Revolving Credit Card Balances by Family Income

IssueM Articles

RetireOne, the leading platform for fee-based insurance solutions, and Midland National Life Insurance Company, have enhanced Constance—their zero-commission portfolio income insurance solution for Registered Investment Advisors (RIAs) and their clients.

Launched in October of 2021, Constance is a contingent deferred annuity or CDA. It allows RIAs to add a living benefit rider to client brokerage accounts, IRAs, or Roth IRAs. The rider works like the lifetime withdrawal benefit on a variable annuity, which involves a guarantee that an insurance company will provide income in an investor’s later years, if needed and if certain spending limits are obeyed.

This week, RetireOne and Midland National, part of Sammons Financial Group, announced the addition of 255 mutual funds, exchange-traded funds (ETFs), and model portfolios to the lineup of investment options that can be covered by the Constance guarantee.

New fund managers include Cambria Investments, Fidelity Investments, Inspire ETFs, Invesco, iShares, Nuveen and Schwab Asset Management. Constance now offers advisers a choice of 390 total funds. Additionally, 60 new model portfolios have been added to the lineup, including strategies from American Funds, Delaware Funds, Dimensional Fund Advisors, Dynamic Wealth Management, Horizon Investments, Inspire ETFs, and WealthCare Capital Management.

Constance certificate fees have also been reduced to lower the cost of insurance. In addition to new investment options and reduced certificate fees, RetireOne said it has developed a new Portfolio Builder tool to help RIAs construct portfolios of publicly traded mutual funds and ETFs covered by Constance.

Serving over 1,000 RIAs and fee-based advisors since 2011, RetireOne, an independent platform for fee-based insurance solutions has served RIAs and fee-based advisers since 2011. It currently services over $1.5 billion of retirement savings and income investments.

Midland National has an A+ (Superior) financial strength rating from A.M. Best, the third-party independent reporting and rating company. This rating is the second highest out of 15 categories and was affirmed by A.M. Best for Midland National.

Envestnet has acquired 401kplans.com, a digital 401(k) retirement plan marketplace that facilitates retirement plan distribution and due diligence processes for financial advisors and third-party administrators. The acquisition is part of Envestnet’s “Intelligent Financial. Life” initiative. Terms of the deal were not disclosed.

The 401(k) plan sponsors and their plan advisers who work with 401kplans.com can employ Envestnet’s outsourced 3(38) or 3(21) fiduciary services to guide their investment selection process and their plan monitoring activities.

The 401kplans.com digital marketplace, available online and via mobile app, gives plan advisers a documented due diligence process for vetting considering plan providers. The platform eliminates manual proposal requests, quickly compares recordkeepers, and evaluates investment options. The innovative platform has direct integrations with more than 36 plan recordkeepers.

Under founder Scott Buffington, 401kplans.com has grown to nearly 28,000 advisors with accounts on the platform and working relationships with many of the largest broker-dealers. Buffington will join Envestnet as Head of Retirement Sales, reporting to Sean Murray.

Envestnet manages retirement asset data from more than 200,000 retirement plans. The 401kplans.com marketplace complements Envestnet’s retirement services strategy to become a major distribution channel for recordkeepers and investment managers.

Putnam Investments intends to reposition its Putnam RetirementReady Funds target-date series as the Putnam Sustainable Retirement Funds, employing sustainability-focused or environmental, social and governance (ESG) principles and strategies.

Putnam Sustainable Retirement Funds will offer vintages ranging every five years from 2025 to 2065, along with a maturity fund, and will invest in active exchange-traded funds (ETFs) advised by Putnam. The new ESG-focused target-date series is expected to be available in the coming months.The firm also offers a second target-date series, the Putnam Retirement Advantage suite.

Putnam has been building out its sustainable investing efforts and related investment offerings since 2017. The firm launched two ESG-focused mutual funds a year later and introduced its first sustainable portfolios in an active ETF format in May 2021.

At the end of April 2022, Putnam had $180 billion in assets under management. Putnam has offices in Boston, London, Munich, Tokyo, Singapore, and Sydney.

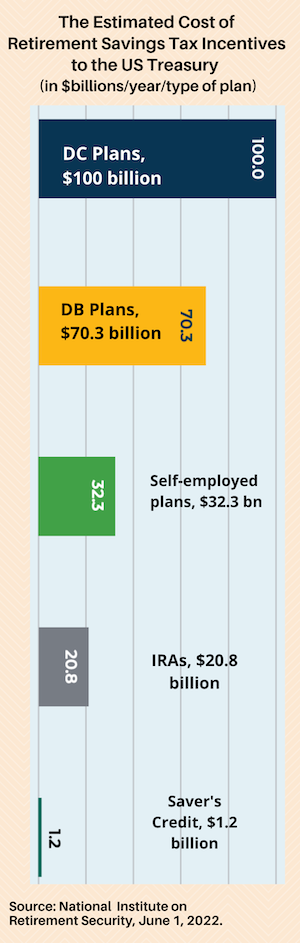

Current tax incentives fail to promote adequate retirement security for the middle class, according to “The Missing Middle: How Tax Incentives for Retirement Savings Leave Middle Class Families Behind,” from the National Institute on Retirement Security, a Washington research group.

The report considers marginal tax rates, retirement plan participation, and income distribution on retirement saving levels. It also offers potential solutions that could enhance retirement security for middle class families.

The analysis indicates that:

This leaves a “missing middle” because the tax code offers meager benefits for these working Americans to save for retirement, the NIRS said in a release. These middle class workers face rising costs in retirement, often lack retirement plans at their jobs, and need more than just Social Security income in retirement to maintain their standard of living.

The report’s key findings are as follows:

While the progressive nature of the Social Security benefit does much to prevent old-age poverty, the level of income replacement from Social Security falls off far more quickly than private savings function to provide adequate retirement income for middle class workers.

Tax expenditures for various retirement programs are heavily skewed toward high-income earners. This stems from the design of the tax breaks themselves, and from the fact that high-income earners are more likely to participate in employer-provided retirement plans and have the financial resources to save for retirement.

The value of tax incentives for saving is much greater for those at higher income levels, For those at higher income levels who face higher marginal tax rates, the value of tax incentives for saving is much greater. These incentives are weaker for much of the middle class.

Those who are able to invest earlier and at higher levels enjoy a greater advantage from the deferral of taxation on investment gains.

The tax expenditures for retirement saving, oriented around the defined contribution system, give rise to inequities beyond income and wealth. Geographic and racial inequities related to retirement are both exacerbated by the tax incentives for saving.

Solutions to these inequities should focus on increasing participation in the retirement savings system and ensuring working families also receive adequate incentives to save for retirement.

Some potential solutions could focus on building upon Social Security, either through benefit changes or allowing the program to integrate lifetime income options for savers. Reforming the tax expenditures themselves, by eliminating the deduction-based system and replacing it with a refundable credit is another possibility.

Other solutions could focus on increasing access and participation in savings plans, which some states are doing for workers who lack workplace plans, thereby making it easier to participate.

Finally, curbing abuses of the existing system would ensure that the significant sums of federal tax revenue that are dedicated to retirement security are directed at generating retirement income.

Adviser allocations to strategies that protect against inflation and rising interest rates, including alternative investments, are discussed in the latest issue of The Cerulli Edge–US Monthly Product Trends for April 2022. Highlights of the report include:

Funds. The market value of mutual fund assets sharply dropped in April 2022 to $18.0 trillion, receding by more than 7% amid the broader market pullback. Since the end of 2021, mutual funds have shed 13.4% of their value.

Exchange-traded funds also shrank, as values dropped 7.3% to $6.5 trillion, a nearly $500 billion loss over the month. Both vehicles suffered outflows during April, with mutual funds losing $78.3 billion and ETFs ceding $12.0 billion.

Inflation hedges. Cerulli expects allocations to the inflation-protected sub-asset class to increase throughout 2022, after receiving only 8% of US taxable fixed income allocations in 2021. For Series I Savings Bonds issued from May 2022 through October 2022, the interest rate is 9.62%.

Investors can purchase only up to $10,000 in I bonds through TreasuryDirect.gov each calendar year, in most cases. But an individual can purchase up to $5,000 in paper I bonds using a federal income tax refund each calendar year.

Private assets. Offering alternative strategies as an inflation hedge continues to increase as an objective—58% of firms cite it as a key objective in 2021, compared to just 21% in 2019.

Asset managers that offer private capital exposures to retail investors will experience stronger tailwinds in the coming years as inflation (and inflation-related interest-rate movements) dampens returns of traditional asset exposures, Cerulli predicted.

In the long term, firms that can offer attractively priced exposures via best-fit structures—along with those that can communicate the benefits of inflation-hedges to advisors and end-investors—will be the most successful, Cerulli said.

© 2022 RIJ Publishing LLC.

Most people, and I mean the average person-on-the-street, most of Congress, as well as many investment advisers and most mass-media journalists, don’t know much about today’s annuities.

They may know the obsolete textbook definition of an annuity as an annual income. But they do not understand how annuities can be, should be, or are in reality, used.

There’s a fundamental misconception in the public mind. It isn’t just the normal discrepancy, true of any industry, between the tidy illusion that an audience sees and the messy reality backstage. It’s not just a matter of annuities being hard to grasp.

My strong impression is that the most of the public believes that all annuities are used to generate lifetime income in retirement. And that’s just not true. Most aren’t.

One of the first things I learned after joining an annuity marketing department 25 years ago was that almost no one ever annuitizes a deferred annuity contract. Since about 97% of all annuities sold are deferred annuities, this means that only immediate annuities, whose sales are a tiny percentage of overall sales, are true annuities. (Sales volumes of deferred income annuities, which the owner commits to convert to guaranteed income at some future date, are even smaller.)

All deferred annuities have a clause somewhere in the contract that allows the owner to convert the value of the contract to a lifetime income stream. That clause, and the fact that annuities are issued by life insurance companies (many of whom sell far more deferred annuities than life insurance policies), is the only reason we call them annuities at all. (By income stream, I don’t mean a source of interest yield such as a “fixed income” investment. I mean a guaranteed paycheck,)

At the risk of divulging common knowledge, it’s equally true that neither the life insurance agents or advisers at broker-dealers and banks, nor the purchasers of the deferred annuities themselves, nor the life insurers that manufactured the deferred annuities, rarely if ever request or recommend that a deferred annuity be converted to income at some future date.

This has to be confusing for the public. They believe that the product is about longevity insurance—protection against underestimating the length of time you will need an income during retirement—when in fact the product is about investment protection.

The majority of deferred annuities are used as tax-favored investments, with some insurance features. The performance of almost all annuities that are sold—deferred variable annuities, fixed indexed annuities, and registered index-linked annuities—relies directly or indirectly on the growth of equity values.

If contract owners want some protection against outliving their savings—the purpose of a real annuity—they have to pay an extra fee for a complicated “living benefit” rider that offers a weak version of a true annuity. These riders can make it more, not less, confusing to spend down your savings in retirement. A true life annuity makes that process simpler.

The widespread misunderstanding of today’s annuities has hurt progress toward resolving some important issues. Regarding annuities in 401(k)s: Congress gave a green light to any annuity in 401(k)s, apparently not understanding the differences between types of annuities. Plan sponsors aren’t likely to accept annuities in 401(k)s when they realize that today’s annuities are, mainly, a type of investment. Regarding Social Security reform: Will Americans vote to keep Social Security if they mis-believe that private deferred annuities with living benefits protect them just as well against outliving their money?

Mishandling these questions could be disastrous. And we can’t wait much longer for answers. More than half of the Boomers are already retired. Social Security’s fate could very well hang on the results of the 2024 election. What we don’t know about annuities is going to hurt us.

© 2022 RIJ Publishing LLC. All rights reserved.

The GameStop short squeeze notwithstanding, insurance companies allocated nearly $1 billion to new hedge fund investments in 2021, according to a new AM Best report.

Book-adjusted carrying value (BACV) rose to $13.1 billion in 2021 from $12.3 billion in 2020, the second consecutive year that BACV increased after multiple years of divesting holdings in hedge funds, said the ratings agencies in the report, “Favorable Hedge Fund Returns Lead to Book Value Increases for Insurers.”

“Hedge funds generally have been perceived as an unfavorable asset class given volatile returns and fee structure,” said Jason Hopper, associate director, industry research and analytics, AM Best.

“During the pandemic, however, hedge funds offered several advantages to mitigate the adverse effects of COVID-19, including less drawdown and volatility and largely independent of stock market trends, thus lowering correlations with broader markets.”

The insurance industry’s hedge fund exposure, which is highly concentrated among a small population of insurers, grew by 6.5% in 2021, with an additional $834 million in holdings. Insurers’ hedge fund investments grew to 861 holdings in 2021, from 811 in 2020.

The life/annuity segment saw its dollar exposure to hedge funds rise by 14.0%, to $6.1 billion, and the property/casualty segment by 0.9% to $6.7 billion, following several years of declines.

Despite favorable returns, the hedge fund industry still had trouble in 2021, according to the report; in particular, the short squeeze initiated by retail investors in GameStop and over heavily shorted companies, which resulted in over $10 billion in losses and led to the collapse of Archegos Capital.

Additionally, stock market volatility toward the end of the year led some insurers to reduce their long/short equity positions, a strategy favored by insurers.

The first quarter of 2022 marked the largest allocation of new capital in a quarter since 2015, largely driven by the uncertainty surrounding commodity prices, geopolitical tensions and the rising levels of inflation. These factors contributed to global macro-strategies being among the most popular for the quarter.

While these economic and geopolitical challenges are generally negative, the uncertainty can bring advantages to the hedge fund market due to their lack of correlation with other typical asset classes. Ultimately, the lingering effects of the pandemic and ongoing market uncertainty will determine if the hedge fund market will continue to see renewed interest and greater exposures.

© 2022 RIJ Publishing LLC.

Answering Sen. Sherrod Brown’s March 2022 request for information about the impact of rising ownership of US life/annuity companies by private equity (PE) firms, the National Association of Insurance Commissioners (NAIC) Tuesday sent an 11-page response letter to Brown. Brown chairs the Senate Committee on Banking, Housing and Urban Affairs.

The NAIC is the national umbrella organization for the 50 state insurance commissioners who supervise the insurers that are domiciled in their states. While the NAIC sets certain standards of supervision, states vary significantly in their regulations and in the rigor of their oversight, with New York State often the most demanding.

In the 14 years since the Great Financial Crisis, there’s been a surge of capital from powerful investment companies like Blackstone, Apollo, and KKR into the annuity business—all eager to manage the tens of billions of dollars in Americans’ savings that life/annuity companies hold.

These Wall Street firms have acquired life insurers, purchased blocks of annuity assets from life insurers, and assumed liabilities of defined benefit (DB) plans from major corporations. Life insurers and DB plan sponsors, weakened by low yields on their bond investments, often welcomed the capital and the investment management expertise that the asset managers provided.

But the sometimes opaque financial and legal strategies that the asset managers use—including, for instance, the securitization of bundles of high risk loans and the transfer of liabilities to reinsurers in Bermuda—have worried some observers, including Federal Reserve economists who have published academic papers about the potential added risks.

News of those concerns recently reached the Senate Banking, Housing and Urban Affairs Committee, which Brown chairs. In March, he sent letters to the NAIC and the Federal Insurance Office asking to be briefed on the matter. The NAIC’s response arrived on May 31, the deadline requested by Brown.

The NAIC replied, accurately, that it has been tracking the PE firms’ influence in the life/annuity business. In its Tuesday letter to Brown, the NAIC met Brown’s inquiry with assurances that, in effect, there is nothing problematic about PE investment in the life/annuity industry that the commissioners aren’t already addressing or aren’t capable of properly regulating.

“State insurance regulators are fully capable of assessing and managing the risks of these insurers, and there is nothing PE firms add to the playing field that changes this fact. It should provide you and the public comfort to know the state insurance regulatory system has already been working on many of the concerns that you and others have highlighted, and we possess the tools and resources to address these issues,” the letter said.

NAIC CEO Michael F. Consedine, president Dean L. Cameron of Idaho and three NAIC officials signed the letter. It focuses on life/annuity company solvency as the core issue.

The question is whether PE-led life insurers, in search of yields that the Fed’s low interest-rate policy has denied them, are over-investing in risky assets that could make a life insurer fail during some future financial crisis. Such failures would threaten the retirement security of millions of Americans.

The risky assets include collateralized loan obligations (CLOs), which resemble the collateralized debt obligations (CDOs) at the center of the 2008 financial crisis. The NAIC letter to Brown conceded, “Some CLOs can carry more credit or liquidity risk or have greater complexity, and as demand for CLOs has increased, there is a potential that underwriting will weaken.”

But the NAIC sees no cause for alarm. “However, while the relative size of this asset class for the sector has been growing, it represents only 2.6% of total cash and invested assets at year-end 2020, and most of the investments held by the industry are of a higher quality. The NAIC has performed multi-scenario stress tests on industry CLO portfolios and closely monitors their performance.”

But some followers of these matters were rankled by what they perceived as the letter’s “nothing to see here” tone.

“The response is certainly no surprise,” said Tom Gober, a Virginia-based forensic accountant who has documented the tens of billions of dollars of annuity liabilities that a handful of PE-led annuity issuers have reinsured offshore, often with affiliated reinsurers. “The NAIC’s leaders apparently huddled around and threw a bunch of points at Brown that, in a vacuum, sound fine. But when you are familiar with the details, the letter is mainly fluff, and grossly inadequate.

“For instance, the letter said that collateralized loan obligations equal only 2% of the life/annuity industry’s total assets,” he added. “If you quoted CLO exposure as a percentage of the private equity-led companies’ surplus, it would knock Sen. Brown’s socks off.” The surplus is the difference between the currrent market value of an insurance company’s investments and the estimated present value of what it owes policyholders.

Gober, in collaboration with Pittsburgh-area insurance agent Matt Zagula, created a “Transparency, Surplus and Riskier Assets” (TSR) rating system. So far, private equity-led firms tend to show the highest TSR ratios, which Gober and Zagula consider a red flag for annuity buyers.

The letter’s reassurances have already been interpreted as a polite rebuff to potential federal encroachment on the states’ regulatory turf. A headline the online trade publication, said, “NAIC Rejects Need for Federal Help with Private Equity-Owned Life Insurers.”

The turf battle over state versus federal regulation of insurance has a long history. In 1944, the Supreme Court ruled that the insurance industry, long regulated by the states, was appropriate for federal regulation under the commerce clause. But the industry rebelled, and the NAIC proposed a compromise, which was tweaked into the McCarran-Ferguson Act of 1945.

The Act permitted the individual states to regulate the “business of insurance” within their borders. Crucially, the law also gave insurance companies exemption from federal anti-trust laws. But the act created some ambiguity by not defining the “business of insurance.” The Dodd-Frank Act of 2010 created the Federal Insurance Office to monitor the insurance sector, but not to regulate it.

The line between the insurance business and the federally regulated investment business has never been well-defined, and it is arguably even less so today. Many former mutual insurance companies have converted to federally regulated stock companies. Waves of mergers and acquisitions have concentrated the sales of life insurance and annuities within a group of giant financial services firms who do both insurance and investment business.

The line is particularly blurry in the arena where private equity-led or asset manager-led insurers sell annuities. PE firms specialize in managing the assets of life/annuity companies—that is, the investment of policyholder savings. The savings product that PE-led life/annuity companies most often sell to the public—the fixed indexed annuity—so resembles an investment that the Securities and Exchange Commission and the Department of Labor, in 2007 and 2016, respectively, have tried to wrap some regulation around it. Both times, the life insurance lobby rebuffed their efforts.

Today, the majority of the $73.5 billion in fixed indexed annuities sold in the US are sold by PE-led or PE-affiliated life/annuity companies like Athene, AIG, Fidelity and Guaranty Life, Global Atlantic, Sammons Financial Group, and Security Benefit Life. Their influence over the annuity industry has steadily grown.

In short, there is much more to be said about PE influence over the individual and group annuity businesses than the NAIC’s letter to Sen. Brown would lead the casual reader to suspect. The letter left many important questions unexplored and unanswered.

© 2022 RIJ Publishing LLC. All right reserved.

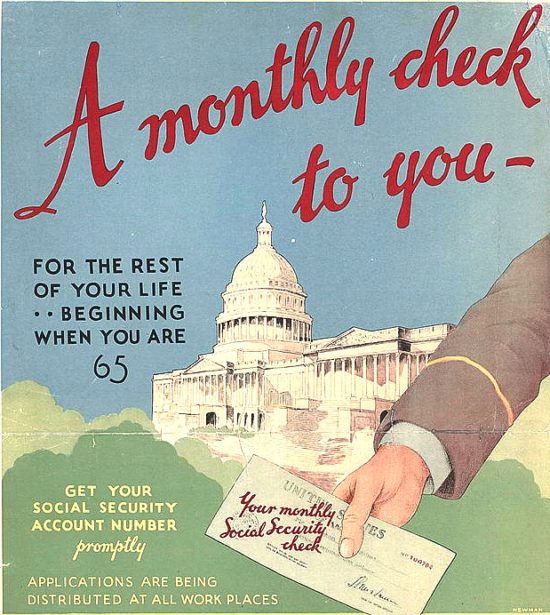

The combined asset reserves of the Old-Age and Survivors Insurance and Disability Insurance (OASI and DI) Trust Funds are projected to last a year longer and to cover five percentage points more of promised benefits than previously predicted, according to the annual report of the Social Security Board of Trustees, released yesterday.

The OASI (Social Security) Trust Fund is projected to become depleted in 2034, one year later than last year’s estimate, with 77% of benefits payable at that time. The DI Trust Fund asset reserves are not projected to become depleted during the 75-year projection period.

In the 2022 Annual Report to Congress, the trustees announced:

The asset reserves of the combined OASI and DI Trust Funds declined by $56 billion in 2021 to a total of $2.852 trillion.

The total annual cost of the program is projected to exceed total annual income in 2022 and remain higher throughout the 75-year projection period. Total cost began to be higher than total income in 2021. Social Security’s cost has exceeded its non-interest income since 2010.

The year when the combined trust fund reserves are projected to become depleted, if Congress does not act before then, is 2035 – one year later than last year’s projection. At that time, there would be sufficient income coming in to pay 80% of scheduled benefits.

“The Trustees recommend that lawmakers address the projected trust fund shortfalls in a timely way in order to phase in necessary changes gradually,” said Kilolo Kijakazi, Acting Commissioner of Social Security. “Social Security will continue to be a vital part of the lives of 66 million beneficiaries and 182 million workers and their families during 2022.”

Other highlights of the Trustees Report include:

Total income, including interest, to the combined OASI and DI Trust Funds amounted to $1.088 trillion in 2021, with $980.6 billion from net payroll tax contributions, $37.6 billion from taxation of benefits, and $70.1 billion in interest.

Total expenditures from the combined OASI and DI Trust Funds amounted to nearly $1.145 trillion in 2021.

Social Security paid benefits of $1.133 trillion in calendar year 2021. There were about 65 million beneficiaries at the end of the calendar year.

The projected actuarial deficit over the 75-year long-range period is 3.42% of taxable payroll, a decline from the 3.54% projected in last year’s report.

During 2021, an estimated 179 million people had earnings covered by Social Security and paid payroll taxes. The cost of $6.5 billion to administer the Social Security program in 2021 was a very low 0.6% of total expenditures. The combined trust fund asset reserves earned interest at an effective annual rate of 2.5% in 2021.

The Board of Trustees usually comprises six members. Four serve by virtue of their positions with the federal government: Janet Yellen, Secretary of the Treasury and Managing Trustee; Kilolo Kijakazi, Acting Commissioner of Social Security; Xavier Becerra, Secretary of Health and Human Services; and Martin J. Walsh, Secretary of Labor. The two public trustee positions are currently vacant.

Yesterday, the Bipartisan Policy Institute, which has proposed compromise solutions to Social Security’s projected funding shortfall, released the following statement:

Social Security’s financial shortfall has been well known for years, and now it’s staring us in the face just over a decade away. This year’s report shows yet again that we are well past the time for talking points and partisan entrenchment.

We need specific plans. We need leadership. And we need action.

Pronouncements like ‘no tax increases,’ ‘no benefit cuts,’ and ‘no tax increases on anyone below a certain threshold’ need to be set aside. There’s no room for red lines. This is a societal challenge that requires broad contributions to a solution.

Wage and job growth have exceeded expectations, which is bringing in more revenue to the trust funds, and sadly, COVID deaths among the elderly have modestly reduced program costs. Claims for disability insurance continue to come in below expectations, which partly explains the bright spot in this report for that trust fund, which is now expected to remain solvent throughout the 75-year projection window. But working in the opposite direction, Social Security benefits are tied to inflation and price growth has continued to accelerate.

The good news is that more members of Congress are actively working to chart a bipartisan path forward on this complex problem than at any time in recent years. We at BPC stand ready to help, and our 2016 commission report serves as a template.

Finally, it’s shameful that many of the leadership positions for the Social Security program have gone without permanent officials for so many years. The commissioner is currently acting, and that position has only been filled by a confirmed appointee for two of the past nine years. Similarly, the public trustee positions have been vacant for the past seven years, mainly due to partisan squabbling.

With Social Security in difficult financial straits, it’s critical that we have trusted public oversight of the program’s finances and operations.

© 2022 RIJ Publishing LLC.

Since 1981, the US national debt has risen from just under $1 trillion to more than $28 trillion. Over the same period, the yield on 10-year Treasury securities fell from 15.84% to, at one point, 1.19%. Since heavy debtors typically pay more to borrow, this makes no sense.

The prominent Harvard economist N. Gregory Mankiw examines this apparent contradiction in a new essay, “Government Debt and Capital Accumulation in an Era of Low Interest Rates.” A government may be able to service a growing debt at low rates for certain period, he concludes, but eventually there will be hell to pay.

“If the government in a dynamically efficient economy observes a safe rate much below the average growth rate and tries to run a Ponzi scheme by issuing a lot of debt and rolling it over forever, it is gambling,” Mankiw writes. (Emphasis added.)

“The policy may well work, but it might not. And the circumstances in which it fails are particularly dire. The big losers are the generations alive when the scheme fails, who must endure either a debt default or higher taxes.”

Welcome to the long-running debate between economists and politicians who predict that “our grandchildren” will spend their lives paying off the debt we’ve run up, and others who disagree—but who can’t seem to explain exactly why they disagree.

Ponzi is a pejorative and provocative word. A “Ponzi scheme,” named after Charles Ponzi, a 1920s con man, and practiced on grand scale by the late Bernard Madoff, is a swindle where the initial investors in a fake business venture are paid back with money from new investors rather than with legitimate profits or revenue.

Such schemes are both illegal and unsustainable: Gullible new investors become harder to find. (Unless they are simply trying to launder ill-gotten money.) The original investors stop receiving dividend checks. The fraud is exposed. The last to “invest” lose all their money.

In comparing deficit financing by the US government to a Ponzi scheme, Mankiw suggests no one, not even a large sovereign government can keep borrowing to the point where it has to borrow to pay the interest on its own debt. Eventually the consequences of recklessness in the public sectors—default, deflation, higher interest rates, higher taxes, or some combination of them—will damage the private economy.

Social Security is often compared to a Ponzi scheme, since new payroll tax revenues (and interest on its surpluses) constitute its only income. But the comparison isn’t justified. Social Security is old-age insurance, not a business venture, and mandatory payroll taxes are not so much investments as insurance premiums. And as we all know, insurers raise premiums all the time; it doesn’t mean they’re at risk of failure. But I digress.

Mankiw warns that some future generation of Americans could get stuck with paying down today’s national debt. “A yet-to-be-born generation does not know whether it will arrive during a lucky or unlucky time, and it may want to share that risk with other generations. This intergenerational risk sharing can be achieved with well-designed fiscal policy. How this risk sharing interacts with debt policy is, I admit, still not completely clear to me,” he writes.

Mankiw reaches a four-fold conclusion:

The reckoning, that is, must come sooner or later.

Another perspective

But is Uncle Sam actually running a swindle? Are our grandchildren doomed to inherit all of our debts? Such pessimism ignores the obvious fact that our grandchildren will inherit our assets along with our debts. The government creates debt and assets simultaneously.

The indictment that America’s current path is unsustainable (unless the government’s creditors let it roll over debt indefinitely at interest rates below the economy’s growth rate) may have been expressed best by former UK prime minister Margaret Thatcher. “Sooner or later the government runs out of other people’s money,” she famously said.

Thatcher seemed to believe that the government relies on borrowing and taxing private wealth to finance its activities. She and Mankiw don’t seem to have considered the fact that the US government creates net new money (or, if it does, it only makes us all poorer by diluting the existing money supply).

The late economist Wynne Godley wrote, “The government cannot have experienced any difficulty with regard to ‘financing’ [its] deficits. It has created more money by running the deficit; money has also been created by bank lending to finance increases in inventories” (Macroeconomics, 1983, p 132).

It’s well known that businesses borrow money (“credit money”) into existence from banks, while simultaneously generating financial assets (loans) for banks. Business owners then spend that money into the general economy, creating the pool of money from which they’ll draw revenue and pay back the banks.

Similarly, the federal government borrows money into existence from the big Wall Street “primary banks” (or from the Fed, in a pinch), releases that money into the general economy, and relies on the general pool of money—its source of taxes and new borrowing—to pay its bills and finance its debt.

We often hear about the $28 trillion in national debt. No one seems to worry about the net $16.8 trillion in credit money that banks have loaned and remains unpaid. In modern US history, the US banks’ stock of outstanding credit has only gone up, never down. Yet no one imagines a day of reckoning when all of those loans will be closed out. No one hopes for such an event; it would only mean that $16.8 trillion disappeared from the economy.

The same is true with government debt.

Were it any other way, our debt would have strangled us a long time ago. Instead, the economy has grown, as has personal wealth. The government could in theory eliminate new spending, apply all taxes to retiring debt, and balance the US budget. Then we would have our purgative reckoning. But to what purpose? We’d be out of debt, but the economy would be a whole lot smaller.

© 2022 RIJ Publishing LLC. All rights reserved.

What do Netflix, Peloton Interactive, Coinbase, and Palantir Technologies have in common? I admit it isn’t a particularly challenging question. As anyone who has been following the US stock market in the last 10 months knows all too well, they are all US large cap growth stocks that have lost more than 50% of their value from their 2021 highs, actually well more than 50%.

[Note: This guest column is a condensed version of a longer article, available at the GMO site.]

But I’d like to point out that they have something else in common that should be more broadly concerning for investors. They are all growth traps. Growth traps are a subset of the growth universe and get much less attention than their cousins, value traps, despite my attempt to call attention to them in the 2Q 2021 GMO Quarterly Letter, “Dispelling Myths in the Value vs. Growth Debate.”

That is a shame, because investors would be well advised to recognize the damage growth traps can do to their portfolios. I’d like to offer a quick refresher on growth traps, why they are so painful, and why I believe they are probably going to continue to snap shut painfully on investors’ portfolios for some time yet to come.

My Quarterly Letter last summer defined a trap as a company in either the value or growth universe that both disappointed on revenues in the last 12 months and saw its future revenue forecast decline as well. When it occurs to a stock in the value universe, it is a value trap.

Investors seem to believe value traps teem in the portfolios of value managers and that those value traps cause massive damage to those portfolios when they appear. While I would love to tell you that the investors are dead wrong on those presumptions, sadly, they are pretty close to spot on. In a typical year, about 30% of stocks in the MSCI US Value index turn out to be value traps, and they underperform that index by 9% on average.

But what seems to be somewhat less well known is that growth traps are both more common and more painful than their value brethren, with a prevalence of about 37% of the MSCI US Growth index and an underperformance of 13% on average.

The fact that growth traps are more painful than value traps is, in one sense, not really a surprise. Value stocks are already companies that investors don’t have particularly high hopes for. They trade at lower-than-average multiples by definition. The fact that a company trades at lower-than-average multiples certainly doesn’t mean it can’t fall when its fundamentals disappoint, but it does generally mean that the pain isn’t compounded too severely by falling valuations as well.

For a growth stock, however, a disappointment in the performance of the company is extremely likely to result in a falling valuation multiple. After all, these are exactly the companies that the market has awarded higher-than-average multiples because of outsized expectations of their growth prospects. When those prospects deteriorate, valuations almost invariably fall significantly, often precipitously.

Some of the pain was inflicted by a generic de-rating that hit the growth universe this year pretty indiscriminately. But a lot of it was driven by growth stocks that fundamentally underperformed investor expectations—growth traps. These growth traps actually had their worst showing on record relative to the growth universe. This fact should be of interest to market historians and, I will admit, it is also a source of some satisfaction for those investors who positioned their portfolios to be short growth stocks a year ago.

But what should be of note to all investors whatever their positioning is that conditions today suggest that it is likely there will be more growth traps in the next year than there were in the last one and there is good reason to believe their underperformance will remain worse than usual until a full unwinding of the growth bubble occurs.

Ben Inker is co-head of GMO’s Asset Allocation team and a member of the GMO Board of Directors.

© 2022 GMO LLC.

The value of US insurance companies’ investments in private equity products grew by 25.8% in 2021, to $117.4 billion, from $93.3 billion in 2020. It was the biggest year-over-year increase in PE investments in recent years, according to a new AM Best special report.

Life/annuity insurers, which account for three-quarters of the insurance industry’s private equity book adjusted/carrying value, are driving the new investments, realizing widespread book value gains, according to the report, “Strong Performance, New Investments Drive Private Equity Growth.”

Of the $24.1 billion in year-over-year growth, $12.9 billion was from growth in book value from 2020 (net of disposals) and $11.2 billion from new investments. The overall annual increase follows strong growth of 14.8% in 2020 and 10.0% in 2019.

“Commitments for additional capital grew 13.1% in 2021—after growing over 10% in five of the six previous years—to roughly $55 billion, more than $31 billion of which are by L/A insurers,” the report said.

“New investments in 2021 were concentrated in a few large organizations, with 10 insurers by book value accounting for roughly 60% of acquisitions for the year,” said Jason Hopper, associate director, industry research and analytics, in a release.

Five large life/annuity companies accounted for more than half of the $73.9 billion in private equity investments of the 15 insurers with the largest PE investments, according to the report: MassMutual Group, with $11.9 billion, New York Life Group, Thrivent Financial, MetLife Group and John Hancock Life Group.

New York Life and MassMutual, both mutual insurance companies, were among the leading issuers of fixed annuities in the first quarter of 2022, according to LIMRA Secure Retirement Institute. New York Life was the top seller of fixed-rate deferred annuities, with sales of $2.78 billion.

MassMutual ranked third in that product category, with $1.62 billion in sales. MassMutual ranked sixth ($934 million) in fixed indexed annuity sales for the quarter and third ($272 million) in sales of payout annuities, according to LIMRA.

“Nearly a third of insurers had new investments totaling less than $5 million, signaling a more-cautious approach by most of the insurers that do not have significant scale or in-house expertise with this asset class,” Hopper said.

While PE investments made up only a tiny (3.7% on average) of the investments of the top 15 PE holders, they made up an average of 27.3% of the capital and surplus of those companies. Among the five insurance groups named above, the PE percentage of capital and surplus ranged from 65.9% (John Hancock Life) to 23.0% (New York Life).

Private equity investments span all stages of a company’s life cycle, each with its own unique sets of risks, the report said. Roughly 58% of the insurance industry’s exposure to private equity is through investments in leveraged buyout funds, although allocations vary by insurance segment.

Venture capital accounts for another 29%, and mezzanine financing, the remainder. All three allocations grew, driven largely by life/annuity insurers, though mezzanine funds grew by double digits for all three insurance segments.

“Insurers are still seeking higher returns and opportunities to diversify their portfolios, and the performance of private equity investments has been strong with a low correlation to the public markets,” said Michael Lynch, associate analyst, AM Best.

Insurers use private equity to diversify investments and potentially achieve higher yields compared with other asset classes, but the small allocations as a percentage of invested assets point to more-conservative investment strategies and lower levels of risk tolerance.

Insurers have the smallest average allocations to private equity, as a percentage of total assets, of all the major types of institutional investors, the report said.

© 2022 RIJ Publishing LLC.

iCapital, a fintech platform through which asset managers and wealth managers can invest in alternative assets, has agreed to acquire SIMON, the online platform that distributes structured investments and indexed annuities, for an undisclosed sum.

SIMON brokered more than $48 billion in contract issuances in 2021, a release said. It served more than 50 product manufacturers, more than 50 broker dealers, private banks, and registered investment advisors, and more than 100,000 advisers.

iCapital services more than $125 billion in platform assets and employs more than 800 people globally. In an interview, iCapital chairman and CEO Lawrence Calcano could not say whether the SIMON brand would be retained or not; there was no sign that it would be.

According to the release, the acquisition “will significantly expand iCapital’s investment menu, and augment its technical capabilities, education offerings and support services for wealth managers.” SIMON offers a suite of digital tools, a library of on-demand educational resources for advisers, data and analytics, and life-cycle management. iCapital will also own SIMON Spectrum, a multi-dimensional allocation analysis and portfolio construction tool designed to evaluate how structured investments and/or annuities may fit into a portfolio.

Under the agreement, Jason Broder, CEO of SIMON, will join iCapital as managing director, head of iCapital Solutions and member of the Operating Committee. He will oversee the combined platform’s integration, market development, and sales of iCapital’s technology offerings. iCapital said it will extend offers of employment to the nearly 200 SIMON team members.

Principal Financial Group (Nasdaq: PFG) announced May 25 that it has successfully closed its transaction to reinsure the company’s in-force US retail fixed annuity and universal life insurance with secondary guarantee blocks of business with an affiliate of Sixth Street and its insurance platform, Talcott Resolution.

Under the agreement, the company has reinsured approximately $25 billion of in-force statutory reserves, and Talcott has engaged Principal to manage approximately $4 billion in commercial mortgage loans and private credit assets for the lifetime of the assets.

Principal expects deployable proceeds of approximately $800 million in 2022 from the closed transaction in combination with additional transactions designed to improve the capital efficiency of its in-force individual life insurance business. The proceeds are included in the company’s planned $2.0 billion-$2.3 billion of share repurchases for 2022.

This reinsurance transaction advances the company’s long-term strategy to focus on higher growth markets, improve capital efficiency, and will meaningfully enhance the company’s future financial profile:

Principal will release its second quarter 2022 financial results after market close on Monday, August 8, 2022. On Tuesday, August 9, 2022, Dan Houston, chairman, president, and chief executive officer, and Deanna Strable, executive vice president and chief financial officer, will discuss the results during a live conference call.

The effective date of the reinsurance transaction is January 1, 2022. Second quarter financial results will include a true-up to transfer all associated revenue and earnings as of the beginning of the year to the counterparty. In addition, the company plans to provide a preliminary estimate of the transition adjustment related to its adoption of the FASB long-duration targeted improvements in 2023.

Strategic Retirement Partners (SRP), a retirement plan consulting services firm, has selected Securian Financial as the pooled plan provider and recordkeeper for its WELLthBUILDER Pooled Employer Plan (PEP).

Made possible by the federal SECURE Act, PEPs allow unrelated companies and organizations to enroll their employees in a single 401(k) retirement plan. Employers can offsource their retirement plan’s fiduciary and administrative responsibilities to PEP providers, who provide economies of scale unavailable to most small plans.

Securian Financial will serve as the pooled plan provider and ERISA 3(16) fiduciary, while Strategic Retirement Partners will provide ERISA 3(38) investment management and consulting services for the platform.

Securian Financial’s qualified retirement plan products are offered through a group variable annuity contract issued by Minnesota Life Insurance Company. Securian Financial is the marketing name for Securian Financial Group, Inc. and subsidiaries. Minnesota Life Insurance Company is a subsidiary of Securian Financial Group, Inc.

Nationwide Life Insurance Company has agreed to pay about $5.6 million in restitution and penalties for violating New York insurance regulations with respect to “deferred to immediate annuity replacement transactions,” the New York Department of Financial Services (DFS) announced this week.

Under the agreement, contract owners will receive higher monthly payouts for the remainder of their contract terms, Superintendent of Financial Services Adrienne A. Harris said in a release.

The settlement was the latest result in DFS’s industry-wide investigation into deferred to immediate annuity replacement practices in New York State. To date, the industry-wide investigation has resulted in settlements with 13 life insurance companies, totaling approximately $29 million in restitution and penalties.

Regulators found that Nationwide failed to properly disclose to consumers income comparisons and suitability information, causing consumers to exchange more financially favorable deferred annuities with immediate annuities.

Hundreds of New York consumers—primarily elderly individuals—received incomplete information regarding the replacement annuities, resulting in less income for identical or substantially similar payout options.

Nationwide has also agreed to take corrective actions, including revising its disclosure statements to include side-by-side monthly income comparison information, and revising its disclosure, suitability, and training procedures to comply with New York regulations.

In the SEC’s first-ever enforcement proceeding under Section 11 of the Investment Company Act of 1940, the financial regulator has settled charges against RiverSource Distributors Inc. for improper switching or replacing of variable annuities.

Without admitting or denying the SEC’s findings, RiverSource consented to an order finding that it violated Section 11 of the Investment Company Act and imposing a cease-and-desist order, a censure and a $5 million civil penalty.

Section 11 of the Investment Company Act prohibits any principal underwriter from making or causing to be made an offer to exchange the securities of registered unit investment trusts (including variable annuities) unless the terms of the offer have been approved by the SEC or they fall within certain limited exceptions, none of which is applicable to RiverSource.

According to the SEC’s order, RiverSource offered and sold variable annuities to retail investors through an affiliated broker-dealer/investment adviser, Ameriprise Financial Services, LLC.

The order finds that certain employees of RiverSource developed and implemented a sales practice that caused exchange offers to be made to holders of variable annuities to switch from one variable annuity to another which had the effect of increasing sales commissions for RiverSource employees, while also increasing RiverSource’s variable annuity related revenues.

According to the order, these types of transactions increased significantly from 2016 until 2018 when RiverSource’s compliance department put a stop to the sales practice abuses.

The SEC’s investigation was conducted by Jeff Leasure, Roger Landsman and James Murtha of the Complex Financial Instruments Unit under the supervision of Reid Muoio and with the assistance of Timothy Halloran of the Trial Unit.

Without admitting or denying the SEC’s findings, RiverSource consented to an order finding that it violated Section 11 of the Investment Company Act and imposing a cease-and-desist order, a censure and a $5 million civil penalty.

“Congress enacted Section 11 to prohibit the improper ‘switching’ of investors from one investment product to another for the purpose of generating additional selling charges – precisely the conduct our order finds RiverSource to have engaged in,” said Sanjay Wadhwa, Deputy Director of the SEC’s Division of Enforcement. “Protecting retail investors from abusive sales practices is a mainstay of our enforcement program, and we remain committed to holding accountable those who engage in such conduct.”

Empower, the $1.4 trillion retirement plan provider, and Rockefeller Capital Management, a $95 billion financial advisory and services firm, are partnering on an fiduciary advice solution for retirement plan participants.

The joint offering is called Rockefeller Capital Management (RCM) Retirement Plan Fiduciary Manager. Rockefeller will serve as the ERISA “3(38)” investment manager to the plan.

A press release offered few specifics other than that Rockefeller’s high-end advisory skills would be tied to a convenient digital platform giving participants a tool for accessing more than 7,000 investment funds offered by Empower.

Headquartered in metro Denver, Empower administers approximately $1.4 trillion in assets for more than 17 million retirement plan participants and is the nation’s second-largest retirement plan recordkeeper by total participants.

Empower serves government 457 plans; small, mid-size and large corporate 401(k) clients; nonprofit 403(b) entities; private-label recordkeeping clients; and IRA customers. Its Personal Capital subsidiary provides robo-advice.

Rockefeller Capital Management advises wealthy individuals and families, institutions and corporations from 36 US locations. As of March 31, 2021, the firm was responsible for approximately $95 billion in client assets.

Stephen Turer will succeed Brian Kroll as senior vice president and head of the annuity business at Lincoln Financial Group, effective July 1, 2022. He will report to Matthew Grove, who will join Lincoln Financial in July as head of Individual Life & Annuities and Lincoln Financial Network. Kroll is retiring.

Turer joined Lincoln Financial in 2005 as assistant vice president, Annuity Pricing. Most recently, he served as senior vice president, Annuity Product, Pricing and Valuation, leading pricing and business unit valuation for Lincoln Financial’s annuity products and the in-plan guaranteed solutions offered by the Retirement business. He is also the co-executive sponsor of Lincoln’s LGBTQ+ Business Resource Group (BRG).

Prior to joining Lincoln, Turer was an actuary with Travelers Life & Annuity. He earned a bachelor’s degree in Actuarial Science from Penn State University.

© 2022 RIJ Publishing LLC.

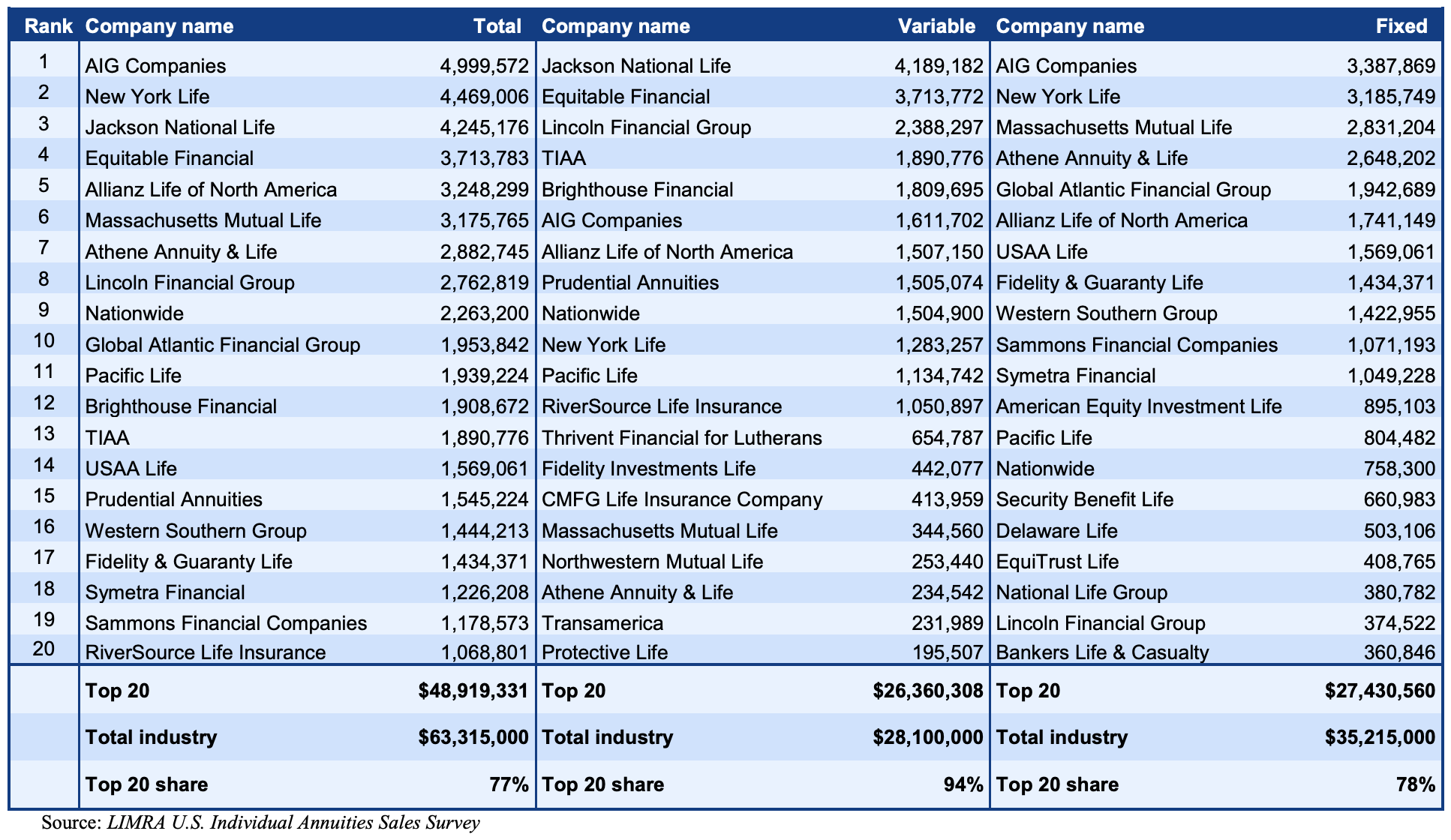

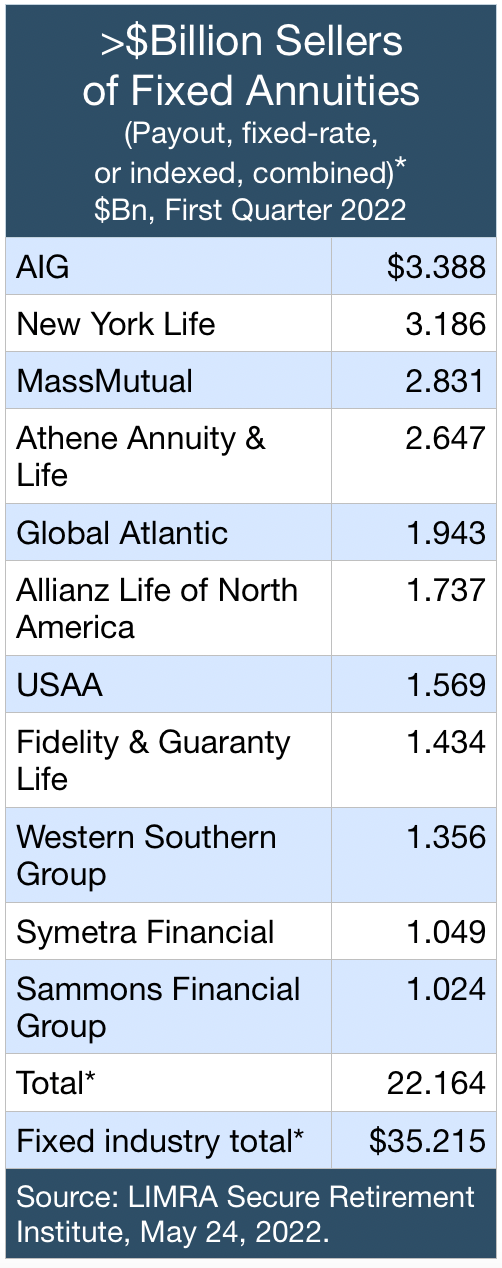

Amid falling bond and equity prices, investors sought the humble predictability of fixed rate deferred (FRD) annuities in the first quarter of 2022, according to the LIMRA’s latest report.

FRD sales were up 45% from the previous quarter, to $15.9 billion, as the average yield on the three-year product rose to 2.25%. Top-five FRD issuers were New York Life ($2.78bn), AIG ($1.82bn), MassMutual ($1.62bn), USAA ($1.21bn), Western Southern Group ($1.15bn) and Global Atlantic ($999m).

For more annuity sales data, see LIMRA’s Fact Tank.

Todd Giesing

Overall, sales of fixed annuities (FRDs, fixed indexed, and payout) rose 14% from the prior quarter, to $35.2 billion. At $16.3 billion, FIA sales were down 2% from the previous quarter. Sales of deferred income annuities were down 15% and immediate annuities were down 12%. but 21% higher than the first quarter of 2021. All fixed products except income annuities recording positive growth.

Relative to the first quarter of 2021, fixed-rate deferred annuity sales were up 9%. FIA sales were up 21% from the year-ago quarter. LIMRA expects FIA sales to grow as much as 10% and fixed-rate sales to grow as much as 7% in 2022.

“FIA and FRD sales benefited from rising interest rates and increased market volatility as investors sought protected growth options,” said Todd Giesing, assistant vice president, LIMRA Annuity Research, in a release.

Some carriers were apparently more nimble than others in incorporating rising rates into their products. “We’ve heard that some life/annuity companies are having challenges with rates moving so quickly, even though the rates are changing in their favor. Some carriers are changing rates only once a month, while others have the flexibility to change once a week,” Giesing told RIJ in a phone interview.

1Q2022 Annuity sales

Meanwhile, investors moved away from equity-linked annuities such as fixed indexed annuities (FIAs) and registered index-linked annuities (RILAs). RILA sales were down 7% from the prior quarter but were up 5% from the year-ago quarter.

At $16.3 billion, first-quarter FIA sales were down 2% from 4Q2021 but up 21% from 1Q2021. Top-five FIA issuers were Athene Annuity & Life ($2.23bn), Allianz Life of North America ($1.74bn), AIG ($1.45bn), Sammons Financial Group (and $1.02bn) and Fidelity & Guaranty Life ($962m).

“FIA and RILA sales were both slightly down from the prior quarter. That might reflect some investor uneasiness about equity index-linked products. But fixed-rate sales went to $16 billion in first quarter of 2022 from $11 billion in the fourth quarter of 2021,” Giesing said. LIMRA’s quarterly annuity sales survey represents 91% of the total market.

Overall US annuity sales were up 1% from the fourth quarter of 2021 in the first quarter of 2022 and up 4% from the year-ago quarter, according to LIMRA’s US Individual Annuity Sales Survey.

The top five sellers of annuities in 1Q2022, of any type, were AIG Companies ($5.0bn), New York Life ($4.47bn), Jackson National Life ($4.25bn), Equitable Financial ($3.71bn) and Allianz Life of North America ($3.25bn).

1Q2022 Annuity Sales

Immediate income annuity sales were $1.5 billion in the first three months of 2022, equal the results from prior year. Deferred income annuity sales totaled $365 million in the first quarter, down 14% year-over-year. With higher interest rates expected this year, LIMRA has forecast as much as 15% growth collectively for immediate and deferred income annuity sales.

Total variable annuity sales fell 6% in the first quarter, to $28.1 billion. Registered index-linked annuity (RILA) sales grew 5% to $9.6 billion in the first quarter. Traditional variable annuity (VA) sales were $18.5 billion in the first quarter, down 11% year-over-year.

The top five variable annuity issuers in 1Q2022 were Jackson National Life ($4.19bn), Equitable Financial ($3.71bn), Lincoln Financial Group ($2.39bn), TIAA (1.89bn) and Brighthouse Financial ($1.81bn). By the end of 2022, LIMRA has predicted traditional VA sales to grow by as much as 8%. LIMRA expects RILA sales to increase as high as 30% by year-end 2022.

© 2022 RIJ Publishing LLC.

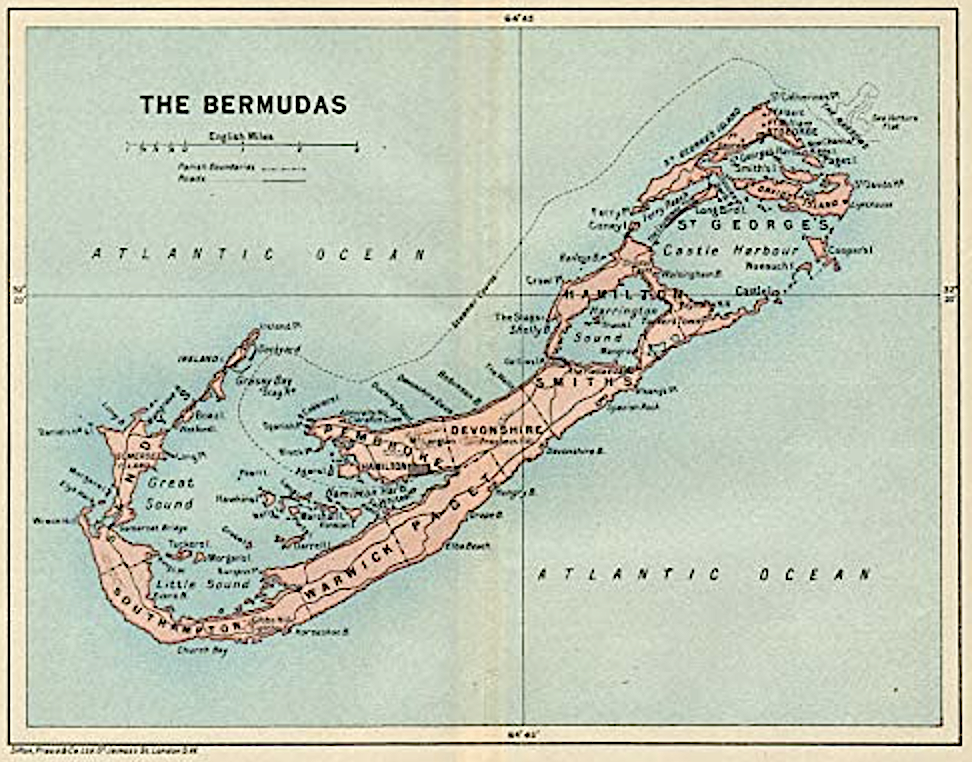

Fortitude Re, the Bermuda-based reinsurer that was born when the Carlyle Group and other investors purchased AIG’s reinsurance business in 2019, in January established a Bermuda multi-line reinsurer and acquired a US life insurer, according to an announcement that RIJ overlooked at the time.

Fortitude Re’s subsidiary, Fortitude Reinsurance Company Ltd., Bermuda’s largest multi-line reinsurer, obtained approval to operate as a Reciprocal Jurisdiction Reinsurer, the first such approval to be granted by the Texas Department of Insurance. “Fortitude Re can now offer the flexibility to transact through multiple entities and structures to help its clients achieve their objectives,” a release said.

Fortitude Re also acquired two U.S.-domiciled third party administrators from American International Group, Inc. and acquired Prudential Annuities Life Assurance Corporation and its in-force legacy variable annuity block from Prudential Financial, Inc.

Fortitude Re and Prudential

Last September, Prudential Financial, Inc., and Fortitude Group Holdings, LLC announced that Prudential would sell a portion of its in-force legacy variable annuity block to Fortitude Re for a total transaction value of $2.2 billion.

Under the agreement, Prudential sold one of its stand-alone legal entity subsidiaries, Prudential Annuities Life Assurance Corporation (PALAC), including PALAC’s in-force annuity contracts, to Fortitude Re, for an all-cash purchase price of $1.5 billion, subject to certain adjustments at closing, plus a capital release to Prudential and an expected tax benefit.

The PALAC block primarily consisted of non-New York traditional variable annuities with guaranteed living benefits that were issued prior to 2011, which constitute approximately $31 billion or 17% of Prudential’s total in-force individual annuity account values as of June 30, 2021.

“PALAC complements Fortitude Re’s market-leading capabilities in designing tailored solutions for leading insurers that enhance capital efficiency and address strategic priorities. Prudential will continue to service and administer all contracts in the PALAC block following the transaction to ensure a consistent experience for customers. Prudential does not expect there to be any direct impact to employee head count as a result of the transaction,” a release said.

Since January 1, 2022, Fortitude International Reinsurance Ltd [FIRL] has operated as a Class 4 and Class E reinsurer, licensed by the Bermuda Monetary Authority. FIRL will complement Fortitude Re’s other operating entities and focus on reinsurance solutions for insurers domiciled outside the US.

On January 3, 2022, Fortitude Re completed its acquisition of Rx Life Insurance Company (to be renamed Fortitude US Reinsurance Company) from Heritage Life Insurance Company. Fortitude Re US, which will serve as a US reinsurance platform for Fortitude Re, is an Arizona domiciled life and annuity insurer widely licensed in the US. This acquisition will enable Fortitude Re to offer clients a US domiciled reinsurance option.

Reciprocal jurisdiction reinsurer status

Effective January 1, 2022, the TDI granted FRL authority to operate as a Reciprocal Jurisdiction Reinsurer. FRL expects to seek similar status in other selected US jurisdictions in the near future.

FRL’s Reciprocal Jurisdiction Reinsurer status allows US ceding companies to take full statutory credit for reinsurance ceded to FRL without any regulatory prescribed collateral requirements, effectively treating FRL for these purposes as a US domiciled reinsurer. FRL is among the first reinsurers to obtain such status in the US.

The transactions and regulatory approval represent an important step in the evolution and expansion of the capabilities Fortitude Re is able to offer to clients to solve their most complex challenges.

“With the establishment of FIRL, we expect to grow our international reinsurance business in Asia and the UK and European markets,” said James Bracken, Fortitude Re CEO.

PALAC is in the process of changing its name to Fortitude Life Insurance & Annuity Company and Rx is in the process of changing its name to Fortitude US Reinsurance Company. Variable annuities are distributed by Prudential Annuities Distributors, Inc. , Shelton, CT.

Reinsurance transactions are entered into by PALAC, Rx, Fortitude Reinsurance Company Ltd (“FRL”) and Fortitude International Reinsurance Ltd (“FIRL”). FRL and FIRL are both located in Hamilton, Bermuda. Fortitude Re is the marketing name for FGH Parent, LP and its subsidiaries, including PALAC, Rx, FRL and FIRL. Each subsidiary is responsible for its own financial and contractual obligations. These subsidiaries are not licensed to do business in New York.

© 2022 RIJ Publishing LLC.

Pacific Life today announced a new collaboration with Wespath Benefits and Investments and WTW (formerly Willis Towers Watson) to provide the qualifying longevity annuity contract (QLAC) option in Wespath’s enhanced LifeStage Retirement Income program.

The program provides participants with a new interactive retirement income modeling tool, an optional Social Security “bridge,” and an optional QLAC.

People using the bridge strategy would delay filing for Social Security benefits until age 70 and finance their expenses, if necessary, during the period between their retirement date and age 70 with defined contribution plan savings.

A QLAC is a deferred income annuity that can be purchased with tax-deferred savings, for income starting after age 72, without violating rules governing required minimum distributions. Wespath’s Pacific Life QLAC allows a 70% continuation payment for surviving spouses.

“We believe that the unique solution Wespath developed will provide enhanced lifetime income security for participants in retirement,” said Paul Hance, senior vice president and head of the Customer Solutions Group for Pacific Life’s Institutional Division, in a release.

“The LifeStage Retirement Income program provides features that few, if any, financial services firms offer in a packaged manner,” said Martin Bauer, senior managing director, Wespath Benefit Plans. “We’re particularly pleased to partner with WTW in the development of the new program features and with Pacific Life in offering the longevity income protection annuity.”

The optional longevity income protection feature helps protect participants against the risk of outliving their savings. With Pacific Life’s QLAC, participants are guaranteed a retirement income stream starting at age 80, regardless of how long the participant and, if applicable, their spouse lives. In addition, the QLAC will reduce required minimum distributions providing additional tax planning options.

“We are honored to be selected as the provider for the QLAC portion of the LifeStage Retirement Income program,” said Ruth Schau, senior director of Pension Solutions for Pacific Life.

Wespath Benefits and Investments (Wespath) is a not-for-profit agency serving The United Methodist Church (UMC). It administers benefit plans and, with its subsidiaries, including Wespath Institutional Investments, invests over $29 billion in assets on behalf of over 100,000 participants and over 100 United Methodist-affiliated institutions (as of December 31, 2021).

Wespath invests in a sustainable manner that seeks to achieve positive financial, social, and environmental impact while upholding the values of the UMC. Wespath maintains the largest reporting faith-based pension fund in the world.

© 2022 RIJ Publishing LLC.

My threshold for surprise is fairly high.

Many years ago, the telephone rang at my desk in the smoky Billings Gazette newsroom. A drug dealer offered crocodile condolences: A man with whom I’d had lunch in a cafe in Red Lodge the previous day was dead. The dead man had been a witness in the dealer’s criminal trial.

That set my benchmark for surprise.

This week, I spotted a headline on the Accounting Today website. It said, “Private Equity in Accounting.” The accompanying podcast transcript also contained the word “annuity.” The needle on my internal surprise-meter didn’t red-line, but it quivered.

For his podcast, the magazine’s editor had interviewed a business broker about the excess of “dry powder” the private equity firms had received from clients, and how the PE firms were inclined to use it to buy accounting firms for the accountants’ “recurring revenue”—their “annuity of tax and audit” services.

“One of the more interesting developments in the past couple years has been the entry of private equity into the accounting space, with PE firms taking stakes and creating ventures with major accounting firms,” the broker told the editor.

“I’d like to call this the ‘private equity invasion.’ So with rock and roll, it was the British invasion. You know, the Beatles and the Rolling Stones. This is going to be huge,” the broker said.

Given years of low yields on publicly-traded debt and a scarcity of bargains in public equities, institutional investors have, in their search for higher yield, pressed hundreds of billions of dollars on asset management firms for astute investment in custom-made, relatively illiquid private equity and credit instruments.

As RIJ has reported in our series on the “Bermuda Triangle” phenomenon, some private equity firms have applied some of that dry powder to the purchase of life/annuity companies or blocks of annuity business. This gives them new money—annuity premiums—to manage and to invest in the private credit instruments they create. Retail annuity contract owners—mom and pop—are less sophisticated and demanding than institutional investors but just as yield-hungry.

The idea that the larger and larger private equity firms would own larger and larger accounting firms was introduced in the Accounting Today article.

“The big question everyone has is, ‘Who is private equity gonna sell to when they have that liquidity event?’ And it’s our belief that it will either be another private equity firm that’s doing the same thing, and big will become bigger, or rather gigantic,” the broker said, or “it may be another CPA firm, or it may be another party that’s totally uninvolved in the business of public accounting.”

When impatient, yield-starved investors throw money at asset managers, the performance incentives can become huge. The process can be hard to stop. It’s like the well-known folk tale of Rumpelstiltskin, in which the miller’s daughter, unable to spin straw into gold though her life depends on it, comes to rely on a troll who knows how.

That tale ends more happily than the story about Allianz Global Investors US, which broke this week when the Securities & Exchange Commission accused the asset manager and three of its advisers—who admitted to the charges—with taking a lot of straw from institutional investors and lying to them before and after the COVID-related market crash of 2020 ruined its flawed formula for turning the straw into gold.

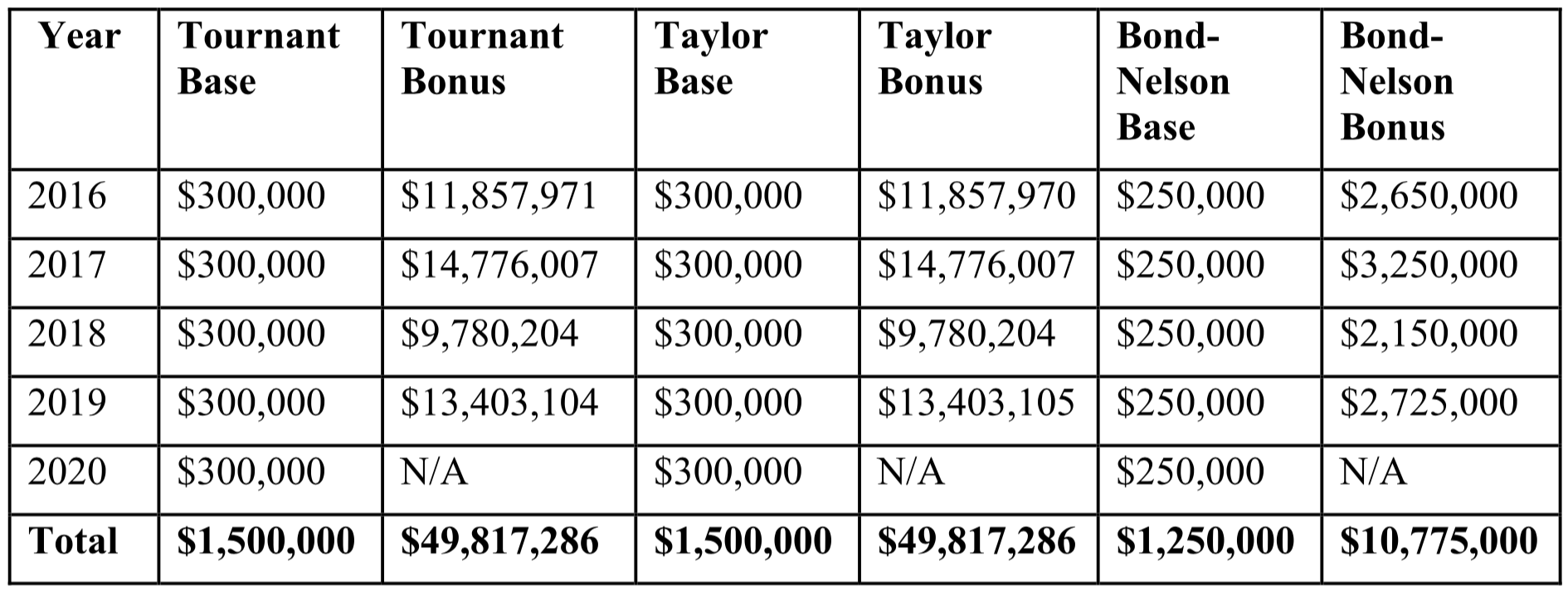

The incentives were huge, and ultimately turned perverse. AGI US paid the advisers—whose individual base salaries were no more than $300,000—some $101 million in bonuses from 2016 to 2020, according to the SEC. The business was so lucrative for AGI US and the advisers that, when it melted down—as a result of un-fiduciary risk management and a black swan event—the incentive to hide the truth was evidently overwhelming.

So what happened back at the cafe in small-town Montana all those years ago?

Two middle-aged West Coast outlaws, their two young street-dealing accomplices and a femme fatale were lying low and dealing pot and meth out of a house at the foot of the snowy Beartooth Mountains. They believed that contributions to local law officers would allow them to distribute their products in peace.

As out-of-towners from the big city, the five never foresaw that rural gossips would instantly notice them. Soon there were FBI stake-outs, a messy raid and, before long, an indictment by the county attorney and a stunt-filled trial in a Victorian-era courthouse with portraits of bearded old jurists on the walls.

One witness, a deputy sheriff aware of both the crimes and the corruption, fatally sat down to lunch one day with the reporter covering the trial. Since Red Lodge boasted only one good cafe, their table and their Monte Cristo sandwiches were in full view of all the other principals in the case.

The next day, I received that surprise phone call.

© 2022 RIJ Publishing LLC. All rights reserved.

For most investors, the word of the year for 2022 is “inflation.”

Runaway inflation has the Fed playing catch up. It is taking an aggressive, hawkish stance towards rate hikes. This has wreaked havoc in the asset market, beating down both stocks and bonds. Growth equities, which have valuations driven primarily by easy capital from exuberant investors, have seen prices cut by 50% to 80%.

The million-dollar question is whether the end is near? Or is there more yet to come? The key to answering this question is in the Fed’s ability to contain skyrocketing inflation, which now stands at 8%.

Let us examine the two geopolitical events at the core of this inflation. The first core issue is record-high energy and food prices driven by the conflict in Ukraine. Russia is one of the world’s biggest energy exporters and both Russia and Ukraine are two of the biggest fertilizer and food producers. A war between these two countries – combined with global trade sanctions against Russia – are driving up the cost of food, manufactured goods, and shipping around the world.

The second core issue is the draconian Covid lockdown in China. This has substantially disrupted both manufacturing and shipping at the world’s de facto factory. Although these two core disruptors are temporary, the impact of the Ukraine war and China’s lockdowns could persist a long time.

For example, some say the US is committed to fighting Putin so long as the last Ukrainian is standing. But Putin will not back down either. Ukraine has a real chance of becoming a Russian quagmire akin to Afghanistan. That means price increases driven by energy and food will not ease in the near-term.

And unfortunately, the Covid lockdown in China seems poised to extend into Q3 if not Q4 of 2022, as China’s XJP has doubled down on his zero Covid policy. This means massive supply chain disruptions will continue indefinitely, impacting the manufacture of both final consumer products and key components. The port congestion outside China has further increased logistical costs that will, inevitably, be reflected in end consumer prices here in the United States.

Crude has gone from $20 a barrel to $100. Bulk container shipping cost has gone from $2,000 to $18,000. The increase in cost associated with critical production and transportation factors must eventually transmit to higher final prices in your Amazon shopping cart. The fact that prices have not gone up more aggressively is a testament to the skill in cost hedging and inventory management practiced by the different key players in the global supply chain. The Fed ought not be taking credit for that.

It’s hard to say which of these two cores – the Ukraine conflict or China’s lockdown – is the “primary” driver of US inflation. But I can say for certain that the Fed’s hawkish tone and rate hikes will have exactly zero impact on either of these two drivers of price inflation. What we have is cost-driven inflation rather than demand-pulled inflation.

Thus, for the foreseeable future, inflation will remain intransigent and the Fed’s efforts will be futile. Slowing demand by hiking interest rates will have little impact on the high prices. It doesn’t matter how much demand is slowing. So long as the cost of inputs remain high, prices on the shelves will remain high; no one is in the business of selling for a loss. In the meantime, we will all experience the unintended consequences of continued rate hikes.

Asset prices will decline automatically as discount rates rise. This will create a meaningful negative wealth shock, which we have already seen. The high cost of capital also means less investment while we are already facing insufficient production. We already have a global slowdown driven by war and Covid; to further compound the shock with higher capital costs and reduced liquidity only adds insult to injury.

Worse yet, the impact of rate hikes on inflation will be more muted than people expect for the reasons already explained above. All of this points to the risk of the market losing confidence in the Fed as it claims mastery over inflation only to lose the fight against a cost-pushed price increase. There is an added risk that the Fed will double-down on its rate hike, pressured by populist politicians who watched a YouTube on the right way to beat inflation. A Volcker-esque approach will surely exacerbate what is already unnecessary self-harming. It is hard to predict how much damage could be inflicted before the Fed and the politicians breathing down its neck pursue an alternative route.

For certain, there is some justifiable populist anger with the low interest rate environment created by the Fed, which has led to record real estate prices and record stock prices; this policy has benefitted the wealthy while meaningfully disadvantaging less affluent families and retirees, who depend on interest income from bank deposits. However, lower rates and easy liquidity, while the root cause of many silly bubbles now blowing up in our face, is not at the heart of our current rising prices. Japan, which has been engaged in the world’s longest and biggest money printing experiment, has decidedly pledged to not raise rates to deal with the very same cost-push inflation that it also faces. Let us not be quick to assume that Japanese central bankers are dumber than our Fed. Japan might know a few things we can learn from.

The forthcoming global stagflation, where growth stalls and inflation is high, will be a “never-market” condition that is unprecedented for this generation of US investors and policymakers. You’re damned if you hike rates and you’re damned if you don’t. So, what does all this mean? It means a prolonged period in the United States of policy bickering and finger-pointing. Our politicians and central bankers have not dealt with this before. They don’t have the right answer even if they have to promise a quick solution for the sake of politics. The result will be economic molasses.

This may sound pessimistic, but the impact on you personally will depend on your time horizon and the overall diversification of your portfolio. Do you have a globally diversified portfolio that will withstand policy missteps here in the US? Or are you all-in the US because it has been the best performing market in the last 10 years? Or perhaps are you aggressively buying on the dip the battered tech darlings, as they make new lows (because they have to come back, right)?

It would be hubris to assume that our democracy must always lead to a world-beating outcome for our stock market. We are quick to criticize others’ regulatory and fiscal missteps, but it would be foolish to imagine the US Federal Reserve and our other institutions are not similarly capable of self-harm—out of ignorance, hubris or politics. It’s impossible to predict what will happen next. But I hazard to guess the worst is not yet over in the United States.

Jason Hsu is founder of and chief investment officer of Rayliant Global Advisors. This article first appeared as a post on LinkedIn.

A major asset manager has admitted that for five years its fund advisers hid the flaws of their complex options strategies—flaws that would cost pension funds, family offices and other institutional investors an estimated $5 billion.