathing suits,” drown in the tsunami’s undertow. These used to be called “panics.”

But the simpler answer is that the intermediaries who work in finance, who earn a geared-up spread from borrowing to lend, or earn fees for creating interest-bearing assets out of nothing, are incentivized to keep doing what they’re doing until it breaks. Some tech fund managers, if you remember, contributed to the dot-com crash of 2000 by accepting new investment long after they knew the sector was over-bought. That’s just a minor example of a endemic phenomenon.

The Financial Times has been waving yellow caution flags about the over-creation and over-distribution of private market assets. In mid-November, the FT published three separate articles on different aspects of the trend. “PE industry backers sound the alarm over rush of retail money into sector,” said one headline. “Apollo shrugs off rate fears with surge in Athene loans,” said another. “UBS warns of ‘looming systemic risk’ from private credit ratings.

All of these articles are looking, from different angles, at the equivalent of a new tulip bulb craze. UBS is, in effect, warning that tulip ratings may be inflated. Analysts are worried that rising tulip sales hide shrinking yields on Apollo’s tulip inventory. A trade group for private equity limited partners worries that mass production of tulips drives down quality for florists.

Maybe the FT is just playing Debbie Downer. But the underlying truism for all three stories is that financial markets are not only not self-regulating, but contain, to use the handiest cliche, the seeds of their own destruction. This idea is at the heart of Hyman Minsky’s hypothesis that financial markets are inherently risky.

Disembodied “markets” don’t risks. People take risks. And when people are using other people’s money, and don’t have sufficient skin of their own in the game, they have no incentive to stop creating assets before the market runs out of either new investors or worthwhile investments. Then it’s Game Over (and cue the Fed).

© 2025 RIJ Publishing LLC. All rights reserved.

A decades-old opinion by the Securities and Exchange Commission leads millions of older Americans to prepare for a financially-secure retirement with, in effect, one hand tied behind their backs. It allows financial advisers to ignore insurance products.

The 1987 opinion (SEC Interpretive Release No. IA-1092) defined “financial planning” services as advice occurring in association with investment advice, which is about buying stocks, bonds, mutual funds and other investments. Advice about buying fixed life insurance and annuities isn’t included in the definition of investment advice.

That interpretation was a mistake. It gives SEC-registered investment advisers a near-monopoly on the provision of paid financial advice. It means that advisers can fulfill their sworn “fiduciary duty” to clients without understanding, explaining or recommending the insurance products that many retirees arguably need.

Technically, the SEC’s omission wasn’t wrong—state insurance commissioners, not any federal agency, regulate insurance companies and their products. But it failed to recognize that insurance is also a financial product, and that investments and insurance are complementary financial tools—especially for retirees.

Investment advice is not the correct regulatory lens for financial planning. To create clarity in the market, we should find ways to distinguish holistic financial advice and comprehensive wealth management from advice that considers only risky investments.

The current legal framework, following SEC Rel. No. IA-1092, incorrectly treats finance as a subset of investments, rather than treating investments as a subset of finance. That approach is just wrong. While there may have been precipitating events and political realities that made it necessary at the time, it does not change the fact that the framework is backwards.

While cash flows into and out of an individual’s portfolio (such as for the provision of safe retirement income) aren’t currently included in an asset manager’s Global Investment Performance Standards (GIPS®-compliant) performance metrics, they should be included in a financial planner’s metrics.

Investment advisers (as distinguished from financial planners) are responsible only for managing portfolios to investment mandates. They aren’t currently required to make sure that their clients’ investment portfolios last for the entirety of their retirements.

Debates over the definition of “fiduciary” conduct fail to ask, “Fiduciary of what?” Investment management is one thing. Wealth management is another. “Wealth” means assets minus liabilities. Since liabilities imply risk, risk management tools—insurance products—should be part of every wealth manager’s toolbox.

If the regulatory framework for financial advice required fiduciary advisers to address and manage each client’s financial risks, then insurance products would likely capture a greater portion of financial markets. More consumers would own them, and many would be better off for it.

With the geometric increase in the numbers of Americans entering and living in retirement, it’s time to change the framework and include insurance as befits its role in optimizing lifetime wealth management. To accomplish that:

The insurance industry should challenge SEC Rel. No. IA-1092, and replace it with a new fiduciary framework that recognizes the value of today’s insurance and annuity products, and equips advisers to include them in their financial planning efforts—especially their plans for retirees.

Michelle Gordon is COO and Head of Retirement & Advisory for Axonic Insurance.

This article reflects the opinions of the author and does not constitute financial, investment, legal, tax, or insurance advice.

These researchers present evidence that counters the common belief that only the healthiest individuals with the most optimistic longevity expectations should buy life-contingent income annuities. This paper asks and answers three questions:

Based on their review of current regulatory and tax rules, as well as evidence on variations in health status and financial accumulations among retirees, they conclude that “better-educated retirees would do well to annuitize part of their 401(k) assets as they can benefit from longevity protection and earn the survival credit.”

On the other hand, “The least educated tend to have little wealth and are at greater risk of entering nursing homes at earlier ages, so they prefer to keep their assets liquid in order to better manage unexpected health care and LTC expenses.” The authors aver that “our results provide clear guidance about when to purchase these annuities, how much to purchase, and when the deferred benefits should start.”

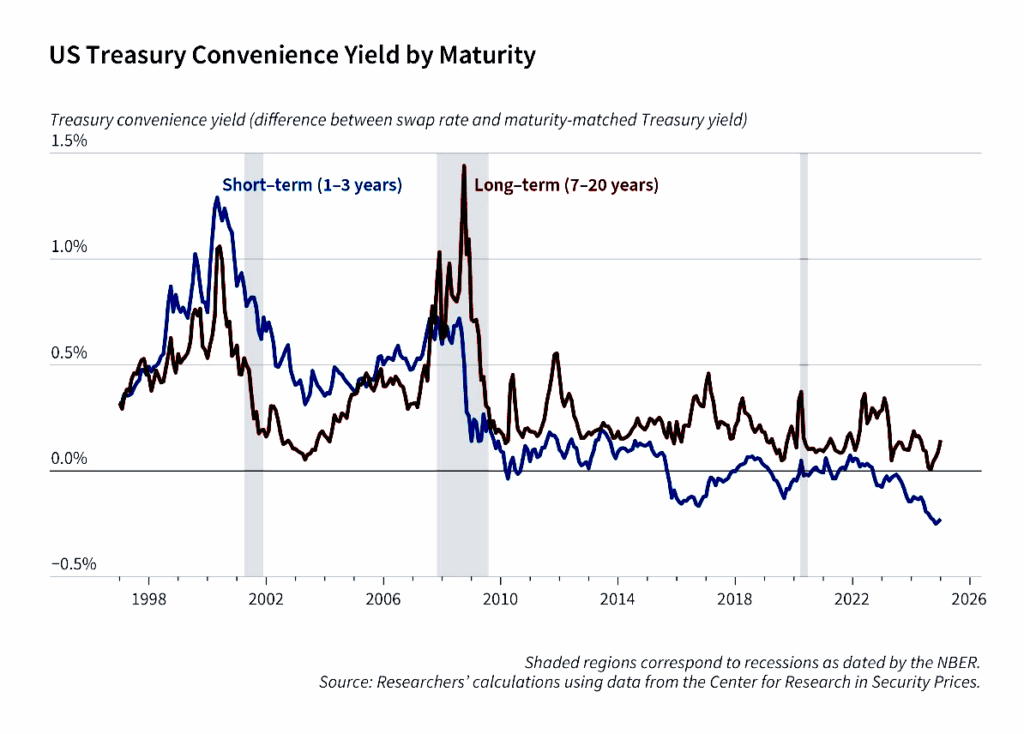

The equity price crash that followed the White House’s “Liberation Day” announcements of huge protective tariffs on America’s trading partners was itself followed a few days later by a spike in long-term Treasury bond yields. A new NBER paper explains why.

It has to do with the rebalancing imperatives of target date funds (TDFs) and other target allocation funds (TAFs). To maintain their target allocations after equity prices dropped, managers of these funds-of-funds sold bonds and bought equities. In doing so, they forced managers of the underlying bonds funds to sell bonds too.

“TAFs are expected to again double in size over the next decade. Moreover, the bond portion of TAF holdings is expected to increase, due to an aging population. As a result, we should expect to see even more cross-market transmission through TAFs and the impact on stock-bond correlation will likely increase even further in the future,” the authors concluded.

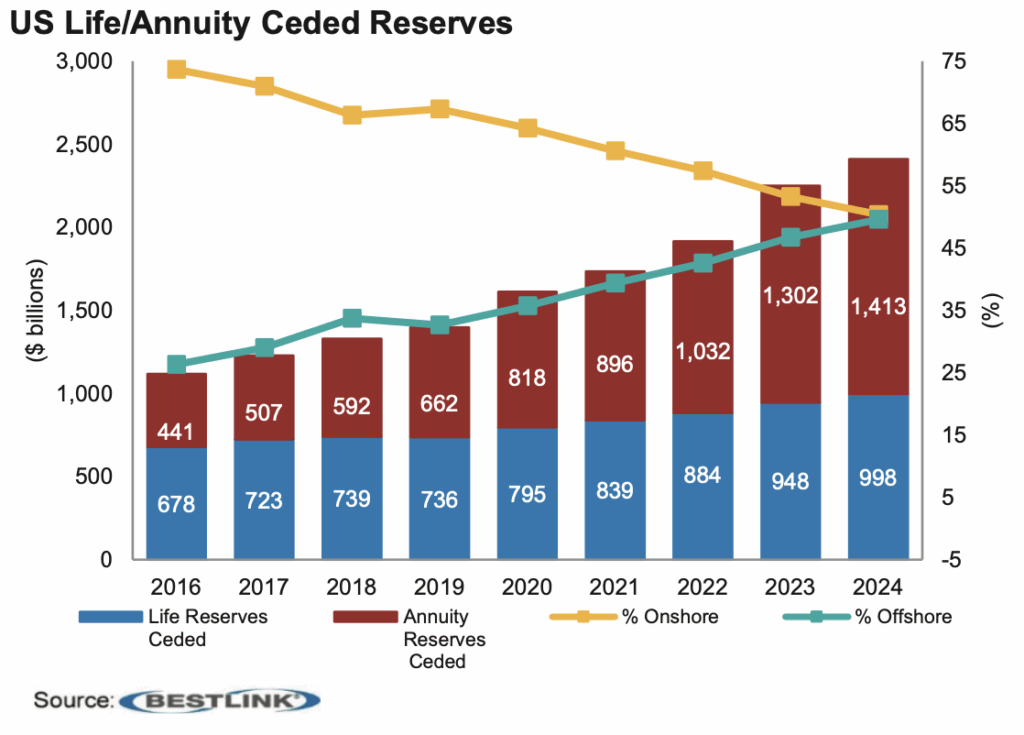

This paper examines the scope and implications of the growth of the “private credit,” “direct lending,” or non-bank loan industry. The volume of non-bank lending has grown ten-fold to an estimated $2 trillion since the Great Financial Crisis of 2008, the paper shows. Of that amount, 75% has gone to private equity-backed companies. Some of these loans are then bundled into collateralized loan obligations (CLOs) whose senior tranches are increasingly purchased by annuity-issuing life insurers.

The paper asks whether and by how much the direct lending business is likely to grow and whether it will continue to replace bank lending. It suggests that direct lenders and banks often collaborate on customized loans to high-risk borrowers. The authors touch briefly on the risks that that alternative investments might pose for life/annuity companies or their policyholders.

“Today’s private debt market is highly competitive and dominated by a small number of very large players. Most of these are alternative asset conglomerates—such as the “big four”: Blackstone, Apollo, KKR, and Carlyle—that operate across a wide range of investment strategies beyond private debt. Private credit funds represent just one segment of the many funds they manage,” notes the author of this paper.

Those four companies are also heavily invested in the annuity-issuing life insurance business (as owners of insurers or as their investment advisers). The overlap makes this paper useful reading for anyone interested in understanding where life insurers fit into the larger context of the private credit business that has grown so much since the 2008 financial crisis.

The author believes that private lending is a positive economic force. But she also identifies its risks: concentration, opacity, and high leverage. “The specific concern,” she writes, is “that, through a complex set of transactions, the same underlying cash flow stream supports a higher burden of leverage. Consequently, a negative shock to that cash flow could destabilize all of the related structures.”

Retirement scholars have recommended that Americans delay their first Social Security payments (until age 70, ideally) and live on 401(k) savings if they retire before then. In this paper, the authors claim that, from an efficiency perspective, Americans would swap their Social Security credits to buy government-issued deferred income annuities. The deferral period would be proportionate to their life expectancies and accumulated savings.

“The optimal path of Social Security benefits for an individual who has retired with a stock of wealth, faces stochastic mortality, and has no access to annuities and no preferences for bequests… is a deferred annuity in which the government annuity pays out zero for some periods and a constant amount after that,” the authors write.

“The individual will optimally front-load their consumption out of their initial wealth, and will gradually lower their consumption rate until [they run] out of their own wealth and [hit] the Social Security payment rate at [time] t∗, at which point they are on a constant consumption rate and consume their Social Security payment.”

“The government would look at your savings and life expectancy and set a date for your Social Security benefit to begin,” co-author Einav told RIJ. “This would be the most efficient way for the government to apply your benefit to you. Instead of people taking their benefits willy-nilly.” But “it’s not a policy recommendation,” he added. “We’re not analyzing data or making empirical findings. We’re making a theoretical point.”

© 2025 RIJ Publishing LLC.

Those who deal in private market assets know that it can take years for such investments to pay off. And for good reason. It’s illiquidity, after all, that delivers the illiquidity premium. But some private market investors inevitably want to drink their wine before its time, so to speak, and cash-out early.

That’s where “secondaries” have become increasingly important. Partners—general and limited—in private equity (PE) funds can now find buyers for their stakes without waiting for an initial public offering. And managers of private credit funds (collateralized loan obligations, or CLOs) can now cull loans from their stacks without calling them in.

Secondaries can do more than make PE and CLO stakes more negotiable. They can broaden the appeal of PE and CLO investments. They might also expand the market for them. Could secondaries be the bridge that carries private assets into the defined contribution world? Do secondaries matter to the Bermuda Triangle strategy?

To learn more about secondaries, we turned to ChatGPT. It started by distinguishing between primary investments, secondary investments, and what it called “primary secondaries.”

RIJ: What are “secondaries,” and why all the fuss about them?

ChatGPT: “Primary secondaries” sit at the intersection of private-equity mechanics and investment-market evolution. Let’s unpack it step by step.

The term comes from private-equity (PE) and private-markets investing:

Primary investments: when a limited partner (LP) — say, a pension fund or endowment — commits fresh capital to a new private-equity fund at launch.

Secondary investments: when an investor buys an existing stake in a private-equity fund (or portfolio company) from another LP who wants liquidity before the fund winds down.

Now, a primary secondary (also sometimes called a GP-led continuation fund or a structured secondary depending on context) blurs that line:

It’s a new fund (a “primary”) created specifically to buy assets out of an existing fund (a “secondary”) — often led by the same general partner (GP).

In practice:

So: Primary because it’s a new fundraise. Secondary because it’s buying existing assets.

In recent years, private markets have become enormous and illiquid — and LPs need ways to get cash out before waiting 10–12 years for fund wind-downs.

At the same time, funds are taking longer to exit their portfolio companies (IPO and M&A markets are slower).

That combination makes the secondary market for private assets explode — it exceeded $130 billion in annual volume globally.

Within that, GP-led “primary secondaries” are the fastest-growing sub-segment because:

GPs can hold on to prized assets longer.

LPs get optional liquidity.

New investors get exposure to mature assets (with lower J-curve risk) at often discounted valuations.

Critics call them “financial engineering” or “optics games” — because GPs are both buyer and seller, setting prices between two related vehicles.

Hence the fuss: Are these fair-market transactions or a way to sidestep poor exits?

Regulators and investors worry about conflicts of interest, valuation transparency, and fee layering (the GP earning new fees on old assets).

Defenders argue they align interests: LPs can choose liquidity or continued exposure, and great companies aren’t sold prematurely just to fit a fund’s time horizon.

Large institutional investors — Blackstone, Lexington Partners, Ardian, Coller, HarbourVest — now run multibillion-dollar secondary programs; many asset allocators view GP-led deals as a permanent fixture of the PE landscape.

Primary secondaries are now a key innovation that helps private-equity firms manage liquidity in a high-AUM, low-exit environment.

They’re controversial because they blur the boundaries between buyer and seller, fee structures, and investor transparency.

Although the word secondaries originated in the private-equity context, its logic—creating liquidity, redistributing risk, and recycling assets—now bleeds into the insurance-asset-manager ecosystem in a few ways.

Asset managers like Apollo, KKR, and Blackstone increasingly hold illiquid private-credit loans, CLO tranches, or structured securities inside their insurance portfolios.

As those assets season, they can be repackaged and sold to other investors — much like a secondary PE transaction — to free up capacity for new origination or to manage duration/risk.

These sales may take the form of secondary transactions in private-credit funds, loan portfolios, or CLO mezzanine tranches.

This secondary-market recycling helps maintain yield targets and liquidity within the Bermuda-Triangle loop — allowing the same families of entities to trade with each other or with outside buyers at current marks.

Some Bermuda reinsurers and affiliated asset managers now use NAV-based financing (a cousin of secondaries) — borrowing against the net-asset-value of their private-credit portfolios to fund new annuity purchases or asset origination.

In effect, secondaries and NAV finance act as synthetic liquidity valves for the insurance-asset complex, allowing continuous growth without waiting for maturities or sales.

Here’s how the mechanics align conceptually:

So, while the Bermuda Triangle is not about PE secondaries per se, the same structural logic applies:

Long-dated, opaque, illiquid assets require an aftermarket — a secondary layer — to keep the system liquid and expandable.

That’s exactly what “secondaries” provide: a way to re-price, recycle, and redistribute exposure without formal liquidation.

The Triangle depends on ever-expanding balance-sheet velocity—annuities bringing in fresh liabilities, credit origination supplying assets, and reinsurers freeing capital.

Secondaries markets (private credit, CLOs, fund interests, NAV loans) are becoming the plumbing that lets that system keep spinning while appearing stable.

Regulators and rating agencies are watching this closely, because if those secondary valuations ever seize up (say, during a credit crunch), both the liquidity and reported solvency of the system could be tested.

Secondaries are to the modern Bermuda Triangle what repo markets were to pre-2008 banking —a critical but sometimes invisible layer of leverage and liquidity.

*NAV (Net Asset Value) lending is a form of fund-level financing where loans are secured by the value of a private equity fund’s investments rather than the uncalled capital commitments of limited partners (LPs). NAV-based credit facilities provide liquidity to private equity funds by allowing them to borrow against the underlying portfolio. With the growth of private equity as an asset class, the NAV lending market has expanded significantly, with transaction sizes increasing from millions to upwards of $1 billion in recent years.

© 2025 RIJ Publishing LLC. All rights reserved.

The Treasury Department recently released its estimates of government spending, revenues, and the deficit for the fiscal year 2025, which ended on September 30. For those willing to look beyond political rhetoric, the data clearly show the severity of our budget crisis.

Non-wartime deficits relative to our national income at this level of low unemployment are at all-time highs, while debt as a share of national income will soon reach records, even surpassing what was needed to fight World War II.

The data also reveal why our budget choices reflect those of a declining economy. Very little in the largest spending categories is allocated to workers and their families, or to efforts that would promote upward mobility and wealth building for most individuals. [To learn about Steuerle’s latest book, Abandoned, click on image at right.]

Meanwhile, recent legislation and executive actions primarily focus on vulnerable constituencies rather than on the parts of the budget that continue to increase the national debt at unsustainable rates.

Meanwhile, recent legislation and executive actions primarily focus on vulnerable constituencies rather than on the parts of the budget that continue to increase the national debt at unsustainable rates.

The deficit for 2025 hit $1.8 trillion, roughly the same as in 2024. At six percent of GDP, it’s unlike anything we’ve seen during times of relative prosperity. For example, from 2013 to 2019, after the initial recovery from the Great Recession, the deficit was at 3.4 percent.

Remember, a non-recessionary deficit of 3.4 percent is already unsustainable because it doesn’t provide enough resources to handle a recession or emergency. The COVID-19 and post-COVID-19 years clearly show this failure, as the debt-to-GDP ratio surged and continued to rise afterward. Budget deficits have been a concerning trend throughout this century, and the situation has only gotten worse.

The largest spending categories in the budget are Social Security and Medicare, other health care expenses (mainly Medicaid and Obamacare), interest on the debt, and defense (see graph above). The first four have been increasing automatically—that is, without new appropriations—at a very rapid pace. Meanwhile, Congress has been enacting significant increases in defense (the fifth-largest item) and veterans’ benefits.

Even with those increases, the interest on the debt surpassed defense spending for the first time in U.S. history only last year and this year. The other items in the budget have been growing at a much slower rate than our national income and, in some cases, have not increased at all in real terms.

So what did Congress and the President do this year? They reduced income taxes while passively allowing the President to offset some of those cuts with tariffs. Regardless of their constitutionality, tariffs imposed whimsically by the President are a highly inefficient, price-increasing source of revenue. They often decrease the international competitiveness of the very industries they claim to support.

On the spending side, Congress and the President focused on government employees, foreign aid recipients, and other smaller budget items.

The only exception was the cutback in health programs other than Medicare, with some reductions in the growth rate for Medicaid and Obamacare exchange subsidies. A significant portion of those cuts will affect lower-income beneficiaries. While controlling government health spending is necessary, it won’t be effective if it targets only those groups.

Additionally, many beneficiaries will likely visit emergency rooms more often, and hospital administrators will probably find ways to pass those costs onto you through higher insurance charges.

Once again, I urge you to look at the graph. Is this the kind of government you support? Are you comfortable passing so many costs onto future taxpayers, including any children and grandchildren you might have? Do you agree with spending priorities that largely ignore working families?

Do you approve of how the government has responded this year with tax cuts that further fuel unsustainable deficits and debt? Do you support cultural warfare and attacking vulnerable groups in small parts of the budget rather than focusing on the broader policies that address how the government collects and spends your money?

Lastly, are you willing to give up something now to free up resources for something better in the future?

© 2025 Eugene Steurele. Reprinted with author’s permission.

U.S. annuity sales totaled $119.3 billion in 3Q2025, a new quarterly sales record in the third quarter of 2025, according to preliminary results from LIMRA’s U.S. Individual Annuity Sales Survey, which represents 89% of the total U.S. annuity market.

At $345 billion (up 4% YOY), annuity sales in the first three quarters of 2025 were the highest ever recorded for the first nine months of any year. Sales have exceeded $100 billion for eight consecutive quarters.

“Although the Federal Reserve’s expected interest rate cuts will likely dampen fixed annuity sales gains, LIMRA is projecting annuity sales to surpass $450 billion in 2025,” said Bryan Hodgens, senior vice president and head of LIMRA research, in a release.

“Registered annuity products – traditional variable annuities and registered index-linked annuities – posted double-digit growth, contributing to the overall growth in quarterly sales. Despite continued market volatility, the equity market’s overall performance attracted investors looking to counter persistent inflation,” he added.

MetLife, Inc., and Alight, Inc., are partnering to put MetLife’s institutional income annuities on the Alight Worklife platform, which serves nearly 12 million defined contribution (DC) plan participants, an October 29 Alight release said.

Alight’s plan sponsor clients will have access to MetLife’s Guaranteed Income (MGI) fixed immediate annuity and Retirement Income Insurance (RII) QLAC, a fixed deferred income annuity, within their DC plans. Participants will be able to purchase these solutions and convert a portion of their savings into predictable monthly income.

The collaboration complements Alight’s partnership with Goldman Sachs Asset Management, L.P. (GSAM). GSAM will serve as a sub-advisor in the Alight Financial Advisors (AFA) Defined Contribution solution.

Agatha Global Tech (AGT) has launched GrantAI on its flagship platform, Annuities Genius. The artificial intelligence-driven process will allow advisors to research, compare, design, and communicate personalized annuity recommendations through a single conversational interface, according to a release and new whitepaper.

The tool gives advisors access to more than 2,000 products and instant quotes for more than 250 income riders. The AI capability assists with product matching, visualization, and documentation. The founder and CEO of Agatha Global Tech is David Novak.

GrantAI is powered by AGT’s proprietary data infrastructure, connected to the calculators, comparison, simulation, and illustration tools of Annuities Genius. For example, in searches for fixed indexed annuities, the AI allocator instantly optimizes allocation plans, explains rationales, and generates supporting materials.

A proposal to limit disclosures of insurers’ risk-based capital (RBC) ratios by a joint task force of the National Association of Insurance Commissioners (NAIC) is inconsistent with the life insurers’ trade association’s preference for transparency.

The RBC issue will be discussed further at a Nov. 19 NAIC online meeting.

In March, the NAIC’s Capital Adequacy and Risk-Based Capital Model Governance task forces proposed prohibiting any publication, dissemination or circulation of RBC levels. Some regulators have said that RBC levels don’t provide clear or meaningful ways to rank insurers, according to AM Best.

But the American Council of Life Insurers (ACLI) has objected that limitations of RBC disclosures could result in a “significant lack of transparency” into an insurer’s financial health and complicate validation of RBC-related information for rating agencies, investors and reinsurance. The ACLI said regulators should promote strengths of the RBC system rather than highlight its weakness.

“RBC is no longer solely used to ‘identify weakly capitalized companies,'” the ACLI wrote to regulators. “It is now part of a complex solvency assessment and regulatory framework that includes other tools like the own risk solvency assessment and liquidity stress testing that support efforts to assess capital adequacy and risk management.”

© 2025 RIJ Publishing LLC. All rights reserved.

Axonic Insurance, an annuity and insurance platform that facilitates annuity/alternative asset/offshore reinsurance strategies, has received a $210 million preferred equity investment led by LuminArx Capital Management (LuminArx) and Deutsche Bank.

The investment from LuminArx and Deutsche Bank “will support Axonic Insurance’s continued growth across retail and institutional distribution channels while also enabling it to further accelerate technology development and enhance product servicing capabilities,” a release said.

Axonic was the subject of an April 2024 article in RIJ. “We’re decomposing the insurance industry into its parts,” Axonic Insurance CEO Michael Gordon (pictured above left) told RIJ at that time. “We want to make Lego sets, and put pieces together.”

According to a 2024 press release, “Axonic Insurance works closely with institutional partners to design, manufacture, and distribute fixed annuities on a global basis. In addition, Axonic Insurance provides investment advisory services for insurance-company general account portfolios.”

Axonic Insurance is wholly owned by Axonic Capital, a $7 billion New York-based alternative investment manager founded in 2010. The firm specializes in structured credit, commercial and residential real estate debt and equity, and systematic fixed income.

Axonic Insurance is licensed in all 50 states and the District of Columbia to sell annuities issued by non-affiliated, Oklahoma-domiciled AmFirst Life. Axonic has created an affiliated life insurer, Texas-domiciled Axonic Annuity and Life Insurance Company. But Axonic said that its new Texas insurer has no immediate plans to issue annuities.

Axonic Insurance also sees potential for the sale of annuities globally. Its affiliated underwriter in the Cayman Islands, Axonic Insurance Company SPC, is licensed to issue annuities outside the U.S. Those products are serviced by Axonic Services LLC, a Puerto Rico LLC.

Linking the capabilities of Axonic Capital, AmFirst Life, and an offshore life insurer, Axonic Insurance has all three capabilities required for the business model that RIJ has called the “Bermuda Triangle,” but out of the Cayman Islands instead of Bermuda. It provides those capabilities for its parent and in the role of a “business process outsourcer” for others.

But an Axonic Insurance spokesperson told RIJ that its business model relies less on transactions with affiliates and less on offshore “regulatory arbitrage” than a pure Bermuda Triangle strategy, where asset manager, life insurer, and offshore reinsurer are all in the same holding company and take advantage of Bermuda’s flexible capital requirements.

Instead, almost all of Axonic’s annuities will be issued by an unaffiliated insurer (AmFirst Life), Axonic told RIJ. It also uses third-party asset managers in addition to its parent, Axonic Capital, and its Cayman-based life insurer maintains stringent U.S. RBC (risk-based capital) standards instead of local capital standards.

© 2025 RIJ Publishing LLC. All rights reserved.

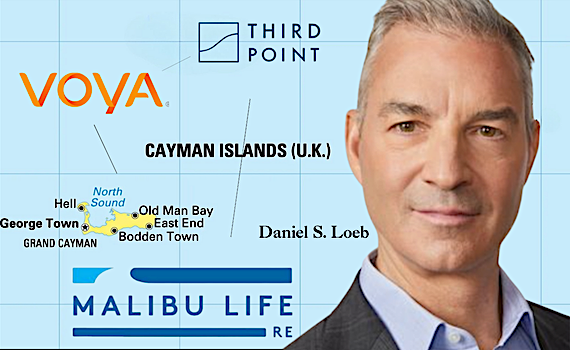

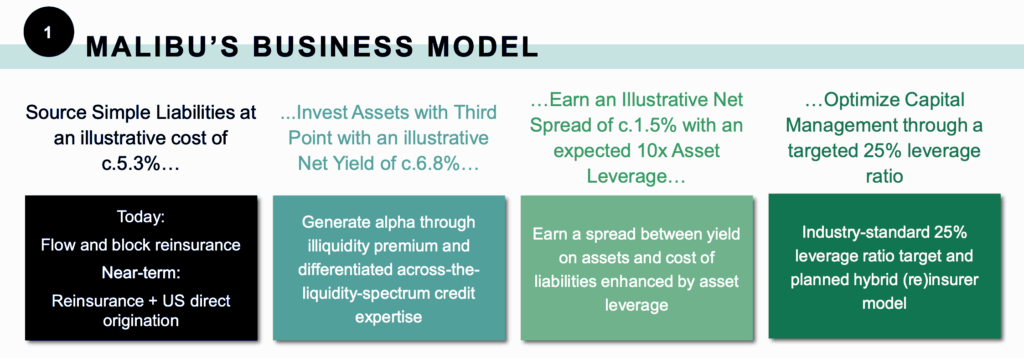

Daniel S. Loeb, the billionaire CEO of asset manager Third Point Investors Ltd., is all-in on the arbitrage that RIJ calls the “Bermuda Triangle.” That’s the synergistic linking of U.S. annuities, private credit, and offshore reinsurance.

Loeb is a latecomer to a semi-mature, crowded, interest rate-sensitive, complex business. It’s a business that has drawn scrutiny from U.S. and global regulators. Presumably, he knows all that. In little over a year, Loeb and his team have:

Loeb’s main departure from the Bermuda Triangle template involves choosing the Cayman Islands instead of Bermuda as Malibu’s headquarters. [See Malibu Re’s recent investor presentation.]

Otherwise, he’s following the playbook written by Apollo/Athene, KKR/Global Atlantic, Brookfield/American Equity, etc. Like them, Loeb has set up the pure version of the Triangle. It can issue and reinsure it own fixed deferred annuities offshore, do “block” or “flow” reinsurance for others, dabble in pension risk transfer (PRT) deals, originate private debt and sell tranches of bundled high-risk loans to its own insurer.

Key staffers in the new venture include Loeb, Robert Hou, and Gary Dombowsky. Loeb, 63, is not a direct descendant of the founders of the investment firm Kuhn, Loeb & Co. (which lasted from 1867 to 1984). His father, Ronald, was a director and briefly president at Mattel. His great-aunt, Ruth Handler, created Mattel’s Barbie doll.

A 1984 economics graduate of Columbia, Loeb worked in distressed debt and high-yield bonds as an executive at Jeffries LLC and Citicorp, respectively, in the early 1990s. He started Third Point Management in 1995 “with $3.3 million from family and friends.”

Robert Hou, who will serve as Malibu’s COO, joined Third Point in 2021 from Blackstone’s Insurance Solutions Group. He had helped launch that group, which now manages hundreds of billions of dollars in insurance company assets. In 2023, Loeb hired Christopher Taylor, CEO of private credit specialist Apogem Capital, to lead Third Point’s private credit team. Last month, three former Apogem private credit professionals joined Third Point, Bloomberg reported in October.

Gary Dombowsky

For experience running a reinsurer in the Cayman Islands, Third Point hired Gary Dombowsky as CEO of Malibu. Dombowsky had co-founded Knighthead Annuity & Life with $230 million raised from 30 investors in 2014. His co-founder, Nate Gemmiti, is now CEO of Cayman-based Triangle upstart Ibexis Life & Annuity.

In October 2020, Dombowsky and Gemmiti founded the Cayman International Reinsurance Companies Association (CIRCA). The two had a shared history at Scottish Re’s since-defunct reinsurance operations (later bankrupt) in the Cayman Islands. Dombowsky left Knighthead and joined Malibu this year.

In its new organization, Third Point owns all of Malibu Holding, which owns all of Malibu Life Re and TruSpire. Malibu Life Re owns all of Malibu Life Re Segregated Portfolio 1.

TruSpire, which Third Point last month announced plans to acquire from Mutual of America by early 2026 for about $45 million. The life B++ insurer is licensed in 44 states. It’s a member of the Federal Home Loan Bank, a key lender of low-cost funds to Bermuda Triangle companies.

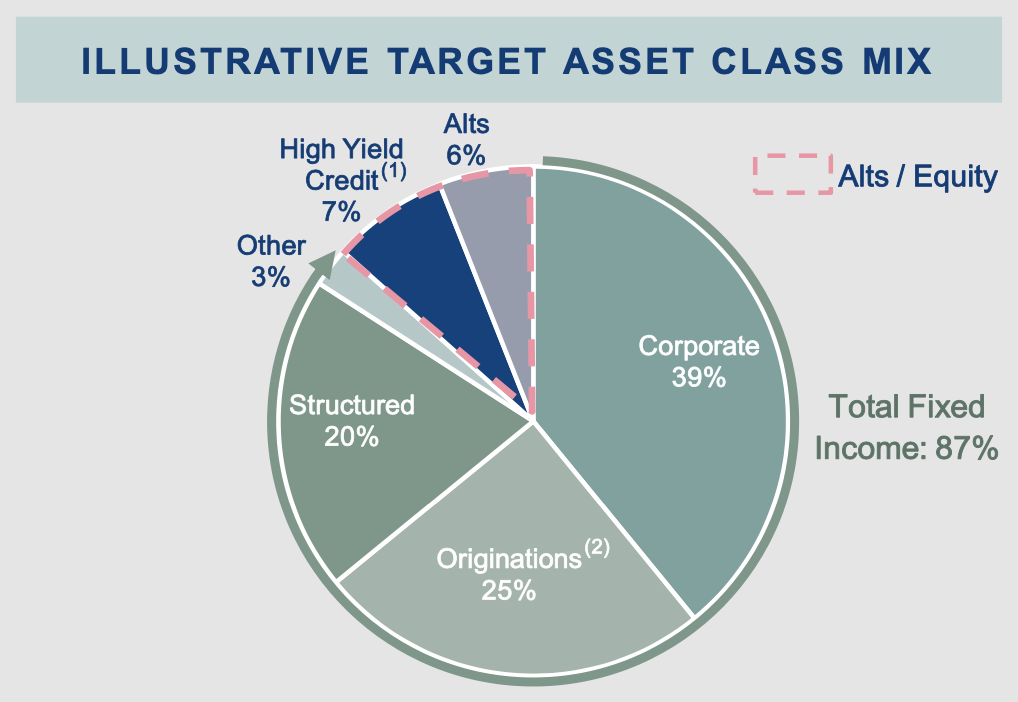

Malibu Re’s target asset class mix. Source: Third Point Investors Presentation, July 2025.

Mutual of America had acquired Landmark Life in October 2023 and renamed it TruSpire with the intent of selling fixed index annuities and competing for PRT deals. AM Best gave TruSpire an a- (Excellent) rating two years ago but updated that to bbb+ (Good) and “under review with developing implications” after the Malibu Re deal.

Malibu Life Holdings, at last notice, has been more or less an address in George Town, Grand Cayman. It has so far outsourced most of its functions; its local management and Cayman residency requirement is furnished by a Cayman company, Artex (Artexrisk.com).

Malibu Life Re has already reinsured $981 million in annuity liabilities (on a 25% quota share, funds-withheld coinsurance basis) for an unnamed “blue-chip” U.S. annuity platform that was established in 2020. There’s an estimated $2 billion more in that pipeline.

Voya is also in the picture, as an investor, and possibly more. Voya Retirement Insurance and Annuity and Voya-unit ReliaStar Life Insurance Company both agreed last July to buy up to $25 million in ordinary shares of Malibu.

Is Voya Malibu’s anonymous blue chip reinsurance partner? A Voya spokesperson offered a “no comment” response.

Malibu’s acquisition of private credit specialist Birch Grove, which raises Third Point’s total AUM to ~$21 billion, should give Third Point new expertise in finding borrowers, originating leveraged loans and bundling the loans into collateralized loan obligations (CLOs).

From Third Point Investors presentation

Malibu’s prospectus included this statement about its investment philosophy: “For assets backing reserves, Third Point will invest predominantly in high quality fixed income securities with robust cash flow modeling to match liability cash flows which prioritizes income and preservation of capital and mitigates market risks. For surplus assets, Third Point will invest prudently in return-enhancing assets while considering their volatility and impact on Malibu’s capital.”

[This approach may strike readers as counterintuitive. Unlike, say, the salt line between a river and the sea it empties into, there’s no clear line in an insurer’s general account between surplus assets and reserve assets. The capital and surplus are simply the excess of assets (what others owe the insurer) over liabilities (what the insurer owes others). As a rule, practitioners of the pure Triangle strategy (e.g., Apollo and KKR) minimize their surpluses and maximize their “return-enhancing” assets. On its face, Third Point’s stated investment strategy sounds prudent—but potentially inconsistent.]

In 2024, Third Point’s back was to the wall. Its flagship closed-end fund was trading at a 20% discount. Investment returns were lagging the benchmark. Its investors were restless. In August 2024, Loeb created a team to brainstorm a corporate reboot.

Loeb’s decided to do a “reverse takeover” that would turn Third Point into London-listed Malibu Life Holdings and clone the Apollo/Athene insurance strategy. That proposal didn’t please all the investors, who marshalled opposition to it.

One Third Point investor told the Financial Times in August 2025 that the proposed business was a latecomer in a crowded field. “Every alternative asset manager now has some sort of reinsurance or insurance client,” said Tom Treanor of Asset Value Investors, part of the investor group opposed to the takeover.

But Loeb, a 25% owner of Third Point, was able to get the 50% vote he needed to push the plan through. Rupert Dorey, chair of the board of Third Point Investors, told the Financial TImes, “The board is confident it has found that balance through a thorough, transparent and independent process, and on behalf of shareholders is genuinely excited by the potential within Malibu.”

Even if Loeb is a latecomer to the party, the party may be getting much bigger. In an August executive order, President Trump blessed the distribution of private credit, crypto, and annuities through 401(k)s. There’s about $9 trillion in U.S. defined contribution plans, and trillions more in other retirement vehicles. Whether regulators will remove all barriers to the distribution of alternative assets through qualified plans remains to be seen. BlackRock, Apollo and Empower are campaigning to make sure they will.

What could spoil the party? A couple of things. Changes in interest rates could affect revenues from the sale of fixed deferred annuities, which play a critical role in financing the loans that asset managers bundle into collateralized loan obligations (CLOs). Higher rates, as we’ve seen, make fixed-rate annuities more attractive. Lower rates—which President Trump has demanded—boost equity prices, which boosts the crediting rates of fixed index annuities. The Fed has lowered rates by a quarter-point twice this year.

Legal arbitrage—between state/federal regimes and onshore/offshore regimes—is also essential to the success of the strategy. Any new regulations that shrink the benefits of offshore reinsurance or spoil the internal synergies of the pure Triangle strategy (where counterparties are sometimes closely-affiliated rather than at arm’s-length) could hurt the trend. In any future Democratic administration, the Labor Department may try (again) to reclassify FIAs as securities, or to put regulatory hurdles between them and qualified plans.

Of course, a big credit crisis would wreak havoc with CLO valuations.

© 2025 RIJ Publishing LLC. All rights reserved.

The secret to successful asset management, one hears, is to acquire other people’s money at low cost and hold onto it as long as possible (keeping it “sticky”). If so, the business of gathering funds by selling long-dated fixed indexed annuities to Boomers should be ideal.

Since the mid-2010s, the biggest “alternative-asset managers,” or AAMs—Apollo, KKR, Blackstone, etc.—have entered the annuity business and used it to finance their private credit operations. Leveraged with offshore reinsurance, it’s a model RIJ has called the “Bermuda Triangle” strategy.

New research from Harvard Business School shows just how successful this strategy has been for the AAMs. From 2014 to 2024, “total AUM of publicly listed AAMs grew five times, from $1.1 trillion in 2014 to $5.5 trillion… [and] $2.5 trillion in credit-focused AUM, almost ten times what they had in 2014.”

The paper, “Permanent Capital Meets Private Markets: The Transformation of Alternative Asset Managers,” documents the “structural change” in the “funding architecture” of 11 publicly-listed AAMs with assets under management of $100 billion or more as they bought, started, or partnered with life/annuity companies.

RIJ’s reporting has focused since 2020 on the way the AAMs’ money changed the life/annuity business. In their paper, Harvard economist George Serafeim and three analysts from State Street Global Advisors show how the life insurers’ money changed the AAMs.

From their perspective, the AAMs needed access to the life insurers’ general account assets because their existing sources of deal capital were shrinking. From RIJ’s perspective, life insurers were weakened by the Great Financial Crisis, regulation and the Fed’s ZIRP policy. AAMs supplied them with cash and investment expertise.

“The appeal of insurance products to AAMs can be understood based on the limitations of existing fund-raising avenues, product scope, and market valuation,” the paper said. “Closed-end private-equity and private-credit funds require periodic vintages, each preceded by a marketing cycle and followed by distributions that return capital to limited partners.”

That was a Sisyphean model. “This episodic model obliges general partners to remain in quasi-permanent fund-raising mode and subjects fee momentum to macro-cyclical investor sentiment,” the authors found. “Life insurers, by contrast, collect policyholder premiums continuously; fixed and fixed-indexed annuities alone generated roughly $280 billion of new deposits in the United States during 2024.”

The authors divide the 11 big AAMs into three categories, heavily, lightly or not at all invested in the insurance business. Apollo (affiliated with Athene), Brookfield (with American Equity Investment Life), and KKR with Global Atlantic, were the three most heavily invested.

The paper show how the AAMs directed insurance funds into private credit:

There’s a downside to the insurer partnerships for publicly-held AAMs, the paper points out. “Public markets assign lower valuation multiples to insurance-integrated AAMs,” the authors write. “Insurance integration requires navigating solvency regulation, asset–liability management, and complex capital structures. Cross-border reinsurance arrangements introduce opacity, and the commingling of fee and spread businesses raises questions around governance, risk appetite, and cultural fit.”

The complexity of the Bermuda Triangle strategy stems in part from its use of regulatory arbitrage. The AAMs are SEC-regulated. The insurance companies are state-regulated. The reinsurers are in Bermuda or the Cayman Islands. The strategy allows the AAMs to sell investment-like products under state supervision and to use Bermuda accounting standards to manage down the capital requirements that can make annuities a tough business.

We should clarify what we mean by “investment-like products.” There’s a misconception about today’s most popular annuities that the HBS paper doesn’t correct. The AAMs don’t sell the sort of traditional annuities that people buy in their 60s for income in retirement. Instead, they mainly sell fixed deferred or options-based fixed indexed annuities with guarantees against loss. Most people buy them for yield, not income.

The AAMs have not so much embraced “your grandfather’s” life insurance business as they have helped complete its evolution into an annuity business and then into an investment business—a process that began decades ago.

© 2025 RIJ Publishing LLC. All rights reserved.

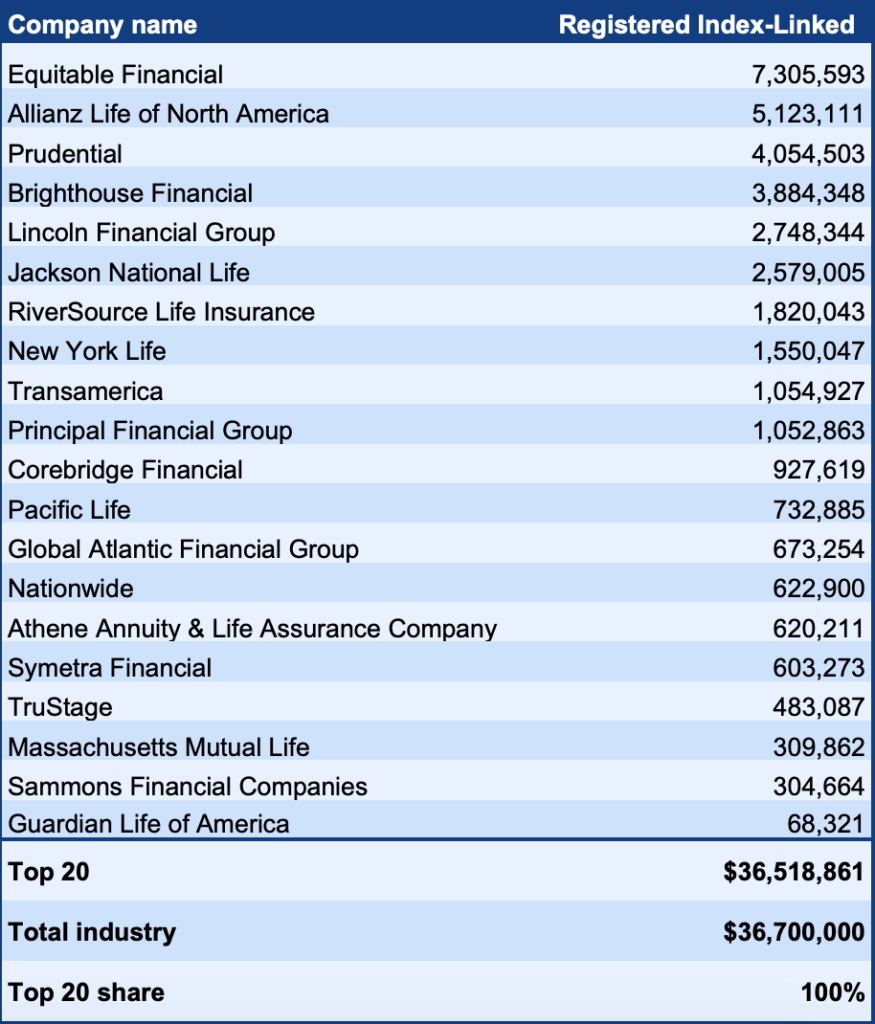

Registered index-linked annuities (RILAs)—structured products introduced by large life/annuity companies over the past 15 years—were originally marketed as sophisticated, conservative savings vehicles for people in their 40s or 50s.

That original target market is now approaching retirement. It’s little surprise, then, that nearly half of the 20 principal issuers of RILAs have taken the next logical step and equipped their contracts with lifetime income riders. Demand for such riders has so far been modest but promising.

Sales of first half of 2025. Source: LIMRA.

“Most fixed index and RILA contracts are being bought without a GLB (guaranteed living benefit),” said Bryan Hodgens, senior vice president and head of LIMRA research, last year. “However, in recent quarters we have seen a slight uptick in consumers buying the GLB rider on FIAs and RILAs.”

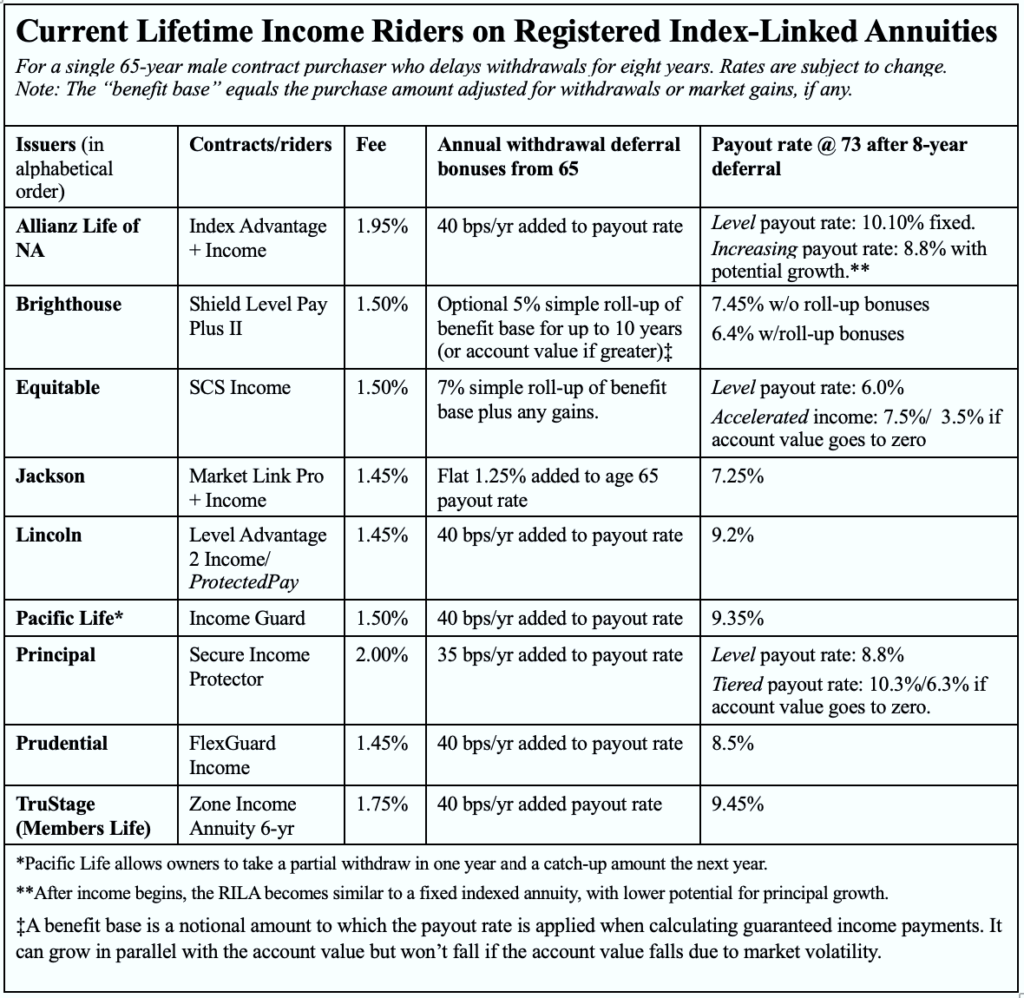

In this issue of RIJ, we examine the income benefits on RILAs from nine insurers: the six largest RILA sellers (Equitable, Allianz Life, Prudential, Brighthouse, Lincoln, and Jackson) along with Principal, Pacific Life, and TruStage (part of CUNA Mutual Group).

Rather than dissecting each rider—the details can be numbing—we asked a simple question: If a single man bought a RILA with an income rider at age 65 and waited eight years (until age 73, when the IRS begins requiring annual distributions from tax-deferred accounts) to activate his guaranteed lifetime income stream, what would his annual payout rate be?

We were particularly interested in the deferral bonuses: the annual increases in either the payout rates or the benefit base (a notional minimum accumulation amount) that issuers use to encourage contract owners to delay withdrawals. These often stop after 10 years and may be subject to waiting periods.

Source: Issuer websites.

Column four shows the annual deferral bonus on each rider. Two issuers (Brighthouse and Equitable) offer “roll-ups” (percentage increases of 5% and 7%, respectively) to the benefit base during the eight-year deferral period. Equitable’s roll-up applies to any annual gain in the contract’s value, while Brighthouse’s provides the greater of the roll-up or the actual gain.

Roll-ups were popular in the early 2000s but often confused buyers. Many mistook increases in the benefit base for guaranteed increases in their account value—essentially “free money.” In reality, the cash value remained exposed to market risk, while the benefit base was simply a notional figure used to calculate income payments.

Source: FRED, Federal Reserve Bank of St. Louis.

The other seven income riders instead offer annual increases in the payout rate for each year income is deferred. For example, if the payout rate is 6% at age 65 and the deferral bonus is 40 basis points, the payout rate at age 73 (after an eight-year delay) would be 9.2% (6% + 8 × 0.40%).

Clients may not realize that deferral bonuses aren’t giveaways. They cost issuers nothing. The higher payout rate simply reflects the fact that the owner is older, and thus expected to collect payments for fewer years.

The far-right column of the chart highlights three riders that allow contract owners to fine-tune their payout at age 73. Allianz Life, for example, offers either a fixed payment equal to 10.10% of the account value or a lower initial payment (8.8%) based on an account value that continues to grow. The trade-off: the RILA effectively converts into a fixed indexed annuity, with reduced growth potential.

Making apples-to-apples comparisons of these riders is nearly impossible. Final payouts depend not only on market performance but also on the indexes chosen, the issuer’s crediting formulas, and the buffers or floors that limit potential losses.

Like FIAs, RILAs are structured products that generate yield through call options on equity indexes. FIA returns might range from 0% to 5%, while RILA returns can range from –10% to +10% or more.

As a rule, annuities with income riders have less upside potential than those without them. Rider fees drag on performance, and the guarantees require risk-management costs that further dampen yields.

In reviewing payout rates, I wondered how today’s RILA income benefits compare with the generous guaranteed lifetime withdrawal benefits (GLWBs) attached to variable annuities (VAs) in the early 2000s. Those riders fueled hundreds of billions in VA sales, but the 2008 crash and subsequent low interest rates exposed their risks, driving up costs and making them unsustainable.

Several of today’s leading RILA issuers were also major VA/GLWB providers 15–20 years ago (or are their corporate successors). It’s unclear whether RILA income riders are more conservative, but RILA returns are generally less volatile than VA returns—an important factor that should make the costs of RILA riders more predictable and manageable.

© 2025 RIJ Publishing LLC. All rights reserved.

Yes, President William McKinley was a tariff-championing Republican. Yes, Congress passed several tariff bills in the 1890s. And, yes, the U.S. enjoyed an economic boom in the second half of the 1890s—a relief from the depression of 1893.

But neither McKinley nor the tariffs can take credit for enabling the U.S. to close out the 19th century on a high economic note and enter the 20th century—the American Century—as a global dynamo.

No. Historians attribute the boom to:

Discoveries of gold in Alaska, the Yukon, and South Africa in the mid-1890s

The Spanish-American Wara, declared and ended in 1898

Last April 2, “Liberation Day,” President Trump announced dramatic new tariff levies on most of the countries of the world, including America’s closest trading partners. He effectively put an end to our 30-year experiment in unfettered free trade and “globalization.”

The following day, the U.S. stock market dropped 10%. Global confusion ensued as leaders of Canada, Mexico, Germany, China, Japan and Vietnam, to keep the list short, struggled to figure out how their export-driven economies would be affected.

President Trump claimed that William McKinley, president from 1896 until his assassination in 1900, had employed tariffs to raise revenue, protect domestic industries from cheap foreign competition, and stimulate the U.S. economy.

He argued tariffs could drive foreign direct investment into the U.S., revive U.S. manufacturing, and reverse America’s huge trade deficit (in goods, not services) with the rest of the world—and that they could juice up the U.S. economy today.

This week, as some of the tariffs announced last April are scheduled to take effect, a hunt for a historical basis for bringing tariffs back won’t turn up much. While tariffs were a major political football after the Civil War, there’s no good evidence that they turned the U.S. economy around after the Crash of 1893.

Here’s Doug Irwin, a tariffs expert at Dartmouth, writing in an April 2000 National Bureau of Economic Research paper, Tariffs and Growth in Late Nineteenth Century America.:

“The U.S. experience in the late nineteenth century is often appealed to as evidence that high tariffs can prove beneficial to economic growth and development. Upon closer scrutiny, it is difficult to establish this claim.”

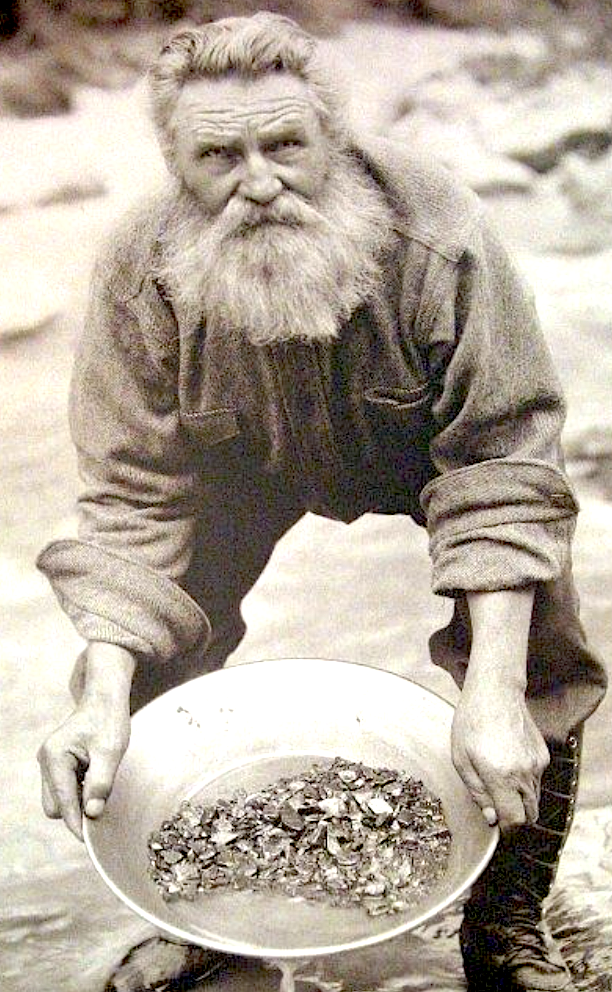

Most Americans probably remember reading about the gold rush of 1849, after the precious metal was discovered at Sutter’s Mill in California. Less discussed is the gold rush of 1896, when gold was discovered at Bonanza Creek in Alaska’s Klondike, in Canada’s Yukon, in South Africa, and in Australia. The flood of gold enriched not just lucky miners but entire countries.

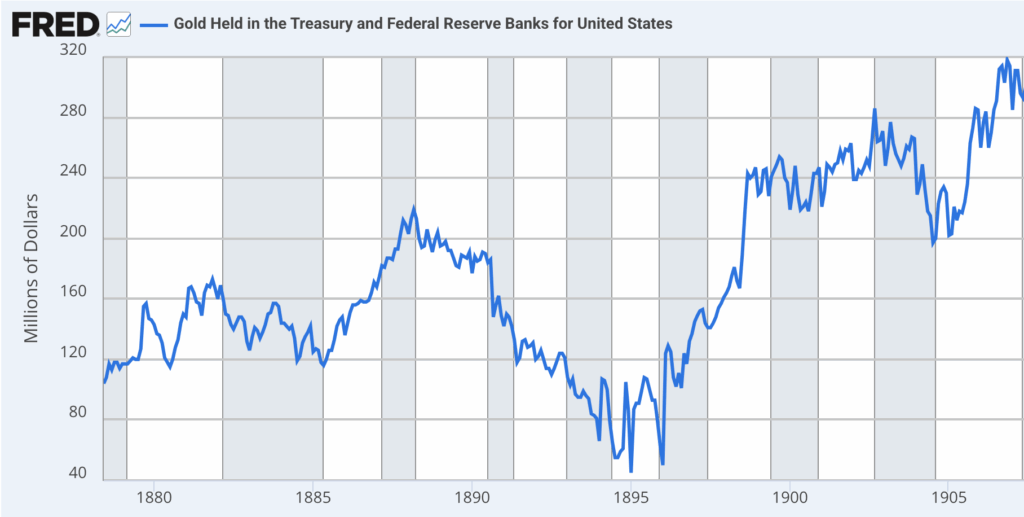

At the time, a country’s gold reserves formed the basis for the quantity and value of its currency. And in the early 1890s, when panicky British investors were selling off their U.S. holdings, literal boatloads of gold were floating away from the U.S.

There’s widespread agreement among economic historians that gold from Alaska and elsewhere, which the U.S. Treasury bought with newly issued “gold certificates,” was a dominant factor in pulling the U.S. out of the long post-Civil War deflation—a reversal of the inflation associated with the war.

The record is unanimous on that point. And largely silent on tariffs.

Milton Friedman, the Nobel laureate in economics, wrote in his 1963 classic, A Monetary History of the United States, 1857–1960 (p. 91), referring to the campaign by William Jennings Bryan and Western farmers to have silver supplement the American gold reserves, which could increase the money supply and reverse the deflation that held down wheat and corn prices.:

Placer miner panning for gold in Klondike

“The secular decline from the 1860s almost to the end of the century… was reversed in the 1890s by the fresh discoveries of gold in South Africa, Alaska, and Colorado, combined with the development of improved methods of mining and refining. After 1897, ‘cheap’ gold achieved the objectives that had been sought by the silver advocates.”

The discovery of gold ended the farmer’s quest for “bimetallic” backing of U.S. paper money. Here’s Ron Chernow in his 1990 National Book Award–winning biography of J.P. Morgan:

“The Yukon gold rush and gold strikes in South Africa and Australia helped expand the U.S. money supply and led to higher prices. The bitter deflationary politics of the late nineteenth century subsided.”

The nation’s money supply, and its creditworthiness, depended on its stock of gold, and the fact that foreign creditors could redeem dollars for gold contributed to a massive outflow of gold after the confidence-shattering crash of 1893. In the West, farmers believed silver could back dollars and lift the money supply. The U.S. Treasury and New York bankers contemplated floating bonds to buy gold.

Gold strikes in Alaska and elsewhere rescued farmers and bankers alike. It was not a case of deus ex machina; the pre-Klondike global shortage of gold incentivized a worldwide search for the precious metal (throughout history the preferred method for paying mercenaries and settling international debts) and stimulated the development of more efficient refining methods. Starting in 1896 on (see chart below) the U.S. gold supply did nothing but grow. For most of the previous decade, gold stocks were falling and the U.S. suffered from deflation.

The tariff debates of the 1880s and 1890s were not unrelated to the gold issue. The common denominator was deflation and falling prices. Democrats touted low tariffs as the solution, while Republicans saw higher tariffs as the remedy. But tariffs were a sideshow. The real problem was the Treasury’s shortage of gold. As Irwin writes:

“The country’s monetary policy under the gold standard, not the tariff, was responsible for the deflation of this period.”

Then came the four-month war with Spain in 1898, which “brought a wave of prosperity… ‘After war will come the piling up of big fortunes again; the craze for wealth will fill all brains,’” wrote economic historian Joseph Dorfman in The Economic Mind in American Civilization, Vol. 3 (p. 230), quoting contemporary observer William Dean Howells, editor of The Atlantic Monthly.

Teddy Roosevelt leading ‘Rough Riders’ in Cuba, 1898

Tariffs were also cousins to the noisy, brief war in Cuba. The common denominator in this case was sugar. Tariffs on sugar provided steady revenue for the U.S. Treasury, but on-and-off tariff policy on sugar in the 1890s created a boom-bust cycle in Cuba, the site of U.S.-owned sugarcane fields and the main source of raw sugar for U.S. refiners.

Economic instability helped spark the Cuban War for Independence from Spain. Spain began burning sugar plantations. The U.S. intervened, Teddy Roosevelt and his Rough Riders took possession of Cuba, and U.S. refiners ended up in control of Cuban sugar (and Cuban politics) until the 1959 communist revolution, led by Fidel Castro.

Victory over Spain gave the U.S. dominion over not just Cuba but also the Philippines. Almost overnight, the country became a global power, with new commitments and opportunities in Asia. American exports later helped European countries fight (and recover from) World Wars I and II, and the U.S. became the world’s biggest creditor nation. Today, we’re the world’s biggest debtor.

Paradoxically, that makes us rich. Much of the world’s savings is parked here. We can afford to run a large trade deficit because we’re wealthy, because everyone everywhere gladly accepts dollars, and because foreigners recycle their export-earned dollars back to the U.S. by investing here or buying our Treasuries.

New U.S. protective tariffs, or even the threat of tariffs, aren’t likely to reverse that mega-trend. The Trump tariffs appear to be bargaining chips for deals he’s making on the side. McKinley could never have imagined that.

© 2025 RIJ Publishing LLC. All rights reserved.

In an August 29 new research brief, “Private Credit: Making the Most of 401(k) Democratization,” bond analysts at KBRA analyzed the potential impact of President Trump’s August 7 executive order “to potentially ease regulatory barriers that have limited defined contribution (DC) retirement plans’ access to alternative investments,” including private credit.

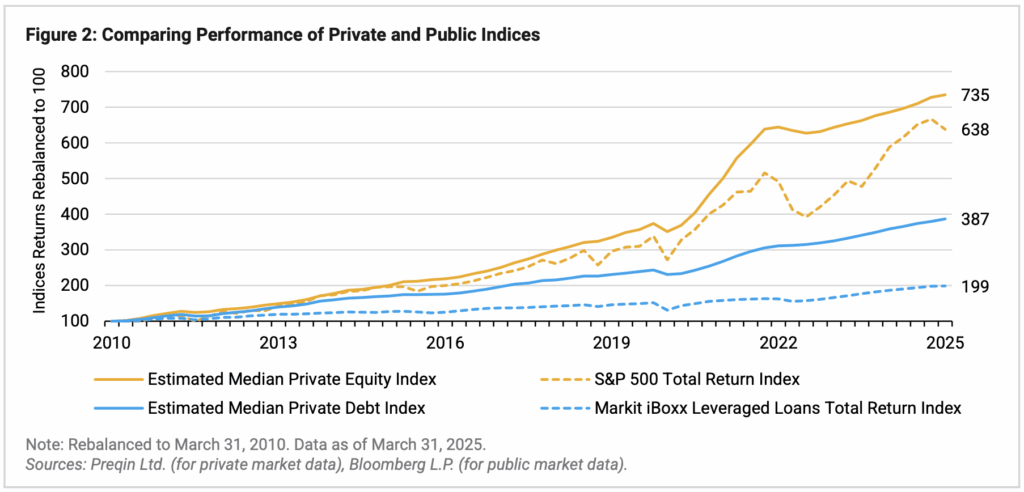

“Access to alternatives is already a common and growing feature in the retirement accounts of defined benefit (DB) plan savers (typically government employees and legacy corporate pension beneficiaries),” the analysts wrote. “This democratization seems profoundly fair, given that alternative investments have historically outperformed comparable public market options, on average.”

But they saw potential dangers in democratization.

“Regulatory Scrutiny: The Department of Labor and the Securities and Exchange Commission (SEC), will likely spend significant time monitoring how alternative investments are being democratized. …Over time, the probability of additional regulation is high.

Missteps: The first AAM that falls short of performance expectations—or the inevitable bad actor—may face litigation, which could engender pushback against the entire industry. This will create additional regulatory scrutiny, headline risk, or a negative perception of alternatives.