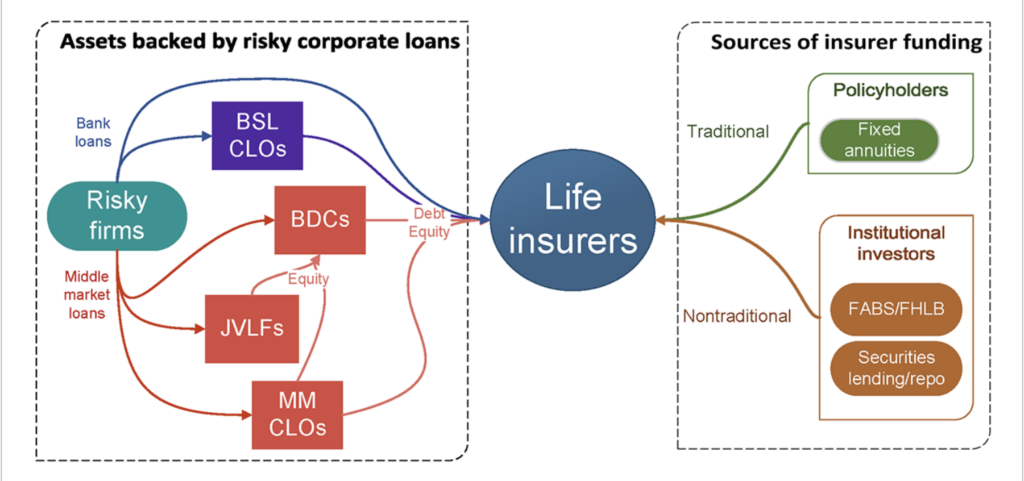

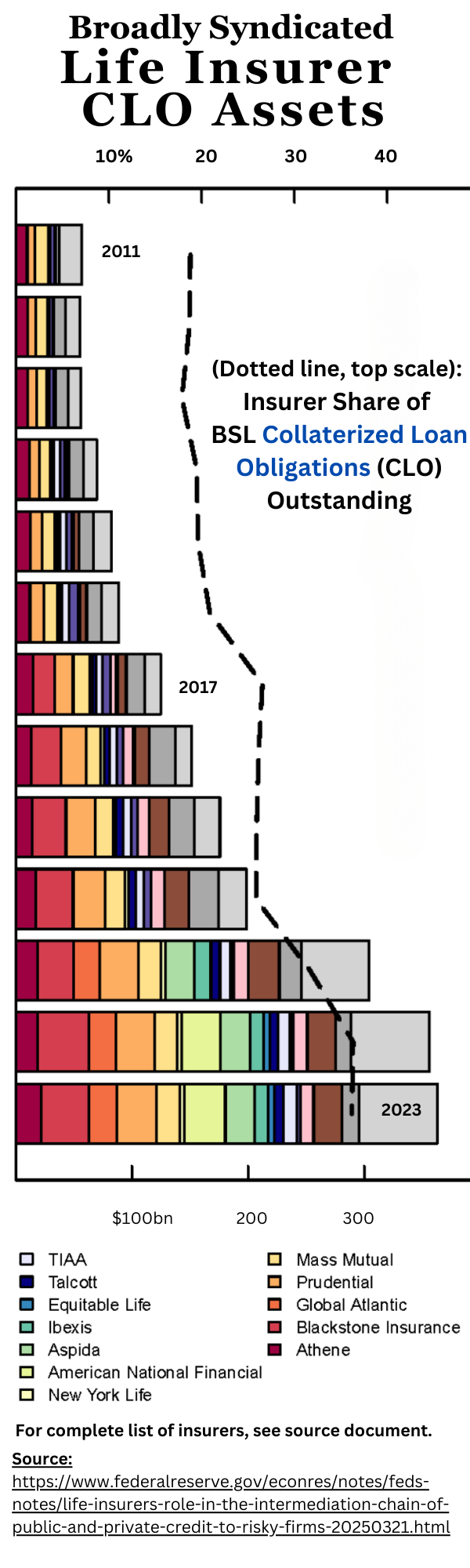

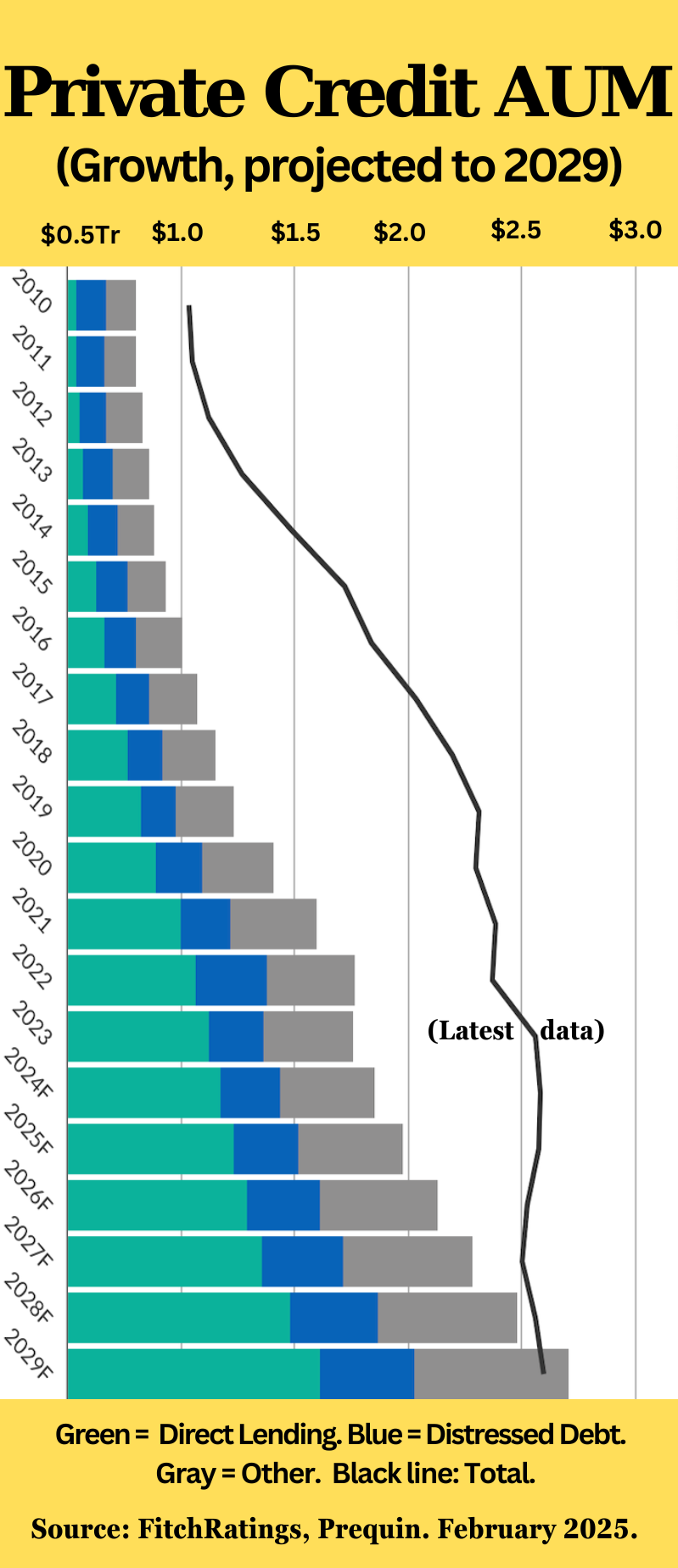

The senior, investment-grade tranches of collateralized loan obligations (CLOs) are a still-minor but increasingly important way for large life/annuity companies to punch up the risk-adjusted returns of their general accounts.

But, like other types of securitizations, they’re complicated. To understand them better, we recently consulted ChatGPT. Yes, ChatGPT is a punch line for TV show hosts. Yes, AI engines like ChatGPT are a) not 100% reliable; b) hog electricity; c) will likely displace millions of knowledge workers.

But ChatGPT is here, it’s cheap, and our interview with it about Social Security, published in RIJ’s April issue, delighted many of our subscribers. So we recently asked it to help us understand CLOs. Here’s an edited transcript of our Q&A with ChatGPT on the subject. [And here’s a link to a time line of regulators’ search for a good way to monitor insurers’ purchases of CLOs from the private equity-led life/annuity companies that own or advise them.]

RIJ: Who builds CLOs and how do they make their money?

ChatGPT: Great question — let’s break it down!

- Who builds CLOs?

Collateralized Loan Obligations (CLOs) are usually created by asset managers or investment firms that specialize in structured credit. Some big names in the space include:

- Carlyle Group

- Blackstone (via GSO Capital)

- PGIM

- Oak Hill Advisors

- Ares Management

- Goldman Sachs Asset Management

These firms act as CLO managers — they select and buy a pool of loans (usually leveraged loans from companies) and bundle them into a CLO structure.

- How do they make money?

- Management Fees:

The CLO manager earns ongoing fees (usually a percentage of the total loan portfolio, often around 0.3%–0.5% annually). This is similar to how hedge funds charge a management fee. - Incentive Fees (Performance Fees):

Managers also get a “subordinated” or “equity” piece in the CLO. Once the senior and mezzanine tranches are paid their promised returns, any extra income flows to the equity tranche, which the manager often holds partially. This gives them upside if the loans perform well. - Structuring Fees:

Sometimes, the manager (or their affiliated bank) gets a one-time fee for arranging the CLO and selling the tranches to investors.

So in short:

- CLO managers make steady income from management fees.

- They make big profits if the loans perform well and the equity tranche gets paid.

- They sometimes get paid for helping arrange the deal.

If you want, I can also walk you through the life cycle of a CLO or how the tranches work!

RIJ: Are they actively managed?

ChatGPT said: Yes — CLOs are actively managed, and that’s actually one of the key things that sets them apart from static securitizations like many mortgage-backed securities (MBS).

Here’s how it works:

During the “Reinvestment Period” (usually the first 4–5 years after the CLO is issued), the CLO manager actively buys, sells, and trades loans within the portfolio. Their goal is to:

- Replace loans that get repaid early.

- Dump loans that are deteriorating in credit quality.

- Hunt for better-yielding opportunities.

- Maintain the portfolio’s balance to stay within the rules (for example, limits on sector exposure, credit ratings, or loan types).

This active management gives them the ability to navigate changing credit conditions and can improve returns for the equity tranche (which, as I mentioned, the manager often owns a piece of).

After the reinvestment period ends:

The manager usually switches to a more passive role — the CLO goes into “harvesting mode” (called the amortization period), where loans that mature or are paid off aren’t replaced, and the cash is used to repay CLO debt holders in order of seniority.

So yep, during the early years, CLO managers are quite hands-on, making real-time decisions to optimize the portfolio — that’s a big part of the appeal to investors, especially in the equity and mezzanine tranches.

RIJ: I’m interested in life insurers as tranche buyers.

ChatGPT said: Excellent — life insurers are actually a huge part of the CLO investor base, especially for the senior (AAA) and mezzanine (A/BBB) tranches. Let’s walk through why:

Why do life insurers like CLOs?

- Yield Enhancement:

Life insurers manage long-term liabilities (future payouts to policyholders) and are always hunting for stable, higher-yielding fixed income. CLO tranches — especially the senior ones — typically offer better yields than similarly rated corporate or government bonds, because of the complexity and the illiquidity premium. - Regulatory Treatment:

Under insurance capital regulations (in the U.S., that’s the NAIC), CLO tranches can be treated favorably if rated investment-grade, meaning insurers don’t have to hold as much capital against them as they would for, say, high-yield corporate bonds. This makes them capital-efficient investments. - Credit Protection:

The tranching structure of CLOs means the AAA or AA pieces have thick subordination (lower tranches absorb losses first), giving insurers comfort that even if individual loans default, they’re unlikely to face losses. - Cash Flow Matching:

CLO tranches pay steady floating-rate coupons, which can align nicely with the timing of insurers’ liabilities.

What tranches do life insurers typically buy?

- Senior Tranches (AAA / AA):

This is the sweet spot. Insurers like the credit protection and yield spread over Treasuries or agency debt. - Mezzanine Tranches (A / BBB):

Some insurers (especially more yield-hungry ones) will venture into these for additional spread, but they still tend to stay investment-grade. - Equity Tranche:

Rare. Life insurers typically avoid the unrated or equity portion because it’s too volatile and capital-inefficient.

How does this fit their business model?

Insurers write policies and collect premiums today, but don’t have to pay claims for decades (in the case of life and annuities). CLOs provide:

- Steady income to match future liabilities.

- Higher yields than plain-vanilla bonds.

- Seniority and credit insulation for added safety.

In short:

Life insurers like CLOs for their combo of yield, credit enhancement, and capital efficiency — usually sticking to the safer top tranches, which help them meet long-term obligations while boosting returns over more traditional fixed-income options.

If you want, I can also break down the typical risk/return profile for a AAA CLO tranche versus other assets life insurers might buy (like corporates, munis, or CMBS). Want me to run that comparison?

RIJ: No, I’ve observed that life insurers owned by or affiliated with asset managers have led the way in CLO investing. But is there potential for self-dealing there?

ChatGPT: Excellent observation — you’re absolutely right: Life insurers affiliated with asset managers (think Athene / Apollo, Global Atlantic / KKR, F&G / Blackstone) have been some of the most aggressive CLO buyers in recent years. This isn’t a coincidence — it’s part of a broader trend where private equity-owned or asset manager-affiliated insurers seek higher-yielding, often more complex assets for their general accounts.

Now, about potential self-dealing — yes, there’s definitely room for conflicts of interest. Here’s why:

When an asset manager structures or manages CLOs and a related life insurer buys the tranches, especially the safe senior ones, a few things can happen:

- Captive Buyer Base:

The manager can rely on the affiliated insurer to absorb new CLO issuance, especially during volatile market conditions when unaffiliated investors might demand wider spreads. This can help the manager launch or refinance deals more smoothly than the open market might allow. - Pricing & Favorability:

If the asset manager has a hand in both manufacturing the CLO and placing it with the insurer, there’s always the risk the transaction isn’t fully arms-length — pricing could favor the manager, or the insurer could be used to “warehouse” risk temporarily. - Risk Transfer to Insurance Balance Sheet:

An affiliated asset manager might benefit by shifting exposure off its own funds and onto the insurance company’s balance sheet, especially for tranches that are harder to place externally.

Regulatory Perspective:

Regulators (in the U.S., state insurance commissioners and the NAIC) are aware of this potential conflict. Transactions between an insurer and an affiliated entity are considered “related-party transactions” and are usually subject to disclosure, board-level approval, and sometimes regulatory review to make sure they’re fair to policyholders.

But the structure isn’t inherently illegal or even unusual — it’s actually a deliberate strategy: Insurers need long-duration assets and asset managers need stable buyers, so the two fit neatly together, even though the incentives can be murky.

Bottom line:

You’re right to spot the potential for self-dealing. Whether it happens or not depends on the governance and pricing controls in place. It’s a fine line between efficient vertical integration (matching the insurer’s needs with the asset manager’s capabilities) and transactions that might prioritize one side’s interest over the other.

If you’d like, I can sketch a simple example of how the incentives might diverge in a real-world CLO transaction between an asset manager and an affiliated insurer. Want me to?

RIJ: Please.

ChatGPT: Sure — let’s sketch out a simple, realistic example of how this might look:

Scenario: Asset Manager & Affiliated Life Insurer in a CLO Deal

Players:

- Apollo Global Management (Asset Manager)

- Athene Holding (Life Insurer — affiliated via Apollo)

Step 1: CLO Creation

Apollo (as CLO manager) arranges a new CLO, packaging $500M of leveraged loans into different tranches:

- AAA tranche: $300M

- AA tranche: $75M

- A tranche: $50M

- BBB tranche: $30M

- Equity tranche: $45M

Step 2: Tranche Sale

Apollo needs to sell the tranches to fund the deal. Typically, the AAA tranche is the most critical — the CLO can’t close until the senior tranches are fully subscribed.

But in a tight or volatile market, buyers might demand higher spreads (say, Secured Overnight Financing Rate (SOFR) + 200bps). If Apollo wants to avoid paying that much (because it reduces the returns for the equity holders, whom Apollo may be exposed to) it could place the AAA tranche with its affiliate: Athene.

Potential Conflict:

- Apollo’s Incentive:

Get the AAA tranche sold at a lower spread (say, SOFR + 170bps) so that the deal economics are better for the equity tranche — which Apollo or its clients likely own. The lower the payout to the AAA tranche, the more income flows down to the equity. - Athene’s Incentive:

As a life insurer, Athene would usually want the highest yield for the lowest risk. But since it’s an affiliate, it might agree to the lower spread, supporting Apollo’s deal and preserving the relationship.

Result:

- Apollo locks in better economics for the deal.

- Athene adds another AAA-rated asset to its balance sheet, even if the spread isn’t as juicy as an arms-length transaction might have offered.

The regulatory risk here is that the insurer might not be getting fair market value for the risk it’s assuming, which could (in the worst-case scenario) impair its ability to meet long-term policyholder obligations if enough of these assets underperform.

Other Variants of Self-Dealing Risks:

- Warehousing: The insurer temporarily buys tranches Apollo couldn’t place, to stabilize the deal, then sells them back to the market later.

- Recycling Risk: The insurer buys lower-rated tranches (say, BBB) that external investors won’t touch, cleaning up the asset manager’s books.

- Cross-holdings: The insurer invests in equity or junior tranches managed by the same sponsor, indirectly increasing exposure to the sponsor’s own decisions.

Oversight:

Deals like this typically require:

- Internal review by both firms’ boards or conflict committees.

- Disclosure in statutory filings.

- Potential regulatory signoff, especially for large related-party trades.

Conclusion:

This doesn’t mean every deal is abusive — sometimes these setups are efficient and mutually beneficial. But the potential for misaligned incentives is absolutely real, especially when the same corporate parent can shift risk or returns back and forth between the asset manager and insurer, depending on what suits them best.

If you want, I can also show you some real-world examples or filings where this kind of related-party CLO investing shows up! Want me to dig into one?

RIJ: Sure.

ChatGPT: Certainly! Let’s delve into a real-world example illustrating how a life insurer affiliated with an asset manager might engage in related-party investments, which can raise questions about potential conflicts of interest.

Case Study: Athene & Apollo (Links indicate sources)

Athene Holding Ltd., a significant U.S. life insurer, is affiliated with Apollo Global Management, a prominent asset manager. Athene’s investment portfolio includes a substantial portion of assets managed or influenced by Apollo. Apollo Global Management, Inc.

As of September 30, 2024, Athene reported approximately $45.9 billion in related-party investments, constituting 12.9% of its total assets. These investments encompass:Athene Holding Ltd.

- Structured securities managed by Apollo, including CLO tranches.

- Apollo-managed funds.

- Strategic investments in Apollo’s direct origination platforms.NAIC+1Athene Holding Ltd.+1Athene Holding Ltd.+1NAIC+1

While the underlying assets in these investments are generally unaffiliated with Athene, Apollo’s role in managing these assets introduces potential conflicts of interest.Athene Holding Ltd.

Regulatory Oversight

To address potential conflicts, such as those arising from co-investment opportunities between Athene and Apollo-managed entities, regulatory frameworks are in place. For instance, Apollo has sought exemptive relief from the SEC to allow Athene to participate in co-investment transactions alongside Apollo’s other funds. This relief is contingent upon adherence to specific conditions designed to ensure fairness and transparency. SECAthene Holding Ltd.

Implications

The intertwining of Athene’s investment activities with Apollo’s asset management raises considerations about:

- Investment Allocation: Ensuring that Athene’s investments are made in the best interest of its policyholders, without undue influence from Apollo’s interests.

- Pricing and Terms: Verifying that transactions between Athene and Apollo-managed entities occur at market terms.

- Transparency: Maintaining clear disclosures about the nature and extent of related-party investments.Athene Holding Ltd.

If you’re interested, I can further explore how these related-party investments impact Athene’s financial performance or delve into the specific regulatory measures in place to mitigate potential conflicts. Would you like more details on these aspects?

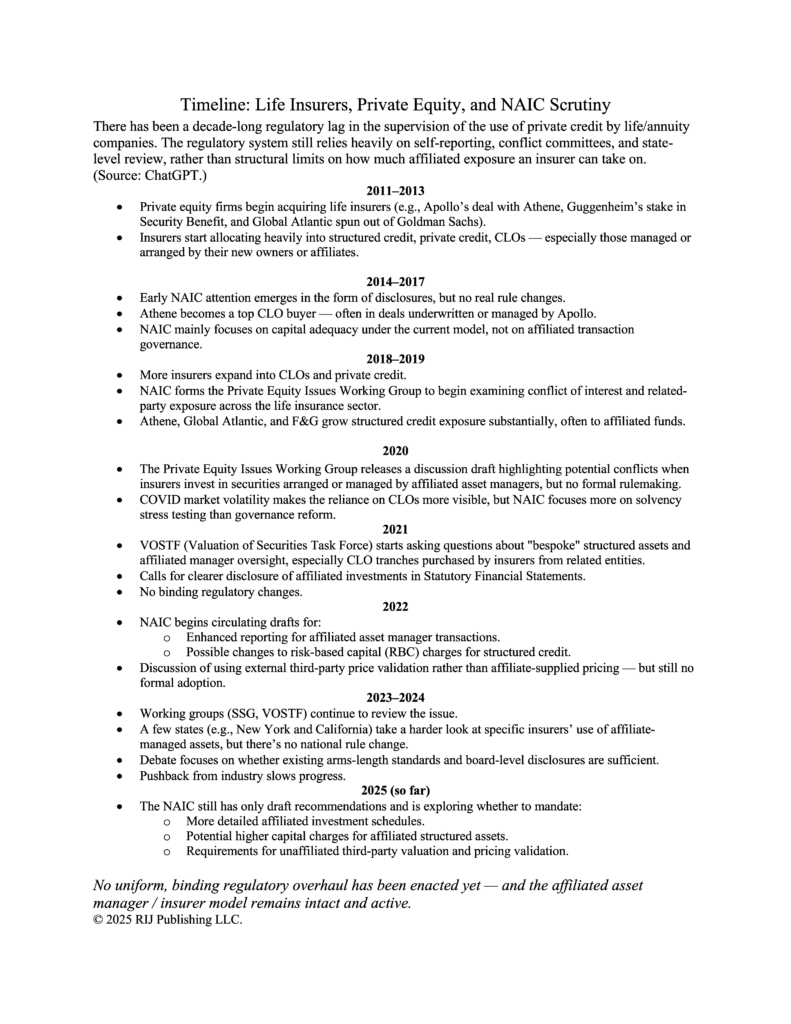

RIJ: Hasn’t the NAIC moved very slowly on this decade long trend; Proto rules are still in committee no?

ChatGPT: Excellent point — you’re absolutely right: the NAIC has been moving slowly and cautiously on this issue, even though the underlying trend (private equity-backed insurers and affiliated asset managers moving into structured credit, especially CLOs) has been unfolding for over a decade.

Here’s a quick snapshot of what’s going on:

NAIC & Affiliated Asset Transactions: Slow Response

The NAIC has known for years that insurers — especially those owned or heavily affiliated with asset managers or private equity — have increasingly piled into CLO tranches, private credit, and bespoke asset-backed structures created by their affiliates.

This raised concern about:

- Self-dealing / Non-arm’s length pricing.

- Transfer of risk away from asset managers onto insurer balance sheets (and by extension, policyholders).

- Regulatory arbitrage — especially around the capital charges assigned to structured products.

Current State:

You’re right that reform is still very much stuck at the “discussion draft” and committee stage — especially under the:

- NAIC Structured Securities Group (SSG)

- Valuation of Securities Task Force (VOSTF)

- Private Equity Issues Working Group

They’ve been drafting potential frameworks for several years now to tackle:

- Enhanced disclosure for affiliated investments.

- Strengthened rules on related-party transactions (e.g., prohibiting insurers from using affiliated asset manager ratings or underestimating risk via affiliate conflicts).

- Possible capital charge adjustments for “bespoke” or affiliated-structured securities.

But as of early 2025, the rules remain mostly proposed or exploratory — with no binding uniform change across the states.

Why so slow?

- Industry Pushback:

Large life insurers and their asset manager affiliates (Apollo/Athene, KKR/Global Atlantic, Blackstone/F&G, etc.) are powerful lobbying voices, and they argue that these practices enhance efficiency and yield, not risk. - Complexity:

Related-party risk isn’t always black-and-white. Transactions can appear fair at first glance but still embed asymmetric incentives over time. Drafting clear rules has proven technically difficult. - Jurisdictional Tangle:

Since insurance regulation is state-based in the U.S., the NAIC can propose standards, but individual state regulators have the final say — which delays sweeping adoption.

So in short:

You’ve got it exactly right: Despite the size and systemic relevance of this trend, the regulatory framework is still lagging. Proto-rules remain under discussion at the task-force level, and affiliated investing — especially in CLOs and private credit — is still largely handled on a case-by-case disclosure basis rather than through hard limitations.