'Zero is the hero' in fixed index annuities, which offer upside without risk of loss. In this first article of a four-part series on FIAs, presented by Retirement Income...

A New Flavor of Variable Indexed Annuity

“You can write this concept out on a cocktail napkin, and ask someone, ‘Are you comfortable with half the downside and more of the upside?’," said Thomas Layton, vice...

Honorable Mention

Generational views of retirement differ: TIAA; Stress on the Bank of Mom and Dad: Legal & General Group.

Is the SECURE Act Too Weak to Make a Difference?

Yes, there's a new 'safe harbor' for selecting an annuity provider for a 401(k) plan in legislation that appears headed for the president's signature. But there's no sign that...

Do Fiduciary Rules Work, or Do They Backfire?

'We found that broker-dealer representatives in states with common law fiduciary duties sold cheaper and better products and sell fewer variable annuities overall,' said Manisha Padi, one of the...

RIJ’s 500th Issue

Ten years ago, the “retirement income industry,” a narrow but deep niche of individuals and organizations that included much more than the annuity industry, evidently needed a news outlet...

Three Annuity Cures for Sequence Risk

New York Life and Fidelity have introduced a variable annuity with principal-protection over 10 years. Similar protection could be obtained with an indexed annuity or with a combination of...

Deregulating Retirement

Retirement bills close to passage in the House and Senate remove barriers to commerce in the 401(k) business but could also weaken safeguards that have been in place for...

How Debt Affects Retirement

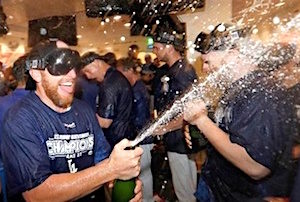

“Remaking Retirement? Debt in an Aging Economy," was the theme of the 65th annual symposium of the Wharton School's Pension Research Council, held last week in Philadelphia. (Photo: Kitchen...

At the Morningstar Investor Conference

Annuity providers failed to sponsor a single booth at the Morningstar conference trade show. That's a bit odd, since they claim to want to break into the registered investment...

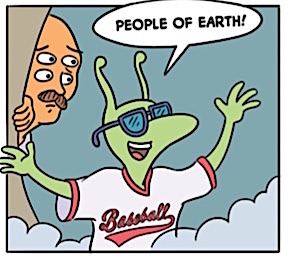

It’s No Joke: The Fed’s Comic Book is Wrong

The educational comic book from the New York Fed means well but perpetuates the myth that money was created in the private sector to facilitate barter and enabled commerce...

The Reason for SPIAs, from Pfau and Finke

In a new whitepaper sponsored by Principal Financial Group, the two retirement experts from The American College use hypothetical cases to show the advantages of using deferred and immediate...

Annuities that Pay Cash Back Rewards

Gainbridge, a insur-tech startup, aims to sell fixed deferred and period certain income annuities online. Its sister company, Relay, uses annuities to fund cash back rewards cards. Both firms...

New Research on 401K Plans, from Top Researchers

Boston College, DCIIA and Morningstar provide new research on Britain's 'NEST' experience with auto-enrollment, custom TDFs and why replacing bad 401k investment options is a good idea.

The Awful Optics of Fighting Fiduciary Rules

Broker trade groups are fighting proposed fiduciary rules in New Jersey and Maryland, but brokers' opposition to consumer protections isn't likely to improve their image.

Why Living Benefits Are Dying

Instead of buying variable and indexed annuities for lifetime income and protection against outliving their savings, Americans are buying annuities for accumulation. We pose six theories for the weakness...

Tell Us What You Really Think

At the LIMRA-Society of Actuaries Retirement Industry Conference in Baltimore last week, Scott Stolz from Raymond James, Greg Jaeck from Edward Jones and Jarrod Fisher from Simplicity Financial Distributors...

Why Indexed Annuity Sales Are So Strong

Many factors are driving the increase in indexed annuity sales: More manufacturers, better products, more distributors, competitive commissions, aging boomers, and relaxed regulation. But does the bubble contain the...

Kindur to Sell American Equity Fixed Annuity with Living Benefits

The fintech startup has chosen to offer ETF portfolios and an American Equity fixed annuity with a living benefit as sources of retirement income for its prospective online customers.

Help AM Best Create Metrics for ‘Innovation’

AM Best’s evaluation of a company’s innovation level will be based on two elements: innovation inputs (the components of a company’s innovation process), and innovation outputs (the impact of...