Several technology companies have set up platforms this year to make it easier for investment advisors, particularly those in the registered investment advisor (RIA) channel, to integrate annuities and other insurance products into their financial plans for pre-retirees and retirees.

The firms are Envestnet, the big Chicago-based turnkey asset management platform, which just launched Envestnet Insurance Exchange; DPL Financial, a creation of one the founders of Jefferson National, which sold variable annuities to RIAs; and ARIA Retirement Solutions, whose RetireOne platform, created in 2011 to sell stand-alone living benefits, has been repurposed as an annuity back office for RIAs. Orion Advisor Services, which competes with Envestnet, is also in this space.

These platforms would give RIA advisors whatever they need—vetted annuity and insurance products from participating carriers, insurance-licensed support desks, retirement income planning tools—to become “holistic” advisors, stop sending business to insurance agents, and differentiate themselves from robo-advisors.

Are we seeing the long-awaited inflection point where the mass of advisors (in addition to existing dually-licensed or hybrid advisors) becomes more “ambidextrous” in the use of investment and insurance products for retirement planning? Given the complexity of the advisory world, it’s hard to generalize or make predictions.

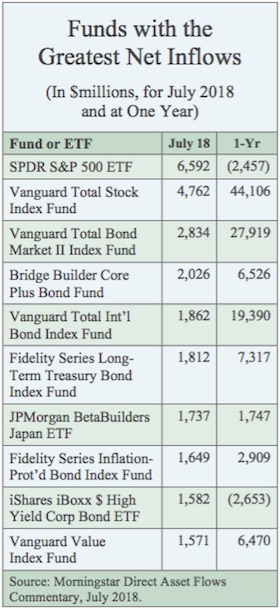

Taking it as a given that Boomers need principal-protection and guaranteed income products along with investments, a few things are clear: The RIA space continues to grow; integrated technology platforms (either in-house or third-party) are replacing traditional distribution; if your products or services aren’t on the platforms, you’ll be left out. One wild card factor: With the disappearance of the Obama fiduciary rule, which discouraged the sale of indexed or variable annuities on commission to IRA owners, no-commission annuities may lose some of their momentum.

DPL Financial

David Lau

David Lau, a co-founder of Jefferson National’s low-cost investment-only variable annuity business for RIAs (since sold to Nationwide), created this platform, which is intended to serve as an “outsourced insurance department” for RIAs. It brings together non-insurance licensed RIAs and no-commission insurance products. DPL Financial charges RIA firms an annual, asset-based membership fee that Lau told RIJ will amount to “75 to 100 basis points over the life of the product.”

Insurance products on the platform, according to a DPL fact sheet, include investment-only variable annuities (from AXA, TIAA, Security Benefit and Great-West), fixed indexed annuities (from Allianz Life and Great American), “buffer” annuities from Allianz Life, AXA and Great-West), fixed annuities from Integrity Life, single-premium immediate annuities from TIAA and Integrity Life, and term life insurance from TIAA.

In a recent interview, RIJ asked Lau if DPL Financial was mainly more about helping RIAs capture 1035 exchanges, where the advisor gains new assets by helping clients get out of existing annuities, than about selling new annuities to people. He said that while about 60% of the business has been 1035 exchanges, he expects that ratio to drop.

“This is about bringing commission-free insurance products to the RIA market,” Lau said. “1035 exchanges are part of it. The clients of RIAs may already own expensive insurance products. But the bigger idea is that insurance is a big component in financial plans.

“For instance, there’s a need for principal protection. RIAs often plan for that need, but they’ve been hamstrung in offering insurance solutions. In the past, the paradigm for the RIA has been to identify clients’ insurance needs and then send the clients away to an insurance-licensed competitor who may or may not fill the RIA’s prescription. It doesn’t make for a great client experience, because the client will get put into expensive, commission-driven insurance products.”

ARIA’s RetireOne

RetireOne, created seven years ago by ARIA Retirement Solutions, which was and is led by former Charles Schwab executive David Stone, was first intended to sell unbundled guaranteed lifetime withdrawal benefits (aka stand-alone living benefits) to RIAs, who would attach them to fee-based investment accounts.

Now RetireOne, like DPL Financial, is betting that non-insurance licensed independent RIAs will feel compelled to respond to the Boomers’ retirement needs by adding an insurance component to their practices. Instead of charging advisors a fee, like DPL, RetireOne will receive compensation from the carriers on its platform. Those carriers currently include Allianz Life, Ameritas, Great American, Great-West, Transamerica, and TIAA.

Mark Forman

“We call ourselves the Insurance and Annuity back office,” said Mark Forman, senior managing director at RetireOne, who came to ARIA from Jefferson National. “The real opportunity, as David Lau has pointed out, comes from the fact that RIAs can’t do insurance and have to outsource it. It’s not about pushing products and getting commissions. It’s about thinking long-term and being a partner. When I talk to RIAs, they see the value in the model. The ones we talk to are open to annuities. And once you can win them over, you have a fan for life.”

While insurance companies will pay RetireOne, Forman doesn’t want his firm to be equated with insurance marketing organizations, or IMOs. “I don’t like the notion that we’re an IMO. I’ve dealt with IMOs in the past. The commissions have driven so much of that business that the term IMO has come to mean questionable sales practices. They wear grey hats. We’re not doing marketing for the insurance companies. We’re trying to educate advisors about these solutions. There are no product-centric conversations.”

RetireOne RIA Platform Scenario

Envestnet Insurance Exchange

Envestnet started out as the first cloud-based turnkey asset management program (TAMP) for independent broker-dealers and has been on a decade-long growth tear. It moved into the RIA space with its acquisition of Tamarac in 2012. Now it’s partnering with Fiduciary Exchange LLC (FIDx) to offer Envestnet Insurance Exchange. The first annuity issuer to jump on board was Global Atlantic, which owns Forethought Life, on June 28.

“Our purpose is to enable advisors to go from being investment advisors to being wealth advisors, to being the expert in the middle of a complex technological and economic eco-system,” Envestnet co-founder Judson Bergman told RIJ in a 2017 interview.

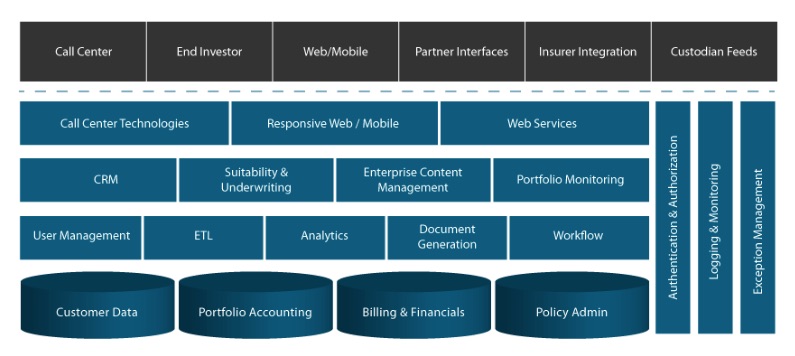

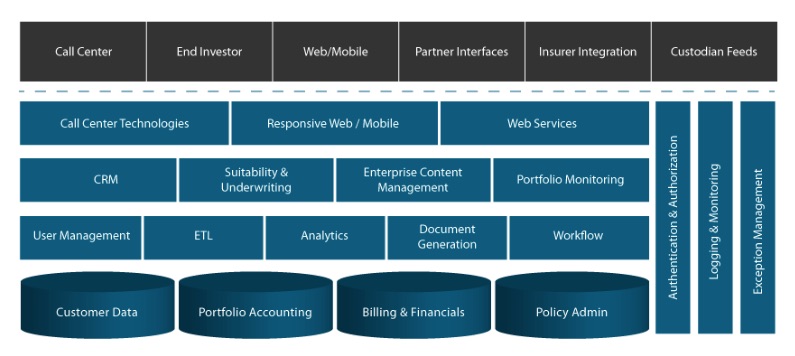

The Exchange will include a “curated” selection of fiduciary-focused insurance products, insurance solutions “tailored to the investor’s needs,” fee-based and commission-based insurance offerings, and a workflow that integrates insurance and investments. The Exchange will include a service called Guidance Desk that will allow unlicensed RIAs access to the consulting and fiduciary services that lets them use the Exchange.

“Envestnet has partnered with FIDx to launch our new Insurance Exchange,” Bill Crager, president of Envestnet, told RIJ in a recent email. “While accommodation services can assist RIAs with annuity sales, our Insurance Exchange is designed with expectations to modernize the current distribution model by fully integrating the annuity ecosystem into the advisory process.

“When completed, the home office and advisor experience will be identical to what our clients currently enjoy with investment products. As part of this offering, we are partnering with industry-leading carriers to deliver commissioned and fee-based products for both fixed and variable annuities. To date, we’ve received significant interest from our clients across all channels including RIAs.”

The life insurer point of view

Corey Walther

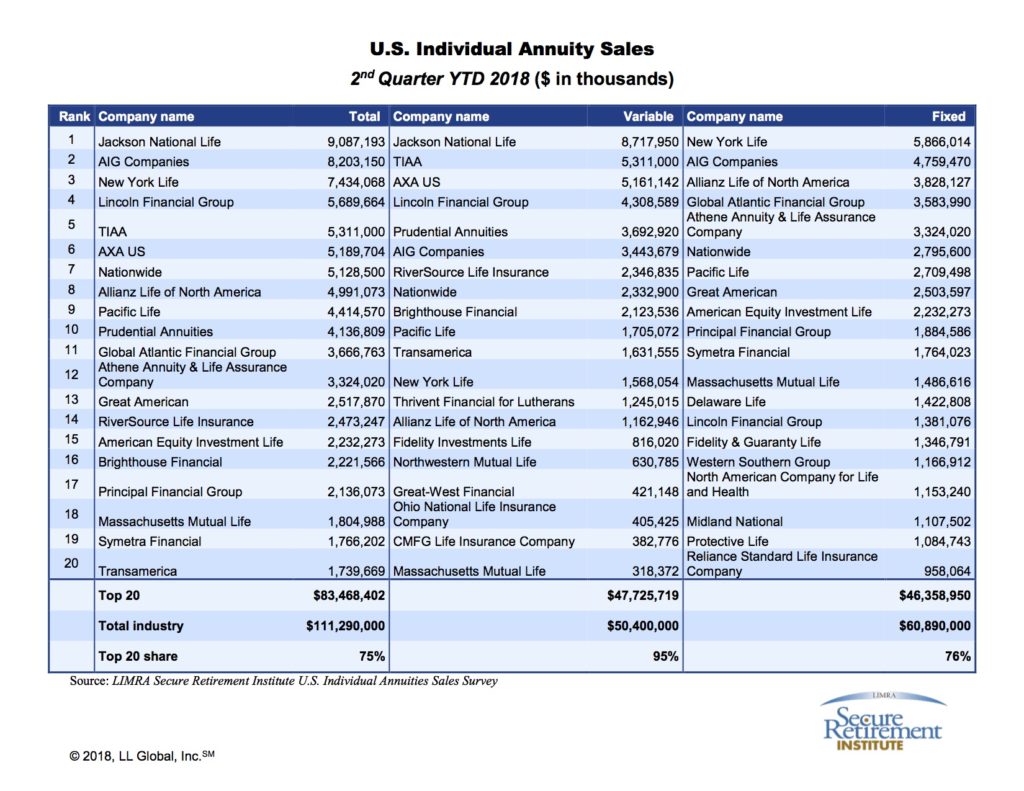

Allianz Life will have products on several of the insurance platforms, according to Corey Walther, head of business development and distribution at the insurer, which has dominated the fixed indexed annuity business in the US since buying Life USA almost 20 years ago. It sold $831.6 million worth of the structured variable annuity, Index Advantage annuity, which comes in commissioned and non-commissioned versions, in the first half of 2018, according to Morningstar, Inc.

Walther notes that the new insurance platforms resolve the technical barriers that hinder advisors from combining insurance and investment products. “The Envestment Insurance Exchange is less about supporting RIAs without a license than about having the technology that integrates annuities and risk management tools into the wealth management platform and producing better client outcomes,” Walther told RIJ. “Advisors won’t have to swivel their chairs from one platform to another to bring annuities into the process. They can do it seamlessly. The technology brings the whole ecosystem together.”

Independent RIAs have been under a lot of stress. With the arrival of robo-advisors, asset allocation has been commoditized. RIAs, including the independents, are becoming better educated about the complexities of risk management, which helps their value proposition. They can ask, ‘How can I help you manage your risks?’ Large RIAs, with $20 to $30 billion under management, are approaching us. They’re interested in learning more about insurance products.”

Trend drivers

Given the asset growth of the RIA channel—18% year-over-year and an 11% compound annual growth rate over the past five years, according to Cerulli Associates—annuity issuers can’t afford to ignore it. An analyst at Aite Group, Denise Valentine, also believes that, because RIAs are fiduciaries, there’s a certain burden on them to provide pension-less Boomers with the risk management tools that they’re going to need in retirement.

Although RIAs without insurance license don’t currently often recommend annuities, Valentine told RIJ, “there is a growing awareness of the shortfall in retirement planning to date and growing recognition of the role of some type of annuity.”

Demand from consumers for protection, she believes, is going to shape the habits of advisors. The development of these platforms, she said, “is a preparation move. More people are going to be asking about some kind of annuity. And if you’re an independent RIA with a fiduciary hat, you have an obligation to do what’s best for them.”

What do RIAs themselves think about all this? “I would agree that RIAs were, and many still are, not appreciative of annuities, but I do think they’re coming around,” said Heather Kelly, vice president, risk management at United Capital, an Irving, Texas RIA, which built its own internal platform for combining investments and annuities. “At United Capital, we recognized that it was important to have true integrated planning.”

Retirees and near-retirees are also starting to demand principal-protection and guaranteed income products. “The markets are really high,” Kelly said. “Anybody over 65 is old enough to remember the 2008 financial crisis. I know advisors who have been in situations where clients have said, ‘I want to move half a million dollars out of the market and put it into an annuity.’”

© 2018 RIJ Publishing LLC. All rights reserved.

.jpg)