Annuities

'After years of ultra-low interest rates, LIMRA believes conservative investors, who were sitting on the sidelines reluctant to lock in low rates, have poured money into the market as...

Should Participants Get Lifetime Income By ‘Default’?

The ERISA Advisory Council heard testimony on whether to tweak the rules for Qualified Default Investment Alternatives to accommodate—or exclude—annuities. Advisors to 401(k) plans should read this.

Annuities enjoy record sales in 1Q2024

'Total annuity sales have come down from fourth quarter 2024, largely due to a softening in the fixed-rate deferred annuity market. However, LIMRA expects annuity sales to perform well...

Athene’s group annuities not the ‘safest available,’ lawsuit charges

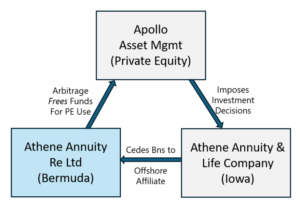

The suit against Athene may be a test case for the legitimacy of Bermuda Triangle strategy. In other news from the Bermuda Triangle: Annuity sales boom attracts private equity-backed...

Test-drive annuities at CANNEX/Luma ‘Marketplace’

The Annuity Marketplace will provide income, rate, yield, and product information on annuities from more than 60 issuers, a CANNEX release said. Advisers can illustrate the outcomes of market...

BlackRock relaunches its “LifePath Paycheck” retirement income tool

'DCIO' asset managers like BlackRock must find ways to retain participant assets post-retirement and enrich the value of their target date funds. They must also make themselves relevant to...

A ‘Nesting Doll’ of an In-Plan Annuity

ARS, State Street Global Advisors, Nationwide, Athene, Transamerica and Global Trust Company have brought to market the State Street GTC Retirement Income Builder, a target date fund with a...

MassMutual platform to distribute Aspida Life fixed-rate annuities

The platform, Flourish, is a wholly owned and independently operated subsidiary of MassMutual. It serves more than 750 wealth management firms managing some $1.5 trillion in financial assets.

MetLife to offer income annuities on Fidelity’s platform

The MetLife solution enables participants at all savings levels to purchase an immediate income annuity through an insurer selected by their employer and annuitize any portion of their savings,...

Meet the Newest Platform in the 401(k) Annuity Space

'We’re a product design firm,' ALEXIncome co-founder E. Graham Clark told RIJ. 'We feel we’ve built the best process for integrating annuities into retirement accounts.'

After record sales year for annuities, LIMRA predicts strong 2024

For all of 2023, FRD annuity sales totaled $164.9 billion, up 46% from the record set in 2022, and more than triple the 2021 sales ($53.1 billion), according to...

Of Athene, Pension Risk Transfers, and Fiduciaries

The ERISA Advisory Council recently heard comments on changing the criteria that fiduciaries use when vetting annuity providers in pension risk transfer deals. Athene's vice chairman defended his company's...

Demographics and interest rate policy favor annuities: LIMRA

The US population aged 65 or over is expected to grow by more than 8.5 million by 2026, LIMRA said. Individual annuity sales cluster around age 65.

Nationwide is 13th life insurer nabbed by New York

To date, New York's industry-wide investigation has led to settlements with thirteen life insurance companies, totaling about $29 million in restitution and penalties.

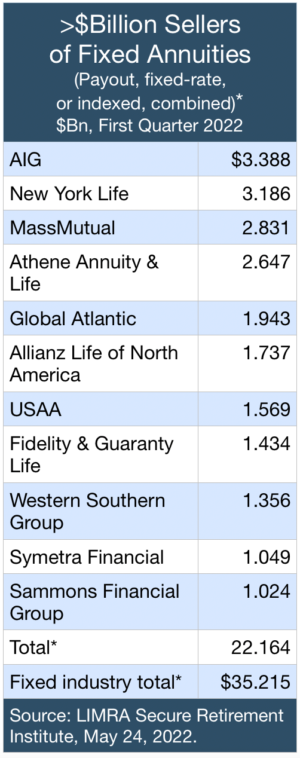

Fixed-Rate Annuities: First Quarter Favorites

“FIA and RILA sales were both slightly down from the prior quarter. That might reflect some investor uneasiness about equity index-linked products,” said Todd Giesing, head of LIMRA Annuity...

Church-affiliated retirement plan adopts Pacific Life longevity annuity

'We are honored to be selected as the provider for the QLAC portion of the LifeStage Retirement Income program,' said Ruth Schau, senior director of Pension Solutions for Pacific...

The ‘Retirement Income Consortium’ is Born

Eight financial giants formed the Retirement Income Consortium to promote income solutions in 401(k) plans and 'develop a vetted due diligence framework' for 'selection and monitoring' of those solutions.

Why RIJ Obsesses over the ‘Bermuda Triangle’

Private equity is no longer a sideshow in the annuity industry. Its involvement is now the main event. But we know too little about private equity’s growing role in...

Annuity sales on pace for another $250bn year

'Both fixed indexed annuities and fixed-rate deferred products benefited from the significant interest rate increases in the first quarter,” said Todd Giesing, assistant vice president, SRI Annuity Research (in...