_Position: Cover

Equitable Holdings' recent reinsurance deals were the topic of critical articles in three financial publications this summer. Underneath the controversy, the leader of the RILA industry was catching up...

A Fixed Index Annuity with a Dash of Risk

The Momentum Growth contract from Delaware Life introduces a bit of gambling to the FIA product category—but within guardrails, and only with what contract owners might call 'house money.'

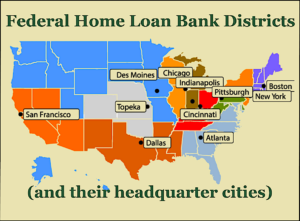

F-H-L-B Spells Cheap Cash for Big Annuity Issuers

The largest borrower from the Federal Home Loan Bank (FHLB) system in 2024 was Athene Annuity and Life, at more than $15 billion. For at least 16 other top...

RIJ and ChatGPT Discuss ‘Funding Short’

Life insurers used to be known as champions of 'asset-liability matching,' or ALM. Today, many of them are doing the opposite by 'funding short.' Here's a transcript of RIJ's...

Warring Watchdogs: NAIC and FIO

'The Federal Insurance Office conflicts with the states’ role as primary regulators, complicates their engagement with fellow insurance regulators globally, duplicates data collection from our industry,' said state...

ChatGPT: Social Security Is No ‘Ponzi Scheme’

'Ponzi schemes are private frauds that collapse when new investors stop joining. Social Security is managed by the U.S. government, backed by legal mandates and payroll tax revenues,' ChatGPT...

‘Rated Note Feeders’ Attract NAIC Attention

Holding a rated note (instead of an unrated private equity fund) can reduce the extra capital that life insurers need to post when buying risky, unrated private assets. Insurance...

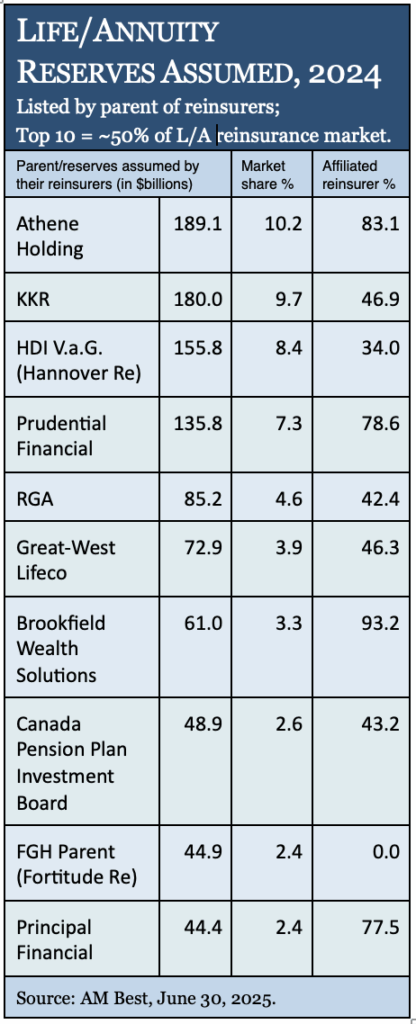

A Flood of ‘Flow Reinsurance’

Flow reinsurance involves the ongoing, immediate transfer of risks from a life insurer to a reinsurer as soon as annuities are issued. Life/annuity companies have used flow reinsurance for...

Nut Case: Prudential and Brighthouse’s Bets on Pistachios

A California pistachio grower defaulted on $1 billion in loans from Prudential, Brighthouse Life, and U.S. Bank this year. Their legal efforts to seize the collateral offer a glimpse...

‘Reinsurance Sidecars’: A Capital Idea

Athene Annuity & Life sold the most fixed deferred annuities in the first three-quarters of 2024. Its parent, Athene Holdings, has attracted billions in just-in-time third-party capital through Bermuda...

Middleware is Central to In-Plan Annuities

Middleware is hub-and-spoke software that lets retirement plan recordkeepers and life insurers talk to each other. Steve McCoy of iJoin, a provider of managed account user interfaces, and Bill...

How T. Rowe Price Approaches the ‘401(k) Income’ Market

By bundling a deferred income annuity with a managed payout program, T. Rowe Price's optional 'out-of-plan' 401(k) income tool aims to boost participants' spending power in retirement by as...

J.P. Morgan Asset Mgt Joins the 401(k) Annuity Race

To educate participants, JPMAM's ‘My Retirement Income Planner,' an online tool for 401(k) participants, will help them decide whether to cover 25% of their plan savings with an...

RIJ Launches the 401(k) Income Research Center

RIJ intends to give plan sponsors, plan advisors, retirement plan service providers and others an up-to-date, easy-to-access source of curated information and competitive intelligence on products and processes that...

DOL Lets Pension Risk Transfer Rules Stand – For Now

But the Department of Labor's Employee Benefits Security Administration still has concerns about 'insurers’ ownership structures; exposure to risky assets... and use of affiliated and offshore reinsurance.'

An In-Plan Annuity with Three Life Insurers

Asset manager AllianceBernstein and three life insurers—Jackson National, Lincoln National, and Nationwide—are offering their Secure Income Portfolio deferred variable annuity (with income rider) to plan sponsors as a retirement...

For Ibexis Life, Cayman Outshines Bermuda

This Missouri-domiciled life insurer epitomizes the asset-manager-driven life/annuity companies that have been disrupting the U.S. life/annuity business since 2010 or so. In its first year selling fixed indexed annuities,...

Life Insurers as LEGO Monsters

Michael Gordon, CEO of Axonic Insurance, part of Axonic Capital, sees the future of the life/annuity/asset-management business as an increasingly a la carte affair, where the components of the...

Meet the Newest Platform in the 401(k) Annuity Space

'We’re a product design firm,' ALEXIncome co-founder E. Graham Clark told RIJ. 'We feel we’ve built the best process for integrating annuities into retirement accounts.'

NAIC Urged to Limit ‘Bermuda Triangle’ Strategy

'The ability of insurers to significantly lower the total asset requirement for long-duration blocks of business that rely heavily on asset returns appears to be one of the drivers...