IRI issues 4Q 2018 annuity sales report

Overall annuity sales rose 9.7% in 2018, with the combined sales of fixed and variable annuities reaching $218 billion, according to the Insured Retirement Institute (IRI), which this week announced final 2018 market data for the U.S. annuity industry based on data reported by Beacon Research and Morningstar, Inc.

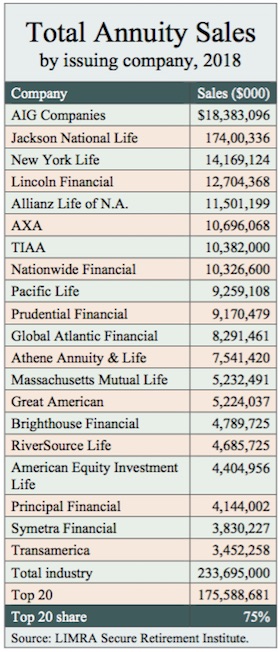

Total annuity sales

Industry-wide annuity sales in the fourth quarter of 2018 were $58.8 billion, a 7.1% increase from sales of $54.9 billion in the third quarter of 2018 and up 23.5% from the versus fourth quarter of 2017, when sales were $47.6 billion. Full-year 2018 total annuity sales were $218.0 billion, up 9.7% from 2017, when total annuity sales were $198.6 billion.

Fixed Annuity Sales

Fixed annuity sales in the 2018 fourth quarter were $35.9 billion, up 12.7% from fixed annuity sales of $31.8 billion in the previous quarterand 51.6% higher than the fourth quarter of 2017, when sales were $23.7 billion. Fixed annuity sales were $125.0 billion in calendar year 2018, up 17.0% from sales of $106.8 billion in 2017.

Variable annuity sales

Fourth quarter 2018 variable annuity total sales were $22.9 billion, down 0.7% from 2018 third quarter sales of $23.0 billion and 4.3% lower than 2017 fourth quarter VA sales of $23.9 billion. The $92.9 billion in sales during 2018 was an increase of 1.2% over 2017 VA sales of $91.8 billion.

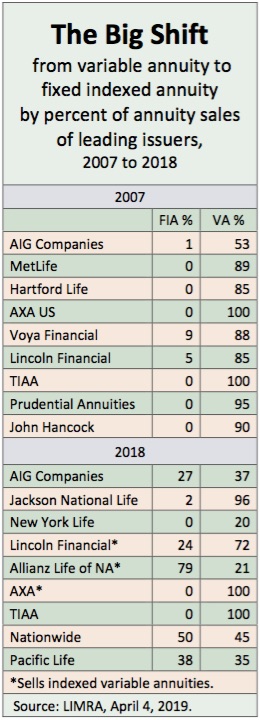

Sales of $19.6 billion for fixed indexed annuity sales in the fourth quarter of 2018 set a new high-water mark. The quarter’s sales were up 8.8% from 2018 third quarter sales of $18 billion (the previous record) and up 42% from 2017 fourth quarter sales of $13.8 billion. Sales of $69.9 billion in 2018 set a new annual record, up 28.8% over 2017 sales of $54.3 billion and 16.3% higher than the previous annual record of $60.1 billion set in 2016.

Book value annuity sales

Sales of book value annuities in the fourth quarter 2018 were $8.9 billion, up 27.7% from the $7.0 billion in the third quarter of 2018 and up 91% from 2017 fourth quarter sales of $4.6 billion. Book value annuity sales were $27.9 billion in 2018 were up 34.5% from 2017 sales of $20.7 billion.

Market value adjusted (MVA) annuity sales were $4.1 billion in the fourth quarter of 2018, equal to sales in the previous quarter. MVA sales increased 61% versus fourth quarter 2017 sales of $2.5 billion. For the full year of 2018, MVA sales were $15.8 billion, up 28.0% from 2017 sales of $12.4 billion.

Income annuity sales were $3.3 billion in the fourth quarter of 2018, up 19.6% from the previous quarter ($2.7 billion) and 24.0% higher than 2017 fourth quarter income annuity sales of $2.6 billion. On a year-over-year basis, income annuity sales reached a new high of $11.4 billion, up 9.1% over 2017 sales of $10.5 billion.

For the entire fixed annuity market, there were approximately $20.6 billion in qualified sales and $15.3 billion in non-qualified sales during the fourth quarter of 2018.

Beacon Research CEO Jeremy Alexander said, “We expect all fixed annuity product types to continue showing robust growth in 2019. as millions of Americans seek solutions that can help them feel secure during retirement.”

According to Morningstar, variable annuity net assets rose in the third quarter as the bull market in equities continued to drive higher valuations in subaccount assets.

Variable annuity assets fell 9.5% from just over $2 trillion in the third quarter to $1.8 trillion, as market volatility weighed on equity and allocation subaccounts. Assets were 8.6% lower than the nearly $2 trillion recorded at the end of 2017. Allocation funds continue to be the largest asset class by share of assets, at $676.8 billion, or 37.3% of total variable annuity assets. Equity funds held $590.6 billion, or 32.6% of total VA assets.

Net asset flows in variable annuities were -$20.2 billion in the fourth quarter, a 4.3% drop from $19.4 billion in the third quarter of 2018. Net flow for the full year 2018 stood at -$79.2 billion, as compared to -$66.7 billion in full year 2017 net flow. Within the variable annuity market, there were $15.3 billion in qualified sales and $7.6 billion in non-qualified sales during the fourth quarter of 2018. For the year, qualified sales were $60.2 billion, or 64.8% of total VA sales, while non-qualified accounted for $32.7 billion, or 35.2%.

“Higher volatility and market losses weighed on VA assets,” said Michael Manetta, Senior Quantitative Analyst at Morningstar, “but we did not see a corresponding plunge in sales. With equity markets recovering in the first quarter of 2019 we should see sales continue to improve, with gains in lifetime income products and structured annuities, which offer protection against the impact of volatility.”

iPipeline favors “best interest” rule in New York

iPipeline, the provider of cloud-based software solutions for the life insurance and financial services industry, today announced its support for NY Reg 187, a proposed regulation in the state of New York, and said that many of its customers support it as well.

The regulation, like the Labor Department “best interest” regulation that was reversed by the Trump administration and a Texas federal appeals court, would require financial intermediaries to act in the “best-interest” of their clients. Currently, a range of intermediaries can call themselves advisors and need only disclose conflicts of interest to their clients, not abandon those conflicts.

iPipeline, which has adapted its proprietary platform to support best interest regulations, said it has assembled a like-minded network of 135 insurance carriers, 1,300 distributors and financial institutions, and hundreds of thousands of agents and licensed financial advisors.

The firm’s ‘SSG Digital’ global platform is designed to support regulatory compliance, suitability assessments, order entry, insurance application quoting, illustrations and processing, underwriting, policy administration, e-Signature, e-Delivery, and analytical reporting, said Tim Wallace, CEO, iPipeline, in a release this week.

Vestwell, a retirement plan fintech, raises $30 million

Vestwell, a digital retirement platform, has raised $30 million in Series B financing in a round led by Goldman Sachs Principal Strategic Investments, working with Goldman Sachs’ Consumer and Investment Management Division, Vestwell holdings Inc. announced this week.

Joining the round were Point72 Ventures, the venture capital arm of Nationwide, Allianz Life Ventures, BNY Mellon, and Franklin Templeton, with additional participation from Series A and Series Seed investors, F-Prime Capital, FinTech Collective, Primary Venture Partners, and Commerce Ventures.

Vestwell claims to be the first digital platform built for the retirement plan working with 401(k) and 403(b) plans.

In the past 12-months, Vestwell said, its client base has grown tenfold and it has entered alliances with BNY Mellon, Allianz, Namely, Dimensional Fund Advisors, OnPay and Riskalyze, with others that will be announced shortly.

Vanguard brings new active commodities fund to market

Vanguard announced that it will launch a new actively-managed fund, Vanguard Commodity Strategy Fund, in June 2019. The Malvern, PA-based mutual fund giant filed a preliminary registration statement with the Securities and Exchange Commission this week.

The new fund will invest primarily in commodities and treasury inflation protected securities (TIPS). It will have an average expense ratio of 1.25%. The fund will solely offer Admiral Shares at a $50,000 investment minimum, with an estimated expense ratio of 0.20%, which Vanguard described as less than a sixth of the cost of competing broad-based commodity-linked funds.

The performance benchmark for the new fund will be the Bloomberg Commodity Total Return Index. It will invest in commodity-linked derivative investments, such as commodity futures and swaps, collateralized by a mix of Treasury bills (T-bills) and short-term TIPS, which add a layer inflation protection.

Vanguard’s Quantitative Equity and Fixed Income Groups will advise the fund. The group is comprised of 35 strategists, analysts, and portfolio managers who managed Vanguard Managed Payout Fund’s commodity strategy for more than 10 years.

At launch of the new commodity fund, the $1.8 billion Vanguard Managed Payout Fund will reallocate its commodities exposure, consisting of $135 million, to the new fund.

Giovanni and Coutts rise at Lincoln Financial

Lincoln Financial Group announced this week that senior vice president Christopher Giovanni has been named corporate treasurer and senior vice president Jeffrey Coutts, who currently serves as corporate treasurer, has been named to the new role of chief valuation actuary, effective May 6, 2019.

Giovanni will assume responsibility for Corporate Treasury oversight, including balance sheet management, debt and capital management, liquidity management and rating agency relationships. He will also continue to oversee Investor Relations and Strategic Planning, reporting to Randal Freitag, executive vice president, chief financial officer and head of Individual Life for Lincoln.

As Lincoln’s first chief valuation actuary, Coutts will be responsible for the executive leadership of actuarial valuation and modeling within Lincoln. This includes the day-to-day management of the actuarial organization. He will continue to have responsibility for mergers and acquisitions and financial reinsurance and report directly to Freitag.

Global Bankers to divest its US life companies

Global Bankers Insurance Group, LLC confirmed this week that it is pursuing a sale of its U.S. life insurance companies and has met with potential acquirers. The company, headquartered in Durham, NC, owns Bankers Life, and the insurance companies acquired by Global Bankers since September 2014 include Southland National Insurance, Life Reinsurance, Colorado Bankers Life, Annuity Reinsurance, Mothe Life, Conservatrix and GB Life (formerly NN Life Luxembourg SA.

© 2019 RIJ Publishing LLC. All rights reserved.