A “pension risk transfer” or PRT allows a company to swap its traditional defined benefit plan for a group annuity issued by a life insurer. To help ensure that plan participants get their benefits from the life insurer in retirement, US pension law requires companies to select the “safest available annuity.”

A federal class action suit, filed last March 13, charged aerospace and defense contractor Lockheed Martin and its plan adviser, State Street Global Advisors, with failing to pick the safest available annuity in 2021 when they replaced Lockheed’s $9 billion pension with a group annuity from Athene Life and Annuity, a leading life/annuity company. The suit was filed by a group of the plan’s participants.

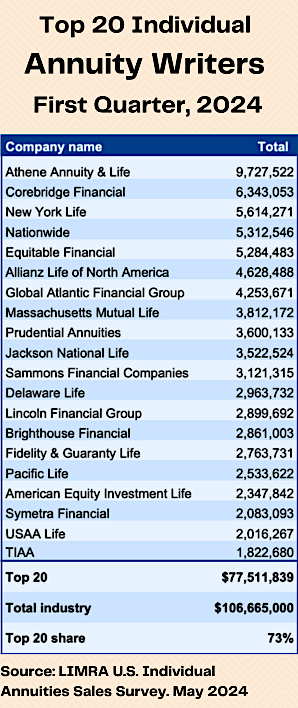

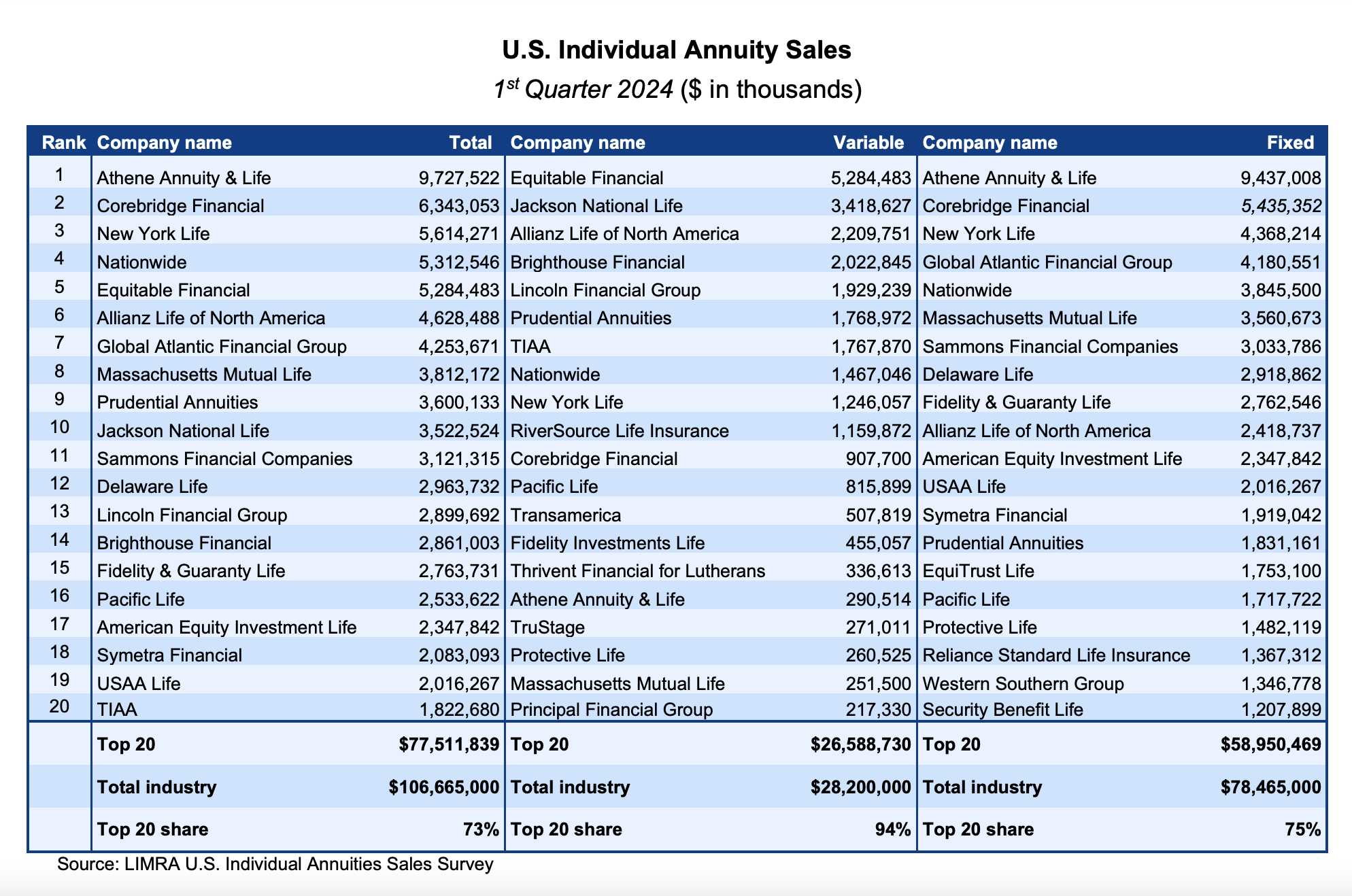

The lawsuit is noteworthy. Athene was the largest seller of annuities in the US in the first quarter of 2021, with $9.73 billion in sales, and it executed the largest PRT transaction of 2023: the transfer of AT&T’s $8.05 billion pension to an Athene annuity. St. Louis attorney Jerry Schlichter, famous for his successful suits against defined contribution plan sponsors for not protecting their participants from high fees, co-filed the suit against State Street and Lockheed.

Thomas D. Gober

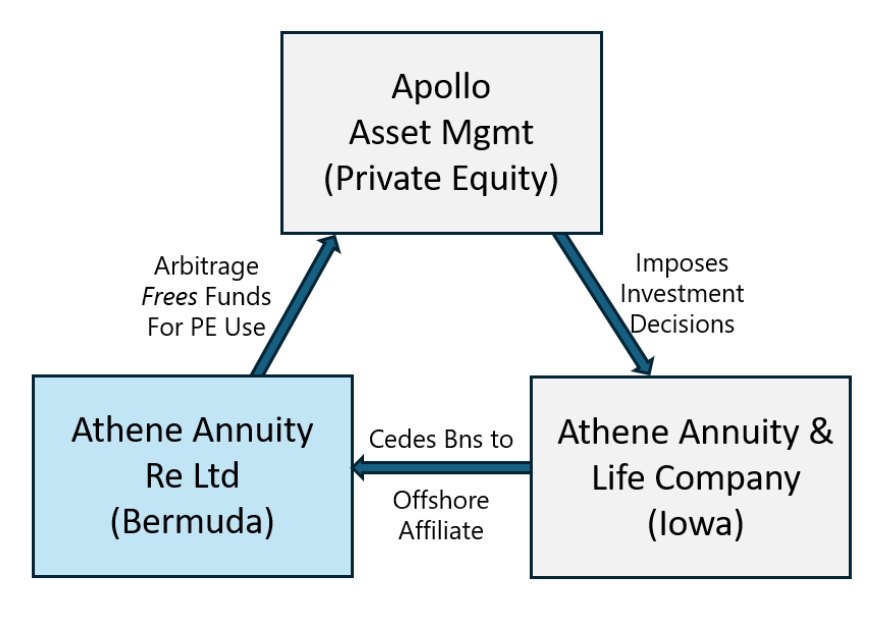

On May 28, in a new filing on behalf of the plaintiffs, certified fraud examiner Thomas D. Gober charged that State Street shouldn’t have recommended Athene to Lockheed, and that Lockheed shouldn’t have bought its group annuity from Athene, because of what Gober described as Athene’s thin surplus, illiquid investments and use of opaque offshore reinsurance with its own affiliates. Athene itself is not a defendant in the case.

The fraud examiner’s 16-page filing said, in part:

By Apollo causing most of the business to be sent to offshore affiliates that do not file under SAP [statutory accounting principles], it makes opaque the solvency or liquidity of the offshore reinsurers. Relevant here, as of December 31, 2023, Athene Iowa is counting on more than $155 billion of reinsurance with its own captives and offshore affiliates.

Comparing that amount in affiliated reinsurance with Athene Iowa’s total reported surplus (its only buffer between a viable carrier and one in receivership) of $2.88 billion [1.44%, or assets of $202 billion divided by liabilities of $199 billion] the gravity of the lack of transparency and risk of the offshore reinsurers is of great concern.

The fact that the Bermuda-based Athene Re controls such a large percentage of Athene Iowa’s assets would make an orderly liquidation under state insurance laws unwieldy and costly as marshaling assets located in Bermuda for the benefit of pensioners will not be a simple and straightforward process.

The surpluses of other large life/annuity companies, such as TIAA (13.83%), New York Life (12.24%), Nationwide (6.77%), and Pacific Life (6.5%) are much higher than Athene’s, Gober said.

Athene rejects the allegations. An Athene spokesperson told RIJ in a May 30 email:

These are baseless complaints instigated by class action attorneys who are attempting to enrich themselves at the expense of retirees. Athene is a safe and secure provider of annuity benefits, with outstanding financial strength, proper reserves, excellent capitalization, and strong credit ratings.

Pension group annuities provide many protections that enhance retirement security. Insurers like Athene have deep expertise in managing annuity obligations, are subject to robust regulation, and hold regulatory capital to protect policyholders.

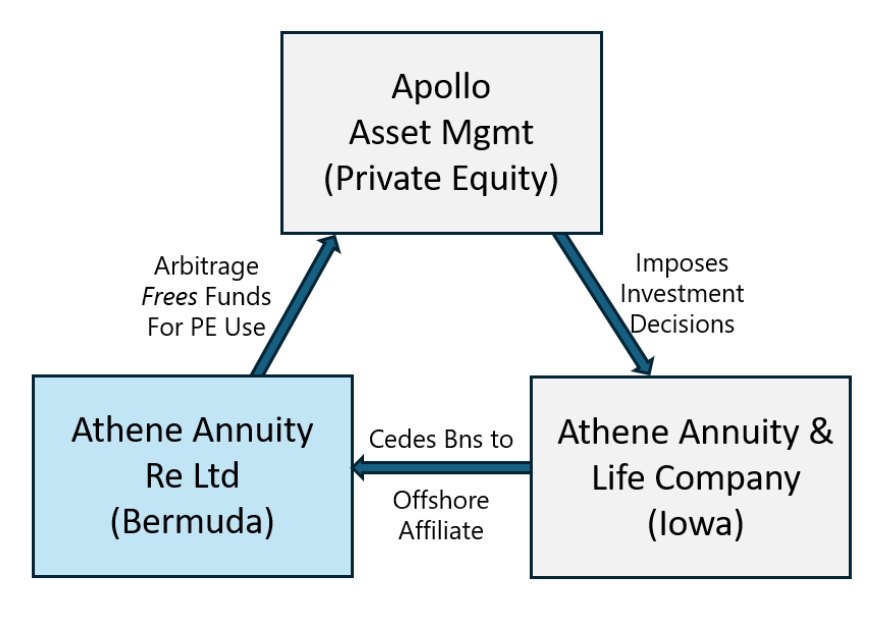

The suit may serve as a test of the legal soundness of what RIJ has called the “Bermuda Triangle” strategy, a business model initiated by Athene and copied by other annuity issuers. In Gober’s statement, he referred to the model as the “Bermuda triangle” and illustrated it with this graphic:

The strategy varies in its details but typically involves a US life/annuity company that sells fixed rate or fixed indexed annuities, a Bermuda or Cayman-based reinsurer, and a large asset manager or investment firm that devotes a portion of the annuity reserves to investments in “alternative” assets, such as collateralized loan obligations and asset-backed securities. In the strategy, all three entities are often affiliated or part of the same holding company.

Practitioners of the Bermuda Triangle business model claim that the reinsurance reduces capital requirements and alternative assets bring in higher investment yields. This allows annuity issuers to offer higher crediting rates for annuity policyholders and higher profits for equity shareholders—a win-win for all stakeholders.

Critics claim that the strategy produces under-capitalized, shakier life/annuity companies, and that without the use of questionable “regulatory arbitrage” between the US and reinsurance havens like Bermuda, some of those life insurers would be insolvent.

The regulation at the heart of this case, Instructional Bulletin 95-1, “was issued on March 6, 1995, in the wake of the failure of Executive Life Insurance Companies of California and New York,” according to a Department of Labor document. “[IB 95-1] provides guidance to pension plans considering the purchase of annuities ‘to transfer liability for benefits purchased under the plan to [an] annuity provider.’ IB 95-1 also emphasizes the fiduciary responsibility owed to plan participants in the selection of the ‘safest annuity available’ and makes it clear that ‘[c]ost consideration may not … justify the purchase of an unsafe annuity;’ nor is it appropriate to rely solely on insurance rating services.”

Annuity sales boom attracts private equity-backed insurers: AM Best

A June 4 Best’s Special Report, “Annuity Premiums Soar, Surrender Protection Strengthens,” states that annuity products have been attractive for consumers in the last few years, propelled by the rising interest rate environment and crediting rates that generally have been higher than competing products offered by larger national banks.

As insurers look to capitalize on the favorable environment, newer market entrants have added much-needed capacity to the market, particularly through multiyear guaranteed annuities (MYGA) with their attractive interest rate spreads and shorter durations. With the overall 2023 premium growth, annuity writers posted a 68% year-over-year increase in indexed annuity net premium income to $28.9 billion; 48% growth in fixed deferred annuities; and a 33% increase in premium for variable annuities without guarantees.

“Growth in the annuity market has heightened competition, as many new companies have entered the space, including several new private equity and asset management-backed insurers looking to capitalize on the difference between the cost of liabilities and potential favorable investment returns,” said Erik Miller, director, AM Best. [Emphasis added.]

Baby Boomers seeking income and wealth transfer solutions for trillions of dollars in assets is also driving consumer demand. Additionally, surrender benefits rose 32% in 2023; however, according to the report, the share of policies with market value adjustment surrender charges also has more than doubled in the last 10 years.

“Older annuity policies with lower rates were outside of the surrender charge protection, and so with the favorable crediting rates, insurers have been able to sell new annuity products with the higher rates to these customers while also locking them into policies with surrender charges,” said Jason Hopper, associate director, industry research and analytics, AM Best.

26North inks $4.9 billion reinsurance deal

26North Reinsurance Holdings, which was founded in 2022 by one of the co-founders of Apollo Global Management, closed a $4.9 billion reinsurance deal with Life Insurance Company of the Southwest (LSW), a unit of National Life Insurance Co., 26N Re said in a release.

The deal will see a subsidiary of 26N Re reinsure a “seasoned and diversified” block of multi-year guarantee and fixed annuity products issued by LSW, the company said. LSW is a member company of National Life Group, which was founded in Vermont in 1848.

In addition, 26N Re agreed to provide a quota share reinsurance agreement for future fixed annuities issued by LSW. The transaction brings 26North’s total assets under management to approximately $22 billion.

“This transaction will significantly scale our reinsurance business and continue to diversify 26North’s platform,” said Josh Harris, founder of 26North and co-founder of Apollo in 1990, in a statement. “We believe that our culture of prudent risk management and strong governance allows 26N Re to partner with the highest-quality cedants who are looking to leverage our long-term capital and asset management expertise.”

Harris has a long history in private equity. He worked for Drexel Burnham Lambert for two years in the 1980s, left to get a degree at Harvard Business School, and then joined former Drexel partners Leon Black and Marc Rowan to establish Apollo Global Management in 1990, according to Harris’ Wikipedia page.

By then, Drexel had filed for bankruptcy due to illegal junk bond activity. A major investor in Drexel junk bonds (i.e., financer of Drexel’s leveraged buyouts), the Executive Life insurance companies, failed in 1991.

In a separate news release last month, Agam Capital, “an analytics-driven platform partnering with insurance companies to enhance their financial flexibility,” is advising and partnering with 26N Re in the formation and launch of AeCe ISA, Ltd. (“AeCe”), a Bermuda-domiciled Class E life and annuity reinsurer. Agam’s founders are Chak Raghunathan and Avi Katz.

National Life Group is a minority owner in AeCe, which will reinsure single premium deferred annuities written by LSW.

Agam’s “pALM” analytical platform and other Bermuda capabilities will support 26North in the development and establishment of a new entrant into the fast-growing market for life and retirement reinsurance solutions in Bermuda. Agam described pALM as a “proprietary asset and liability management (ALM) system” offering “a fully embedded dynamic strategic asset allocation (SAA) and enterprise risk management (ERM) infrastructure.”

As part of the launch, AeCe will leverage Agam’s Bermuda ISAC structure which offers a comprehensive suite of operational, management and governance services to Bermuda based reinsurers. Separately, Agam and AeCe entered into a long-term Management Services Agreement.

Suit continues against Aon plc over Bermuda reinsurance

Clear Blue Insurance Co. and Aon plc, the insurance broker, will have until June 21 to present motions in Clear Blue’s lawsuit again the Aon plc and Aon Insurance Managers (Bermuda) Ltd. in a case related to the bankruptcy of the insurtech firm Vesttoo Ltd., AM Best reported in May.

Clear Blue seeks to recover damages from Aon for, according to the complaint, “hosting a rogue operation on its Bermuda-based platform in clear violation of law, regulation, contract and standard market practice.”

Clear Blue sued Aon in New York state court in 2023 for alleged damages connected with letters of credit issued by Vesttoo involving Aon and its Bermuda-based segregated cell entity, White Rock. The complaint said, “Clear Blue entered into a series of reinsurance transactions with and/or involving Aon, its wholly owned subsidiaries Aon Insurance Managers, White Rock and White Rock’s various segregated accounts, causing material financial, regulatory and reputational damage to Clear Blue.

“Aon and its entities could have stopped the Vesttoo fraud ‘dead in its tracks,’ but “facilitated it by removing all the statutory, regulatory and contractual safeguards and ignoring standard market practice.”

“This complaint is meritless,” an Aon spokesperson told AM Best. “Vesttoo has publicly admitted that its executives conspired with third parties in a highly sophisticated and elaborate fraud. As one of the victims of that fraud, Aon is focused on continuing our work to develop a path forward for all affected parties.”

The Supreme Court of Bermuda recently sanctioned a bankruptcy plan filed by Vesttoo creditors and approved the joint provisional liquidators (JPLs) of Aon’s White Rock Insurance SAC to remove objections to the Chapter 11 plan involving White Rock and other parties, AM Best said.

The Bermuda court’s decision, filed with the U.S. Bankruptcy Court for the District of Delaware, allows the JPLs to unconditionally withdraw their objections to previously proposed versions of the bankruptcy settlement plan and cedent settlements with the Official Committee of Unsecured Creditors of Vesttoo, appointed in the Vesttoo Chapter 11 case involving White Rock. The liquidators are also authorized to consent to confirmation of the plan.

The liquidators are also allowed to consent to cedent settlements with the committee and JPLs for White Rock involving insurers Clear Blue, Chaucer, Beazley plc., Markel Corp. and Porch, according to the Bermuda court ruling. Underwriting entities of Clear Blue parent Pine Brook Capital Partners II (Cayman) have current Best’s Financial Strength Ratings of A- (Excellent).

Strength ratings of Everlake Life (formerly Allstate) downgraded

In May, AM Best downgraded the financial strength rating (FSR) to A (Excellent) from A+ (Superior) and the long-term issuer credit ratings (Long-Term ICR) to “a+” (Excellent) from “aa-” (Superior) of Everlake Life Insurance Company and Everlake Assurance Company, collectively known as Everlake Life Group (Everlake Life). Both companies are domiciled in Northbrook, IL.

According to AM Best:

The outlook of these Credit Ratings (ratings) has been revised to stable from negative. The ratings reflect Everlake Life’s balance sheet strength, which AM Best assesses as very strong, as well as its strong operating performance, neutral business profile and appropriate enterprise risk management (ERM).

The change in Everlake Life’s business profile assessment to neutral from favorable reflects the strong competitive environment for bidding on flow reinsurance of annuities; Everlake Life’s moderate market share and reserve profile; and is similar to peers with a strategy of seeking flow reinsurance of annuities.

Everlake Life’s reserve profile, which includes universal life with secondary guarantees and structured settlements, is unlikely to change in the near term, even with the successful acquisition of additional multiyear guarantee annuity business, which was done in 2023 and is expected to continue.

According to its website, Everlake Life Insurance Company and Everlake Assurance Company are US based insurance companies specializing in life insurance and annuities. Everlake U.S. Holdings Company purchased Allstate Life Insurance Company and Allstate Assurance Company on November 1, 2021.

Everlake Life has over 1.6 million policies in force and over $23 billion in assets under management. It also administers select policies issued by Lincoln Benefit Life Company, Surety Life Insurance Company, American Maturity Life Insurance Company, and Columbia Universal Life Insurance Company.

According to AM Best, Everlake Life’s balance sheet strength assessment benefits from its strongest level of risk-adjusted capitalization, as measured by Best’s Capital Adequacy Ratio (BCAR), prudent asset liability management and development of its own internal capital modeling. This is partially offset by affiliated reinsurance in support of a significant block of term life insurance.

The operating performance continues to be assessed as strong given the three- and five-year return on equity ratios, which compare well against other strong-level peers, in addition to diversified profits between ordinary life and individual annuity products.

Everlake Life’s growth will be dependent on management successfully executing its strategy to acquire new business given the run-off of a large in-force block, but management has recently been more successful in acquiring new business. The ERM approach employs a typical three lines of defense strategy, including individual risk owners in the business areas, an ERM committee and an audit risk committee that reports directly to the board of directors. Risk appetite and tolerance statements with limits and triggers are quantitative and clear.

Midland National FIA for RIAs leads its category

Capital Income, Midland National’s first commission-free fixed index annuity (FIA), was named top fee-based fixed index annuity in 2023, according to LIMRA.

The product emerged from Midland Advisory, an internal team that Midland National Life formed in 2021 to design annuities for registered investment advisors (RIAs) and their clients. Midland is part of Sammons Financial Group.

Since its launch, Capital Income has consistently ranked high as a strong indexed annuity choice for advisors. In addition to earning the 2023 overall top spot from LIMRA, Midland National performed well in fourth quarter 2023 sales. Notable results from the Q4 2023 Wink Report include:

No. 3 Deferred Annuity Companies – RIA Distribution

- Deferred Annuity for RIA Distribution & Fee-Based Overall

- No. 1 Capital Income FIA

- No. 5 Oak ADVantage 7-year MYGA

- No. 6 Oak ADVantage 5-year MYGA

- Indexed Annuity Products – RIA Distribution

- No. 1 Capital Income FIA

- No. 9 IndexMax ADV 5-year

Midland National Capital Income carries a guaranteed lifetime income rider with an income multiplier that can double income payments for up to five years for contract owners with health problems.

If a fee-based advisor does not have an insurance license but wants to provide a client with an annuity, Midland National makes Capital Income available through outsourced insurance desks that can act as agents of record. This enables the advisor to maintain discretionary authority over the client’s account.

© 2024 RIJ Publishing LLC. All rights reserved.

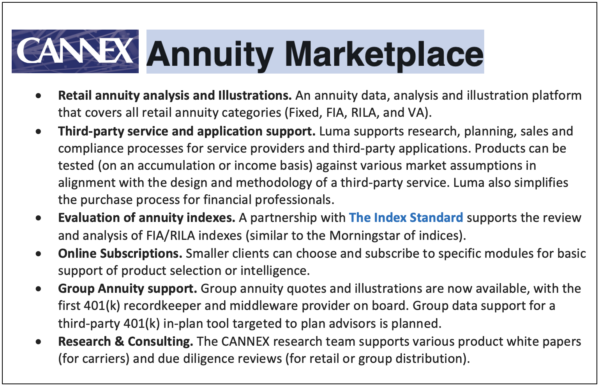

The proliferation of new annuity products, the expansion of annuity sales, and the passage of regulations that require advisers and agents to find products “consistent with best interest requirements and client goals” has increased “the importance of being able to understand and evaluate annuities on a standardized basis” said Gary Baker, president, CANNEX USA, in a release.

The proliferation of new annuity products, the expansion of annuity sales, and the passage of regulations that require advisers and agents to find products “consistent with best interest requirements and client goals” has increased “the importance of being able to understand and evaluate annuities on a standardized basis” said Gary Baker, president, CANNEX USA, in a release.