By hiring Steve Kluever as its new vice president of global marketing last March, Hartford Life signaled that its variable annuity strategy was about to change. Kluever came from Jackson National, where he helped engineer that company’s post-financial-crisis VA sales surge.

Indeed, changes were due. The company, like a few others, misread the VA market in the fall of 2009 when it brought out Personal Retirement Manager. Instead of offering the popular but risky guaranteed lifetime withdrawal benefit, the product encouraged contract owners to move assets gradually from mutual funds to a deferred income annuity.

Hartford was de-risking because it was scorched in 2008. It had needed a $2.5 billion infusion from Allianz Life that October. The following month, it bought a small Florida bank to qualify for $4.6 billion under the Troubled Asset Relief Program. Its CEO, Liam McGee, at one point publicly signaled a retreat from VAs.

But the advisor market didn’t embrace simplified, de-risked, or SPIA-driven VAs, and Personal Retirement Manager didn’t sell as hoped. At year-end 2009, the contract ranked 29th of 50 in U.S. sales, according to Morningstar, with $276 million in fourth-quarter sales. It finished 50th of 50 in 2010, with sales of $156 million.

“Because the Hartford didn’t offer a living benefit, that created challenges on the sales side,” Kluever (above) told RIJ recently. “We’re committed to the [variable annuity] space, and to reestablish ourselves and be competitive we knew we had to bring back living benefits.”

So the Hartford’s VA engineers returned to the GLWB. They wanted to sweeten it with a roll-up, but with minimum market risk exposure. So they took a page from the Prudential VA playbook and introduced a modified Constant Proportion Portfolio Insurance mechanism into the mix.

The result was unveiled in mid-June, when Hartford introduced three new riders: Future5 (a GLWB with a 5%/10-year deferral bonus), Future6 (a GLWB with a 6%/10-year roll-up), and a SafetyPlus, a guaranteed minimum account balance (GMAB) with a xx% bonus to the benefit base after 10 years if the assets are transferred into the Personal Retirement Manager (still a contract option).

“It’s a fair statement to say that Future5 and Future6 were a rescue action on Personal Retirement Manager,” Kluever said.

The risks of the Future5 are controlled by a requirement that the client invest in certain designated equity-based models, called Personal Protection Portfolios (PPP). The risks of the richer Future6 and of the SafetyPlus GMAB are controlled by a requirement that half of a client’s assets go into the PPPs and half goes into a Portfolio Diversification Fund, or PDF.

The PDF uses a CPPI method to limit volatility, and aims for negative correlation with the performance of the rest of each client’s portfolio. The PDF assets are invested in three sleeves, of which one consists of futures and options. “That’s the derivative sleeve. It’s through that sleeve that we can bring in negative correlation,” Kluever said.

Twenty-percent of the PDF is invested in an S&P Index Fund, 40% is invested in the BarCap Aggregate Bond Index (the former Lehman Aggregate Bond Index), and the last 40% is invested in futures and options.

“The derivative sleeve lowers the volatility. It cuts off the high-highs and the low-lows. The theory is that, over time, it will perform like a 60/40 asset allocation but without big swings up or down. We went through a lot of back-testing to see it performed historically as well as intended. Based on those results, we settled on the 50% allocation to the PDF. For the other 50% we give people access to 10 models from 10 fund companies.” The Hartford will “periodically rebalance” the two halves of the portfolio to maintain the 50-50 allocation, according to the prospectus.

“If they aim for a 60/40-like performance, then their strategy is in line with other new products on the market,” said Ryan Hinchey, a consulting actuary and co-founder of the website and blog, Nobullannuities.com.

“But the only way to see how good these funds are is to observe how they behave. Variable annuities are opaque to being with, and [with dynamic asset allocation funds] they’ve added another layer of complexity. It sounds nice, but it’s hard to sell to advisors when there’s no track record to show how these funds will behave relative to the sales story.”

The lackluster sales of Personal Retirement Manager notwithstanding, Kluever believes that Hartford’s original instinct that investors are more risk-averse remains valid. “We continue to hear that people are more interested in minimizing downside than maximizing upside,” Kluever said.

“They’ve seen two bear markets over last decade, and they’re looking to reduce volatility. They want asset classes that have better negative correlation to the S&P500,” he added. “When you couple the PDF with the other investments, it reduces the overall volatility of the clients’ experience. Our interests are aligned. Other insurance companies are moving in the same direction, toward reducing volatility. We just have a different way of doing it.”

If it sounds like Hartford is offering a smorgasbord to the consumer or advisor—well, that’s what worked for Kluever at Jackson National. He came to Hartford with a belief, grounded in Jackson National’s huge VA growth in the past two years, that giving advisors lots of options is the recipe for success in the VA space.

“I’ll be here three months, I was at Lincoln, Jackson, Hartford, and a lot of my philosophy is to give people choice,” he told RIJ. “Contract owners and advisors want choice. We gave people the choices rather than a one-size-fits-all. From manager selection to index versus active, we wanted to give people choice.”

At Lincoln Financial from 1998 to 2003, Kluever worked in investment management and product development. He spent the next eight years at Jackson National, eventually as head of the product management group. During the latter part of his tenure there, the company shot from 14th to third in VA sales rankings.

Hartford is supporting its Future5/6 launch with a direct mail and media campaign aimed financial advisors with the theme, “Fresh Thinking from a Familiar Face,” Kluever told RIJ. “We’re going to the financial advisors who have stuck with us and to those who used to be big producers for us, to let them know we have a new VA. The reaction has been, ‘We’re glad to have you back.’

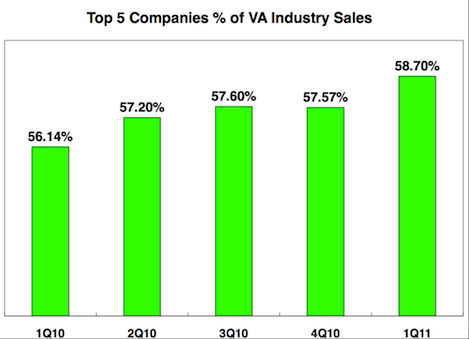

“We believe there’s a big opportunity for us. You still hear a lot of [insurance] companies saying that they’re continuing to pull back from VAs. We’re still seeing more folks pulling back than getting in, either by design or because they don’t want to be in that space.”

Editor’s note: Hartford filed four contracts on June 3 with the SEC for a Personal Retirement Manager Foundation Contract, in an A share and an O share. (The June 13 product prospectus included B, C, I and L shares). There are no roll-ups and there is no Portfolio Diversification Fund.

Contract owners may shift money into a Personal Retirement Manager for later annuitization, however. Investments must be in the designated asset allocations. Interestingly, the m&e charge is reduced for higher premiums. It ranges from 71 basis points on less than $50,000 in premium and falls to 17 basis points on $1 million or more.

In the A share contract, the upfront load ranges from 5.5% for premia under $50,000 and falls to 1% on premia of $1 million or more. There is only one age band, with a GLWB payout rate of 5% for individuals and 4.5% for couples.

© 2011 RIJ Publishing LLC. All rights reserved.