In a letter dated March 21, the National Association of Insurance Commissioners (NAIC) asked Congressional leaders to eliminate the Federal Insurance Office (FIO), a small agency that reports annually to the Treasury Secretary on the state of the U.S. insurance industry.

“We urge Congress to respect states’ primary role in regulating the insurance market by abolishing [it],” read the letter from the leaders of the NAIC, which represents state insurance commissioners in the 50 U.S. states, five territories and the District of Columbia.

The NAIC may see Donald Trump’s arrival in Washington as a chance to push back federal encroachment on its turf. FIO is the kind of pro-consumer, early-warning watchdog that the Trump administration is targeting for cuts.

Ironically, neither of these entities is a regulator per se. The NAIC is a private trade association whose members are public officials. It was founded 154 years ago to bring consistency to the patchwork of state insurance laws. The FIO was created in response to the life insurer insolvencies of 2008, which took the Treasury Department by surprise.

Back in 2010, the NAIC supported the creation of the FIO. Since then, for reasons and in ways that we’ll explore here, the NAIC and its allies in Congress have repeatedly tried to shut the FIO down.

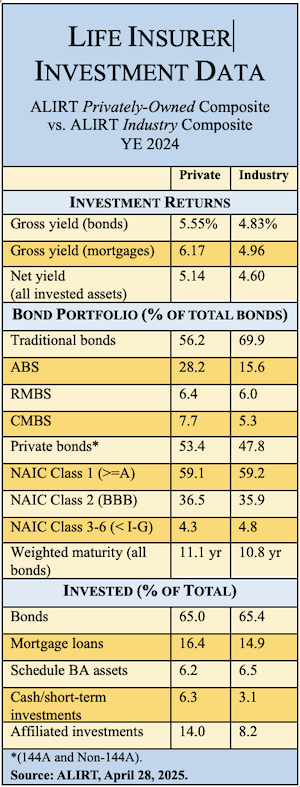

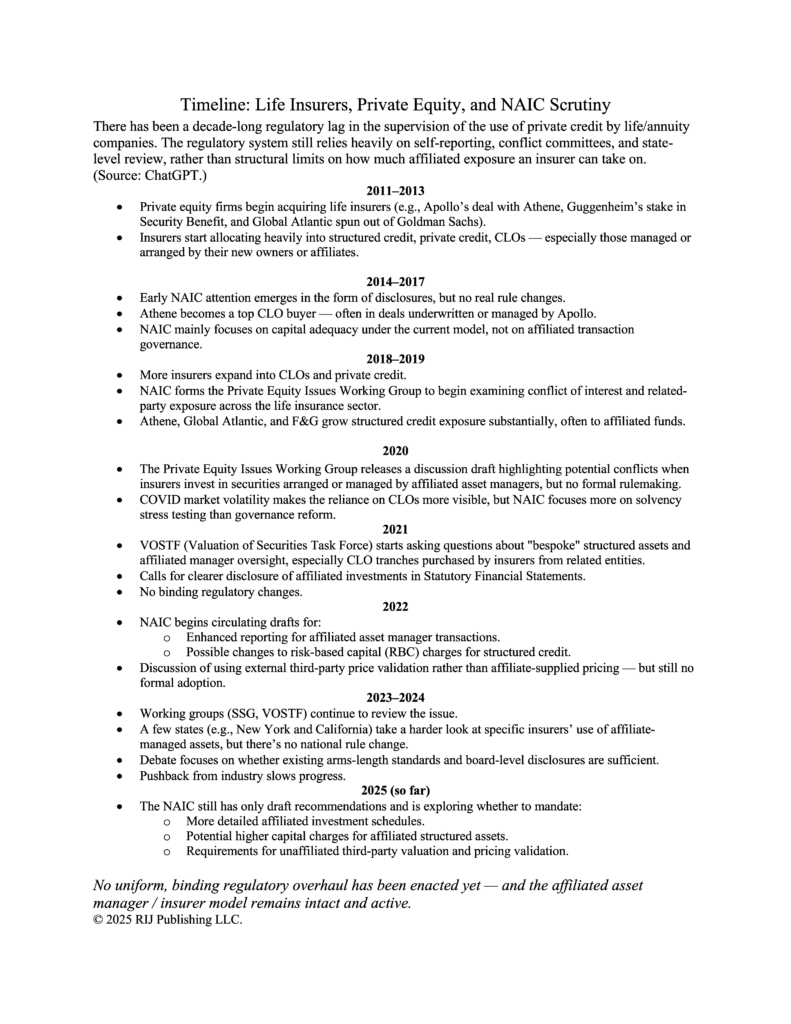

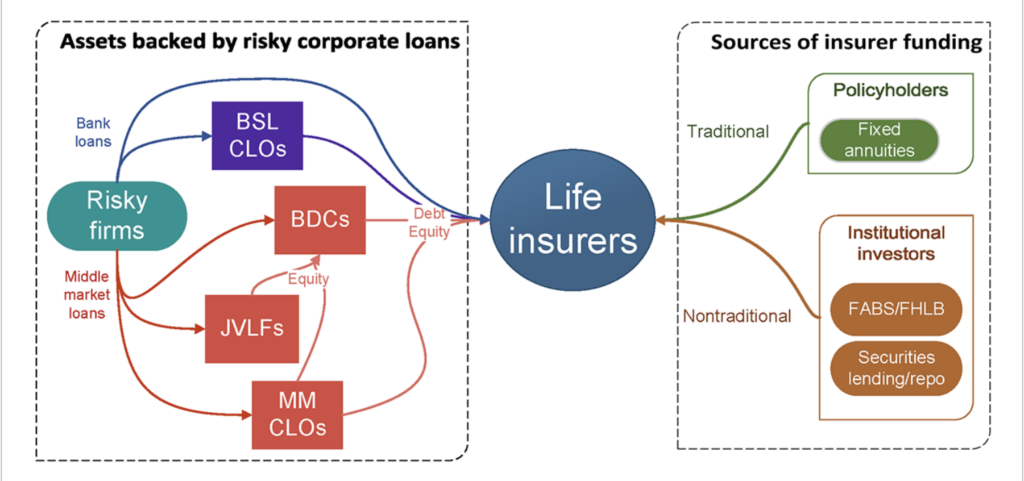

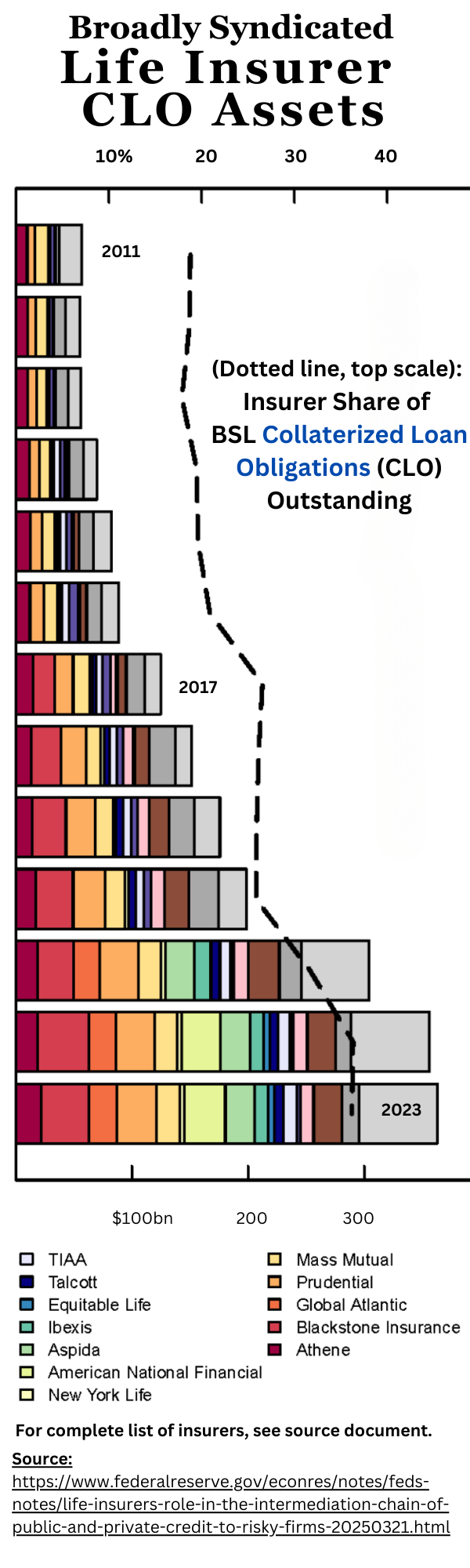

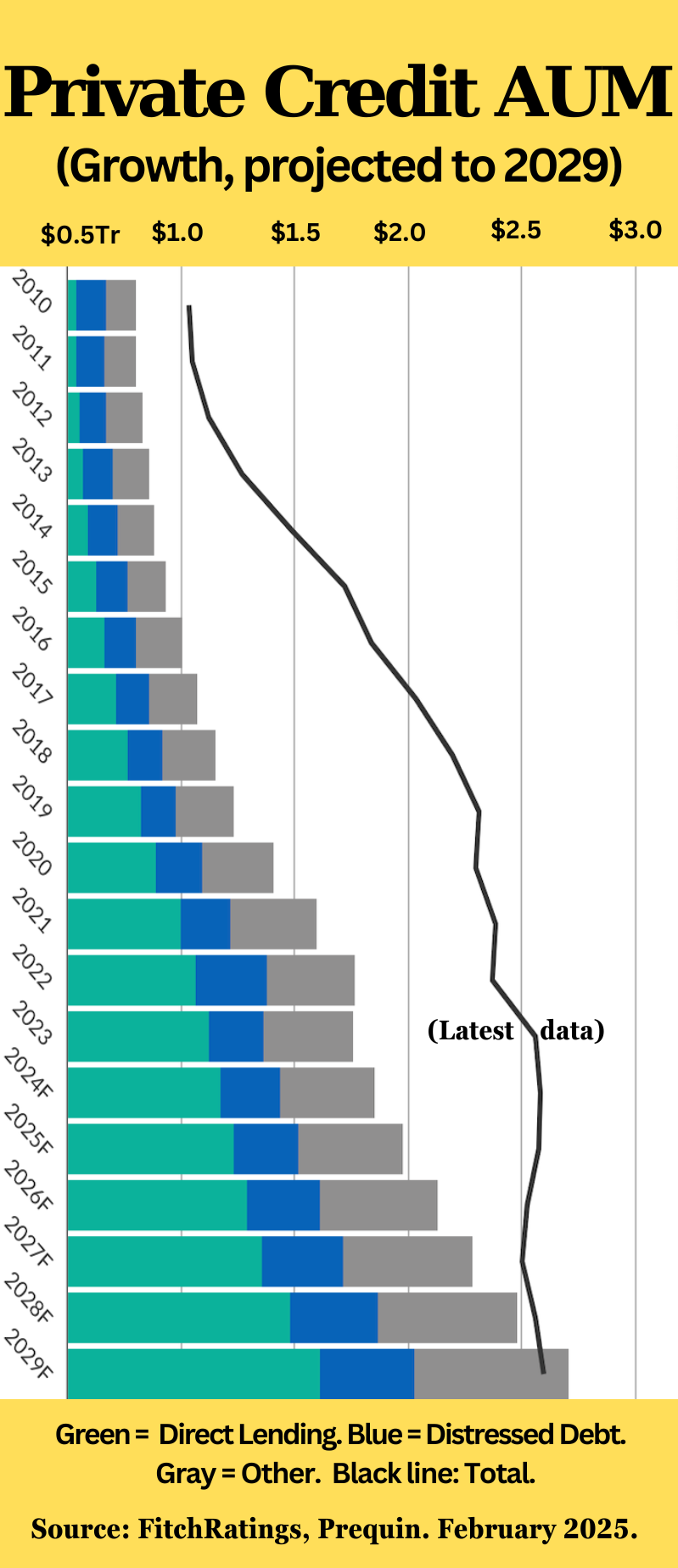

Importantly, the FIO and NAIC have differed in their responses to what RIJ sees as the most pressing issue in the U.S. life/annuity industry today. We call it the “Bermuda Triangle strategy.” This is an arbitrage, practiced by private equity-led U.S. life insurers since 2013, that involves selling fixed annuities in the U.S., investing the revenues in asset-backed securities, and outsourcing the financial risks of the annuities to offshore reinsurers.

It’s a complex and potent business strategy. It has helped life insurers repair the damage inflicted on their balance sheets by the long, low-interest-rate regime of the 2010s. But it has also connected the U.S. life insurance industry to the worlds of “shadow banking” and “shadow insurance.” [See Bermuda Triangle sidebar.]

The latest NAIC assault on the FIO provides an opportunity to explore the transformation of the U.S. life insurance industry since the Great Financial Crisis. The industry looks increasingly like an investment business, which raises new questions about its potential risks and about the way it’s regulated.

A decade-long turf skirmish

The FIO is a young agency. It was created by the insurance section (Title V) of the 900-page Dodd-Frank Act of 2010, when, along with the flood of bank bailouts, the Federal Reserve’s $182 billion bailout of an insurer—AIG—was fresh in legislators’ minds. Title V aimed to help the Treasury Secretary prevent such insurance crises in the future.

The FIO’s normal staff level is estimated at a mere 13. It occupies the bottom rung of the Treasury org chart, according to a 2021 report. But, in theory, the FIO director has the ear of the Treasury Secretary and can leverage the Treasury Department’s power on its behalf. According to its 2024 Annual Report on the Insurance Industry, the FIO can (among other things):

- Monitor all aspects of the insurance industry, identifying issues or gaps in regulation that could contribute to a systemic financial crisis in the industry or the U.S. financial system;

- Recommend to the Financial Stability Oversight Committee (another Dodd-Frank creation) that it designate an insurer as subject to regulation as a nonbank financial company supervised by the Federal Reserve; and

- Coordinate federal efforts and develop policy on international insurance matters, represent the U.S. in the International Association of Insurance Supervisors, and help craft cross-border regulations.

What about these powers doesn’t the NAIC like? Almost everything. In their March 21 letter to Speaker of the House Michael Johnson, Senate Majority Leader John Thune, House Minority Leader Hakim Jeffries, and Senate Minority Leader Charles Schumer, NAIC officers wrote, in part:

“The Federal Insurance Office stands in direct conflict with the states’ role as primary regulators, complicates the state’s engagement with fellow insurance regulators globally, duplicates confidential data collection from our industry, and blurs the lines that separate Treasury from the financial regulators.”

Specifically, the NAIC objected to:

- Federal interference with the writing of insurance for cannabis businesses where growing weed is state-legal despite remaining a federal crime.

- IRS tax claims on insurers that can interfere with the states’ processing of insurer insolvencies.

- FIO’s leadership role in representing the U.S. insurance industry in negotiations of international insurance treaties (though only the federal government can represent the U.S. on treaties).

The 2008 crisis

The NAIC has tried to remove the FIO before. Indeed, a pillar of the NAIC’s mission, since 1871, has been to protect the states’ rights to regulate the business of insurance within their borders. The McCarran-Ferguson Act of 1945 designated the states as the “primary” (but not exclusive) regulators of insurers.

The NAIC’s other foundational purpose has been to promote uniformity of regulations across the states and territories. That’s not easy. The states prefer the freedom to customize their insurance regulations, while insurers would prefer legal consistency across the states. NAIC provides “model” laws for the states, but local commissioners aren’t bound by them.

(“The debate carries tension from the inconsistent dual commitment to uniformity of regulation and preservation of state regulation,” wrote one academic in 1999. A McKinsey study, cited in a 2014 congressional hearing, showed that patchwork regulation cost the insurance industry $13 billion that year.)

The federal government does regulate crop insurance, flood insurance, mortgage insurance, public health insurance (through Medicare, Medicaid and the Affordable Care Act), as well as longevity and disability insurance (through Social Security). But it usually takes a crisis (like the property/casualty crisis of the 1980s or the Executive Life bankruptcy of 1991) for Congress to question state supervision of insurance companies.

The crash of 2008 was one such crisis. While the crisis was concentrated among the banks, many large insurers owned banks. Demutualization and deregulation in the late 1990s had allowed life insurers to diversify into asset management, which made them potential victims and sources of “systemic risk” contagion.

Three large insurers accepted (and later repaid) bailout loans from the Federal Reserve. AIG’s $182 billion bailout (necessitated by its financial rather than its life insurance businesses) was the biggest. The Hartford and Lincoln also accepted loans. Other life insurers sold their banks, divested their U.S. acquisitions (AXA, ING, Prudential plc), or spun off their retail annuity businesses (AIG and MetLife).

Title V of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, which covers insurance, was intended to help Congress detect and prevent the future build-up of potentially contagious financial risk within the new breed of big, diversified life insurers. Title V created the FIO and defined its mission.

[Note: the FIO did not respond to RIJ’s request for an interview, and the NAIC referred us to its public statements about the FIO.]

Pocketbook issues

For the states and for the NAIC, regulation of insurance is also a business, and federal competition could potentially undercut it. States took in an estimated $27 billion in insurance premium taxes alone in 2023, according to the U.S. Census Bureau’s Quarterly Summary of State & Local Tax Revenue. Most of that flows into states’ general funds, not to their insurance divisions. Federal regulation of insurance could disrupt that cash flow.

Nationalized insurance regulation would also reduce the states’ abilities to compete to host insurance company headquarters. Insurers are free to build their office towers, pay taxes, name stadiums, and create thousands of jobs in the most hospitable state or city, regardless of where the sell their products. Federal regulation could eliminate that arbitrage opportunity.

The FIO’s mission poses a potential threat to the NAIC’s main source of income. Of the NAIC’s expected $163 million in 2024 revenue, tens of million dollars come from its collection and syndication of granular insurance industry data from and to the insurance industry and others. The FIO theoretically could gather and distribute similar data. The states themselves pay only $2.4 million in dues to finance the NAIC.

“The NAIC is a private organization comprised of public officials. It makes a healthy profit selling that data. The federal government could publish that information for public consumption. That’s always bugged the NAIC,” Ray Lehmann, editor at the International Center for Law Economics and former Washington bureau manager for AM Best, told RIJ.

The insurers also have a reason to ring-fence their data from the FIO. The FIO is tasked with ensuring that insurers—an industry whose sales rely on the federally-endowed tax benefits of its products—treat Americans fairly. Zipcode-by-zipcode analyses of sales might show that minority communities lack access to auto or homeowners insurance, possibly sparking federal inquiries.

Ironically, the NAIC backed the legislation “creating a Federal Office of Insurance Information… that would construct an insurance data base within the Department of Treasury and be available to provide directly to the Congress and Federal agencies the encyclopedic insurance-related data and information presently compiled by the States.”

So said then-Illinois insurance commissioner Mike McRaith at a March 2009 House hearing on modernizing insurance regulation. Representing the NAIC, McRaith reassured Congress that the FIO could achieve its objectives “without a Federal insurance regulator and without preempting State authority over the fundamental consumer protections, including solvency standards.” [Emphasis added.]

The Duffy hearing

Even though the FIO’s first director was McRaith, an NAIC veteran, peace between the agencies didn’t last. The first of FIO’s annual assessments of the insurance industry, in 2013, was somewhat provocatively titled, How to Modernize and Improve the System of Insurance Regulation in the United States.

The state insurance commissioners’ embrace of the spirit of the Dodd-Frank legislation had been “uneven,” the report said, “despite the absence of any dispute about the need for change.” The text somewhat high-handedly warned that if “the states fail to accomplish necessary modernization reforms in the near term, Congress should strongly consider direct federal involvement.”

Whatever support the FIO enjoyed in the Treasury Department during the Obama years failed to survive the Trump administration’s arrival in early 2017. McGraith departed, and no replacement was appointed for 17 months. The leaderless agency was nonetheless targeted by an insurance industry ally, Rep. Sean P. Duffy (R-WI), chair of the House subcommittee on Housing and Insurance.

Duffy sponsored HB 3861, the Federal Insurance Office Reform Act of 2018. The bill would have eliminated FIO’s function of advising Treasury on domestic insurance issues, terminated its “subpoena and enforcement powers regarding information gathering,” and reduced its staff to five. (In the 2015-2016 election cycle, the insurance industry gave Duffy $236,755, or more than 10% of his campaign’s war-chest.)

Duffy’s subcommittee held a hearing on HB 3861 in October 2017. Given the composition of the committee—these were state representatives, after all—and the object of scrutiny—federal regulations, the FIO came under predictable criticism for representing federal “encroachment” on state powers and for imposing “one-size-fits-all” on the states.

Voices from the heartland were heard. Paul Ehlert, president and CEO of Germania, a mutual insurer in rural Texas writing $500 million in premium for 200,000 Texas families (and the type of carrier unlikely ever to encounter federal regulation), said that his firm “strongly supports the State-based system of regulation in the United States and is opposed to duplicative and onerous Federal involvement… Unfortunately, since the passage of Dodd-Frank in 2010, we have seen a growing level of insurance-related activity in Washington. And we would urge Congress to consider ways to reverse this trend.”

But the FIO had a vigorous champion. Testifying in its defense was University of Minnesota law professor Daniel Schwarcz, an expert in the history of insurance regulation. Schwarcz argued that the FIO was necessary, if only, he said, because state insurance commissions rarely act without nudges from Uncle Sam.

“The accreditation standards, which is the bedrock of the State solvency system, is a direct response to Federal scrutiny,” Schwarcz told the Duffy committee. “Risk-based capital requirements were a direct response to Federal scrutiny. The guarantee fund system was a direct response to Federal scrutiny.

“Rate regulation was a direct response to Federal scrutiny. The elimination of the ability of insurers to fixed rates was a direct response to Federal scrutiny. So if you just look historically, it is factually accurate to say that the State-based system is a product of Federal monitoring and scrutiny.” The committee approved the Duffy bill, but it died before reaching the House floor.

Back in the cross-hairs

With the NAIC’s recent letter to Congress, the FIO’s future is in doubt again. Among all the possible targets within the federal bureaucracy today, the FIO is likely to be low-hanging fruit—especially when the administration is shrinking the federal bureaucracy.

Without the FIO, however, there would be one less critic of the Bermuda Triangle strategy within the U.S. government. The question here is not whether the federal government or the states should regulate insurance. Both do, and both will continue to.

The issue is that the Bermuda Triangle segment of the life/annuity business has arguably become more of an investment business than an insurance business, and might need more appropriate regulation than the NAIC’s members or NAIC model laws can provide. The FIO has been a bearer of that news. Should NAIC shoot the messenger?

© 2025 RIJ Publishing LLC.