For all of 2023, FRD annuity sales totaled $164.9 billion, up 46% from the record set in 2022, and more than triple the 2021 sales ($53.1 billion), according to...

Annuity Sales Reach Record Highs, Again

'Economic conditions and growing demand for protected investment growth propelled fixed annuity sales to a remarkable $286.2 billion, a 36% jump from the record sales set in 2022,' said...

Pension experts assess ‘OregonSaves’

Workers in industries and firms with low wages, volatile wages, and high turnover have trouble saving, even in state-sponsored, auto-enrolled Roth IRAs, research shows.

Breaking News

Income Lab launches ‘Life Hub’; Ubiquity and Paycor announce 401(k) partnership; Amber Williams to lead Lincoln ESG initiatives.

Demographics and interest rate policy favor annuities: LIMRA

The US population aged 65 or over is expected to grow by more than 8.5 million by 2026, LIMRA said. Individual annuity sales cluster around age 65.

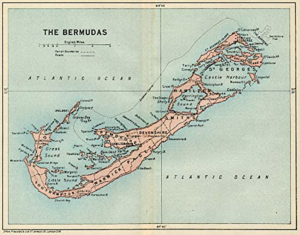

Bermuda ‘confident’ in regulating reinsurers

Bermuda Premier David Burt responded to concerns of US Sen. Sherrod Brown (D-OH) about Bermuda's oversight of the $707 billion of life insurance and annuity assets reinsured on the...

Robo-advice settlement costs Schwab $185 million

'We are proud to have built a product that allows investors to elect not to pay an advisory fee in return for allowing us to hold a portion of...

Breaking News

Aiming at inflation, the Fed tightens base rate by 0.75 percentage points; NWL and Achaean Financial introduce SPIA with upside; Protective Life and Michael Finke in retirement education co-venture;...

Nationwide is 13th life insurer nabbed by New York

To date, New York's industry-wide investigation has led to settlements with thirteen life insurance companies, totaling about $29 million in restitution and penalties.

How do 401(k) participants save? Vanguard knows.

Vanguard released its 2022 edition of 'How America Saves,' a compendium of data on millions of Vanguard-administered 401(k) plan accounts. Of participants ages 65+, half had balances under $88k....

Breaking News

‘Constance,’ a CDA, gains new investment choices; Envestnet acquires 401kplans.com; Putnam repositions its target-date series for ESG; NIRS says retirement tax breaks are unfair; Alternatives can hedge inflation risk:...

Insurers get an edge from hedge funds in 2021

The life/annuity segment saw its dollar exposure to hedge funds rise in 2021 by 14.0%, to $6.1 bn, and the property/casualty segment by 0.9% to $6.7 bn, following several...

Social Security’s solvency has improved

Social Security paid benefits of $1.133 trillion in 2021. There were about 65 million beneficiaries at the end of the calendar year, according to the Social Security trustees' annual...

Life/annuity insurers lead surge into private equity investments

Roughly 58% of the insurance industry's exposure to private equity is through investments in leveraged buyout funds, according to a new AM Best report. Among insurers, MassMutual was most...

Breaking News

iCapital buys SIMON, fusing two fintech firms; Principal closes $25bn reinsurance deal; Securian Financial will be recordkeeper and PPP for WELLthBUILDER PEP; Nationwide is latest in New York's purge...

Fixed-Rate Annuities: First Quarter Favorites

“FIA and RILA sales were both slightly down from the prior quarter. That might reflect some investor uneasiness about equity index-linked products,” said Todd Giesing, head of LIMRA Annuity...

Fortitude Re’s expansion continues

Fortitude Re bought Rx Life Insurance Company from Heritage Life. Now named 'Fortitude US Reinsurance Company,' and domiciled in Arizona, it will enable Bermuda-based Fortitude Re to offer clients...

Church-affiliated retirement plan adopts Pacific Life longevity annuity

'We are honored to be selected as the provider for the QLAC portion of the LifeStage Retirement Income program,' said Ruth Schau, senior director of Pension Solutions for Pacific...

Envestnet and Kestra co-launch platform for plan advisers

Envestnet's cloud-based platform supports more than 108,000 advisors and 6,000 companies. Kestra Financial, based in Austin, Texas, is part of Kestra Holdings.

Annuity providers report 1Q2022 performance

Jackson National Life reported almost $200 million in sales of its new registered index-linked annuity in the first quarter. Equitable's RILA, launched over a decade ago, took in about...