I asked Josephine Lin, my tour-guide for a sightseeing trip through Taiwan’s spectacular Taroko Gorge, how she intended to pay for her retirement. She hesitated only a moment before sharing her life’s salient financial and personal details.

“I used to be a rich woman, with a house and a trading company,” the sturdy 51-year-old explained as we motored up and down the Gorge, a lush chasm carved through marble by a turquoise river. “Then I married a man who was handsome and tall” but unreliable.

He didn’t have the right “attitude” for business, she said, and squandered about half a million U.S. dollars, throwing good money after bad on a doomed enterprise. A personal financial tsunami followed and the couple lost everything.

More troubles followed. Her import-export business failed when customers and suppliers began trading direct over the Internet. She was forced to use her lump-sum state pension, equal to a month’s salary for each of the 25 years she contributed to it, to repay relatives who’d lent her money.

Four years ago, single again, Ms. Lin left teeming Taipei to live with her parents in Hua Lien, a banana-growing, stone-cutting city of 100,000 on Taiwan’s Pacific Coast. She eventually reinvented herself and turned her life around—but I’ll come back to that later in this story.

27% savings rate

You might still think of Taiwan as a crowded island of cheap factories off the coast of China, instead of the beautiful, subtropical, high-tech place that it is. You might also imagine that the Taiwanese don’t have much in common with Americans regarding retirement.

You might still think of Taiwan as a crowded island of cheap factories off the coast of China, instead of the beautiful, subtropical, high-tech place that it is. You might also imagine that the Taiwanese don’t have much in common with Americans regarding retirement.

But like Ms. Lin, who speaks fluent English and has traveled widely, Taiwanese Boomers often arrive at retirement by paths as steep and circuitous as many American Boomers do. And a look at retirement financing in Taiwan can offer some useful perspective on our own predicament.

A week’s visit obviously wasn’t enough for me to fully understand the retirement situation in Taiwan. But meetings with university professors, local managers from Prudential Financial and Fitch Ratings, and government officials—including pro-business President Ma Ying-jeou—provided a lot of detail.

During a visit to National Chengchi University in the mountains near Taipei, for instance, I heard professor Jennifer L. Wang of the Department of Risk Management and Insurance give a PowerPoint presentation called “Retirement Strategy for an Aging Population.”

As a country, the Taiwanese have good reason to worry about their collective ability to finance retirement. Over the next couple of decades, women’s life expectancy at birth is expected to rise to 85.6 years. The ratio of those over age 65 to those 15 to 64 years old will jump to 34% from 13.5%. At the same time, women are bearing an average of only 1.14 children.

The country’s pension system, like ours, has several moving parts. For government and university employees, a lifetime of low pay is redeemed by a relatively generous pension. Indeed, older Taiwanese public employees still earn a state-guaranteed 18% on their lump-sum payouts, no matter how low the prevailing rates go. Some workers in the private sector and public sector also receive a defined benefit pension through their job.

For other workers, since 1950 there’s been a pay-as-you-go Social Security-type lump-sum pension that replaces as little as 15% of income in retirement, according to one source. To supplement it, the government added a national defined contribution plan in 2005. It’s funded by employer contributions (6% of pay) and employee contributions (up to 6%), but few workers contribute to it. Workers don’t manage their own accounts; the funds are managed—poorly and opaquely, some say—by the government.

In 2008, the government created a National Annuity Pension Plan with an annuity payout option that covers the self-employed and those not enrolled in other public plans. There are also $180-a-month stipends for retired farmers and supplemental $90-a-month checks for certain of the elderly.

The Taiwanese also save a lot in personal accounts. On average, they put aside 27% of their income despite a dearth of tax incentives to do so. Most of the savings goes into bank accounts or in fixed annuities and certificates of deposit. The wealthy traditionally park their savings overseas to elude estate taxes, but a recent inheritance tax cut to 10% from 50% has drawn some of that money back to Taiwan—boosting housing and equity prices.

Prudential sees opportunity

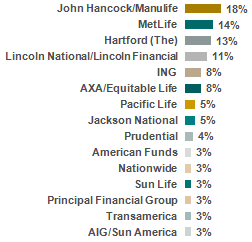

Attracted by Taiwan’s wealth—it has a per capita GDP of $16,500 and $320 billion in U.S. Treasuries in reserve—and relatively open market, many overseas financial firms have set up shop here. Thirty-nine firms have established local entities called Securities Investment Trust Enterprises (SITEs) and offer 509 offshore mutual funds currently worth about NT$1.94 trillion or $58 billion.

One of those SITEs belongs to Prudential Financial, which entered Taiwan by buying Masterlink in October 2000. In a presentation at the Caesar Park Hotel on XhongXiao East Rd., Patricia Tsai, CEO of Prudential Financial’s SITE, explained that her firm manages $3.08 billion here, divided among 26 equity (domestic and international) and fixed income funds.

The retirement market offers at least two opportunities for Prudential and competitors like Polaris and JPMorgan. First, Taiwan’s state pensions are loosening their investment rules. In 2000, they outsourced none of their money to outside managers. But in 2008, desperate for better returns, they outsourced 30% of it. That money is up for grabs.

Second, a 2007 survey by mutual fund providers showed that participants in the state defined contribution plan would like the option to invest in mutual funds rather than keep all of their money in the state-managed fund, which guarantees only a two percent return. Firms like Prudential want to help them manage their own money, 401(k) style.

Pensions as political footballs

Before that can happen, however, legislative changes will have to occur. Retirement finance here, as everywhere, has complex political ramifications. Promises of higher pension payouts and even outright payments have long played a role in local election campaigns in Taiwan, according to Lin Wan-I, a sociologist at National Taiwan University.

Before that can happen, however, legislative changes will have to occur. Retirement finance here, as everywhere, has complex political ramifications. Promises of higher pension payouts and even outright payments have long played a role in local election campaigns in Taiwan, according to Lin Wan-I, a sociologist at National Taiwan University.

Today, because the government chooses investments for the state pension funds and awards contracts for managing part of the money, fund management is vulnerable to political manipulation, said Mr. Lin, a rice farmer’s son who was a government official in the recent Democratic Progressive Party (DPP) administration.

(The DPP held Taiwan’s presidency from 2000 to 2008 before losing it to the Kuomintang (KMT). The KMT had ruled the country since 1949, as a dictatorship until 1988 and since then as a democratically-elected government.)

Under the DPP, Lin said, he helped design a national long-term care insurance program and worked to rationalize the country’s fragmented old age pension system. In a conversation with RIJ, he was critical of the KMT, which he said used unrealistic promises of high pension benefits and low pension-related taxes to help win the presidency in 2008.

“Every day, people pay less, but get higher benefits,” Lin said. He also charged that, under President Ma, the government has begun collecting a national long-term care insurance tax but has neglected Lin’s plan to create an infrastructure to deliver nursing home care to Taiwan’s elderly.

And while the state’s defined contribution pension fund lost billions in the 2008 financial crisis, the fund is not run transparently. Reports are issued, but only infrequently, he said.

“We don’t know how the government invests that money. It’s very difficult to understand where the money went. I’m a social insurance expert but I still don’t know much about it.” The state pension is on track to run out of money in 17 years, he said. When asked who would make up the shortfall for Taiwan’s elderly, he smiled, pointed skyward and said, “God.”

Peaks and valleys

The politicians in Taipei have had mixed success coping with the country’s pension problems, but Josephine Lin has made a lot of headway in her personal quest to ensure a secure old age. In the U.S., we hear a lot of talk about how retirees may have to embark on second careers; Ms. Lin has been there and done that.

Not long after moving back to her hometown of Hua Lien in 2005, Ms. Lin was chatting to a friend about what to do next. The friend said, in effect, “You speak English. You love to talk. We live a half-hour from one of the most famous natural wonders in the world. You ought to become a tour guide.”

So she did. She joined the Tourist Guide Association and hired herself out on a contract basis to one of Taiwan’s major tour group management firms. She became a self-taught expert on the volcanic forces that slowly fused and lifted Pacific Ocean sediment into marble mountains 10,000 feet high, and the typhoon-driven rains that, over the millennia, cleft them and created Taroko Gorge.

Almost every day, she and her driver shepherd groups of Western, Mainland Chinese, and Southeast Asian tourists in a VW Caravelle minibus up and down the 19-kilometer canyon, pointing out the shrine to the fallen construction workers, the killer bee nests and the seasonal waterfalls that pour spigot-like from the near-vertical hillsides.

An independent contractor, she earns a decent wage and lots of tips—and perhaps a revenue stream from the owners of the jade shops to which she steers tourists after their trip to the Gorge. She’s still paying down old credit card debt, but after a career with as many peaks and valley as the mountains that surround her, she’s pleased to say that life is good again.

© 2009 RIJ Publishing. All rights reserved.

You might still think of Taiwan as a crowded island of cheap factories off the coast of China, instead of the beautiful, subtropical, high-tech place that it is. You might also imagine that the Taiwanese don’t have much in common with Americans regarding retirement.

You might still think of Taiwan as a crowded island of cheap factories off the coast of China, instead of the beautiful, subtropical, high-tech place that it is. You might also imagine that the Taiwanese don’t have much in common with Americans regarding retirement. Before that can happen, however, legislative changes will have to occur. Retirement finance here, as everywhere, has complex political ramifications. Promises of higher pension payouts and even outright payments have long played a role in local election campaigns in Taiwan, according to Lin Wan-I, a sociologist at National Taiwan University.

Before that can happen, however, legislative changes will have to occur. Retirement finance here, as everywhere, has complex political ramifications. Promises of higher pension payouts and even outright payments have long played a role in local election campaigns in Taiwan, according to Lin Wan-I, a sociologist at National Taiwan University.