The variable annuity arms race lives on.

Judging by the companies that experienced the sharpest sales growth in the quarter, investors and advisors still can’t resist living benefit riders that promise generous 10-year “roll-ups” followed by a lifetime of guaranteed income.

Prudential Annuities sold a whopping $5.83 billion w orth of variable annuities in the third quarter, a number that accounted for 23.2% of the quarter’s advisor-sold (non institutional) variable annuity volume, according to VARDS, Morningstar’s variable annuity information service.

Until late August, Prudential was still selling its lavish HD7 living benefit rider, which offered 7% annual compound growth of the income base over a 10-year waiting period. The insurer subsequently offered a slightly de-risked HD6 product that still offered a 6% annual compound roll-up over 10 years.

The other breakout issuer was Jackson National Life, whose $2.91 billion in third quarter sales represented a 90% year-over-year increase for the carrier, a unit of Prudential plc (no relation to Prudential in the U.S.), according to executive vice president Clifford Jack.

MetLife, the VA sales leader through September 30, 2009, sold $3.4 billion in the third-quarter, a decline from its sales pace during the first half of the year. Overall, variable annuity sales were down about one percent from the second quarter, at about $31.8 billion.

Although the Dow Jones Industrial Average rose about 16% in the third quarter—which should have offered a brisk tailwind for VAs—a drop-off in 1035 exchanges apparently nullified the effect. With so many VA issuers offering less generous guarantees than they did last year, there were virtually no flashy new products to tempt contract owners into switching to.

Too early to tell

It’s probably premature to leap to the conclusion that the variable annuity arms race has been rekindled, albeit at a slightly lower temperature. But aggressive, complicated retirement income benefits apparently still appeal as much to Boomers and their advisors as they did before the crisis—and perhaps more so.

| U.S. Individual Annuity Sales 1st Quarter 2009 ($ in thousands) |

|

|---|---|

| Company Name | Variable |

| MetLife | 3,735,343 |

| TIAA-CREF | 3,477,673 |

| AXA Equitable | 2,836,115 |

| ING | 2,229,345 |

| Prudential Annuities | 2,106,642 |

| John Hancock | 2,057,327 |

| Lincoln Financial Group | 1,811,063 |

| Jackson National Life | 1,507,550 |

| RiverSource Life Insurance | 1,314,669 |

| Allianz Life | 1,222,546 |

| AIG | 1,179,538 |

| Pacific Life | 973,833 |

| Nationwide Life | 921,400 |

| Hartford Life | 702,009 |

| AEGON USA | 687,395 |

| Sun Life Financial | 580,910 |

| Fidelity Investment Life | 458,398 |

| Massachusetts Mutual Life | 342,007 |

| Thrivent Financial for Lutherans | 292,584 |

| New York Life | 207,364 |

| Top 20 | 28,643,711 |

| Total Industry | 30,700,000 |

| Top 20 Share | 93% |

| Source: U.S. Individual Annuities, LIMRA International | |

The third-quarter sales data did not suggest that advisors are embracing simpler, less expensive income riders, like the one that John Hancock introduced last summer. Perhaps Boomers will always insist on roll-ups with their living benefit riders, and not just step-ups and guaranteed payouts.

Both Prudential and Jackson National offer lifetime income riders with six percent “rollups.” That means the carrier will increase the owner’s income base—the notional amount on which future payouts will be calculated—by at least six percent each year over a ten-year waiting period.

With Prudential’s compound 6% rollup, for example, a client who invested $100,000 at age 55 would have an income base of at least $179,000 at age 65 if he took no withdrawals, regardless of market performance. After age 59 1/2, he could receive at least five percent of that amount (about $9,000) each year for life if he didn’t withdraw more than $9,000 in any year. [An HD6 Plus prospectus indicated that the income base could double after 10 years and quadruple after 20 years of no withdrawals.]

Jackson National’s LifeGuard Freedom 6 living benefit lets owners withdraw six percent of the guaranteed income base starting at age 75 and seven percent at age 81. The rider includes a chance for a six percent increase to the income base for every year the contract owner delays his or her first withdrawal. The bonus period lasts for ten years, and the period can start over if rising markets lift the income base to a new and higher level.

Beyond that rough similarity, the two companies traveled different routes to higher sales levels. Trade advertising for Prudential’s “Highest Daily” VA income rider seemed to be on every website and every magazine frequented by financial advisors. The company got big results from an eight-minute video for consumers and advisors that explains the rider’s benefits. E-mail blasts to readers of trade publications helped too.

But the ad spending “doesn’t explain our momentum,” said Jac Herschler, head of marketing at Prudential Annuities. “Our success in the four channels [bank, wirehouse, independent, and captive] has been growing over time. Our differentiation in product design is a big factor. The momentum is also a reflection of producers electing our award-winning product.” The number of independent advisors selling Prudential’s variable annuity reportedly more than doubled in the quarter.

But the ad spending “doesn’t explain our momentum,” said Jac Herschler, head of marketing at Prudential Annuities. “Our success in the four channels [bank, wirehouse, independent, and captive] has been growing over time. Our differentiation in product design is a big factor. The momentum is also a reflection of producers electing our award-winning product.” The number of independent advisors selling Prudential’s variable annuity reportedly more than doubled in the quarter.

Prudential’s HD or “Highest Daily” series is one of the few, if not the only, major VA income rider that offers a daily step up in the income base. It can afford to do that partly because of its “dynamic rebalancing” risk management method, which automatically re-allocates contract assets from equities to fixed income investments when the market dips.

This “selling the dips” technique defies conventional investment wisdom and Prudential admits that it dampens a contract owner’s upside in a bull market. But it significantly limits damage to account balance in a bear market. During the darkest moments of the financial crisis, accounts guaranteed by HD7 riders fell only about 18%, compared to 36% for many contracts whose income riders didn’t use dynamic rebalancing, according to data provided last spring by Prudential.

“Our product design allows us to protect customer account values in adverse markets, and that results in lower net amounts at risk for insurance company,” said Herschler. “In that way our capacity has benefited and the amount that we need to manage through hedging strategies is less than at many companies.”

Another risk management technique in the HD6 appears to be a somewhat stingier payout rate. Contract owners must settle for a five percent payout if they begin taking guaranteed payments between ages 59 ½ and 79, inclusive. Owners must wait until age 80 to receive a six percent annual payout.

Sticking to its story

Jackson National Life, in contrast, spends little on advertising, preferring a slow, steady approach to sales, for which it relies entirely on third-parties. “Something that’s often overlooked but is incredibly important is consistency of message,” said Clifford Jack.

“We’ve been telling the same people the same story for quite some time,” he said. “We’ve had consistency in the senior management for over a decade, consistency in sales leadership, and a higher persistency of wholesalers who’ve been in their territories for a lengthy period of time. The result has been a significant net positive in the number of producers selling our products.”

The company’s outside wholesalers generally start as annuity phone reps, then as internal wholesalers supporting the outside wholesalers, then as business developers who guide advisors through online tutorials, then as outside wholesalers who meet with advisors.

Three other factors contributed to Jackson National’s increasing variable annuity market share over the past two years, Jack added. For one, his company has raised its agility and speed-to-market by building its own technology platform rather than buying it from the outside. Second, even during the thick of the variable annuity arms race, it insisted on pricing its guarantees properly instead of buying volume with unsustainably low fees. Third, Jackson National has benefited from others’ mistakes.

The annuities market is “going through a period of brand inversion,” he said. “There was a time when everyone thought that ‘bigger was better.’ But now some of the bigger brands have become tainted,” creating opportunities for a less well-known but highly-rated company like Jackson National to seize.

© 2009 RIJ Publishing. All rights reserved.

If you’ve seen Seibert lately, you may also have heard him announce that the Certified Retirement Counselor designation, which

If you’ve seen Seibert lately, you may also have heard him announce that the Certified Retirement Counselor designation, which

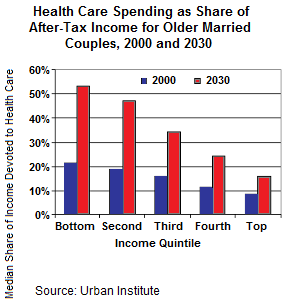

“In the short run, it seems fairly clear that taxes are going up,” said Russell Wild, a fee-only financial planner in Allentown, Pa. “I think the conversion is something everyone should look at. It should be particularly helpful to those already retired, who don’t currently have any money in a Roth.”

“In the short run, it seems fairly clear that taxes are going up,” said Russell Wild, a fee-only financial planner in Allentown, Pa. “I think the conversion is something everyone should look at. It should be particularly helpful to those already retired, who don’t currently have any money in a Roth.”  Unlike many advisors, he also recommends drawing down tax-deferred money before taxable money in retirement. While the money in tax-deferred accounts may be compounding, he said, “The taxes are compounding too. The concept comes from Don Blanton’s Moneytrax.”

Unlike many advisors, he also recommends drawing down tax-deferred money before taxable money in retirement. While the money in tax-deferred accounts may be compounding, he said, “The taxes are compounding too. The concept comes from Don Blanton’s Moneytrax.”