Data Connection

IssueM Articles

People talk about software and hardware. They talk about firmware. But they haven’t talked as much about “middleware.” Yet, if or when the integration of annuities into 401(k) plans makes the leap from novelty to normal, we’ll thank the middleware providers for it.

Middleware is a type of software. It bridges the gaps between the databases where plan recordkeepers, insurance companies, and investment companies store confidential participant or policyholder information. It lets those databases communicate in “the Cloud” using APIs (application programming interfaces).

When annuities were common only in 403(b) plans, a plan recordkeeper and an annuity issuer might arrange an exclusive, bilateral exchange of information. But middleware is a hub-and-spoke operation. It lets plan sponsors switch life insurers easily and inexpensively, if needed. It furnishes the annuity “portability” that most 401(k) plan sponsors will insist upon before they add annuities to the investment menus of their plans.

The three most prominent middleware providers in the DC space today are said to be Toronto-based Micruity (about whom RIJ has written), SS&C Technologies, a global tech company with some $2 trillion under administration, and the Investment Provider Xchange, or IPX Retirement, a former 403(b) recordkeeper based in Centennial, CO.

Recently, RIJ had a chance to talk with Bill Mueller, CEO of IPX, and Steve McCoy, CEO of iJoin, a managed account provider that gives plan sponsors a turnkey interface for messaging and educating participants about converting part of their savings to guaranteed income streams at retirement. income solutions.

The two firms are currently partnering with Allianz Life of North America on Allianz Lifetime Income+, Allianz Life’s in-plan solution for 401(k) plan participants. When auto-enrolled participants get close to retirement age, the solution starts funding an Allianz fixed indexed annuity with an option, income-providing guaranteed lifetime withdrawal benefit.

Steve McCoy

“Our technology spans the full plan-size spectrum, from startup plans to jumbo or mega-plans,” McCoy told RIJ. “Our direct customers are the plan providers, but the indirect customer are the plan advisors. A lot of our technology supports their objectives.

“Forward-thinking advisors don’t want to be boxed in. They want choice, optionality, and flexibility. Our strategy is to build out a marketplace of solutions for more personalized advice,” he said. In iJoin’s case, that means providing a managed account.

Like target date funds, managed accounts are “qualified default investment alternatives,” which means that under the Pension Protection Act of 2006 participants can be defaulted into them. Managed accounts, which compete with TDFs as vehicles for annuities within 401(k) accounts, can incorporate a participant’s personal data—a spouse’s income, assets outside the plan, real estate—into its algorithms, or what McCoy calls iJoin’s “advice equation.”

“Our first carrier partner was Allianz. We’ve also partnered with Annexus, Athene and Nationwide. We’re working on TIAA’s Secure Income program for the defined contribution market. We’ll be announcing a relationship with Capital Group to provide a personalized target date fund. We have a relationship with T. Rowe Price through an insurer.”

Where iJoin builds the online user-interface that determines the plan participants’ user-experience, it partners with IPX to tie the interface to the other plan service providers. IPX divested its 403(b) recordkeeping business last March in order to stake its future on the 401(k) annuity opportunity.

“We’ve developed a platform called Retirement Edge,” IPX CEO Bill Mueller told RIJ. “It provides connectivity between the recordkeeper, the custodian, and the insurance carriers.” The connections are product-agnostic. Retirement Edge currently accommodates fixed income annuities, collective investment trusts (CITs) with income riders, or qualified longevity annuity annuities.

Bill Mueller

“QLACs” are deferred income annuities whose assets, according to a 2014 Treasury Department action, can be excluded from retirees’ required minimum distribution calculations until age 85. Retirement Edge can execute the data exchanges for both “in-plan” annuities (which are funded during the accumulation stage) “out of plan” annuities (which aren’t funded until the participant leaves the plan).

“On the back end, we’re ‘cashiering’ the transaction,” Mueller said. “Cashiering” is one of the more complicated steps in the 401(k) annuity digital machinery. It occurs when a participant is either purchasing a small amount of future income benefits with each paycheck, or buying an annuity with a lump sum at retirement.

The middleware provider coordinates the liquidation of all or part of the participant’s account value and the purchase of an annuity contract with the recordkeeper, the custodian of the money, and the annuity provider. “IPX is the only middleware player that has cashiering capability for the client,” McCoy told RIJ.

Each firm involved in these chains of transactions gets incremental shares of the compressed fees that 401(k) plan providers and their fiduciaries have been allowed to charge in the wake of several court rulings during the wave of “breach of fiduciary duty” class action lawsuits brought by participants and plaintiffs’ attorneys in the 2010s. Mueller nonetheless has faith in the future of the 401(k) annuity market.

“Since we divested our recordkeeping business, we are solely focused on DC,” Mueller said. He believes that there’s “no question” that the 401(k) annuity trend has legs. “Two years ago when we talked to recordkeepers, they’d say they weren’t sure about how they would approach this market. But now the conversation is, ‘We’ll do this. We’re just not sure when.’”

IPX is preparing for a future where 401(k) plans will offer not one but a choice of several lifetime income options to their participants. With that in mind, “we set out to create a marketplace,” he said. “In addition to providing portability, we think it will standard for plans to provide more than one flavor. That’s why we currently support a fixed income annuity and a QLAC. Our TDF-style annuity is a work-in-progress.”

© 2024 RIJ Publishing LLC. All rights reserved.

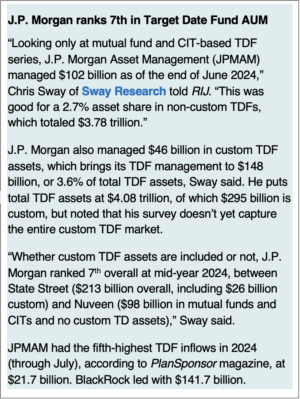

Several of the major target-date fund (TDF) providers, in their quest to equip defined contribution (DC) plan participants with tools for “pension-izing” their savings (and to retain assets in the plan), have embedded deferred annuities into their popular funds-of-funds.

Their expectation is that plan sponsors will default auto-enrolled participants into the TDFs, that participants will automatically start contributing to the deferred annuity at about age 50, and that when participants retire, some will choose to switch on the annuity’s lifetime income rider.

The Baltimore-based asset manager decided several years ago to focus on non-guaranteed “managed payouts” as an optional income solution for auto-enrolled participants. Starting this year, it is offering an enhanced managed payout program called “Managed Lifetime Income.” It includes a deferred income annuity that guarantees payouts until the annuitant dies.

In the jargon of 401(k) income solutions, MLI offers an “out-of-plan” annuity (funded at or after retirement) rather than “in-plan” annuity (notionally funded before the participant retires). T. Rowe Price will offer MLI initially to the DC plans that it administers.

Last September, T. Rowe Price’s senior global retirement strategist, Jessica Sclafani, explained her company’s initiatives to the ERISA Advisory Council (EAC), a 15-person panel representing various stakeholder-groups in the retirement industry and the public at large.

Jessica Sclafani

The panel was hearing witnesses and gathering testimony for the Department of Labor about Qualified Default Investment Alternatives, of which TDFs are one, and whether regulations governing QDIAs should be tweaked to reflect their use as vehicles for annuities in 401(k) plans.

“There are several solutions in the marketplace today where contributions are allocated to an annuity-like asset class that would allow for the future purchase of guaranteed income,” Sclafani told RIJ in an interview after the EAC meeting.

Instead, she added, “We believe that ultimately retirement income will be implemented through an array of investment options. We don’t think that one solution will meet the majority of participants’ needs.”

In 2017, T. Rowe Price started offering participants in its plans a mutual fund with a managed payout program that’s offered to participants over age 59½ and retirees. In 2019, it introduced a collective investment trust (CIT) with the same feature. The target (but not guaranteed) payout rate was 5% of an amount based on the participant’s final TDF balance, subject to a “smoothing” mechanism that makes the income stream less volatile. In an email to RIJ, Sclafani described the payout calculation:

The total calendar-year distribution amount is determined each year by calculating 5% of the average net asset value (NAV) of the participant’s fund or CIT over the trailing five years. The fund/trust automatically makes 12 equal monthly dividend payments to investors each calendar year. The amount to be paid each year is reset annually as a means to balance these competing goals and risks.

The 5-year look-back serves to smooth potential volatility in the amount paid out. Also, the participant chooses how much to invest in the “Price Managed Payout Investment.” They could allocate their entire balance or just a portion. In this way they can influence the amount of the payout, even though it is set at 5%.

“That solution is currently available only on our recordkeeping platform,” Sclafani said. We’re looking to work with a middleware provider to launch it on third-party recordkeeping platforms.”

The company’s new Managed Lifetime Income (MLI) program bundles a managed payout process with a type of deferred income annuity called a Qualified Longevity Annuity Contract (QLAC).

[Established in 2014 by the U.S. Treasury Department, QLACs are deferred income annuities with a twist. Savings in a QLAC aren’t subject to the Required Minimum Distribution rules, which require withdrawals from IRAs, 401(k) and other qualified accounts starting at age 73.]

“We know that a certain cohort of participants will benefit from a QLAC, so we’ve paired QLAC and managed payouts,” Sclafani said. “You choose either at retirement or in retirement how much to put into Managed Lifetime Income.”

At retirement, participants who are invested in TDFs must decide whether to opt-into the MLI program or not. If they do, part of their money stays in a liquid managed payout account in the 401(k) plan. The rest is applied to irrevocable purchase of the QLAC.

For example, a 65-year-old might decide to receive a managed payout for 15 years, until age 80.

At that point, income from the QLAC would begin and would last for as long as the retiree lives. (If retirees die before receiving all of their QLAC income, their beneficiaries receive the unpaid balance.)

Significantly, the QLAC could boost a retiree’s income by 50% a year relative to the annuity-less managed payout program, T. Rowe Price estimates. “There’s a roughly 7.5% payout of the managed payout portion over 15 years. The QLAC is sized to offer the same payment that the retiree had been receiving before.”

Although the money used to buy the QLACs would move over to the general account of the annuity provider from the retired participants’ 401(k)s, the present value of the annuity would still be visible on the retirees’ account statements.

“We made sure that participants would still have a holistic view into MLI as a solution,” she said. “Participants have worked hard to achieve a desired balance. It shouldn’t look like they’re giving up a chunk of it when they buy the annuity.” [T. Rowe Price has not yet identified the life insurer providing its QLAC.]

From “A Five-Dimensional Framework for Retirement Income Needs and Solutions,” T. Rowe Price. May, 2024.

Large plan sponsors now actively ask for information about income-generating tools rather than simply listen to pitches about it, Sclafani said. “More DC plan sponsors are taking meetings proactively. We’ve moved from the 10,000-foot level to the implementation stage.” A slight language barrier still impedes communication, however. “As an industry we lack a standard taxonomy for discussing retirement income,” she said. “That’s a barrier to future implementation.”

No one should expect the 401(k) income market, still in its infancy, to reach instant maturity, she said. “If you think you’ll see 20% of eligible participants use the solution, that’s a recipe for disappointment. We see 5% to 10% adoption rates among participants,” Sclafani told RIJ. Among T. Rowe Price’s 8,400 plans, the managed payout solution is offered to about 400. Of those, 60 currently use the managed payout solution.

The solutions don’t have to be embedded in QDIAs. “Adding a retirement income solution to a DC plan is already a complex decision,” she added. “We’re not doing ourselves any favors by attaching it to a QDIA. The industry is conflating two decision points that are already monumental by themselves. That’s just making it harder for plan sponsors.”

© 2024 RIJ Publishing LLC. All rights reserved.

U.S. Senator Elizabeth Warren (D-MA) has just attacked the life/annuity industry at the most sensitive spot in its organizational anatomy—its reliance on flashy sales incentives for the marketing organizations and insurance agents who distribute and sell its bread-and-butter products.

Warren, a long-time, persistent scourge of the financial services industry recently published a white paper, “Cancun, Cruises and Cash: How the Department of Labor’s New Retirement Security Rule Would End Insurance Industry Kickbacks that Cost Savers Billions.”

While criticism of gifts, high commissions and hard sales tactics in certain parts of the annuity industry is old news, the whitepaper has a fresh peg. Warren timed it to appear on the date—September 23, 2024—when the Biden Department of Labor hoped that the latest iteration of its “best interest rule” would go into effect. A judge blocked its progress last July.

The “best interest rule” required that insurance agents, instead of trying to persuade clients to buy annuities (especially fixed indexed annuities) with rollover IRA money, adopt a more selfless “fiduciary” ethical standard and only recommend products to IRA owners that would be in their best interest.

Introduced at the end of the Obama administration, the first version of the fiduciary rule ran into a wall in 2018 when, in a 2-1 decision, the Fifth Circuit Court of Appeals reversed a lower court decision (overruling the dissent of its own chief judge) and vacated the rule on the grounds that the DOL had no authority to put special hurdles between insurance agents—whose activities are regulated by state insurance commissions, not the DOL—and the savings in IRA accounts.

(The DOL regulates the investments in 401(k) plans, but its jurisdiction has never been explicitly extended to include the rollover IRAs into which so many plan participants transfer their 401(k) savings when they change jobs. The Fifth Circuit judges ruled that only Congress could do that, and it hasn’t.)

The initial lawsuit against the rule was brought not by injured citizens—the rule appeared to be popular—but by the American Council of Life Insurers, whose members could lose sales as a result of it, with support from the U.S. Chamber of Commerce. The lead attorney, Eugene Scalia (son of the late Supreme Court Justice Antonin Scalia) had represented the industry before. The following year, President Donald Trump appointed Scalia to be U.S. Secretary of Labor.

When the Biden administration succeeded Trump, the DOL started work on a new and more challenge-proof version of the fiduciary rule.

Much of Warren’s white paper is devoted to documenting the many kinds of sales incentives that annuity issuers advertise to annuity wholesalers and insurance agents. Warren’s argument is that these incentives, rather than the clients’ best interests, drive the agents’ recommendations to older Americans.

Her white paper concludes, “The annuity industry’s efforts to obscure its pervasive use of kickbacks and perks reveal why the DOL’s Retirement Security Rule is needed—and how it will protect consumers. The industry’s secret kickbacks hurt consumers by incentivizing agents to sell certain products because they will earn a bigger cash bonus or fancier vacation, not because they are in their client’s best interest.”

© 2024 RIJ Publishing LLC. All rights reserved.

Actuaries and math puzzle-solvers, here’s a question. Several novel target date funds (TDFs) have come to market in which deferred annuities are embedded as one of the investment sleeves. These TDFs are intended to be distributed through 401(k) plans as qualified default investment alternatives (QDIAs) for auto-enrolled participants.

Here’s how they work: When participants who are auto-invested in the TDFs reach age 45 or 50, increasing percentages of their contributions begin to spill over into the deferred annuity sleeve. At age ~65 or so, the participant must decide whether or not to convert the amount in the annuity sleeve to guaranteed lifetime income.

The conundrum concerns the asset-based fee on the contents of the deferred annuity sleeve during accumulation. Starting at age 50, the participant might pay as much as 100 bps/year on the assets in the sleeve; in return, typically, the annuity issuer sets a floor under the sleeve’s accumulation. But the floor (as I understand it) is contingent on the participant’s decision at age 65 to convert the sleeve assets to guaranteed income.

If there’s no conversion, the floor vanishes and the participant has only the amount in the sleeve. Some people have worried that participants who have paid the annual 100 bps for 15 years but never opt into the annual lifetime income stream (~5% – 6% of an amount no less than the floor) may feel robbed of the fee (which may have eroded their accumulations along the way).

But one witness at a meeting of the ERISA Advisory Council this week suggested that those participants might be like people who buy car insurance but never have accidents: they shouldn’t feel robbed of their premium.

So, is the 100 bps drag on the TDF sleeve an unfair charge for participants who don’t opt into the annuity at retirement? Or does it have value either way? What if the participant could see that her account balance was higher than the floor, and so declined the income benefit because it wasn’t “in the money.” Did her 100 bps have insurance value? Was it like an call option that served its purpose and died?

Some actuarial wisdom is needed here, perhaps. Future plaintiffs’ attorneys may examine this question carefully. BTW, this is not a new problem. Living benefit riders on individual annuities have posed similar ambiguities. Now the 401(k) world is about to experience it.

Here’s another question for those with high numeracy quotients. Suppose an insurance wrap fee during accumulation is fixed at 100 bps for the participant in the TDF. (Ignore whether the whole TDF or just a sleeve is wrapped, and the age when the billing starts.)

If the wrapper offers a floor, and resets the future minimum benefit every year, will the wrap provider (the annuity issuer) need to change the crediting rate in response to changing interest rates and the participant’s rising age? (In a multi-insurer lifetime income benefit auction system, each insurer’s appetite for a piece of the business may also affect its crediting rate bid.)

Is changing the crediting rate each year or month tantamount to changing the product fee? I don’t know. If it is, fiduciaries may need to justify that uncertainty. What might happen to crediting rates if the next financial crisis brings a new ZIRP?

Clearly, it is difficult to draw general conclusions about in-plan annuities, since features vary so much and the benefit can be variable.

Out-of-plan annuities are usually fixed, simpler, not linked to QDIAs, and provide less (or no) liquidity. They entail fewer fiduciary issues. But they’re much harder to get participants to use. I review out-of-plan annuities (and in-plan QLACs) in this and future editions of Retirement Income Journal.

© 2024 RIJ Publishing LLC. All rights reserved.

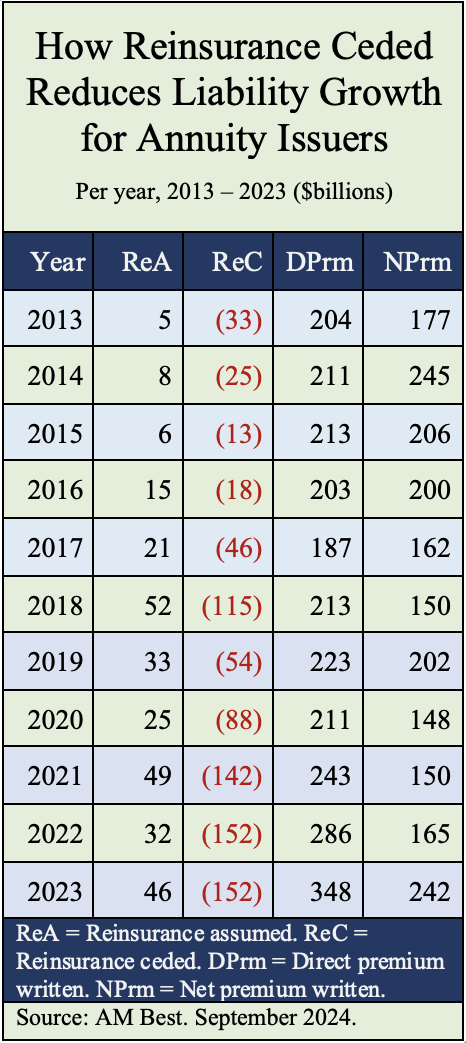

Even as the “Bermuda Triangle” strategy stokes this year’s sharp rise in U.S. fixed deferred annuity sales—by enabling life insurers to reduce capital requirements with reinsurance—the strategy keeps attracting criticism from financial governing bodies.

In mid-September, economists at the Bank of International Settlements (BIS) in Basel, Switzerland, following the Federal Reserve and the International Monetary Fund, warned about the systemic risk posed by private equity firms that “have funneled investment into private markets by acquiring insurance portfolios through affiliated reinsurers.”

In a paper entitled, “Shifting landscapes: life insurance and financial stability,” four BIS analysts show through data and commentary that:

The global mission of the BIS, according to its website, is to “support central banks’ pursuit of monetary and financial stability through international cooperation, and to act as a bank for central banks.” Established in 1930, the BIS is owned by 63 central banks in countries that together account for about 95% of world GDP.

The new paper’s authors are Fabian Garavito, Ulf Lewrick, Tomas Stastny, and Karamfil Todorov. Like economists at the Federal Reserve, the BIS analysts offer the standard disclosure that their report doesn’t necessarily reflect an official position of the BIS or the International Association of Insurance Supervisors.

The analysts’ description of the life/annuity industry in the U.S. aligns closely with RIJ’s descriptions of what we call the “Bermuda Triangle.” This is the three-cornered partnership between fixed deferred annuity issuers (i.e., life insurers), private credit originators (i.e., private equity firms) and Bermuda- or Cayman-based reinsurer—all three of which are often affiliated in both synergistic and conflicted ways.

The BIS report diverges slightly from RIJ in leaving the impression that the Bermuda Triangle life insurers are still selling multiple-premium insurance products that offer protection against mortality risk and longevity risk.

RIJ’s reporting has shown that PE-controlled life insurers sell mainly single-premium products that offer protection against investment risk, and make their money mainly from asset-management fees rather from the difference between the yields they promise policyholders and what they earn on safe, hold-to-maturity bonds.

© 2024 RIJ Publishing LLC. All rights reserved.

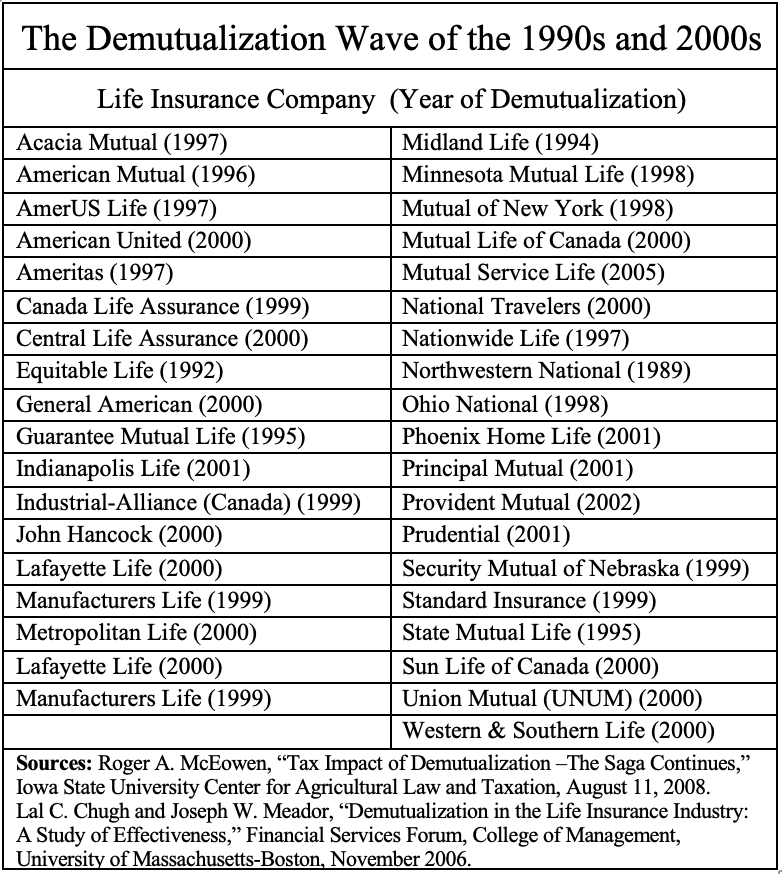

Ironically, the bankruptcies of multi-billion dollar life insurers owned by publicly-held Baldwin-United (in 1983), First Executive (1991), and First Capital Holding (1991) didn’t scare major mutual life insurance companies away from changing into stock companies. On the contrary.

Starting with The Equitable in 1992, a wave of household-name mutuals would “demutualize” in the 1990s and early 2000s. From then on, they would be owned by investors and not, as they had been, by the people who bought their life insurance policies and annuities.

As stock companies, they could do what mutual insurers couldn’t: Hold an initial public offering, sell shares, and raise billions of dollars in fresh capital. In doing so, they hoped to compete in a rapidly consolidating financial services industry where scale would be the price of survival.

The watershed year was 2000 when, after Congress repealed the Glass-Steagall Act, a dozen large mutuals, including Prudential and MetLife, celebrated the end of the old millennium by becoming either stock insurance companies or “mutual holding companies” that owned stock insurance companies.

What few recognized, then or even today, is that stock life insurance companies are fundamentally different from mutual life insurance companies. To varying degrees, and with good as well as regrettable consequences, demutualization changed a company’s priorities, products, profit requirements, relationships with customers, and even their corporate cultures.

There are three types of life insurance companies: stock, mutual, and fraternal. We’re interested in the first two; fraternals tend to be small. Mutual life insurers play two important but narrow roles in the economy. Owned by their customers—the policyholders—they’re tasked with providing those owners (or “members”) with life insurance and annuities at the lowest possible cost.

All life insurers support the overall economy by lending to businesses. That is, they buy mostly corporate bonds and hold them to maturity. The profitability of mutuals depends mainly on the difference (the “spread”) between the yield on their bonds and the benefits they’ve promised to policyholders.

If a mutual earns more on its investments than it needs, it pays dividends to its policyholders, thus lowering their cost of insurance even more. Since mutuals are akin to non-profits, and provide a public good, all life insurers in the U.S. enjoy favorable tax treatment of their products and relatively light regulation by state insurance commissions.

The strength of mutuals is also their weakness. Gibraltar is impossible to move; for the same reason, it’s not very nimble. A mutual insurer can’t raise large amounts of fresh capital overnight or seize new opportunities in fast-changing times. But since they don’t have investors to cheer on that kind of behavior, they have no incentive to do so—unless or until their survival is at stake.

Stock companies are fundamentally different creatures. They are owned by their shareholders, who include individuals and institutions like pension funds and endowments, not by their customers. Unlike policyholders, who seek relief from risk, investor-shareholders seek risk and its ability to deliver wealth. Where mutuals rely on the spread for their profits, stock life insurers prefer to rely on asset management fees.

From the Panic of 1837 to the turn of the 20th century, most U.S. life insurers had been stock companies. After the Armstrong Committee’s exposure of stock insurance company mischief in 1905, many became mutuals. But the 1970s would change the financial game. The abandonment of the gold standard and unprecedented inflation in 1971, which led to the soaring interest rates of the early 1980s, disrupted the entire U.S. financial services industry.

To compete in a rapidly diversifying and consolidating financial service industry, many mutual life insurers felt they needed more resources and flexibility. Conversion to the stock company model, in a legal process opaquely called “demutualization,” presented a path to growth, independence, and higher profits. Once a few large mutuals showed the way, the herd followed.

Between 1997 and 2001, five of the 15 largest U.S. life insurers demutualized. Ten other major life insurance companies, with total assets in 2003 of $775 billion, demutualized over the same time period [Meader and Chugh]. Of the 1,470 life insurance companies that were in business in the United States at the end of 1999, only 106 were still mutual companies, or 7% of the total. But they included giants like MassMutual, New York Life, and Northwestern Mutual Life. Mutuals accounted for 21% of the total industry assets, 17% of premium income, and 36% of life insurance in force. [Smallenberger].

Many factors drove demutualization. As a business strategy, demutualization was seen as a company’s route to increase competitiveness and profits as a one-stop shop for all kinds financial services. But macroeconomic forces, like globalization, government spending, and the aging of the Boomer generation also contributed to the trend. Pressure to demutualize or not varied, of course, by company.

In the freewheeling financial industry of the late 1990s and early 2000s, before the reality check of 2008, mutual insurers looked over-specialized and under-financed relative to the competition. The industry landscape and outlook was described in 2000 by executive James Smallenberger of AmerUs Group (acquired by British insurer Aviva plc in 2006) in a 2000 Drake Law Review article.

Smallenberger predicted “continued consolidation within the life insurance industry and convergence of the life insurance industry with… banks, securities firms, and mutual fund companies. Many life insurance companies will need to gain significant economies of scale through acquisition or internal growth in order to cost-effectively invest in new products and technologies to meet changing insurance and investment needs and customer service expectations…”

“Mutual insurers do not have sufficient organizational flexibility to participate in the emerging integrated financial services market” [Butler, et al]. Smallenberger believed that “companies unable to achieve the necessary economies of scale will be gobbled up by larger competitors.” [Smallenberger].

Consumer advocates, especially in New York, charged that executives at mutual insurers might use demutualization as an opportunity to appropriate the general account surplus—the owners’ equity—for themselves. This was a murky area, and, in the patchwork system of insurance regulation in the U.S., the rules varied by state.

In a mutual insurer, the surplus belongs to the policyholders. In a stock company, it belongs to the shareholders. To the extent that executives could choose to reward shareholders—of whom executives were likely to be among the largest—the path to self-enrichment was certainly there. In the collapse of First Executive Corp., parent of Executive Life, insiders did in fact engineer control of a large share of the failed company’s assets.

Few policyholders knew they had rights to a portion of the equity. Rules for securing, quantifying and transferring those rights varied by state, if they existed at all. Prudential’s demutualization in 2001 showed one way in which the pie could be sliced among its then-approximately 11,000,000 policyholders. [IRS, Demutualization-Revised]

“Management gave 454.6 million shares to the policyholders directly and in addition sold 110 million shares to the public at $27.50 per share. Part of the $3 billion in proceeds was paid to cash-out small policyholders and to other policyholders who chose not to receive shares of stock in the new company.” [Meador & Chugh]

Large European insurers were naturally eager to enter U.S. market. According to a May 1999 Bloomberg News report, the U.S. “accounts for more than half the world’s retirement savings market,” which Intersec Research of Stamford, Conn., predicted would grow 39% to $15.4 trillion by 2003. (That number reached $40 trillion in 2024, according to the Investment Company Institute.) To accept foreign investment, however insurers needed to be stock companies. The Equitable’s demutualization in 1991 was driven by the prospect of a $1 billion capital infusion from French insurance giant AXA [International Herald Tribune].

Mutual insurers could see that financial conglomerates were encroaching on their turf. Banks, which sell fixed-rate annuities today, were as interested in diversifying into insurance as insurers were to diversify out of it. [Stephen Friedman, “The Next Five Years.”] “On the demutualization debate, the proposal for demutualization comes not from the life insurance companies, which are very happy being mutual companies, but from the banks, because the banks want to demutualize the life insurance companies and then buy them. That is more than a sidelight on this discussion, I think, because it reflects a worldwide trend. If I can coin a double cliche, I would call that trend the ‘globalization of the homogenization of financial institutions.’”

The growth of the U.S. financial sector in the 1990s could not have occurred without a growing money supply. An increase in deficit spending by the U.S. government after 1980 provided that supply.

The national debt is the difference between what the federal government has spent into the economy since the founding of the country and what it has taxed out of the economy. In 1980, the accumulated difference was $908 billion.

The Reagan Administration criticized the debt as a drag on the economy. But rather than reduce it by cutting spending and raising taxes, the administration cut taxes and increased military spending. Over the next decade, the debt rose to $3.23 trillion. Those new trillions cascaded through government contractors, banks, businesses, employers, the financial markets, and American households.

The national debt reached $5.67 trillion in 2000 and then more than doubled, to $13.56 trillion by 2010 as a result of the bailout of the financial system after 2008. Today, the debt stands at more than $33 trillion. The national debt troubles many people. They believe that U.S. taxpayers will have to pay down the debt someday, impoverishing themselves in the process. Reasonable economists disagree [Fiscaldata.treasury].

Even before they converted to stock companies, mutuals were already creating “variable” or “indexed” life insurance and annuity products that offered potential for investment growth along with their usual insurance-related benefits. “The spike in interest rates at the beginning of the 1980s “caused the development of a series of investment products lodged within life insurance companies’ variable life and annuity products. These products pass on to the customer the risks and the benefits of the investment management process.” Also, “many large life insurance companies have bought large investment management firms. Alliance Capital, for example, with more than $40 billion under management, is a subsidiary of the Equitable… The life insurance business itself has become an investment management business.” [Friedman]

By demutualizing, life insurers were following the flow of the 1990s. The flow was into stocks. The deregulation of telecom industry, the mass ownership of personal computers, the Internet, and the dot-com boom gave investors plenty of opportunity to invest. It was the period of index funds and discount brokerages, when “Main Street met Wall Street.”

The technology-heavy NASDAQ was 458 at the start of 1990, and 4,798 in March 2000, before the inevitable shake-out of 2001. The S&P 500 was 813 in 1990 and 2,756 in March 2000. The DJIA was 2,560 at the beginning of 1990 and 11,390 at the beginning of 2000. If life insurers wanted to join this party, and hold onto customers, they would have to become part of the securities world.

Changes in federal tax law helped shape the evolution of the life/annuity business in the 1980s and 1990s. The Tax Equity and Fiscal Responsibility Act of 1982 (TEFRA) eliminated a loophole in the use of variable annuities, along with many other tax breaks. But despite TEFRA, the variable annuity allowed wealthy investors to delay taxes on the growth of their investments until they retired.

In 1984, the passage of the Deficit Reduction Act (DEFRA) limited the deductibility of policyholder dividends paid by mutuals as a way to “allocate taxes more equitably between mutual and stock life insurers” [McNamara and Rhee]. In 1988, a New York law ended a 66-year prohibition against demutualization and “served as a model for demutualization statutes in other states” [Battilani and Schröter].

The demutualization trend, already well under way, was eventually codified and sanctified by legislation at the end of the Clinton administration. “With the passage of the Gramm-Leach-Bliley Financial Services Modernization Act in 1999, the Depression-era barriers that blocked cross-industry mergers and product sales among banks, securities firms, and insurance companies have been removed. This reform will clear the way for these firms to move increasingly into each other’s businesses, thereby forcing each firm to become more efficient, more creative, and more customer-focused than ever” [Smallenberger].

During the 1990s and early 2000s, 37 major life insurers demutualized. Of those, the estimated number of policyholders was reported for only 15 companies was available. They had an estimated 29,713,000. Of that total, Prudential and MetLife had combined 22,200,000 policyholders.

The macro-trend arguably driving all of the financial micro-trends of our recent history is the maturation of the Baby Boomer Generation. By 1990, the entire Boomer generation (born 1946 to 1964) was old enough to be in the workforce. They had married, created families, set up households. They were beginning to save in large numbers in hundreds of thousands of relatively new 401(k) plans.

U.S. savings in tax-deferred defined contribution savings plans (e.g., 401(k)s and 403(b)s) was only $874 billion in 1990. By 2000, it was $2.958 trillion, According to the Investment Company Institute. In 1990, $636 billion was in individual IRAs.

By 2000, that figure was $2.629 trillion (reflecting the growth of “rollover IRAs,” which contain money saved in defined contribution plans but later “rolled over” to individual IRAs). In 1997, when I went to work at The Vanguard Group (now “Vanguard”), a kind of cooperative, it managed about $250 billion worth of mutual funds. In 2024, Vanguard managed $7.2 trillion.

This is the first part of a two-part article on demutualization. The second and final part, covering the opposition to, the impact of, and the long-term implications of demutualization, will appear in the November issue of Retirement Income Journal.

Battilani, Patrizia, and Harm G. Schröter. “Decumulation and Its Problems,” Quaderni – Working Paper DSE N° 762.

Butler, Richard J., Yijing Cui, and Andrew Whitman, “Insurers’ Demutualization Decisions,” Risk Management and Insurance Review, 2000, Vol. 3, No. 2, pages 135-154.

Friedman, Stephen J. “The U.S. Life Insurance Industry: The Next Five Years” (1990) Pace Law Faculty Publications. https://digitalcommons.pace.edu/lawfaculty/115

“Historical Debt Outstanding,” FiscalData.treasury.gov https://fiscaldata.treasury.gov/datasets/historical-debt-outstanding/historical-debt-outstanding

Malkin, Lawrence, and Jacques Neher. “French Insurer to Put $1 billion into Equitable: AXA Buys Stake in U.S. firm,” International Herald Tribune, July 19, 1991.

McNamara, Michael J., and S. Ghon Rhee. “Ownership Structure and Performance: The Demutualization of Life Insurers.” The Journal of Risk and Insurance, Jun., 1992, Vol. 59, No. 2 (June, 1992).

Smallenberger, James A. “Restructuring Mutual Insurance Companies: A Practical Guide Through the Process,” Drake Law Review, Vol. 49, 2001.

© 2024 RIJ Publishing LLC. All rights reserved.

Aimed at helping workers in low-pay, high-turnover jobs save for retirement, Britain’s national defined contribution plan, known as NEST, is barely a dozen years old. Most of its participants are young and have small accounts. It’s too soon to say how they’ll “draw down” their “pension pots” in retirement.

But Will Sandbrook, director of NEST Insight, the program’s in-house research group, expects that retired NEST participants will take systematic withdrawals from their accounts for the first 10 or 15 years of retirement, then switch to a late-life deferred income annuity.

Will Sandbrook

Sandbrook spoke at a September 18 webinar sponsored by the National Institute for Retirement Security (NIRS) in Washington and entitled “What the U.S. Can Learn from the U.K.’s National Employment Savings Trust.” (That’s NEST’s full name.) He was interviewed by Tyler Bond, research director of NIRS.

“In the future, we think the best default income process will be a hybrid approach, with ‘drawdown’ [systematic withdrawal] in the first part of retirement and a guaranteed solution in the later part,” Sandbrook said. Today, he added, “most of the people in NEST who are reaching retirement today have small pension pots [accumulations] that they take as cash.”

While NEST faces no immediate pressure to design a decumulation strategy for its participants, corporate sponsors of large 401(k) plans in the U.S. are. Asset managers and life/annuity companies have begun dunning them with a variety of proprietary draw-down products.

Those products and processes come in a variety of shapes and sizes, with a few that fit the model that NEST imagines its members using in the future. Principal Financial currently offers a program that lets 401(k) participants lock-in credits toward a qualified longevity annuity contract (QLAC) during the accumulation period. They decide at retirement whether to commit to it or not. T. Rowe Price is preparing to roll out a strategy where the participants decide at retirement whether to allocate money to a QLAC or not.

NEST envisions its members waiting until age 75 or so before they move part of their NEST assets into a late-life annuity, Sandbrook said. Five or ten years later, they would start receiving annuity payments that will last as long as they (or their spouses) are living.

“Annuities were never designed to be 30-year products,” he said. “Better to have draw-down and then an annuity to deal with the larger long-tail risks.” Income annuities cost least, any actuary can tell you, when payouts start in advanced old age. That’s when you’re both least likely to be still alive and most likely to have run out of money. To make that strategy work, you just have to make sure that your liquid savings don’t hit zero before your monthly annuity checks start arriving.

There’s also behavioral drawback to buying an “immediate” life annuity that starts producing income at the beginning of retirement, Sandbrook said. NEST may want to “put some conditionality in the draw-down”—that is, “encourage people to tighten their belts in some years” rather than, say, liquidate depressed assets during a market downturn and lock in a permanent loss. But with a “30-year immediate annuity you take away some of that discretion.”

Interestingly, the type of decumulation strategy favored by NEST, Principal, and T. Rowe Price resembles the one that Jason S. Scott of Financial Engines prophesied in a 2007 research paper.

Partly because interest rates were so low for so long, these late-life annuities, also known as deferred income annuities (DIAs), have not offered payout rates high enough to be popular. They accounted for only 1.2% of U.S. annuity sales in the first half of 2024, at $2.5 billion. But DIA sales were up 30% in first-half 2024 over first-half 2023, apparently benefiting from the higher bond yields that lifted sales of most fixed annuities.

Inaugurated in 2012 with start-up funding from the U.K. government, NEST now has about 13 million members. It was designed for people previously not well-served by the pensions sector, including those on low-to-moderate incomes, working for smaller employers, or with higher likelihood of job turnover. NEST also draws members from large employers in sectors with lower income levels and higher job turnover.

Sandbrook estimated that a stunning 25 million people in the U.K., or more than a third of the U.K.’s population of 67 million, live in households where at least one source of income is “volatile.”

The U.K. has a “flat-rate” state pension that equals about 30% of the average pre-retirement earnings of a median worker starting at age 66, Sandbrook said. NEST started out with the stated goal of enabling lifelong participants in the program to eventually replace an additional 15% of pre-retirement income, with retirees relying on personal savings for the rest of their retirement income.

NEST participants contribute a minimum of 8% of pay to their accounts—the current default minimum contribution rate for all employers/pension plans under the auto-enrollment regulations in Britain. Since 2012, U.K. law has required all employers in the U.K. to offer access to an auto-enrolled retirement savings plan. NEST makes it easy for small employers to fulfill that obligation.

The U.K. state pension contrasts with that of the U.S., where Social Security benefits are based on payroll tax contributions, up to a salary cap. Benefits in the U.S. are “progressive” rather than flat. As percentages of pre-retirement income, they’re higher for low-income workers than for high-income workers.

Sandbrook’s job—his title is executive director of NEST Insight—gives the Oxford-educated social scientist a window into the financial lives of low- and middle-income couples. A survey of 50 families showed them constantly moving money between checking, savings, and credit accounts to try and pay bills on time and avoid penalties. One couple made 150 transfers in a single month. “They were just moving money from one account to another,” he said via Zoom from London.

Tyler Bond

This modern, smartphone-enabled game of financial whack-a-mole doesn’t leave much money for retirement saving or much time for retirement planning. “It creates a massive focus on today,” Sandbrook said. “Low-income people are capable money managers in the short-term. But it exhausts their capacity for long-term planning. Imagine the cognitive load that that uses.”

“People try to save. Some households belong to savings circles, where five households might contribute to a fund, and each household receives the whole pot every fifth month. The degree of innovation that people go through to make ends meet is amazing,” the NEST research director said.

That evidence was furnished by the Real Accounts project, a long-term study by NEST Insights of U.K. households’ financial lives. The project, according to its website, “uses first hand stories and digital transaction tracking to build an in-depth, in-the-moment understanding of households’ income, spending and money management strategies over time.”

The Real Accounts project was inspired by the U.S. Financial Diaries project, a joint venture of the Financial Access Initiative at the NYU Wagner Graduate School of Public Service, The Center for Financial Services Innovation (now the Financial Health Network), and Bankable Frontier Associates.

One of the lingering questions about auto-enrolling low-income workers in retirement plans is whether or not nudging them to make salary deferrals every month might backfire and drive up their use of credit cards. NEST has gathered enough data on that issue to reach a tentative answer.

“We saw a small increase in debt for those auto-enrolled,” Sandbrook said. “We can hypothesize about the mechanism for this, that if you live day-to-day, and someone takes a bit of money out of your pay check, you just run out of money a bit sooner and adjust through credit.”

“It’s easy to see how pushing on one part of the household balance sheet affects another part, without them having any real choice. But they didn’t opt out of NEST. Those who design pension plans need to know this about people.”

© 2024 RIJ Publishing LLC. All rights reserved.

U.S. insurers experienced a second straight year of declining income on their private equity investments, which dropped to $7.7 billion in 2023, down from $10.2 billion in 2022, according to ratings agency AM Best.

A new Best’s Special Report notes that U.S. insurers’ private equity holdings rose 10.8% to $146.2 billion, up from $132 billion in 2022; this followed growth of 3.3% in 2022 and 37% in 2021.

That increase in 2023 was driven by $7.4 billion from new investment acquisitions or additional investments in current holdings, with the book value of current holdings increasing by approximately $6.8 billion.

Nearly all of that growth was generated by life-annuity (L/A) insurers, which account for over three quarters of the insurance industry’s private equity investments.

Investments in private equity remain concentrated in a few large insurers, according to the report. Fifteen companies, almost entirely L/A carriers, account for just over 60% of private equity holdings, with allocations averaging only 5% of invested assets. “The ratio of these holdings to capital can be a better guide for determining potential exposure,” said David Lopes, senior industry analyst, AM Best.

The report notes that the average exposure for capital & surplus (C&S) among the top 15 holders of private equity investments is 40.2%. However, more than half of AM Best’s rated companies with private equity investments have exposures amounting to less than 10% of their C&S.

Demand for private equity investments had slowed in 2022 compared with 2021, due to a rise in interest rates and concerns about a potential recession, but private equity investments again rose in 2023, as insurers sought higher yields with alternative options.

“Understanding the performance and risks of the private equity firms that investors choose to invest in requires comprehensive due diligence,” Lopes said. “Most insurers investing in private equity have larger sophisticated in-house investment management teams. Also, most insurers prefer experienced money managers with a solid history.”

Insurers use private equity to diversify investments and achieve higher yields versus other asset classes, but the small percentage allocations of invested assets point to generally more conservative investment strategies and lower levels of risk tolerance, according to the report. Insurers are also wary of the effects of private equity investments on capital models. Investments in common equity vehicles such as limited partnerships are subject to higher capital charges than rated debt or preferred equity.

Two new federal class action lawsuits were filed in September against State Street Global Advisors Trust Co., as a pension adviser, and against pension plan sponsors who followed SSgA’s recommendations to replace their defined benefit pensions with group annuities underwritten by Athene Annuity & Life.

In recommending Athene, both lawsuits claim, SSgA failed in its fiduciary duty to recommend only the “best available annuity,” as required by the Employee Retirement Income Security Act of 1974 (ERISA). Athene is not, however, named as a defendant in either case. Similar suits, filed on behalf of pension plan beneficiaries, were filed earlier in 2024.

The first of the latest two cases, filed September 3 in U.S. District Court, Southern District of New York, involved the 2019 transfer of more than $2 billion in pension plan assets of pharmaceutical giant Bristol-Myers Squibb to Athene. The second case, filed September 4 in U.S. District Court, District of Colorado, involved the 2021 transfer of $1.4 billion in pension plan assets of Lumen Technologies to Athene.

The lead attorney in the Bristol-Myers Squibb case is Edward Stone of New York. The lead law firm in the Lumen case is Schlichter Bogard LLP of St. Louis. Both firms have filed similar lawsuits in the past alleging violations of U.S. pension law in pension risk transfer deals involving SSgA and Athene. Schlichter filed suits in March and May of this year, regarding SSgA’s advice for plan sponsors AT&T and Lockheed-Martin.

The Bristol-Myers Squibb suit alleges that:

“Bristol-Myers, The [pension] Committee, and State Street breached their duty of prudence by selecting an unsuitable annuity provider and breached their duty of loyalty by favoring their own corporate interests over the participants’ interests in a secure retirement. Bristol-Myers’ and The Committee’s goal was to save Bristol-Myers money and State Street’s goal was to further its line of business that recommends Athene as an annuity provider. Consequently, their search and selection of Athene was biased in favor of the lower-cost provider and neither objective nor sufficiently thorough or analytical, thereby breaching their duty of prudence.”

According to the Lumen suit:

“Defendants did not select the safest possible annuity available to ensure the continued, long-term financial security of Lumen retirees and their beneficiaries. Instead, Defendants selected Athene, whose annuity products are substantially riskier than those of numerous other traditional annuity providers. Athene structures its annuities to generate higher expected returns and profits for itself and its affiliates by investing in lower-quality, higher-risk assets rather than in quality assets that would better support its future benefit obligations. In transferring Plaintiffs’ pension benefits to Athene, Defendants put Lumen retirees’ and their beneficiaries’ future retirement benefits at substantial risk of default without appropriate compensation. Because the market devalues annuities when accounting for such risk, it is also likely that Lumen saved a substantial amount of money by selecting a group annuity contract (or group annuity contracts) from Athene instead of the actual safest annuity available.”

Both suits make reference to Athene, a life insurer created by private equity firm Apollo Global Management in 2009 for the purpose of selling annuities to older Americans, reducing the capital requirements that come with those sales through offshore “financial reinsurance,” and investing a portion of the annuity premium in loans originated by Apollo. Retirement Income Journal has tagged such a business model, since copied by many other U.S. life insurers, as the “Bermuda Triangle strategy.”

State Street Global Advisors (SSgA), the wealth management firm, and Apollo Global Management, Inc., manager of alternative assets and issuer of Athene fixed deferred annuities, has announced a partnership to bring private assets to a wider audience of investors.

“This relationship of a market-leading, global asset manager and a market leading originator of private assets is designed to open the door to investing in private markets and expand access to a wider investor base,” the two firms said in a September release.

As of June 30, Apollo reported more than $145 billion of asset origination in the prior twelve months, through its credit business and “origination ecosystem spanning 16 standalone platforms.”

At the end of 2023, SSgA was the world’s fourth-largest asset manager with assets under management of $4.37 trillion, according to the Pensions and Investments Research center. That figure includes (as of June 30, 2024), $1.394 trillion in its proprietary SPDR exchange-traded funds, of which $69.35 billion was in gold assets.

Oceanview Life and Annuity, a fixed deferred annuity issuer affiliated with Bayview Asset Management, and Simplicity Group, a financial products distributor, have brought a new fixed indexed annuity to market: Topsider FIA.

The Topsider FIA’s “Gain Control Option” allows clients to potentially increase their participation in market gains by applying a portion of their annual index credits towards a higher participation rate for the following year. “This feature aims to capitalize on market recovery cycles,” an Oceanview release said.

Oceanview Holdings Ltd. provides retail annuities and asset-intensive reinsurance solutions through its subsidiaries. On a consolidated basis, Oceanview had over $12 billion in assets as of year-end 2023. It holds an A (Excellent) strength rating from AM Best.

The Topsider FIA’s features include (beside the standard FIA features of tax deferral and protection from market loss):

Allows clients to increase participation rates using a portion of their annual index credits.

Includes crediting strategies tied to the S&P 500 Daily Risk Control 10% Excess Return Index.

Allows clients to modify their Gain Control Option percentage each contract anniversary.

Is available exclusively through Simplicity Group’s distribution network.

Oceanview has the structure of companies that use what RIJ has called the “Bermuda Triangle” strategy. This structure includes an alternative asset management firm, a U.S. issuer of fixed-rate or fixed indexed annuities, and reinsurers in Bermuda or the Cayman Islands—all of which are under the same corporate umbrella.

In 2018, Bayview Asset Management, led by David Ertel, funded Oceanview Holdings Ltd with $1 billion raised from institutional investors, according to AnnuityAdvantage.com. Oceanview Holdings then purchased Alabama-domiciled Longevity Insurance and renamed it Oceanview Life and Annuity Company.

Oceanview Asset Management LLC, a wholly-owned subsidiary of Bayview Asset Management, LLC, is Oceanview Life and Annuity’s investment manager.

In April 2018, Oceanview Holdings established Oceanview Reinsurance in Bermuda. In 2021, Oceanview Bermuda Reinsurance was formed, with 75% ownership by Oceanview Reinsurance and 25% ownership by Overview Holdings. In June 2024, Oceanview Holdings Ltd. announced the establishment of Oceanview Secure Reinsurance Ltd., in the Cayman Islands.

Munich Re North America Life is now offering “longevity reinsurance” to help clients “accumulate assets while transferring biometric risk,” a release said. This “pension risk transfer” (PRT) product will allow clients to “convert uncertain future pension or annuity payments to a fixed cash flow stream.”

“Likely clients are insurance companies involved the PRT deals and also asset reinsurers which are often private equity companies buying blocks from insurance companies in order to reinvest assets,” said Munich Re Second Vice President and Actuary, Longevity Reinsurance, Ben Blakeslee.

“There was ~$45b of PRT transactions in the U.S. in 2023 across 21 insurers, and these figure have been rapidly growing over the past 10 years,” he added, citing data from Aon, the consulting firm. “Despite this, longevity reinsurance has been rarely used, so these insurers are retaining substantial longevity risk. We expect reinsurance capacity will become increasingly valuable to support this quickly growing market.”

“We believe there is significant, untapped demand for longevity reinsurance in the US and Canada markets,” said Mary Forrest, President and CEO of Munich Re North America Life, in a statement.

Clients will be able to lock in mortality assumptions and a fee at inception, according to the statement. “With the increased reserve and capital requirements for longevity risks, and further changes coming in the US, insurers and asset reinsurers can leverage Munich Re’s strong balance sheet and deep mortality expertise,” the release said.

The pension risk transfer market has grown alongside elevated interest rates in recent years. Meanwhile, insurers are seeking to balance mortality and longevity risks. Under these conditions, longevity reinsurance “can complement a variety of risk management strategies,” Munich Re said.

Munich Re North America Life includes Munich Re Life US and Munich Re, Canada (Life), which have served the U.S., Canada, Bermuda and Caribbean markets for 65 years.

Munich Re Life US, a subsidiary of Munich Re Group, is a leading US reinsurer. Munich Re Life US also offers “tailored financial reinsurance solutions to help life and disability insurance carriers manage organic growth and capital efficiency as well as M&A support to help achieve transaction success.”

Global Atlantic Financial Group, a life/annuity subsidiary of asset manager KKR, has appointed Emily LeMay, its chief operations officer and Jason Bickler, its chief distribution officer, as co-heads, Individual Markets, effective immediately. LeMay and Bickler will report to Rob Arena, co-president of Global Atlantic.

LeMay joined Global Atlantic seven years ago. She began her career at MetLife, rising to Operations and Customer Experience Strategy for the U.S. and Latin America. She currently serves as vice-chair of the Insured Retirement Institute’s (IRI’s) Digital First Initiative.

Bickler has been with Global Atlantic for 10 years. He began his career as an actuary at Allstate, assuming roles of increasing leadership responsibility including product design, relationship management, direct sales and sales leadership.

© 2024 RIJ Publishing LLC. All rights reserved.

Over the course of several months, 102 financial professionals in the U.S. received phone calls from General Accounting Office researchers posing as a fictitious 60-year-old who wanted advice about what to do with about $600,000 in IRA and 401(k) accounts.

Acting more as mystery shoppers than as sting operators, the GAO investigators documented 75 completed encounters in which the “financial professionals described their role and the nature of the relationship with the client and discussed the client’s financial profile.”

Here’s how the GAO, in a report published in July and released last week, described what its researchers did:

We steered the conversations toward subjects that would help us learn about potential conflicts of interest that might exist in the relationship. We brought up subjects conversationally, without using uniform language. In most cases, we explicitly asked about conflicts of interest, because regulators suggest doing so.

In most cases, we discussed the term fiduciary, because it helped establish the nature of the relationship, facilitated a discussion of the investor protection standards that would be applicable, and because the definition of a fiduciary was the subject of DOL’s 2016 rule regarding conflicts of interest…

We discussed variable compensation to financial professionals, because earning more from recommending one product, service, or company over another can be a source of conflicts of interest… We analyzed call transcripts for information obtained about conflicts of interest, including responses to questions about conflicts of interest, fiduciary protections, and variable compensation.

GAO’s undercover calls revealed that when investors ask professionals about conflicts of interest, their questions “may not always produce helpful information.” While “firms’ disclosures of conflicts are available to investors… investors may not review or understand these documents.” In other discoveries:

The GAO concluded:

Whether a fiduciary standard applies can vary based on context. As a result, it may not always be apparent whether a financial professional has a fiduciary obligation to the retirement investor or not. Financial professionals can have multiple roles, such as registered representative of a broker-dealer of securities and insurance agent, and retirement investors may not fully understand the conflicts associated with each role.85 Most financial professionals we spoke to (49 of 75) were both. registered representatives of broker-dealers and investment adviser representatives, which meant they could act in either capacity.

Based on our disclosure review and our undercover phone calls, conflicts can be numerous, complex, and dynamic, which can make it challenging to completely convey them all, and their implications, through a real time conversation with a retirement investor. Retirement investors have a stake in understanding conflicts of interest in their relationships with their firm and financial professional because conflicts of interest may be associated with lower investment returns.

Conflicts of interest are a common part of many financial transactions involving products recommended to retirement investors. The mechanisms in place to help identify or explain conflicts of interest, such as required disclosures and discussions with financial professionals, may not fully explain the risk and challenges posed by conflicts of interests. Despite obligations to mitigate and eliminate certain conflicts, conflicts of interest persist and can negatively impact retirement investors.

The Securities and Exchange Commission has charged six nationally recognized statistical rating organizations, or NRSROs, for significant failures by the firms and their personnel to maintain and preserve electronic communications.

The firms admitted the facts set forth in their respective SEC orders, an SEC release said. They “acknowledged that their conduct violated recordkeeping provisions of the federal securities laws; agreed to pay combined civil penalties of more than $49 million, as detailed below; and have begun implementing improvements to their compliance policies and procedures to address these violations.”

Each of the credit rating agencies, with the exception of A.M. Best and Demotech, is also required to retain a compliance consultant.

A.M. Best and Demotech engaged in significant efforts to comply with the recordkeeping requirements relatively early as registered credit rating agencies and otherwise cooperated with the SEC’s investigations, and, as a result, they will not be required to retain a compliance consultant under the terms of their settlements.

“We have seen repeatedly that failures to maintain and preserve required records can hinder the staff’s ability to ensure that firms are complying with their obligations and the Commission’s ability to hold accountable those that fall short of those obligations, often at the expense of investors,” said Sanjay Wadhwa, Deputy Director of the SEC’s Division of Enforcement. “In today’s actions, the Commission once again makes clear that there are tangible benefits to firms that make significant efforts to comply and otherwise cooperate with the staff’s investigations.”

Each of the six firms was charged with violating Section 17(a)(1) of the Securities Exchange Act of 1934 and Rule 17g-2(b)(7) thereunder. In addition to significant financial penalties, each credit rating agency was ordered to cease and desist from future violations of these provisions and was censured.

The four firms ordered to retain compliance consultants have agreed to, among other things, conduct comprehensive reviews of their policies and procedures relating to the retention of electronic communications found on their personnel’s personal devices and their respective frameworks for addressing non-compliance by their personnel with those policies and procedures.

Recognizing U.S. life insurers’ “significant exposure” to commercial real estate (CRE), and “pressure on commercial property values” from “lower demand for office space as well as higher interest rates,” at the Chicago Fed recently analyzed “life insurers’ CRE exposures and their implications for financial stability.”

The Fed’s researchers published their findings in Economic Perspectives, No. 5, August 2024. They reported that:

Prudential Financial, Inc., has agreed to reinsure a portion of its guaranteed universal life block with Wilton Re, resulting in approximately $350 million of expected proceeds, post-closing, according to a release last month.

Wilton Re will reinsure ~$11 billions of reserves backing guaranteed universal life policies issued by Pruco Life Insurance Company Arizona (PLAZ) and Pruco Life Insurance Company of New Jersey (PLNJ). The deal covers policies written through 2019 and represents ~40% of Prudential’s remaining guaranteed universal life statutory reserves.

In March 2024, Prudential reinsured a $12.5 billion guaranteed universal life block with Somerset Re. Upon closing, Prudential will have achieved an approximately 60% reduction in its exposure to guaranteed universal life.

PGIM Portfolio Advisory, PGIM’s multi-asset solutions affiliate, will manage all the assets supporting the block and will also receive additional assets to manage from Wilton Re. After two years, Prismic, the Bermuda-based reinsurance company created by Prudential and Warburg Pincus, will have an option to reinsure 30% of the block from Wilton Re on substantially similar terms.

Prismic (not to be confused with the web development software company) was created by Prudential and Warburg Pincus last September, with an additional group of investors agreeing to make equity investments in it. At that time, Prudential expected to reinsure to Prismic a block of structured settlement annuity contracts with reserves of ~$10 billion. Prudential’s obligations to the holders of these annuities will remain unchanged following the reinsurance arrangement and Prudential will continue to administer the contracts.

Prudential aims for Prismic to be a strategic reinsurance partner with the ambition to grow their reinsurance relationship materially in years to come. PGIM and Warburg Pincus will provide asset management services to Prismic. Through expanded reinsurance capacity, Prudential expects Prismic will allow the company to provide more people with access to its life and annuity products.

The group of global investors that has agreed to make equity investments in Prismic, alongside Prudential and Warburg Pincus, will give Prismic a combined initial equity investment of $1 billion from Prudential, Warburg Pincus and a group of global investors.

Prudential and Warburg Pincus will initially own 20% and 15% of the equity in Prismic, respectively. Prismic’s board will include two independent directors. Prudential, Warburg Pincus, and the group of investors will each nominate one director.

Prismic is led by Amy Kessler, a 30-year financial services industry veteran, who will serve as CEO. Kessler was the founding leader of Prudential’s international reinsurance business.

Upon closing of the Wilton Re deal, Prudential anticipates a decrease in total after-tax annual adjusted operating income of ~$35 million. The earnings impact will be finalized at closing. Prudential expects to incur one-time transaction expenses of ~$25 million in the quarter of closing, primarily due to the extinguishment of certain financing facilities and other closing costs.

Nassau Financial Group has introduced Nassau Bonus Annuity Plus, a bonus fixed indexed annuity designed to give people confidence that they can reach their retirement goals.

Issued by Nassau Life and Annuity Company, Nassau Bonus Annuity Plus is a single premium accumulation-focused fixed indexed annuity that helps increase retirement savings with an up-front premium bonus as well as total accumulation potential from powerful growth options and enhanced control over contract value.

Nassau Bonus Annuity Plus includes several enhanced features, including Nassau’s highest premium bonus of up to 18%, a free withdrawal rollover feature, and an early return of premium surrender benefit. These features are made possible by an enhanced benefit fee applied during the surrender charge period, which is 10 contract years in most states.

The enhanced premium bonus of up to 18% creates a larger base to help contract holders grow their retirement savings and increase accumulation potential over the long term.1

Contract holders also receive enhanced liquidity features, with the ability to withdraw up to 5% penalty-free annually or roll over the withdrawal option for up to five contract years to receive up to 25%2. Also, with the early return of premium surrender benefit, after the fifth contract year contract holders can receive a cash surrender value of at least their single premium less prior gross withdrawals and enhanced benefit fees.

Nassau Bonus Annuity Plus provides powerful, tax-deferred growth potential to help contract holders catch up or get a head start on their nest eggs, all while protecting the principal from market downturns3. It offers indexed accounts linked to indices like the S&P 500® and Nasdaq-100®.

1Bonus is not available for immediate withdrawal and the bonus amount and associated earnings are subject to a vesting schedule. The bonus amount may vary by age and state and is not intended to meet short-term financial goals.

2Withdrawals of any kind (including Required Minimum Distributions) will cause the free withdrawal amount to revert back to 5% on the next contract anniversary. Withdrawals exceeding the free withdrawal amount may be subject to surrender charges, recovery of non-vested premium bonus amounts, Market Value Adjustment, and pro-rated fees. See the Product Summary and Product Disclosure for more information.

3The principal is protected against market losses and guaranteed under the base contract. Applicable fees will be deducted from the contract value, and this could potentially result in a loss of principal if the contract has had interest credits less than the fees.

Nassau was founded in 2015 and has grown to $24.3 billion in assets under management, $1.5 billion in total adjusted capital, and about 374,000 policies and contracts as of June 30, 2024.

Voya Financial, Inc., announced today a milestone growth advancement as the firm surpassed $100 billion across various multiple employer solutions. Further highlighting Voya’s experience and commitment to Multiple Employer Plans (MEPs), Pooled Employer Plans (PEPs), Employer Aggregation Programs and other customized solutions, the firm continues to drive growth in this important market segment, with total assets increasing 15% since the same time period last year.

To support its growth and commitment to the multiple employer plan space, Voya recently announced the addition of newly created positions to support sales growth in this important market segment. These roles, which have been focused on driving growth and engagement with both advisors and plan sponsors, are dedicated to helping facilitate the creation of new solutions and adding adopting employers into existing solutions.

Voya’s growth across the abundance of multiple employer arrangements has been driven by flexible programs designed to provide optimal support for clients of all sizes. As a result, Voya has experienced significant growth specifically within its Wealth Solutions business, with 34% of total employer-sponsored DC plans participating in a multiple employer plan solution.

Last year, Voya also announced it is serving as the recordkeeper for first 403(b) Pooled Employer Plan following the SECURE Act 2.0 legislation. The PEP is designed to provide a pooled plan option for 501(c)(3) nonprofit organizations and health care related entities, expanding retirement plan access for employees in these industries.

American Life & Security Corp., a six-year-old, Nebraska-based insurer (B++ by AM Best), has launched the American Life MaxGrowth 10 Fixed Indexed Annuity (FIA). MaxGrowth has a contract term of 10 years with annual point-to-point, monthly sum, and “performance-triggered” options. The annuity allows for additional premium contributions within the first 6 months and offers a 5×5 Annuitization option for accessing the full Contract Value over 5 years after 5 years.*

The contract offers these crediting strategies:

MaxGrowth is Distributed through American Life’s IMO partners, MaxGrowth is currently available in Arizona, Colorado, Florida, Georgia, Illinois, Iowa, Kansas, Kentucky, Michigan, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, South Dakota, Utah, and the District of Columbia.

*5×5 Annuitization is only available if no withdrawals other than RMDs have previously been taken. Additionally, MaxGrowth includes a Nursing Home Benefit rider for those who may need nursing home care.

© 2024 RIJ Publishing LLC.

Fueled by strong annuity growth on higher interest rates, U.S. life/annuity (L/A) insurers have doubled their ceded reserves to $1.74 trillion between 2016 and 2023, with an increasingly larger portion headed offshore, according to a new AM Best report.The Best’s Market Segment Report, “Strong Annuity Growth Continues Shift to Bermuda Reinsurers,” is part of AM Best’s look at the global reinsurance industry ahead of the Rendez-Vous de Septembre in Monte Carlo.

According to this report, nearly 47% of ceded L/A reserves were transferred offshore in 2023, after climbing steadily from the 26% level in 2016. AM Best believes this growth is likely to continue, as more companies may look to reinsurance to manage growth and capital levels. “With new company formations, partnerships, and private capital entering the market, the reinsurance market remains competitive and a larger share of business is being ceded to affiliates,” said Jason Hopper, associate director, AM Best.

The report notes that the vast majority of $103.2 billion in ceded reserves stemming from the 10 largest transactions of 2023 involved offshore transactions. Bermuda accounted for over a third of all in-force business, as well as 60% of new business, in 2023. Many private equity-owned insurers have started creating offshore reinsurance entities in recent years; approximately two-thirds of reserves ceded offshore go to affiliates. Companies with asset manager/private equity sponsors account for almost 44% of reserves ceded to offshore affiliates.

Bermuda and the Cayman Islands have gained in popularity due to their stable political and economic environments and regulatory landscapes, as well as access to talent (mainly legal and financial professionals). They also have flexible accounting regimes and can choose which system works best, whether that involves IFRS 17, GAAP, modified GAAP, or even a statutory approach.

Life/annuity reinsurance companies have benefited from higher interest rates and favorable mortality trends, an earlier AM Best report says. But firms backed by alt-asset managers or large private equity firms have intensified the level of competition in that niche.

The Best’s Market Segment Report, “Life/Annuity Reinsurers Face Growing Competition as Conditions Improve,” is part of AM Best’s look at the global reinsurance industry ahead of the Rendez-Vous de Septembre in Monte Carlo.

Other reports, including AM Best’s ranking of top global reinsurance groups and in-depth looks at the insurance-linked securities, Lloyd’s, health and regional reinsurance markets, will be available during August and September.

New capital continues to flow into the reinsurance segment, primarily via reinsurers owned by investment managers focused on annuity business, AM Best analysts write. These newer entrants have sought to coinsure assets that can be rolled into high-yielding positions, mainly in public, private or alternative fixed income products.

“These reinsurers also can offer attractive ceding commissions based on higher anticipated investment returns once the transferred assets are rolled into a wider set of investment opportunities,” AM Best said.