Purpose Financial's Longevity Pension Fund, introduced in Canada last summer, is designed to provide sustainable income for life with liquidity of principal. Getting SEC approval for its sale as...

‘I Can’t Believe This’

Ukraine had been touted as a cheap place for Americans to retire. That's one way to look at it. Of the ~11 million retirees in Ukraine (as of mid-2021),...

Will Buy-Out Firms Buy Out Medicare?

'Direct Contracting,' as the experiment is called, could put private equity (PE) firms between doctors and patients.

A Policy Dynamo Touts ‘Dynamic Pensions’

Bonnie-Jeanne MacDonald, an actuary and retirement policy expert at Canada's National Institute on Aging, claims that a non-guaranteed lifetime income tool could generate more income than any annuities. Tontines,...

‘Creeping inflation’ could hurt life insurers: AM Best

'Inflation could increase skepticism of a potential customer’s ability to afford life and annuity products, especially in the middle market,” said an AM Best analyst.

RIAs, 401(k)s, and Annuities: Is This the Future?

Managed accounts are one way to build annuities into 401(k) plans. Morningstar is bundling Hueler Income Solutions into its managed accounts, giving participants an easy path to an income...

Origins of the ‘Bermuda Triangle’ Strategy

This month's Roundup includes research on regulatory arbitrage by US life insurers; how income and wealth affect longevity; the intersection of pensions, trade and immigration; using home equity to...

Confessions of an MMT Groupie

Systems of paper money or “fiat money” have always been, and remain, as problematic as they are powerful. I can’t speak for MMT economists, but I don’t think that...

A New Alt-Asset Manager Enters the ‘Bermuda Triangle’

Since mid-2021, Sixth Street Partners has done reinsurance and investment deals with Lincoln Financial, Allianz Life and Principal Financial. The asset manager and its affiliates now manage $111 billion...

Energize a SPIA with Equities: Cannex

A new Cannex white paper shows how a single-premium immediate annuity (SPIA) combined with a strong equity allocation can make savings last longer in retirement and still provide a...

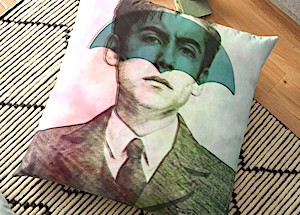

A New Film, ‘The Baby Boomer Dilemma,’ Praises Annuities

By the end of this cautionary tale, you might want to run out and, like Tom Hegna, buy a dozen annuities. (In photo: The film's fictional couple, under financial...

A 5-Year Cushion against Market Risk

'Prudent Asset Allocation' gives you the confidence of knowing that over the next five years, you don’t have to worry about market conditions,” says Louis S. Harvey of Dalbar,...

MassMutual flies into the ‘Bermuda Triangle’

MassMutual has all the pieces--a life insurer that issues fixed annuities, a stake in a Bermuda reinsurer, a big in-house asset manager, and various partnerships--that should enable it to...

‘Smart,’ from UK, Enters the US PEP Market

'Smart' is the recently-launched American branch of a British fintech with expertise in a kind of retirement savings plan that's called a 'master trust' in the UK and a...

Why Asset Managers Keep Buying Annuity Issuers

What is concerning are not so much the practices of pioneers of this business. More concerning are the 'me-too' players--smaller johnny-come-lately asset managers who want some of those billions...

Research Roundup

Almost every controversial subject in the US today--from Fed policy to machine learning to immigration--contains an element or theme related to retirement policy. The articles reviewed in this month's Research...

The ‘Catch-22’ of Social Security

Don't let the pundits confuse you into trading your retirement parachute for paper. We need Social Security AND employer-sponsored retirement savings plans.

‘Retirement Bonds’ could increase income, lower risk: EDHEC

Similar to the SeLFIES proposed by Robert Merton and Arun Muralidhar, the Retirement Bonds proposed by Lionel Martellini and Shahyar Safaee of France's EDHEC Risk Institute would guarantee safe...

A Revolt Against PE-Led Annuity Issuers

Matt Zagula is an annuity wholesaler and fixed indexed annuity (FIA) designer. He and forensic accountant Tom Gober created the TSR ratio, a scale for rating FIA issuers. Mutual...

Don’t Fight Inflation with Unemployment

If our current inflationary trend is caused by kinks in the global supply chain, does it make sense to raise interest rates, knock asset prices down, and put people...